Executive Summary - Houses of the Oireachtas

advertisement

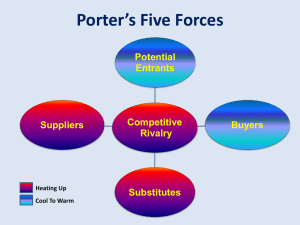

AN COMHCHOISTE UM FHIONTAR, TRÁDÁIL AGUS FOSTAÍOCHT An Caidreamh idir Soláthraithe agus Miondíoltóirí i Margadh Grósaeireachta na hÉireann MÁRTA 2010 JOINT COMMITTEE ON ENTERPRISE, TRADE AND EMPLOYMENT SUPPLIER – RETAILER RELATIONSHIPS IN THE IRISH GROCERY MARKET MARCH 2010 TUARASCÁIL FT&F 9/2010 – REPORT ET&E 9/2010 (PRN: A10/0344) 2 CONTENTS 1. Introduction 5 2. Executive Summary 9 3. Recommendations 11 4. Methodology 13 5. Findings 15 5.1 Relationships – Power in the Market 15 5.2 Strengths and Weaknesses in the Market 16 5.3 Gross Margins 17 5.4 5.5 Pricing 5.4.1 Low Population Density 5.4.2 Pricing Policy 5.4.3 Inefficiencies and Distortions Market Distortions 17 17 18 18 18 5.6 Negotiations 20 5.7 Payments 5.7.1 Payments to Initially List a Product 5.7.2 Continuing Payments for the Ongoing Listing of a Product 5.7.3 Rebate Per Unit or Item not Sold by the Retailer 5.7.4 Promotion Investment 5.7.5 Marketing Contributions 5.7.6 Payments for Re-tendering 5.7.7 Rebates to the Retailer Services Required 5.8.1 Help with Marketing 5.8.2 Provision of Staff in Busy Periods 5.8.3 Adapting Packaging Systems to Conform to Retailers Standards 5.8.4 Delivering on Pallets which Conform to Retailers Standards 5.8.5 Category Management – Managing Shelf Space for Products 21 21 22 22 22 23 24 24 25 25 25 25 26 26 Unfair Practices 5.9.1 Requests for Retailers to Provide Standard Terms of Business to Suppliers 5.9.2 Delays in Payments from Retailers to Suppliers 5.9.3 Requests for Retailers to Suppliers to Reduce Prices and Change Products 5.9.4 Obligatory Contributions to Marketing Costs by Suppliers 5.9.5 Payments Requested by Retailers for Stoking or Listing Suppliers’ Products 5.9.6 Liability of Suppliers for Products Unsold by Retailers either through Wastage or Damage 5.9.7 Payments for Store Promotions and Upgrades 5.9.8 Cancellation of Product at Short Notice outside the Terms of an Agreement 5.9.9 Potential Loss of Business to Suppliers not Supporting Promotions, New Lines, Loss Leaders, etc 27 27 27 28 28 28 29 29 29 30 5.8 5.9 6. Conclusions 31 7. Report Laid Before Houses 33 8. Orders of Reference of the Joint Committee 8.1 Dáil Éireann on 23 October 2007 ordered: 8.2 Seanad Éireann on 24 October 2007 ordered: 35 35 39 9. Members of the Joint Committee 43 3 4 1. Introduction The Committee on Enterprise, Trade and Employment has been conducting investigations into matters concerning the retail trade in Ireland over the last year plus. As part of these investigations the Committee has heard evidence from a wide number of organisations and commercial companies involved in the retail trade. The evidence presented to the Committee has indicated that certain commercial companies are abusing their strong position within the market to exert undue pressures on other commercial companies with whom they have business relations. While the Committee has been informed that both primary producers and retailers have applied such methods in their business dealings, the Committee has been unable to verify all the assertions made. This is largely due to the fact that nearly all the suppliers and producers who were invited to appear before the Committee declined to do so. Those companies that declined this invitation were not just small local-based companies but included international brand names with considerable resources. Having listened to the evidence presented to the Committee and realising it was not possible to obtain all the information we required through the normal formula of calling witnesses and gathering information in the public forum, the Vice-Chairman of the Committee, Cyprian Brady TD, decided to seek this information through a different method; by making contact with a number of suppliers directly, committing the process to total confidentiality and obtaining the relevant information on that basis. This report focuses on the relationships between suppliers and retailers within the grocery trade in Ireland. It highlights the opinions of suppliers on how the market operates, explores the balance of power within the market and identifies the occurrence of unfair practices. The Vice-Chairman of the Committee commissioned Ms Donna Mc Guinness (the researcher) to conduct this research and she did so by engaging in qualitative interviews with seven grocery suppliers (the respondents) in Ireland. I wish to thank Ms Mc Guinness for her professionalism and expertise which have facilitated the preparation of this report. I wish to take this opportunity to assure all the respondents who met with Ms Mc Guinness that their confidentiality was maintained by her and that while having 5 access to the information provided by her, no member of the Committee obtained any information on the identity of any of the respondents. International findings suggest that retailers with significant market share have greater power in their dealings with suppliers. Reports in the United Kingdom (UK) have highlighted examples of the misuse of this greater power to distort the accepted normal retailer supplier relationship. These examples include requests by retailers for suppliers to:1) Reduce their prices just before or after they have delivered their products; 2) Make payments to stock or list their products; 3) Contribute to the cost of marketing their products in the retailers’ stores; 4) 5) 6) 7) Make payments for store promotions within the retailers’ stores; Make payments for store upgrades within the retailers’ stores; Make excessive payments following consumer complaints; Provide additional services to retailers such as packaging and distribution. These UK Reports have also highlighted examples of:1) Suppliers not being given standard terms of business by retailers when they have requested these of the retailers; 2) Payments due to suppliers being substantially delayed by