It's - vuZs Virtual University Community

Internship Report of National Bank of Pakistan Presented by SAM

Virtual University of Pakistan

Evaluation Sheet for Internship Report

Fall 2011

FINI619: Internship Report (Finance) Credit Hours: 3

Name of Student:

Samina Ameer Din

Student’s ID:

Mc090404110

Evaluation Criteria

Written Work Status

(Internship Report)

Presentation & Viva

Voce

Final Result

Result

Pass

Pass

1

Internship Report of National Bank of Pakistan Presented by SAM

Pass

Good attempt

For any further guidance about your final internship report, ask your queries via MDBs or emails us at

Fini619@vu.edu.pk

Prepare yourself well for presentation and viva voice by revising the report, handouts and related lessons, you must have strong grip both on ratio portion and on training program.

Be very careful in interpretation, revise the concepts, see the trends, their reasons and effects

Presented by: Samina Ameer Din

ID: Mc090404110

2

Internship Report of National Bank of Pakistan Presented by SAM

Session: 2009- 2011

Submission Date: January 31, 2012

3

Internship Report of National Bank of Pakistan Presented by SAM

4

Internship Report of National Bank of Pakistan Presented by SAM

5

Internship Report of National Bank of Pakistan Presented by SAM

I dedicate all of my work to my teacher and all of the members of NBP who helped me to do my internship and to prepare this report.

First of all I am thankful to ALLAH who always helped me in all of the ways in my life and always gave me courage and patience to do all of my internship in a good manner and secondly I am thankful to my teacher and all of the staff of the bank that also helped me to do my internship.

This report is about National Bank of Pakistan. In November 8, 1949, National Bank of

Pakistan was established under National Bank of Pakistan Ordinance 1949. National bank is owned by the government and act as an agent of the State bank of Pakistan. It’s headquarter is situated in Karachi. It has its national and international level branches i.e.

1250 national and 22 international branches.

National Bank of Pakistan maintains its positions as a pakistan’s premier bank for higher achievements. Its subsidiaries include

NBP Capital, NBP Modaraba Management Company, NBP Exchange Company, Taurus

Securities, NBP Almaty and others. It offers its unique products that are affordable for all classes.

During my internship, I learn a lot about working in different departments that are account opening, clearing and remittance. The main department of any bank is finance department and the main function of any bank is to deal with finance. Any bank secures the resources of general public and offers them a good profit. NBP also provides services for government employees. One portion of bank is reserve for government employees’ dealings only.

After complete analysis of National Bank, I come to this conclusion that the NPB plays an important part in financial sector and it can gain highest success.

6

Internship Report of National Bank of Pakistan Presented by SAM

12

13

14

15

10

11

16

17

9

5

6

7

8

2

3

4

Sections Sub-

Section

1

9.a

9.b

9.c

9.d

9.e

9.f

9.g

10.a

10.b

10.c

Description

Title Page

Scanned copy of Letter of Undertaking

Scanned copy of Internship Completion Certificate

Dedication

Acknowledgement

Executive Summery

4

4

Table of Contents 5

Brief intoduction of the organization’s business sector 6

2

3

4

Page

No.

1

Overview of the Organization

Brief History

Organizational Hierarchy Chart

Business Volume

Product Lines

Competitors of NBP

Brief Introduction of all the departments

Comments on organizational structure

8

9

11

12

12

16

16

17

Plan of Internship Program

Brief Introduction of the branch

Starting & Ending dates of Internship

Training Departments & Duration

Training Program

Detailed description of the Tasks during Internship

Ratio Analysis

Future Prospects of the Organization

Conclusion

Recommendations for Improvement

References & Sources used

Annexes

24

42

43

43

18

18

20

20

21

22

44

44

7

Internship Report of National Bank of Pakistan Presented by SAM

8

Internship Report of National Bank of Pakistan Presented by SAM

Definition of Bank:

A bank is a financial institution that deals with deposits and advances and acts as a financial intermediary. It receives money in the form of deposits and lends that money to those who need it. A Bank derives a profit from the difference in the interest rates paid and charged, respectively. Banks are usually charted by state bank or federal government.

Banking in Pakistan:

At the time of independence, commercial banking facilities were provided fairly well here. There were 487 offices of scheduled banks in the territories now constituting

Pakistan. An Expert committee was appointed. The committee recommended that the reserve bank of India should continue to function in Pakistan until 30th September

1948, and Pakistan would take over the management of public debt and exchange control from Reserve Bank of India on 1st April 1948 and that India Notes would continue to be legal tender in Pakistan till 30th September 1948.

Moreover the banks including those having their registered offices in Pakistan transferred them to India in order to bring a collapse of a new state. By 30th June1948 the number offices of scheduled banks in

Pakistan declined from 487 to only 195.

The Governor General of Pakistan QUAID-E-AZAM MUHAMMAD ALI JINNAH inaugurated the State Bank of Pakistan on July 1, 1948 , after the state Bank of Pakistan

Order was promulgated on May 12, 1948. The first Pakistan notes were issued in

October 1948 . As the Centered Bank of the country, the State Bank addressed itself with the equally urgent task of creating a national banking system. In order to attain this goal it provided every help and encouragement to Habib Bank to expand its network of branches and also recommend to Government the establishment of a new bank which could serve as an agent or the State Bank. As the result the National Bank of Pakistan came into over the agency function from the Imperial Bank of India. More Pakistan scheduled banks continued to be established which included the Commerce Bank Limited and the Standard Bank Limited. By June 1965, the number of scheduled banks stood at

36.

Banking structure in Pakistan:

Banking structure in Pakistan consists of the following:

1. (SBP) State Bank of Pakistan (Central Bank)

2. Commercial Banks

3. Exchange Banks

4. Saving Banks

9

Internship Report of National Bank of Pakistan Presented by SAM

10

Internship Report of National Bank of Pakistan Presented by SAM

9. a. Brief History:

NBP is the largest commercial bank operation in Pakistan. In 1949, NBP was established under National Bank of Pakistan Ordinance 1949. NBP head office is located in Karachi.

NBP has moved from a public sector organization into modern commercial bank and acts as an agent of central bank. It provides both public sector and commercial banking services. The bank also handles treasury transactions for the government of Pakistan

(GOP) as an agent of State Bank of Pakistan (SBP). The National Bank of Pakistan was established on November 29, 1949 as a semi public commercial bank.

NBP has diversified its business portfolio and is today a major lead player in the debt equity market, corporate investment banking, retail and consumer banking, agricultural financing, treasury services and is showing growing interest in promoting and developing the country's small and medium enterprises and at the same time fulfilling its social responsibilities.

