Chapter 4

advertisement

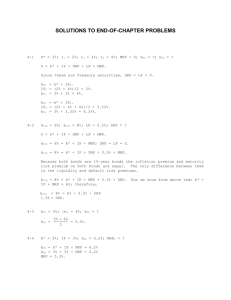

Chapter 4 The Financial Environment: Markets, Institutions, and Interest Rates SOLUTIONS TO END-OF-CHAPTER PROBLEMS 4-1 k* = 3%; I1 = 2%; I2 = 4%; I3 = 4%; MRP = 0; kT2 = ?; kT3 = ? k = k* + IP + DRP + LP + MRP. Since these are Treasury securities, DRP = LP = 0. kT2 = k* + IP2. IP2 = (2% + 4%)/2 = 3%. kT2 = 3% + 3% = 6%. kT3 = k* + IP3. IP3 = (2% + 4% + 4%)/3 = 3.33%. kT3 = 3% + 3.33% = 6.33%. 4-2 kT10 = 6%; kC10 = 8%; LP = 0.5%; DRP = ? k = k* + IP + DRP + LP + MRP. kT10 = 6% = k* + IP + MRP; DRP = LP = 0. kC10 = 8% = k* + IP + DRP + 0.5% + MRP. Because both bonds are 10-year bonds the inflation premium and maturity risk premium on both bonds are equal. The only difference between them is the liquidity and default risk premiums. kC10 = 8% = k* + IP + MRP + 0.5% + DRP. IP + MRP = 6%; therefore, But we know from above that k* + kC10 = 8% = 6% + 0.5% + DRP 1.5% = DRP. 4-3 kT1 = 5%; 1kT1 = 6%; kT2 = ? kT2 = 4-4 5% + 6% = 5.5%. 2 k* = 3%; IP = 3%; kT2 = 6.2%; MRP2 = ? Answers and Solutions: 4 - 1 kT2 = k* + IP + MRP = 6.2% kT2 = 3% + 3% + MRP = 6.2% MRP = 0.2%. 4-5 Let x equal the yield on 2-year securities 4 years from now: 7.5% = [(4)(7%) + 2x]/6 0.45 = 0.28 + 2x x = 0.085 or 8.5%. 4-6 k = k* + IP + MRP + DRP + LP. k* = 0.03. IP = [0.03 + 0.04 + (5)(0.035)]/7 = 0.035. MRP = 0.0005(6) = 0.003. DRP = 0. LP = 0. kT7 = 0.03 + 0.035 + 0.003 = 0.068 = 6.8%. 4-7 a. k1 = 3%, and k2 = 3% + 1k1 2 = 4.5%, Solving for k1 in Year 2, 1k1, we obtain 1k1 = (4.5% × 2) - 3% = 6%. b. For riskless bonds under the expectations theory, the interest rate for a bond of any maturity is kn = k* + average inflation over n years. If k* = 1%, we can solve for IPn: Year 1: k1 = 1% + I1 = 3%; I1 = expected inflation = 3% - 1% = 2%. Year 2: k1 = 1% + I2 = 6%; I2 = expected inflation = 6% - 1% = 5%. Note also that the average inflation rate is (2% + 5%)/2 = 3.5%, which, when added to k* = 1%, produces the yield on a 2-year bond, 4.5 percent. Therefore, all of our results are consistent. Alternative solution: 2 first: kRF = k* + IP. Answers and Solutions: 4 - 2 Solve for the inflation rates in Year 1 and Year Year 1: 3% = 1% + IP1; IP1 = 2%, thus I1 = 2%. Year 2: 4.5% = 1% + IP2; IP2 = 3.5%. IP2 = (I1 + I2)/2 3.5% = (2% + I2)/2 I2 = 5%. Then solve for the yield on the one-year bond in the second year: Year 2: k1 = 1% + 5% = 6%. 4-8 k* = 2%; MRP = 0%; k1 = 5%; k2 = 7%; 1k1 = ? 1k1 represents the one-year rate on a bond one year from now (Year 2). k1 + 1k1 2 5% + 1k 1 7% = 2 9% = 1k1. k2 = 1k1 = k* + I2 9% = 2% + I2 7% = I2. The average interest rate during the 2-year period differs from the 1-year interest rate expected for Year 2 because of the inflation rate reflected in the two interest rates. The inflation rate reflected in the interest rate on any security is the average rate of inflation expected over the security’s life. 4-9 Basic relevant equations: kt = k* + IPt + DRPt + MRPt + LPt. But here IP is the only premium, so kt = k* + IPt. IPt = Avg. inflation = (I1 + I2 + ...)/N. We know that I1 = IP1 = 3% and k* = 2%. kT1 = 2% + 3% = 5%. Therefore, kT3 = k1 + 2% = 5% + 2% = 7%. But, kT3 = k* + IP3 = 2% + IP3 = 7%, so IP3 = 7% - 2% = 5%. We also know that It = Constant after t = 1. Answers and Solutions: 4 - 3 We can set up this table: k* 2 2 2 1 2 3 I 3 I I Avg. I = IPt 3%/1 = 3% (3% + I)/2 = IP2 (3% + I + I)/3 = IP3 k = k* + IPt 5% k3 = 7%, so IP3 = 7% - 2% = 5%. IP3 = (3% + 2I)/3 = 5% 2I = 12% I = 6%. 