retailers beyond the previously agreed time scale. The Competition Authority in Ireland has published three reports in relation to the grocery industry in Ireland. However, they have not examined supplier retailer relationships and accordingly, this report has sought data on these relationships in other jurisdictions. The Competition Commission in the UK has investigated supplier retailer relationships on three occasions and has made recommendations to prohibit unfair practices they have identified as occurring. The most recent of these reports has suggested that a statutory Code of Conduct is needed to ensure fair and competitive practices are adhered to within the industry. Based on informal information gathered from suppliers in Ireland there is reason for concern that unfair practices may also occur in the Irish grocery market. This report attempts to identify whether or not this is so and, if so, whether or not its extent merits 6 the introduction of a statutory Code of Practice by the Minister for Enterprise, Trade and Employment and the appointment of an Ombudsman for the Retail Trade to police its enforcement. Lastly, I wish to thank Deputy Brady for presenting the original Rapporteur’s Report on this subject to the Committee for its consideration and adoption. _____________ Willie Penrose, Chairman 9 March 2010 7 8 2. Executive Summary This report examines the relationship between suppliers and large retailers in the Irish grocery market. It evaluates whether or not these relationships are fair and open or whether or not they allow large retailers to impose unfair conditions on suppliers. It documents the experience of a representative share of suppliers in the Irish grocery sector. It gives rise to serious concerns as it draws attention to assertions that some retailers engage in ‘gross misconduct’, ‘bullying and intimidation’ and even ‘illegal practices’ against suppliers. Many of the respondents state that they had been subjected to practices by retailers that include unreasonable demands for financial ‘contributions’ being made with implied threats for non-compliance. Most respondents believe that certain retailers hold the majority of power within Ireland’s grocery sector. This power imbalance seriously disadvantages suppliers in operating profitably. It is common practice for them to be subjected to requests for ‘hello money’, in one form or another, and they are also frequently required to make payments and provide services that are considered to be outside acceptable business practice. Such requests and requirements are particularly onerous on small suppliers who have limited resources. Most respondents believe consumers have a wide selection of stores to shop in and a wide variety of products and brands to choose from. The quality of Irish produce is of a very high standard, often higher than that of produce available elsewhere. The Irish emphasis on home-grown produce contributes significantly to this advantage. However, Irish consumers are paying too high a price for these products. This can partly be attributed to inefficiencies within the supply chain, but is mainly caused by retailers retaining profit margins three times greater in Ireland than in their operations elsewhere. This report identifies serious irregularities within the market that the Government must act to eliminate. It provides a strong case for introducing a statutory Code of Practice and the appointment of an Ombudsman to oversee its implementation and strict adherence to its terms by all participants. Such a Code of Practice should facilitate 9 transparency and oblige suppliers and retailers to publish their data including their profit margins. All the questions put to the respondents by the researcher referred to ten of the large retailers operating in Ireland. 10 3. Recommendations 1. Put in place the necessary measures to investigate the concerns outlined in this report and take appropriate action to counteract them by ensuring that all participants in the market operate within given acceptable modes of business behaviour; 2. Agree a method by which all relevant data pertaining to the market, including profit margins of suppliers and retailers, is put into the public domain; 3. Introduce a legislative Code of Practice to ensure fairness and equality within the sector and a system for measuring compliance with this Code; 4. Establish a cross-border advisory group to look for inequities within the retail market; 5. Consider methods to facilitate suppliers and retailers in reporting incidences of unfair practice; 6. Research the needs and wants of consumers to ensure that the retail sector are meeting them fairly and justly; 7. Educate consumers about the importance of local food culture and support local business. 11 12 4. Methodology This report explores rather than describes. It does this through engaging a number of suppliers in private and confidential interviews and obtaining from them an informative insight into the working of the grocery sector in Ireland. The process was initiated by the researcher drawing up a list of suppliers to the Irish grocery market and issuing an invitation to the Managing Directors of 50 of these suppliers to participate. This correspondence was followed up with a further contact by telephone by the researcher. Eight companies responded to her initial contact. They expressed reservations about participating in the process for the following reasons:1) The confidentiality of participation; 2) Fear of the consequence of voicing their opinions; 3) Scepticism of the value of the process. After the researcher assured them that their confidentiality was guaranteed, and that no member of the Oireachtas would be aware of who was interviewed, seven suppliers agreed to participate in the process and share their experiences in in-depth interviews. An interview schedule was adapted from the work of the Competition Commission (2009). All interviews were transcribed word for word and analysed using the computer package Nvivo. Coding and analysis techniques were used to identify the main themes of the study. These themes are now explored in more depth. 