Vision:

“To be recognized as a leader and a brand synonymous with trust, highest standards of service quality, international best practices and social responsibility”

Mission:

NBP will aspire to the values that make NBP truly the Nation’s Bank, by:

Institutionalizing a merit and performance culture

Creating a distinctive brand identity by providing the highest standards of services

Adopting the best international management practices

Maximizing stakeholders value

Discharging our responsibility as a good corporate citizen of Pakistan and in countries where we operate

11

Internship Report of National Bank of Pakistan Presented by SAM

Core Values:

Highest standards of Integrity

Institutionalizing team work and performance culture

Excellence in service

Advancement of skills for tomorrow’s challenges

Awareness of social and community responsibility

Value creation for all stakeholders

Goal:

To enhance profitability and maximization of NBP share through increasing leverage of existing customer base and diversified range of products.

12

Internship Report of National Bank of Pakistan Presented by SAM

2. SEVP

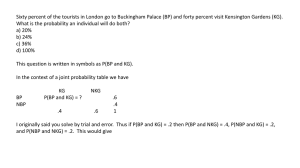

9. b. Organizational Hierarchy Chart:

1. President

Executives

3. EVP 4. SVP

Officers

5. VP

OG-I

Cash

Dept.

Head Cashier

Cashier

OG-II

Clerical

Staff

Assistant

Non Clerical

Staff

Peon, Guards etc

OG-III

6. AVP

13

Internship Report of National Bank of Pakistan Presented by SAM

9. c. Business Volume:

2010 (Particulars) (Rs. in Million)

Total Assets 1,035,025

Deposits 832,152

Advances 477,507

Investments 301,324

Shareholder’s Equity

103,762

Pre-tax Profit 24,415

After-tax Profit 17,563

Earning Per Share (Rs.) 13.05

Number of Branches 1289

Number of Employees 16457

9. d. Product lines:

1. NBP Premium Aamdani (Monthly Income Scheme):

• Earn up to 12.25% p.a. +

• Minimum deposit of Rs. 20,000/- with maximum balance of Rs. 10 million for 5 years

• Free Demand Draft, Pay Order and Cheque Book*

• Convenience of NBP online Aasan Banking (for online banking customers)

• Free NBP Cash Card (ATM+Debit)

• Running finance facility up to 90%

2. NBP Premium Saver (PLS Saving Account)

• Earn up to 8.50% p.a. +.

• Minimum saving balance of Rs. 20,001/- & a maximum balance of Rs. 1 million*.

14

Internship Report of National Bank of Pakistan Presented by SAM

• Free NBP Cash Card (ATM + Debit).

• Convenience of NBP Online Aasan Banking (for online banking customers).

• Two debit withdrawals allowed in a month & no limit on number of deposit transaction.

• Profit calculated on monthly and paid on half yearly basis.

3. NBP Saibaan (Home Financing):

NBP Saibaan

(Open the Door to Your Dream Home)

• Home Purchase

• Home Construction

• Home Renovation

• Purchase of Land + Construction

• Balance Transfer Facility (BTF)

4. Advance Salary (Personal Loan):

• Easy installments of 1 to 60 months at your choice.

• No minimum income, collateral & insurance charges required.

• Quick processing and fastest disbursement.

• For permanent employees of Government, Semi Government and Autonomous bodies receiving salaries through NBP.

5.

Cash Card (ATM + Debit Card):

• Use it as an ATM in any of the ATM’s in Pakistan

• Use it as Debit Card in any of the outlets with ORIX POS machine

• Cash withdrawal up to Rs. 20,000/- per day

• Account Balance Enquiry

• Mini Statement (Only at NBP ATM)

• PIN Change facility (Only at NBP ATM)

15

Internship Report of National Bank of Pakistan Presented by SAM

6. Investor Advantage (Financing Facility for Stock Investors):

• Comfortable environment for trading

• No security requirement, except for the customer’s equity

• Customer’s equity freely available for investment

• Equity acceptable in cash or approved shares

7. Cash n Gold (Ready Cash against Gold):

Facility of Rs. 20, 000/-against each 10 gms of net weight of Gold Ornaments

No maximum limit of cash

Repayment after one year

Roll over facility

No penalty for each repayment

8. NBP Karobar (Mera Apna Karobar):

Minimum down payment, 10% of asset price (5% for PCO & Telecaster)

Tenure 1 to 5 years (for PCO 2 years)

Grace period 3 months

Maximum loan amount Rs. 200,000/-

Age 18-45 years

Mark-up (variable) 1 year KIBOR + 2.00% p.a.

The customer will pay markup @ 6% p.a.

9. Kisan Dost:

Competitive mark-up rate

Quick & easy processing

Delivery at the farmer’s doorstep

Technical guidance to farmers

16

Internship Report of National Bank of Pakistan Presented by SAM

Wide range of financing schemes for farmers

Finance facility up to Rs. 500,000/- for landless farmers against personal guarantee.

Financing available against pass book, residential/commercial property, gold ornaments and paper security.

Loan facility on revolving basis for three years (renewable on yearly basis without obtention of fresh documentation and approval).

10. NBP PAK Remit:

Pak remit is an internet based Home Remittance Service. This service is available to U.S. residents for sending money to their family and friends in Pakistan.

One must have a valid US Dollar account with a U.S. bank or a US Dollar credit or debit card in order to remit funds through this channel.

Remitters in USA can log on to NBP user friendly website, www.pakremit.com and easily remit funds to Pakistan from the comfort of their homes, in a matter of minutes.

The service is fully secure with advance encryption application and is available for use 24 hours a day, 7 days a week.

Fees and exchange rate have been set at competitive levels and the remitters have the ability to track delivery of funds as well.

11. Protection Shield (Personal Accident Insurance):

(Life is precious)

No documentation

No medical required

Premium Auto Debit facility & choice of deactivation

Coverage includes death due to: Natural Calamities e.g. Earthquake, Flood,

Cyclone etc. Accident, Riots, Civil Commotion, Strikes and Acts of Terrorism.

17

Internship Report of National Bank of Pakistan Presented by SAM

9. e. Competitors of NBP:

The competitors of NBP at public sector:

Competitors at Public Sector

First Women Bank Limited (FWB)

The Bank of Khyber (KB)

The Bank of Punjab (BOP)

The competitors of NBP at private sector:

Competitors at Private Sector

My Bank Limited Allied Bank Limited

Bank Al-Falah Limited Atlas Bank

Bank Al Habib Limited Habib Bank Limited

Askari Bank Saudi Pak Bank Limited

Faysal Bank Limited

Metropolitan Bank limited

Muslim Commercial Bank Limited

9. f. Brief Introduction of all the departments:

1. Finance department

2. Deposit department

3. Credit department

4. Operation department

5. Human Resource (HR) department

1. Finance department:

Finance department of any organization controls and manage all routine financial matters.

This department helps to maintain the books of account of any organization. It performs the investing and lending functions. This department not only prepares the income statements and balance sheet of any bank but also it estimates the profit and loss of any bank. It keeps record of total deposits of the bank. It keeps eye on total worth of the bank.

2. Deposit department:

18

Internship Report of National Bank of Pakistan Presented by SAM

Deposits are the lifeblood of any bank. This department promotes all of the departments in a bank. Without deposits, a bank can not perform its banking function. This department keeps it eye on potential customers for deposits. This department motivates the branches to get a fixed target through different schemes like cash prizes and special increments. This department helps to run a banking function.

3. Credit department:

Credit department includes all the credit policies of the NBP. It controls all the credit policies in this bank like loans and keeps eye on securities, mortgages, pledges and so on.

This department fixes the markup rate for credit.

4. Operation department:

Operation department concerned with the operation in a bank. This department helps in handling the routine work in a bank. Without this department, bank cannot maintain its operations. If there is any problem in working area in any branch, this department helps to correct the error and make sure that all operations are working correctly. Account opening is also handled by this department.

5. Human Resource (HR) department:

Human resource department is basically concerned with the employees. This department works for the benefits of the employees. This department also helps how to assign the task and jobs of the employees. It helps to the employees to do their work easily and to get more and more benefits and incentives for the employees. This department works in hiring and firing to the employees. Its work is all about the human resources/ work forces.

9. g. Comments on organizational structure:

NBP is one of the oldest banks in Pakistan. It has the biggest structure in Asia. National

Bank has not been changed its structure from many years so it is not so good. NBP has its great contribution towards building structure and is serving for all classes of the society.

In any branch of NBP, branch manager perform all the activities in a branch. NBP has not a rigid structure. It has decentralized structure that can be adopted easily by all the employees. NBP has large its network because it is the major business partner for the

Government of Pakistan because of its special emphasis to fostering pakistan’s economic growth through various services like aggressive and balanced lending policies, technologically oreinted products and services offered through its large networks of brances like nationally and internationaly. So NBP has its good structure as compared to other banks.

19

Internship Report of National Bank of Pakistan Presented by SAM

10. a. Brief Introduction of the Branch:

National Bank of Pakistan

Main Branch, Kasur

Branch Code: 0348

Branch Manager: Siddique Akbar

Operations Manager: Muhammad Waheed

Hierarchy of Branch:

Branch

Manager

Credit Officer

Operations

Manager

All other staff

HR Officer

20

Internship Report of National Bank of Pakistan Presented by SAM

Departments in Branch:

1. Cash Department:

Cash department is such department that purely deals with cash. It is the most critical part of departments. Three main cashiers in cash department are cash receipts, cash payments and bill payments. One deals with cash receipts, second deals with the cash payments and the last one deal with the bill payments. It is supervised by CD in charge and head.

2. Govt. Department:

This department deals with all the govt. things like govt. receipts, govt. payments pension, taxes, bills, salaries etc.

3. Credit / Advances Department:

Credit department includes all the credit policies and control these policies. This department gives different types of loan and chare a fix markup rate for credit. Three main types of loans are:

1. Personal loans 2. Agricultural loans 3. Commercial loans

4. Operation Department:

This department deals with all general banking operations. Dealing with customers, HR maintenance and account opening etc all these dealings relate to this department and is controlled by it.

5. Account Opening Department:

Account opening department deals with opening the account of the customers on the bank. In this department different types of account are opened like PLS saving account,

Current account etc.

6. Clearing Department:

Clearing department deals with clearance of the payments within the branches of the same bank and with the branches of the other banks.

7. Remittance/ Bills Department:

Remittance department deals with the transfer of money. It transfers money from one place to another place or from one branch to another branch.

8. Establishment Department / HRM:

This department basically works for staff benefits like medical, traveling etc

21

Internship Report of National Bank of Pakistan Presented by SAM

9. Electronic Banking System (EBS):

This controlls the over all banking system in a bank.

10. Compliance Group / Auditor:

The work of compliance group / auditor is to audit all the banking work.

10. b. Starting & Ending Dates of Internship:

Starting Date: 30-11-2011

Ending Date: 13-01-2012

10. c. Training Departments & Duration:

Departments Duration

30-11-2011

16-12-2011

01-01-2012

15-12-2011

31-12-2011

13-01-2012

Account Opening

Clearing

Remittance

22

Internship Report of National Bank of Pakistan Presented by SAM

23

Internship Report of National Bank of Pakistan Presented by SAM

Detailed description of the tasks assigned to me during my

Internship:

1. Account Opening Department

2. Clearing Department

3. Remittance Department

1. Account Opening Department:

The first task assigned to me was the account opening. Fisrt of all I asked the customer to give me his/her ID card. In ID card, I checked the Expiry Date of the ID card. If the expiry date of the card is corect and it has not been expired then I took interview of the customer so that I can know what type of account he wanna open PLS saving or current account and what is his/her source of income for which he/she want to open this account.

After the interview, he asked me that he wanna open saving account. I said ok then I tell him that the minimum amount for opening the saving account is Rs. 100 and maximum amount you want to deposit and I also told him that in this account zakat will be deducted and profit will be added. He said ok I will deposit Rs. 500. After this, I asked the customer you will have to take some necessary things to open this account that are as follows:

Photocopy of your C.N.I.C

Photocopy of Next of Kin C.N.I.C

Photocopy of your mother C.N.I.C

Photocopy of the your home electricity bill

3 Photos if he/she can’t sign menas illiterate or sign in urdu and can be copied by other.

After taking these documents I filled the Customer Information Folio (CIF) and in CIF I asked the customer of whom person you want to make your Next of Kin. He told me the name of next of kin, what’s his relation with him/her, photocopy of his/her C.N.I.C and his mobile number. After filling these information I took a verisys of his/her C.N.I.C from Nadra from the operations manager so I can know is this correct C.N.I.C. After all these things I opened the account of customer . After this I took print of all the forms and then I took the signature card and took the signature of that person whose account I opened and I used the Brach Stapm on signature card. After this I took the sign of the designation authority means my supervisor and I also used the stamp of attested on the photocopy of C.N.I.C.After this, I filled his/ her deposit slip with that amount from which he wanna open this account that is Rs. 500 and asked him to pay the money to the cash counter and then your account will be opened. When he came back to pay the amount

24

Internship Report of National Bank of Pakistan Presented by SAM then I gave his all the forms and asked him that a letter of thanks will be reached your home address by post. I told him you will have to sign on letter of thanks and post it.