13 14 5. Findings The information outlined in this report was obtained on the basis of interviews with two manufacturers, two primary producers; two processors / packers; and one importer. All these suppliers supplied the main retail outlets in Ireland including Aldi, BMG, Dunnes Stores, Lidl, Londis, Musgrave, Stonehouse, Superquinn, Supervalue / Centra and Tesco Ireland. In most cases, the respondents supply at least 90% of their total produce to supermarkets and wholesalers within Ireland. For the purpose of this report, exact figures are not given to ensure confidentiality within the supply chain. Each interview was conducted by asking suppliers to comment on the following topics with respect to their dealings with retailers:5.1 Relationships – Power in the Market; 5.2 Strengths and Weaknesses in the market; 5.3 Gross Margins 5.4 5.5 5.6 5.7 5.8 5.9 Pricing; Market Distortions; Negotiations; Payments; Services Required; Unfair practices These themes will now be explored in more detail. 5.1 Relationships – Power in the Market The majority of respondents believe retailers hold the buying power in the Irish grocery market, the only exception to this being those suppliers who have a 15 strong brand recognition. Suppliers with this strong brand recognition are usually supported by a multi-national corporation and have a strong bargaining power of their own. Respondents emphasise that this power imbalance in favour of the retailers allows the latter to impose extortionate prices on the products they sell, to the disadvantage of consumers. It also allows retailers to increase their power over time and in the long term push small retailers out of the market. This reduces competition and the range of choice available to the consumer. One respondent states:“In Ireland’s market we have choice of product and choice of shop but that will be lost and we will have no identity, no food culture, no sense of purpose”. 5.2 Strengths and Weaknesses in the Market Respondents believe that Irish consumers have a wide choice of stores to shop including supermarkets, discounters, independents and convenience stores. There is also a good balance between in-town and out-of-town retail centres. However, if the multiple retailers increase their market share, this choice and diversity may be eroded and even lost which would have a detrimental effect on the market. Some of the larger retailers hold large land banks and if these are utilised to provide more shopping outlets, the market may be saturated especially within the convenience sector. Two respondents believe that Ireland is already “over shopped”. One of the respondents demonstrated these concerns as follows:“We have a healthy mix of retailers in Ireland – a good mix of town and out-of-town shopping. However, we have too many [convenience stores] and a healthy mix of top-end retailers and discounters”. 16 5.3 Gross Margins The gross margins of all respondents have decreased in the last five years and significantly in the last number of months. Increased production and labour costs and currency fluctuations have contributed to this, but a far greater cause is the unreasonable demands made of respondents by retailers which one supplier described as “retailer bullying tactics.” 5.4 Pricing Respondents believe that Irish consumers have a wide choice of products and brands to choose from and that the quality and freshness of Irish grocery items is of a higher standard compared to other countries. Five respondents acknowledge that prices for Irish consumers have decreased significantly in recent months. However, it is producers and suppliers who have absorbed the cost of these decreases rather than retailers. The retailers are mostly unwilling to reduce their own profit margins by any significant amount and have passed these costs on to the producers and suppliers. Despite these decreases respondents remain gravely concerned that prices are still much higher in Ireland than elsewhere and identified a number of reasons for this which include:- 5.4.1 Low Population Density In many parts of Ireland this means that retailers do not have the same level of footfall compared to other countries with much larger population densities. 17 5.4.2 Pricing Policy In this regard one respondent states:“Multiples being quite bullish in their pricing, therefore making smaller stores [such as independent stores] appear more expensive.” 5.4.3 Inefficiencies and Distortions Respondents attribute the responsibility for these distortions to the practices of the multiple supermarket chains operating in Ireland. These multiple supermarket chains have an “insatiable appetite for margin and an unregulated marketplace” and accordingly regard the Irish consumer market as an ideal opportunity to extract superlative profits over and above the norm – i.e. they see Ireland as a massive profit centre. One respondent states:“The main reason why prices are so different here [in Ireland] is a result of the high margins retailers make on their stock ... there are logistic issues and currency issues as well, but realistically it is the supermarkets and their high margins which add on the high prices to products.” [Market Distortions are discussed in section 5.5] 5.5 Market Distortions When asked if they were aware of unfair practices occurring in the Irish market, all the respondents stated that they were not only aware of such practices occurring, but that such practices were a common occurrence and regular feature. One respondent states:- 18 “Everything that you hear about unfair practices goes on and more mainly due to the fact that nobody wants to stand up and give the supporting evidence behind them.” When asked to define what they meant by unfair practices, one respondent gives the following definition:“Not paying bills, holding back money [due], false claims, demanding money, hidden threats and undue pressures” (see below). The application of unfair practices and the extent to which they impose on those who are subject to them depends on the type and quantity of produce being supplied to the retailer. Quantity is of more consequence in this regard than type. There is a direct correlation between the size of the supplier and the likelihood of their being subjected to unfair practices by retailers. The smaller the supplier the more likely this is to happen. The respondents believe that many of the unfair practices endured by suppliers are actually in breach of competition law and that the Competition Authority is aware of their occurrence. However, as the existence of such practices is not documented and is difficult to prove, the Competition Authority is unable to take action against them. Respondents are fearful of the consequence of reporting unfair practices to which they have been subjected to by retailers. They acknowledge that the retailers control access to the vast majority of consumers without which suppliers could not function. They also acknowledge the partial benefit they can gain from the economies of scale that the retailers can provide. The respondents fear that reporting unfair practices could lead to their being delisted and their products not being available on the shelves of retailers throughout the country. This would in effect lead to their ultimate failure and cessation of business. respondents summarises their position as:- One of the “It is not worth biting off the hand that feeds you.” 19 The respondents protest that this situation is unfair but again their attitude in this regard is summed up by the comments of one respondent:“Unfair practices come hand in hand with an unregulated industry”. The unfair practice to which respondents are most frequently subjected to is the request for ‘Hello Money’. This practice is camouflaged by retailers under the title ‘marketing support’. Respondents believe that this requirement for market support bullies them into supporting various campaigns and promotions. One respondent describes how retailers:“Demanded a lump sum of money simply to stock the product.” Another unfair practice is where supplier pay for a charity events held by retailers. Respondents believe that suppliers who decline such requests are at risk of being unilaterally delisted by the retailer. They describe these types of payment as:“Nonsensical and nothing to do with the everyday running of the business.” 5.6 Negotiations An important aspect of how businesses interact with each other is the ‘psychological contract’ that exists between them. This is an unwritten contract that incorporates a belief that both sides to the interaction will act honestly, will treat their opposite honourably and will not subject them to any unfair practices. Business interactions that honour this informal contract in addition to the terms and conditions of the legal contract will survive longer that those that do not. The latter will survive only so long as the injured party believes they have no option but to continue the relationship or that no other better option is available to them. In other words they are obliged, in order to survive, to submit to 20 conditions which they believe to be unfair but which they have no option but to accept. With regard to price negotiations between suppliers and retailers, suppliers seem to adhere to certain models. The terms of these models are dictated by retailers and generally accepted by suppliers who adapt their negotiation strategies to function within these models. Price negotiations between suppliers and retailers are conducted on a day-to-day basis. In addition to this Long Term Agreements are revised on a yearly basis. Larger suppliers are able to maintain greater control over these negotiations compared to smaller suppliers. The majority of respondent’s state that they are satisfied with how often price negotiations are made whether it is daily, weekly, monthly or yearly. The majority of respondents have, over the last ten years, been asked by retailers to enter into exclusivity agreements and they view these agreements positively, as good commercial business. They believe these agreements are to the advantage of both retailers and suppliers and some respondents state that they would like to see more of these agreements. 5.7 Payments Respondents were asked about various types of payments that they are requested to make to retailers. They were asked to state whether requests for these payments were made regularly, occasionally or never. 5.7.1 Payments to Initially List a Product The majority of respondents maintain that this practice is common within the market. However, it must be noted that larger suppliers feel less pressure to comply compared to smaller suppliers. All respondents state 21 that this practice is very unfair, especially for smaller suppliers with one respondent stating:“It is worse for smaller suppliers; they have to pay the same amount of money as us. We are a large global company; we can cope with those charges but the likes of smaller suppliers can and do go out of business with these types of payments.” 5.7.2 Continuing Payments for the Ongoing Listing of a Product Two respondents state that they are obliged to make continuing payments to retailers for the ongoing listing of their product. The other 5 respondents state, that while there is an issue with requests for once-off payments, they are not requested to make ongoing payments for the ongoing listing of their product. 5.7.3 Rebate Per Unit or Item not Sold by the Retailer All respondents state that they provide rebates per unit or items not sold by retailers. In general the larger suppliers do not object to this but smaller suppliers do, seeing such rebates as a tool used by retailers to increase their profit margins at the expense of suppliers. 