Then I told him when the bank will receive this letter of thanks then the bank will issue you the check book. At the last, I asked the customer now you are free and you can go now. In this way , I opened the account of a person completely and I accomplished my task.

The same procedure I used for opening the current account. But the minimum amount for opening the current acount is Rs. 5000 and this account is not profit oriented and no zakat deduction is made in this account and this account is for businessman and companies etc.

2. Clearing Department:

The second task assigned to me was the clearing which means the clearance of payments and cheques within city or with different cities. In clearing, I learnt about the inward clearing, outward clearing, intercity clearing and local clearing. My supervisor told me that the clearing we receive is inward clearing and that we sent to other is outward clearing. After that my supervisor gave me some intercity and local cheques and asked me to clear them. First of all I went to the clearance counter and applied the CROSSING

STAMP at the front of all the cheques. After that I separated all the cheques of Lahore.

And all the cheques of other cities like Islamabad, Gujranwala, and Faisalabad etc. After this I applied the CLEARING STAMP with the same date of all the cheques of Lahore and the CLEARING STAMP with the next day date of other cities cheques. After that I used the INTER CITY CLEARING stamp of all the inter city cheques. After that I used

Govt. Account Credited stamp for all the govt. cheques and Payees Account Credited stamp for account holders. After that I used the Collecting Bank Endorsement Confirmed stamp for other banks cheques which are made collection from our branch and Our

Branch Endorsement Confirmed stamp for those cheques if any branch from outside said to our bank to collect money. After completing these stamps I took the registers of local clearing and intercity clearing. In the register of local clearing, I entered all the local cheques and in intercity register, I entered all the intercity cheques. After that entering the cheques in register I total all the amount of entered cheques and confirm that total with total amount of cheques. After completing this work, I made one list for local cheques and the other list for intercity cheques and entered the amount of all the cheques and made total of it. After this, I put them in an envelope and then I put stamp of the bank on it. In this way, I completed my whole work.

25

Internship Report of National Bank of Pakistan Presented by SAM

3. Remittance Department:

The third task assigned to me was the remittance. In remittance department, I learnt about how the pay orders (PO), demand draft (DD) and call deposit at receipts (CDR) are made.

My supervisor asked me to make a pay order of the customer. First of all I asked the customer, are you account holder of NBP or not? He asked me I am account holder of

NBP. I said ok the charges for making pay order for account holders of NBP are Rs. 100 and for non account holders are Rs. 150. He asked me to make the pay order. Then I asked the customer gave me the photocopy of your C.N.I.C. He gave me the photocopy of his C.N.I.C and told me his account number. After this I took the pay order (PO) book and filled it with his name, account number, amount in figures and words and the name of the bank. After writing these things, I applied two stamps at the front of the pay order that are branch stamp and stamp of the date. After this my supervisor signed the pay order

(PO). After signed I gave the pay order (PO) to the customer. In this way, I made the complete pay order of the customer.

The same procedure I used for making demand draft (DD) and call deposit at receipts

(CDR). But the charges rates for making demand draft (DD) and call deposit at receipts

(CDR) are also different for account holders & non account holders. During making the demand draft (DD), I used the same stamps like branch stamp and stamp of the date but the charges rates that I used for making the demand draft (DD) for account holders are

Rs. 80 and for non account holders are Rs. 100 that I used during my work and I used the demand draft (DD) book for making DD. Similarly, the charges rates that I used for making call deposit at receipts (CDR) for account holders are Rs. 100 and for non account holders are Rs. 200 and I used the call deposits at receipts (CDR) book for making CDR. In this way, I made all these things that are pay order (PO), (DD) demand draft and call deposit at receipts (CDR). Hence, I completed my whole in a good manner.

We can use Ratio analysis to check out how profitable a business is, we can use it to check out how much enough money a business has to pay its bill and we can even tell whether its shareholders should be happy.

Ratio analysis can also help us to check whether a business is doing better this year that it was last year, and it can tell us if our business is doing better or worse than other businesses doing and selling the same things.

26

Internship Report of National Bank of Pakistan Presented by SAM

1. Net Profit Margin

Formula:

Net profit margin= (Net profit/ Revenue) *100

Calculation:

2010

Net profit= 17,563,214

Revenue/sales= 88,472,134

= (net profit/ revenues)*100

= (17,563,214/ 88,472,134)*100

= 19.85%

19.85%

Net profit= 17,561,846

Revenue/sales= 77,947,697

= (net profit/ revenues)*100

=

2009

(17,561,846/ 77,947,697)*100

= 22.53%

2008

Net profit= 15,458,590

Revenue/sales= 60,942,798

= (net profit/ revenues)*100

= (15,458,590/ 60,942,798)*100

= 25.36%

22.53% 25.36%

Graphical Representation:

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

Year

2008

Year

2009

Year

2010

Net Profit M argin

Interpretation:

This graph is showing that the net profit margin of NBP for the year 2008, 2009 & 2010 is 25.36%, 22.53% & 19.85% respectively. This ratio is not constant in all over the years.

It’s showing that the net profit margin of NBP is decreasing day by day due to increase in non mark-up interest expenses and taxes.

As the net profit margin of NBP is decreasing in all over the years it is showing that the

NBP is not efficient to converting its revenue into actual profits. As we know, the higher the net profit margin the better it is. So this decreasing trend is not a good sign for NBP.

27

Internship Report of National Bank of Pakistan Presented by SAM

2. Gross Spread Ratio

Formula:

Gross Spread Ratio = ( Mark-up / return / interest earned - Mark-up / return / interest expensed) / Mark-up / return / interest earned*100

Calculation:

2010

Spread = 43,221,658

Revenue/ sales= 88,472,134

= (Spread / Revenue)*100

= 43,221,658/ 88,472,134*100

= 48.85%

48.85%

2009

Spread = 37,458,048

Revenue/ sales= 77,947,697

= (Spread / Revenue)*100

= 37,458,048/ 77,947,697*100

= 48.05%

48.05%

2008

Spread = 37,058,030

Revenue/ sales= 60,942,798

= (Spread / Revenue)*100

= 37,058,030/ 60,942,798*100

= 60.80%

60.80%

Working of Net Interest Margin:

Net Interest Margin = Mark-up / return / interest earned - Mark-up / return / interest expensed

2010) Net interest margin = 88,472,134-45,250,476= 43,221,658

2009) Net interest margin = 77,947,697-40,489,649= 37,458,048

2008) Net interest margin = 60,942,798-23,884,768= 37,058,030

Graphical Representation:

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

Year Year Year

Gross Spread Ratio

2008 2009 2010

28

Internship Report of National Bank of Pakistan Presented by SAM

Interpretation:

This graph is showing that the Gross Spread Ratio of NBP for the year 2008, 2009 &

2010 is 60.80%, 48.05% and 48.85%. It is showing that the Gross Spread Ratio of NBP is not constant and is going to decrease day by day due to increase in interest expenses. This ratio was high in 2008 but due to increase in interest expenses this ratio is decreasing in

2009 and 2010 that is not a good sign for the national bank.