5.7.4 Promotion Investment Respondents differentiate very clearly between payments for Promotion Investment, which are dealt with in this subsection and payments for Marketing Contributions which are dealt with in the next subsection. The majority of respondents believe retailers use requests for Promotion Investment to oblige suppliers to contribute financially towards the cost of in-store promotions. Furthermore, the selling of shelf space, in particular the premium price end of aisle space is also a method of charging 22 suppliers for Promotion Investment. One respondent describes Promotion Investment as making some sense as it will ultimately give Irish consumers better value through the promotions. Nevertheless, some respondents draw attention to the fact that smaller companies are encouraged to pay for end displays even if they are not keen to do so. One respondent describes this type of encouragement as:“Powerful persuasion, if you do not you are threatened with delisting, if you do you could lose a phenomenal amount of money for something that is not necessary for my business”. 5.7.5 Marketing Contributions All respondents state that have been requested by retailers to make Marketing Contributions. Retailers have requested these contributions for:1) Initial negotiations of stocking products; 2) Charity events; 3) Advertising even if their products are not in the advert. Further to this, respondents state that on occasion, retailers request them to make payments without giving an exact explanation of what the payment is for. Respondents regard these payments as euphemisms for ‘Hello Money’ used by retailers to extract payments, outside normal business arrangements, from suppliers. One respondent states that on one occasion no reason was given and that the retailer simply asked for “X amount of hello money”. Accordingly, respondents regard Marketing Contributions as a serious breech of competition law. 23 5.7.6 Payments for Re-tendering Respondents state that requests for payments for re-tendering are not a regular occurrence. One respondent had made such a payment and this had been made “in a round about way”. The implication here is that the respondent had not been asked directly for this payment. 5.7.7 Rebates to the Retailer Respondents state that requests for rebates to retailers are not a regular occurrence. One respondent states that they provide rebates to retailers, not in monetary terms but through the provision of other services [see section 5.8 below]. The majority of respondents complain that the monetary value of the payments that retailers expect them to make have increased dramatically in recent years. All respondents agree that some of these requests for payment are unwarranted and unjust and one respondent describes them as “complete rape and pilferage”. This practice is strengthened by the ongoing increase in power being gained by the larger retailers who one correspondent states are “renowned for their bully tactics”. As an example of this practice one respondent illustrates the margin maintained by Irish supermarkets compared to those in the UK:“The margin a retailer enjoys on some of our products in the Republic of Ireland is significantly more compared to [that in the] UK. In [the] UK it is 32%-35% and in the Republic of Ireland [it] is 45-50%. This is before VAT [Value Added Tax], exchange rates and logistics. Some retailers enjoy three times more profit here than in the UK.” The margins retained by retailers, quoted as the “extortionate amount of margin” by respondents is a re-occurring theme throughout this report. 24 5.8 Services Required Respondents state that retailers require suppliers to provide various additional services to them. Details of these types of services are outlined below. 5.8.1 Help with Marketing The majority of respondents assist retailers to some degree in marketing their products. Two of the respondents only assist with labelling as opposed to shop signage. Respondents do not object to doing this as they believe it is a justifiable contribution and is beneficial to them as it allows them to have an in-put into how their products are offered within stores, assists them in gaining insights into the retail industry and brings them closer to consumers. Respondents who do not assist retailers with marketing tend to be smaller in size and therefore, they do not justify such assistance as necessary or reasonable. 5.8.2 Provision of Staff in Busy Periods Two respondents provide staff to retailers during busy periods. They see this as providing an opportunity to understand and appreciate the whole supply chain. One respondent encourages this practice and also invites retail staff to work in its premises. This facilitates the respondent’s employees with a greater understanding of the entire supply chain. 5.8.3 Adapting Packaging Systems to Conform to Retailers Standards The majority of respondents offer to adapt their packaging systems to conform with retailers standards. This is a good practice that benefits consumers. One respondent states:- 25 “If the customer has done their research to investigate customer demands, then we will try to meet these findings. At the end of it, the customer is our main priority.” Two respondents have never been asked to adapt their packaging systems to conform with retailers standards. 5.8.4 Delivering on Pallets which Conform to Retailers Standards Respondents regularly deliver pallets that meet retailers needs. This is a common service provided by suppliers to retailers at the expense of the suppliers. The respondents are happy to meet this requirement as it creates greater efficiencies for them. Only one respondent does not provide pallets to retailers, stating that the company has a pallet system that “works for their company and seems to work for their suppliers too.” This implies an agreeable relationship between the supplier and the retailer. 5.8.5 Category Management – Managing Shelf Space for Products Respondents have different opinions on category management. The majority of respondents believe it helps them to support retailers and ultimately satisfy the consumer. It is very closely related to merchandising and is a business investment through being involved with managing shelf space. Two respondents believe that category management is of very little benefit to them, squanders their resources and facilitates retailers in playing suppliers off against each other. 26 5.9 Unfair Practices Respondents were asked whether they had experienced certain practices within the last five years when dealing with retailers. Some of these practices were based on scenarios which have occurred within the UK grocery market. 5.9.1 Requests for Retailers to Provide Standard Terms of Business to Suppliers Six respondents were provided with standard terms of business when they requested them from retailers. However, one respondent was not provided with them but this respondent declined to provide details on the basis that the information is sensitive and might identify the supplier in question. 5.9.2 Delays in Payments from Retailers to Suppliers Three respondents have experienced delays in receiving payment from retailers later than the payment date originally agreed. This has not always involved an extensive time delay. Two respondents state that retailers have delayed payments for long periods of time, and this is a common occurrence. One respondent states that in one case payment was delayed for a long period of time, 90% of the payment was eventually paid but the remaining 10% was never paid. Respondents appear to accept late payments from retailers as an unavoidable condition of doing business and their resigned attitude in this regard is best summarised by one respondent who states:“All in all I cannot complain. Like in all businesses payments can be late, but sure what can be done? We depend on that money to keep afloat.” 27 5.9.3 Requests for Retailers to Suppliers to Reduce Prices and Change Products Six respondents state that retailers often request price reductions soon before or after delivery. In some cases retailers reduce the price paid for produce without due reason or cause. Retailers may also request respondents to change their products shortly before or soon after delivery, for example they may seek to reduce previous orders. This is a particularly severe problem for suppliers producing fresh produce [such as fruit, vegetables, beef and poultry] which they need to dispose of before it perishes or sustain the loss of. referring to the problems these requests create, states:- One respondent, “For fresh produce it is ordered and when that order is committed to and grown there is no way you can stop the flow of that order, but retailers can come in change orders even if they haven’t received them.” 5.9.4 Obligatory Contributions to Marketing Costs by Suppliers Respondents state that retailers regularly require obligatory contributions from them. In many instances they clearly ask for such contributions and even when they do not do so directly, the respondents believe the retailers expect them to make such contributions “voluntarily.” 5.9.5 Payments Requested by Retailers for Stoking or Listing Suppliers’ Products The majority of respondents state that requests from retailers for payment to stock or list a supplier’s products are common practice within the market. If they refuse to make these payments their products may be delisted by the retailer and this distorts the market by reducing competition and the choice available to the consumer. 28 For obvious reasons, larger suppliers are under less pressure to make these payments than smaller suppliers with on respondent stating that they do not “have to pay for the privilege of stocking or listing their products.” 5.9.6 Liability of Suppliers for Products Unsold by Retailers either through Wastage or Damage Retailers oblige respondents to refund payments that have been made for products which are not subsequently sold on to the consumer. The retailer may also oblige the respondent to collect and dispose of the products at the respondent’s own expense. 5.9.7 Payments for Store Promotions and Upgrades Two respondents state that they have been asked and have agreed to pay for promotions or competitions that retailers have organised. Furthermore, one respondent was asked and agreed to pay for an extension to a large retail store. However, this type of request is not very frequent among the respondents. Respondents state that larger suppliers are more likely to be asked for payment for store upgrades whereas smaller suppliers are more likely to be asked for smaller payments to sponsor re-openings of retail outlets. 5.9.8 Cancellation of Product at Short Notice outside the Terms of an Agreement Two respondents who supply fresh or short shelf life products state that their product has been cancelled at short notice outside the terms of the agreement they had with retailers at the time. One of these respondents comments on the effects this can have:29 “When our orders are cancelled it means that we could be at risk of losing a substantial amount of money.” This respondent’s main product is fresh fish. The respondent believes that when the produce is pre-ordered and planted or grown, that is when the sale takes place. However, retailers regularly cancel or change their orders after this time and the respondent is left with either too much product or product shortages. 