3. Non Interest Income to Total Income Ratio

Formula:

Non Mark-up / interest income to total income ratio= non mark-up / interest income /

(non mark-up / interest income +Mark-up / return / interest earned)*100

Calculation:

2010 non mark-up / interest income=

17,632,640

Total income = 106,104,774

= (non mark-up / interest income /

Total income)*100

= (17,632,640 / 106,104,774)*100

= 16.61%

16.61%

19,025,357

2009 non mark-up / interest income=

Total income= 96,973,054

= (non mark-up / interest income

/ Total Income)*100

= (19,025,357 / 96,973,054)*100

= 19.61%

19.61%

Total income = 77,358,660

= (non mark-up / interest income /

TotalIncome)*100

= (16,415,862 / 77,358,660)*100

= 21.22%

2008 non mark-up / interest income=

16,415,862

21.22%

Working of Total Income:

Total Income = (non mark-up / interest income +Mark-up / return / interest earned)

2010) Total Income = 17,632,640+88,472,134= 106,104,774

2009) Total Income = 19,025,357+77,947,697= 96,973,054

2008) Total Income = 16,415,862+60,942,798= 77,358,660

Graphical Representation:

29

Internship Report of National Bank of Pakistan Presented by SAM

25.00%

20.00%

15.00%

10.00%

5.00%

Non Interest Income to Total Income Ratio

0.00%

Year

2008

Year

2009

Year

2010

Interpretation:

This graph is indicating that the Non Interest Income to Total Income Ratio of NBP for the year of 2008, 2009 & 2010 is 21.22%, 19.61% and 16.61% respectively. It is showing that this ratio of NBP is not constant in all over the years. It is decreasing day by day.

It indicates that non markup income is how much percent of the total income of the NBP.

In 2008, this ratio is high but in 2009 and 2010 this ratio is decreasing it means in 2009 &

2010 NBP is not gaining more non interest income like commission, brokerage income & income from dealing in foreign currencies etc due to which this ratio is decreasing in

2009 & 2010 than 2008.

4. Spread Ratio

Formula:

Spread Ratio = Interest Earned / Interest Expensed

Calculation:

2010

Interest Earned= 88,472,134

Interest Expensed= 45,250,476

= (Interest Earned / Interest

Expensed)

= (88,472,134 / 45,250,476)

=1.95 times

1.95

2009

Interest Earned = 77,947,697

Interest Expensed= 40,489,649

= (Interest Earned / Interest

Expensed)

= (77,947,697 / 40,489,649)

= 1.92 times

1.92

2008

Interest Earned = 60,942,798

Interest Expensed = 23,884,768

= (Interest Earned / Interest

Expensed)

= (60,942,798 / 23,884,768)

= 2.55 times

2.55

30

Internship Report of National Bank of Pakistan Presented by SAM

= 1.69%

Graphical Representation:

3

2.5

2

1.5

1

0.5

0

Year 2008 Year 2009 Year 2010

Spread Ratio

Interpretation:

This graph is showing that the Spread ratio of NBP for the year 2008, 2009 & 2010 is

2.55, 1.92 & 1.95 Times respectively. It’s showing that the Spread Ratio of NBP is not constant and decreasing day by day. This ratio is much lower in 2009 and 2010 as compared to 2008. It is showing that the interest expenses in 2009 and 2010 are more than 2008 that is becoming cause to decrease the ratio.

5. Return on Asstes

Formula:

Return on Assets = (Net profit/ Total assets) *100

Calculation:

2010

Net profit= 17,563,214

Total Assets= 1,035,024,680

= (Net profit/ Total assets) *100

= (17,563,214/1,035,024,680)*100

1.69%

Working of Total Assets:

2009

Net profit= 17,561,846

Total Assets= 944,582,762

= (Net profit/ Total assets) *100

= (17,561,846/ 944,582,762)*100

= 1.85%

1.85%

Total Assets

2008

Net profit= 15,458,590

Total Assets=817,758,326

= (Net profit/ Total assets) *100

= (15,458,590/ 817,758,326)*100

= 1.89%

1.89%

31

Internship Report of National Bank of Pakistan Presented by SAM

Description

Cash and balance with treasury banks

Balance with other banks

Lending to financial institution-net

Investments-net

Advances-net

Operating fixed assets

Deffered tax assets-net

Other assets

Total Assets

2010

115,442,360

30,389,664

23,025,156

301,323,804

477,506,564

26,888,226

6,952,666

53,496,240

1,035,024,680

2009

115,827,868

28,405,564

19,587,176

217,642,822

475,243,431

25,147,192

3,062,271

59,666,438

944,582,762

2008

106,503,756

38,344,608

17,128,032

170,822,491

412,986,865

24,217,655

3,204,572

44,550,347

817,758,326

Graphical Representation:

1.90%

1.85%

1.80%

1.75%

1.70%

1.65%

1.60%

1.55%

Year Year Year

Return on Assets

2008 2009 2010

Interpretation:

This graph is indicating that the Return on Asset ratio of NBP for the year 2008, 2009 &

2010 is 1.89%, 1.85% and 1.69% respectively. It is showing that the Return on Assets

Ratio of NBP is not constant and is decreasing with the passage of time. This ratio is high in 2008 and 2009 but is decreasing in 2010. It’s indicating that the management of NBP is not utilizing its assets in an efficient manner in generating earnings and revenues for the NBP.