5.9.9 Potential Loss of Business to Suppliers not Supporting Promotions, New Lines, Loss Leaders, etc Respondents are expected to support promotions on a regular basis. They are asked to support new lines and expected to take a financial loss if the product is not successful. Furthermore, retailers regularly expect suppliers to take a financial loss on some products that allows retailers to undercut their competition. When asked how retailers make suppliers do this the answer was clear, they are threatened by their retailers to do so. Respondents state that the use of threats is an everyday occurrence in the relationships between some retailers and their suppliers. All respondents have experienced such threats on a regular basis and one respondent comments on these as follows:“Threats are a normal part of business. ‘We may not be able to support you,’ that is a threat.” 30 6. Conclusions This report clearly highlights the disproportionate market power that large retailers retain in the Irish retail market and the disadvantages that this places suppliers and other retailers in, when seeking to conduct their businesses. This report also clearly highlights that some of these large retailers are using their disproportionate share of market power to impose unfair conditions on suppliers. The various types of ‘hello money’ and the unwarranted payments they regularly require of suppliers and the ‘requests’ for sponsoring advertisements, charity events, etc can be described as not only a misuse of their market power but as unethical. The accompanying possibility of delisting of products as a consequence of refusing these demands or declining these ‘requests’ is a constant reminder to many suppliers that they operate in an market where power is divided unevenly and where their continued ability to access the consumer is often subject to arbitrary control and restriction by others. As a consequence of these findings I recommend that the Government puts in place the necessary measures to investigate these matters more thoroughly and ascertain the level and frequency of any malpractices. The aim of such an investigation must be to ensure that participants in the market operate in accordance with acceptable business practice and that ultimately retailers, suppliers or consumers do not engage in or are not subject to unfair practices or undue pressure. Lastly, a method must be agreed by which all relevant data pertaining to the production, supply and sale of goods from the supplier at one end to the consumer at the other is put into the public domain. This will help in developing an open and transparent market that will inform retailers, suppliers and consumers of the relevant data with regard to market share, market power, price margins, etc and allow each participant to make informed judgements and choices based on how they interpret this information. 31 32 7. Report Laid Before Houses At its meeting on Wednesday, 16 February 2010 the Oireachtas Joint Committee on Enterprise, Trade and Employment approved the Report on Supplier – Retailer Relationships in the Irish Grocery Market and instructed the Clerk to the Committee to lay six copies of the Report before the Houses of the Oireachtas. 33 34 8. Orders of Reference of the Joint Committee 8.1 Dáil Éireann on 23 October 2007 ordered: (1) (a) That a Select Committee, which shall be called the Select Committee on Enterprise, Trade and Employment consisting of 11 members of Dáil Éireann (of whom 4 shall constitute a quorum), be appointed to consider:(i) Such Bills the statute law in respect of which is dealt with by the Department of Enterprise, Trade and Employment; (ii) Such Estimates for Public Services within the aegis of the Department of Enterprise, Trade and Employment; (iii) Such proposals contained in any motion, including any motion within the meaning of Standing Order 159, concerning the approval by Dáil Éireann of the terms of international agreements involving a charge on public funds; and (iv) Such other matters as shall be referred to it by Dáil Éireann from time to time; (v) Annual Output Statements produced by the Department of Enterprise, Trade and Employment; and (vi) Such Value for Money and Policy Reviews conducted and commissioned by the Department of Enterprise, Trade and Employment as it may select. 35 (b) For the purpose of its consideration of matters under paragraphs (1)(a)(i), (iii), (iv), (v) and (vi), the Select Committee shall have the powers defined in Standing Order 83(1), (2) and (3). (c) For the avoidance of doubt, by virtue of his or her ex officio membership of the Select Committee in accordance with Standing Order 92(1), the Minister for Enterprise, Trade and Employment (or a Minister or Minister of State nominated in his or her stead) shall be entitled to vote. (2) The Select Committee shall be joined with a Select Committee to be appointed by Seanad Éireann to form the Joint Committee on Enterprise, Trade and Employment to consider – (i) such public affairs administered by the Department of Enterprise, Trade and Employment as it may select, including, in respect of Government policy, bodies under the aegis of that Department; (ii) such matters of policy, including EU related matters, for which the Minister for Enterprise, Trade and Employment is officially responsible as it may select; (iii) such matters across Departments which come within the remit of the Minister of State with special responsibility for Innovation Policy as it may select; Provided that members of the Joint Committee on Education and Science shall be afforded the opportunity to participate in the consideration of matters within this remit; (iv) such related policy issues as it may select concerning bodies which are partly or wholly funded by the State or which are established or appointed by Members of the Government or by the Oireachtas; (v) such Statutory Instruments made by the Minister for Enterprise, Trade and Employment and laid before both Houses of the Oireachtas as it may select; 36 (vi) such proposals for EU legislation and related policy issues as may be referred to it from time to time, in accordance with Standing Order 83(4); (vii) the strategy statement laid before each House of the Oireachtas by the Minister