6. DuPont Return on Assets

Formula:

Dupont returns on assets= ((net income/revenues)*(revenues/assets))*100

32

Internship Report of National Bank of Pakistan Presented by SAM

Calculation:

2010

Net income= 17,563,214

Revenues/sales= 88,472,134

Assets= 1,035,024,680

= ((net income/revenues)*

(revenues/assets))*100

= ((17,563,214/ 88,472,134)*

(88,472,134/ 1,035,024,680)*100

= (0.0169)*100

= 1.69%

1.69%

2009

Net income= 17,561,846

Revenues/sales= 77,947,697

Assets= 944,582,762

= ((net income/revenues)*

(revenues/assets))*100

= ((17,561,846/ 77,947,697)*

(77,947,697/ 944,582,762)*100

= (0.0185)*100

= 1.85%

1.85%

Working of Total Assets:

Total Assets

Description

Cash and balance with treasury banks

Balance with other banks

Lending to financial institution-net

Investments-net

Advances-net

Operating fixed assets

Deffered tax assets-net

Other assets

2010

115,442,360

30,389,664

23,025,156

301,323,804

477,506,564

26,888,226

6,952,666

53,496,240

2009

115,827,868

28,405,564

19,587,176

217,642,822

475,243,431

25,147,192

3,062,271

59,666,438

Total Assets 1,035,024,680

2008

Net income= 15,458,590

Revenues/sales= 60,942,798

Assets= 817,758,326

= ((net income/revenues)*

(revenues/assets))*100

= ((15,458,590/ 60,942,798)*

(60,942,798/ 817,758,326)*100

= (0.0188)*100

= 1.88%

944,582,762

1.88%

2008

106,503,756

38,344,608

17,128,032

170,822,491

412,986,865

24,217,655

3,204,572

44,550,347

817,758,326

Graphical Representation:

1.90%

1.85%

1.80%

1.75%

1.70%

1.65%

1.60%

1.55%

Year

2008

Year

2009

Year

2010

DuPont Return on

Assets

33

Internship Report of National Bank of Pakistan Presented by SAM

Interpretation:

The graphical representation is showing that the Dupont Return on Assets Ratio of NBP for the years 2008, 2009 & 2010 is 1.88%, 1.85% and 1.69% respectively. It’s showing that Dupont Return on Assets Ratio of NBP is not constant and is decreasing with the passage of time. This ratio is much lower in 2010 as compared to 2008 & 2009. It’s showing that in 2010, the management of NBP is not utilizing its assets in an efficient manner due to which this ratio is decreasing and is not generating much revenue for NBP.

7. Return on Total Equity

Formula:

Return on total Equity=Net Income/ Total equity*100

Calculation:

2010

Net income= 17,563,214

Total Equity= 103,762,310

=Net Income/ Total equity*100

=

17,563,214/ 103,762,310*100

= 16.92%

16.92%

2009

Net income= 17,561,846

Total Equity= 94,141,919

=Net Income/ Total equity*100

=

17,561,846/ 94,141,919*100

= 18.65%

18.65%

2008

Net income= 15,458,590

Total Equity= 81,367,002

=Net Income/ Total equity*100

= 15,458,590/ 81,367,002*100

= 18.99%

18.99%

Working of Total Equity:

Total Equity

Description

Share capital

Reserves

Un appropriated profit

2010

13,454,628

24,450,244

65,857,438

Total Equity 103,762,310

2009

10,763,702

22,681,707

60,696,510

94,141,919

2008

8,969,751

19,941,047

52,456,204

81,367,002

Graphical Representation:

34

Internship Report of National Bank of Pakistan Presented by SAM

19.00%

18.50%

18.00%

17.50%

17.00%

16.50%

16.00%

Return on Total

Equity

15.50%

Interpretation:

Year

2008

Year

2009

Year

2010

The graph is showing that the Return on Total Equity Ratio of NBP for the year 2008,

2009 & 2010 is 18.99%, 18.65% and 16.92% respectively. It’s indicating that this ratio is not constant in all over the years and is decreasing with the passage of time. The Return on Total Equity Ratio of NBP in 2010 is lower as compared to 2008 & 2009. This ratio measures the profitability of NBP and is showing that the NBP can generate much profit by the money invested by shareholders. In 2010, NBP is less effective in using contributions from stockholders to generate earnings due to which this ratio is low in

2010.

8. Debt Ratio

Formula:

Debt ratio= (Total debt/ Total assets)*100

Calculation:

2010

Total Debt= 906,528,852

Total Assets= 1,035,024,680

=(906,528,852/1,035,024,680)*100

=87%

87%

Total Debt= 825,676,384

Total Assets= 944,582,762

=87%

Working of Total Debt:

Total Debt

2009

=(825,676,384/944,582,762)*100

87%

2008

Total Debt= 715,299,108

Total Assets= 817,758,326

=(715,299,108/817,758,326)*100

=87%

87%

35

Internship Report of National Bank of Pakistan Presented by SAM

Description

Bills payable

Borrowings

Deposits and other accounts

Liabilities against assets subject to finance

Deferred tax liability

Other liabilities

2010

8,006,631

20,103,591

832,151,888

106,704

-

46,160,038

906,528,852 Total Debt

Working of Total Assets:

Total Assets

2009

10,621,169

45,278,138

727,464,825

42,629

-

42,269,623

825,676,384

Description

Cash and balances with treasury banks

Balances with other banks

Lending to financial institution-net

Investments-net

Advances-net

Operating fixed assets

Deffered tax assets

Other assets-net

Total Assets

2010

115,442,360

30,389,664

23,025,156

301,323,804

477,506,564

26,888,226

6,952,666

53,496,240

1,035,024,680

Graphical Representation:

90.00%

80.00%

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

Interpretation:

10.00%

0.00%

Year 2008 Year 2009 Year 2010

2009

115,827,868

28,405,564

19,587,176

217,642,822

475,243,431

25,147,192

3,062,271

59,666,438

944,582,762

2008

10,219,061

40,458,926

624,939,016

25,274

-

39,656,831

715,299,108

2008

106,503,756

38,344,608

17,128,032

170,822,491

412,986,865

24,217,655

3,204,572

44,550,347

817,758,326

Debt Ratio

36

Internship Report of National Bank of Pakistan Presented by SAM

The graph is showing that the Debt Ratio of NBP for the year 2008, 2009 & 2010 is constant that is 87%. It’s showing that the NBP is using much debts to finance its assets.

This ratio is very high and is not a good sign for NBP. NBP need to decrease to its debts because high debt shows the NBP has high risk of default due to which investors will not like the NBP.