for Enterprise, Trade and Employment pursuant to section 5(2) of the Public Service Management Act 1997, and for which the Joint Committee is authorised for the purposes of section 10 of that Act; (viii) such annual reports or annual reports and accounts, required by law and laid before either or both Houses of the Oireachtas, of bodies specified in paragraphs 2(i) and (iv), and the overall operational results, statements of strategy and corporate plans of these bodies, as it may select; Provided that the Joint Committee shall not, at any time, consider any matter relating to such a body which is, which has been, or which is, at that time, proposed to be considered by the Committee of Public Accounts pursuant to the Orders of Reference of that Committee and/or the Comptroller and Auditor General (Amendment) Act 1993; Provided further that the Joint Committee shall refrain from inquiring into in public session, or publishing confidential information regarding, any such matter if so requested either by the body concerned or by the Minister for Enterprise, Trade and Employment; and (ix) Such other matters as may be jointly referred to it from time to time by both Houses of the Oireachtas, And shall report thereon to both Houses of the Oireachtas. (3) The Joint Committee shall have the power to require that the Minister for Enterprise, Trade and Employment (or a Minister or Minister of State nominated in his or her stead) shall attend before the Joint Committee and provide, in private session if so desired by the Minister or Minister of State, oral briefings in advance of EU Council meetings to enable the Joint 37 Committee to make known its views. (4) The quorum of the Joint Committee shall be five, of whom at least one shall be a member of Dáil Éireann and one a member of Seanad Éireann. (5) The Joint Committee shall have the powers defined in Standing Order 83(1) to (9) inclusive. (6) The Chairman of the Joint Committee, who shall be a member of Dáil Éireann, shall also be Chairman of the Select Committee.” 38 8.2 Seanad Éireann on 24 October 2007 ordered: (1) That a Select Committee consisting of 4 members of Seanad Éireann shall be appointed to be joined with a Select Committee of Dáil Éireann to form the Joint Committee on Enterprise, Trade and Employment to consider – (i) such public affairs administered by the Department of Enterprise, Trade and Employment as it may select, including, in respect of Government policy, bodies under the aegis of that Department; (ii) such matters of policy, including EU related matters, for which the Minister for Enterprise, Trade and Employment is officially responsible as it may select; (iii) such matters across Departments which come within the remit of the Minister of State with special responsibility for Innovation Policy as it may select; Provided that members of the Joint Committee on Education and Science shall be afforded the opportunity to participate in the consideration of matters with this remit; (iv) such related policy issues as it may select concerning bodies which are partly or wholly funded by the State or which are established or appointed by Members of the Government or by the Oireachtas; (v) such Statutory Instruments made by the Minister for Enterprise, Trade and Employment and laid before both Houses of the Oireachtas as it may select; (vi) such proposals for EU legislation and related policy issues as may be referred to it from time to time, in accordance with Standing Order 70(4); (vii) the strategy statement laid before each House of the Oireachtas by the Minister for Enterprise, Trade and Employment pursuant to section 5(2) of the Public Service Management Act, 1997, and for which the Joint Committee is authorised for the purposes of section 10 of that Act; 39 (viii) such annual reports or annual reports and accounts, required by law and laid before either or both Houses of the Oireachtas, of bodies specified in paragraphs 1(i) and (iv), and the overall operational results, statements of strategy and corporate plans of these bodies, as it may select; Provided that the Joint Committee shall not, at any time, consider any matter relating to such a body which is, which has been, or which is, at that time, proposed to be considered by the Committee of Public Accounts pursuant to the Orders of Reference of that Committee and/or the Comptroller and Auditor General (Amendment) Act, 1993; Provided further that the Joint Committee shall refrain from inquiring into in public session, or publishing confidential information regarding, any such matter if so requested either by the body or by the Minister for Enterprise, Trade and Employment; and (ix) Such other matters as may be jointly referred to it from time to time by both Houses of the Oireachtas, And shall report thereon to both Houses of the Oireachtas. (2) The Joint Committee shall have the power to require that the Minister for Enterprise, Trade and Employment (or a Minister or Minister of State nominated in his or her stead) shall attend before the Joint Committee and provide, in private session if so desired by the Minister or Minister of State, oral briefings in advance of EU Council meetings to enable the Joint Committee to make known its views. (3) The quorum of the Joint Committee shall be five, of whom at least one shall be a member of Dáil Éireann and one a member of Seanad Éireann. (4) The Joint Committee shall have the powers defined in Standing Order 70(1) to (9) 40 inclusive. (5) The Chairman of the Joint Committee shall be a member of Dáil Éireann.” 41 42 9. Members of the Joint Committee MR CHRIS ANDREWS TD MR CYPRIAN BRADY TD (VICE-CHAIRPERSON) MS DEIRDRE CLUNE TD MR DAMIEN ENGLISH TD MR MICHAEL FITZPATRICK TD MR ARTHUR MORGAN TD MR EDWARD O’KEEFFE TD MR WILLIE PENROSE TD (CHAIRPERSON) MR SEÁN POWER TD DR LEO VARADKAR TD MS MARY WHITE TD SENATOR IVOR CALLELY SENATOR DONIE CASSIDY SENATOR JOHN PAUL PHELAN SENATOR BRENDAN RYAN 43