9. Debt / Equity Ratio

Formula:

Debt / Equity Ratio = (total debt/ total equity)

Calculation:

2010

Total Debt= 906,528,852

Total Equity= 103,762,310

= (906,528,852/ 103,762,310)

= 8.73

8.73

2009

Total Debts= 825,676,384

Total Equity= 94,141,919

= (825,676,384/ 94,141,919)

= 8.77

8.77

2008

Total Debt= 715,299,108

Total Equity= 81,367,002

= (715,299,108/ 81,367,002)

= 8.79

8.79

Working of Total Equity:

Total Equity

Description

Share capital

Reserves

Un appropriated profit

Total Equity

2010

13,454,628

24,450,244

65,857,438

103,762,310

2009

10,763,702

22,681,707

60,696,510

94,141,919

Graphical Representation:

8.79

8.78

8.77

8.76

8.75

8.74

8.73

8.72

8.71

8.7

Year

2008

Year

2009

Year

2010

2008

8,969,751

19,941,047

52,456,204

81,367,002

Debt / Equity Ratio

37

Internship Report of National Bank of Pakistan Presented by SAM

Interpretation:

This graph is indicating that the Debt to Equity Ratio of NBP for the year 2008, 2009 &

2010 is 8.79, 8.77 and 8.73 Times respectively. This ratio is not constant in all over the years and is decreasing with the passage of time. NBP has this ratio low in the year 2010 as compared to 2008 & 2009. But this ratio is approximately 9 which indicating that the

NBP has 9 times more debt than its equity that is not a good sign for NBP because investors like this ratio low.

10. Time Interest Earned Ratio

Formula:

Time Interest Earned Ratio = (EBIT/ total interest)

Calculation:

2010

EBIT= 69,665,595

Total Interest= 45,250,476

= (EBIT/ total interest)

= 69,665,595/ 45,250,476

= 1.53 times

1.53

2009

EBIT= 61,789,822

Total Interest= 40,489,649

= (EBIT/ total interest)

= 61,789,822/ 40,489,649

= 1.52 times

1.52

2008

EBIT= 46,885,766

Total Interest= 23,884,768

= (EBIT/ total interest)

= 46,885,766/ 23,884,768

= 1.96 times

1.96

Working of EBIT:

EBIT= Profit before Taxation+ Mark-up / return / interest expensed

2010) EBIT = 24,415,119+45,250,476= 69,665,595

2009) EBIT = 21,300,173+40,489,649= 61,789,822

2008) EBIT = 23,000,998+23,884,768= 46,885,766

Graphical Representation:

2

1.5

1

0.5

Time Interest Earned

Ratio

0

Year

2008

Year

2009

Year

2010

38

Internship Report of National Bank of Pakistan Presented by SAM

Interpretation:

This graph is indicating that the Time Interest Earned Ratio of NBP for the years 2008,

2009 & 2010 is 1.96, 1.52 and 1.53 times respectively. It’s showing that the Time Interest

Earned Ratio of NBP is not constant. NBP has the ability to cover its interest expenses with its EBIT in all over the years. This ratio is high in 2008 but it is decreasing in 2009 and 2010 due to increase in interest expenses.

11. Advances / Deposits Ratio

Formula:

Advances / Deposits Ratio= Total Advances/ Total Deposits

Calculation:

2010

Advances= 477,506,564

Deposits= 832,151,888

= (Advances/ Deposits)

= 477,506,564/ 832,151,888

= 0.5738 times

0.5738

2009

Advances= 475,243,431

Deposits= 727,464,825

= (Advances/ Deposits)

= 475,243,431/ 727,464,825

= 0.6532 times

0.6532

2008

Advances= 412,986,865

Deposits= 624,939,016

= (Advances/ Deposits)

= 412,986,865/ 624,939,016

= 0.6608 times

0.6608

Graphical Representation:

0.68

0.66

0.64

0.62

0.6

0.58

0.56

0.54

0.52

Year

2008

Interpretation:

Year

2009

Year

2010

Advances / Deposits

Ratio

39

Internship Report of National Bank of Pakistan Presented by SAM

This graph is indicating that the Adavnces to Deposits Ratio of NBP for the year 2008,

2009 & 2010 is 0.6608, 0.6532 and 0.5738 respectively. This ratio is not constant in all over the years and is decreasing day by day. NBP has this ratio very low in all over the years but the standard for this ratio is 1:1. This low ratio is showing that the NBP is not using its deposits efficiently in advancing to the borrowers. It means NBP has excess liquidity and potentially low profits.

12. Operating Cash Flow Ratio

Formula:

Operation Cash Flow Ratio= Net cash generated from operating activities/ Current

Liabilities

Calculation:

2010

OCF= 93,163,784

Current liabilities= 867,626,368

= (OCF/ Current liabilities)

= 93,163,784/ 867,626,368

= 0.107 times

2009

OCF= 41,576,364

Current liabilities= 725,293,720

= (OCF/ Current liabilities)

= 41,576,364/ 725,293,720

= 0.057 times

0.057

2008

OCF= 2,532,681

Current liabilities= 682,905,461

= (OCF/ Current liabilities)

= 2,532,681/ 682,905,461

= 0.003 times

0.003 0.107

Working of Current Liabilities:

Current Liabilities

Description

Bills payable (Short term)

Borrowings (Short term)

Deposits and other accounts (Short term)

Liabilities against assets subject to finance lease (Short term)

Other liabilities (Short term)

Total Current liabilities

2010

8,006,631

17,154,131

816,172,861

43,963

26,248,782

867,626,368

2009

10,621,169

37,057,189

655,031,896

20,408

22,563,058

725,293,720

2008

10,219,061

37,409,288

614,538,859

16,517

20,721,736

682,905,461

Graphical Representation:

40

Internship Report of National Bank of Pakistan Presented by SAM

0.12

0.1

0.08

0.06

0.04

0.02

0

Operating Cash Flow

Ratio

Year

2008

Year

2009

Year

2010

Interpretation:

This graph is showing that the Operating Cash Flow Ratio of NBP for the year 2008,

2009 & 2010 is 0.003, 0.057 and 0.107 Times respectively. NBP has not constant this ratio in all of the years. In 2008, this ratio is very low but in 2009 and 2010 this ratio is increasing with the passage of time. This ratio less than 1 is showing that the NBP is not generating much OCF to cover its current liabilities. So NBP need to improve liquidity by increasing the assets.

13. Dividend Per Share

Formula:

DPS = Dividends paid to Shareholders/ Average common shares outstanding

Calculation:

Dividend paid= 8,072,777

Average common shares outstanding= 1,345,462.8

= Dividends paid to Shareholders

/ Average common shares outstanding

2010

= 8,072,777/ 1,345,462.8

= Rs.6 per share

6 outstanding

Graphical Representation:

2009

Dividend paid= 5,830,338

Average common shares outstanding= 1,076,370.2

= Dividends paid to Shareholders

/ Average common shares

= 5,830,338/ 1,076,370.2

= Rs.5.41 per share

5.41

2008

Dividend paid= 6,115,739

Average common shares outstanding= 896,975.1

= Dividends paid to Shareholders

/ Average common shares outstanding

= 6,115,739/ 869,975.1

= Rs.6.81 per share

6.81

41

Internship Report of National Bank of Pakistan Presented by SAM

7

6

5

4

3

2

1

0

Year

2008

Year

2009

Year

2010

Dividend Per Share

Interpretation:

This graph is indicating that the Dividend per Share Ratio of NBP for the year 2008,

2009 & 2010 is Rs. 6.81, Rs. 5.41 and Rs. 6 respectively. It’s showing that NBP has positive ratio in all over the years. NBP is generating more earnings to pay its shareholder’s for their common shares outstanding that is a good sign for NBP. It will attract more and more investors to invest in NBP.

14. Earning Per Share

Formula:

Earning per Share = Net income/ outstanding number of shares

Calculation:

2010

Net Income= 17,563,214

Number of shares= 1,345,463

= Net income/ outstanding number of shares

= 17,563,214/ 1,345,463

= 13.05 per share

13.05

Graphical Representation:

2009

Net Income= 17,561,846

Number of shares= 1,345,463

= Net income/ outstanding number of shares

= 17,561,846/ 1,345,463

= 13.05 per share

13.05

2008

Net Income= 15,458,590

Number of shares= 1,076,370

= Net income/ outstanding number of shares

= 15,458,590/ 1,076,370

= 14.36 per share

14.36

42

Internship Report of National Bank of Pakistan Presented by SAM

14.5

14

13.5

13

12.5

Earning Per Share

Interpretation:

12

Year

2008

Year

2009

Year

2010

This graph is indicating that the Earning per Share Ratio of NBP for the year 2008, 2009

& 2010 Rs. 14.36, 13.05 and 13.05 respectively. It is showing that the Earning per Share

Ratio of NBP is decreasing in 2009 and 2010. The EPS ratio of NBP in 2008 is more due to the increasing net income than other years that is showing the shareholders were earning more per share in 2008 as compared to 2009 and 2010.

15. Price / Earning Ratio

Formula:

P/E = Current Market Share Price/ EPS

Calculation:

2010

Current Market Share Price= 76.82

EPS= 13.05

= Current Market Share Price/ EPS

= 76.82/13.05

= 5.88

5.88

2009

Current Market Share Price= 74.37

EPS= 13.05

= Current Market Share Price/ EPS

= 74.37/13.05

= 5.69

5.69

2008

Current Market Share Price= 50.32

EPS= 14.36

= Current Market Share Price/EPS

= 50.32/14.36

= 3.50

3.50

Graphical Representation:

6

5

4

3

2

Price / Earning Ratio

1

0

43

Year

2008

Year

2009

Year

2010

Internship Report of National Bank of Pakistan Presented by SAM

Interpretation:

The graph is showing that the Price to Earning Ratio of NBP for the year 2008, 2009 &

2010 is Rs. 3.50, Rs. 5.69 and 5.88 respectively. P/E ratio shows what the market is willing to pay for the company’s earnings.This ratio is low in 2008 that is not good and shows that the market is not willing to pay more for the NBP earnings. But in 2009 and

2010 this ratio is high which shows that the more the market is willing to pay for the NBP earnings.

NBP is the biggest bank of Pakistan that has its branches at national and international level. This is only the bank that is owned by the government of Pakistan. NBP acts as an agent of the State Bank of Pakistan. The future prospect of NBP is looking very strong because it has its branches at the national and international level. It has huge amount of profit. No other bank can compete this bank because it works on the behalf of the government. Management of the NBP is also very efficient to meet the requirements.

Customers have trust on it. NBP also deals with government employees and provides benefits to them. NBP can touch the heights by the computerized system. Financial position of NBP is very good. Assets and profits of NBP are in a position that no other bank will even think to earn. NBP plans to continue its strong focus on recovery and reduction in non performing loans, deposit mobilization, expense management and consolidation of loans. Financial position of NBP in 2010 is good and is expected to be better in the future. NBP is taking IT initiatives to upgrade and implement new application solutions to meet the challenges of the growing competition. It will improve the operational efficiency and control, customer services.

It is expected that the NBP will lead to the other banks of Pakistan in the future.

44

Internship Report of National Bank of Pakistan Presented by SAM

As a financial analyst I concluded that some ratios are good for NBP while some ratios are not good. These ratios are as following:

The net profit margin of NBP in all of the years is good.

Gross spread ratio is also good in all of over the years.

Spread ratio of NBP is also good because it covers its interest expenses.

Non Interest Income to Total Income Ratio of NBP is good.

Return on assets ratio of NBP is low.

Dupont return on assets ratio is also low.

Return on total equity ratio is good in all over the years.

Debt ratio of NBP is very high in all of the year that is not good.

Debt to equity ratio is also too high of NBP that is not god.

Time Interest earned ratio of NBP is good.

Advances / Deposits ratio is very low and not good for NBP.

Operating Cash Flow ratio is also very low in all over the year that is not good.

Dividend per share ratio of NBP is good.

Earning per share ratio is very good.

P / E ratio is also good of NBP.

But despite of all these problems NBP is in good position. If it solves these problems it can reach at the highest position and no one can touch its hights.

As a financial analyst I will recommend that some necessary points should be improved that are as following:

NBP can also increase the net profit margin ratio by decreasing its non mark-up interest expenses and taxes.

NBP can increase more its gross spread ratio by decreasing the interest expenses.

Return on assets ratio & Dupont return on assets ratio can also be increased by utilizing the assets in an efficient manner.

NBP need to decrease its debts to manage the debt ratio because a high debt is not a good sign for NBP.

Debt to equity ratio is also very high. NBP should decrease its debts because the equity investors will not invest in it due to high debts.

NBP can increase its advances / deposits ratio by giving advances to the customers.

NBP needs to improve its liquidity by increasing assets for operating cash flow.

45

Internship Report of National Bank of Pakistan Presented by SAM

I took help from the following sources:

Website of NBP: www.nbp.com.pk

www.google.com.pk

www.wikipedia.com

www.investopedia.com

Branch officers like

Operations manager

Compliance officer

Other staff etc

All the material used in this report is obtained from website of NBP. All financial statements are downloaded from annual report of www.nbp.com.pk

. Financial reports are present in Annual reports. I took all the data from the financial statements of 2010 and for

2008 I took the financial statements of 2008 for the preparation of this report.

46