4-10 kC8 8.3% 8.3% 8.3% DRP8 = = = = = k* + IP8 + MRP8 + DRP8 + LP8 2.5% + (2.8% 4 + 3.75% 4)/8 + 0.0% + DRP8 + 0.75% 2.5% + 3.275% + 0.0% + DRP8 + 0.75% 6.525% + DRP8 1.775%. 4-11 T-bill rate = k* + IP 5.5% = k* + 3.25% k* = 2.25%. 4-12 We’re given all the components to determine the yield on the Cartwright bonds except the default risk premium (DRP) and MRP. Calculate the MRP as 0.1%(5 - 1) = 0.4%. Now, we can solve for the DRP as follows: 7.75% = 2.3% + 2.5% + 0.4% + 1.0% + DRP, or DRP = 1.55%. 4-13 First, calculate the inflation premiums for the next three and five years, respectively. They are IP3 = (2.5% + 3.2% + 3.6%)/3 = 3.1% and IP5 = (2.5% + 3.2% + 3.6% + 3.6% + 3.6%)/5 = 3.3%. The real risk-free rate is given as 2.75%. Since the default and liquidity premiums are zero on Treasury bonds, we can now solve for the default risk premium. Thus, 6.25% = 2.75% + 3.1% + MRP3, or MRP3 = 0.4%. Similarly, 6.8% = 2.75% + 3.3% + MRP5, or MRP5 = 0.75%. Thus, MRP5 – MRP3 = 0.75% - 0.40% = 0.35%. 4-14 a. Years to Maturity 1 2 3 4 5 10 20 Real Risk-Free Rate (k*) 2% 2 2 2 2 2 2 Answers and Solutions: 4 - 4 IP** 7.00% 6.00 5.00 4.50 4.20 3.60 3.30 MRP 0.2% 0.4 0.6 0.8 1.0 1.0 1.0 kT = k* + IP + MRP 9.20% 8.40 7.60 7.30 7.20 6.60 6.30 **The computation of the inflation premium is as follows: Year 1 2 3 4 5 10 20 Expected Inflation 7% 5 3 3 3 3 3 Average Expected Inflation 7.00% 6.00 5.00 4.50 4.20 3.60 3.30 For example, the calculation for 3 years is as follows: 7% + 5% + 3% = 5.00%. 3 Thus, the yield curve would be as follows: Interest Rate (%) 11.0 10.5 10.0 9.5 9.0 8.5 Exelon 8.0 7.5 Exxon Mobil 7.0 6.5 T-bonds 0 2 4 6 8 10 12 14 16 18 20 Years to Maturity b. The interest rate on the Exxon Mobil bonds has the same components as the Treasury securities, except that the Exxon Mobil bonds have default risk, so a default risk premium must be included. Therefore, kExxon Mobil = k* + IP + MRP + DRP. For a strong company such as Exxon Mobil, the default risk premium is virtually zero for short-term bonds. However, as time to maturity increases, the probability of default, although still small, is sufficient to warrant a default premium. Thus, the yield risk curve for the Exxon Mobil bonds will rise above the yield curve for the Treasury Answers and Solutions: 4 - 5 securities. In the graph, the default risk premium was assumed to be 1.0 percentage point on the 20-year Exxon Mobil bonds. The return should equal 6.3% + 1% = 7.3%. c. Exelon bonds would have significantly more default risk than either Treasury securities or Exxon Mobil bonds, and the risk of default would increase over time due to possible financial deterioration. In this example, the default risk premium was assumed to be 1.0 percentage point on the 1-year Exelon bonds and 2.0 percentage points on the 20-year bonds. The 20-year return should equal 6.3% + 2% = 8.3%. 4-15 6 1 2 3 4 5 10 20 30 Term months year years years years years years years years Rate 5.1% 5.5 5.6 5.7 5.8 6.0 6.1 6.5 6.3 Interest Rate (%) 10 8 6 4 2 0 0 5 10 15 20 25 30 Years to Maturity 4-16 a. The average rate of inflation for the 5-year period is calculated as: Average inflation = (0.13 + 0.09 + 0.07 + 0.06 + 0.06)/5 = 8.20%. rate b. k = k* + IPAvg. = 2% + 8.2% = 10.20%. c. Here is the general situation: Year 1 2 3 5 . . . 10 20 1-Year Expected Inflation 13% 9 7 6 . . . 6 6 Answers and Solutions: 4 - 6 Arithmetic Average Expected Inflation 13.0% 11.0 9.7 8.2 . . . 7.1 6.6 k* 2% 2 2 2 . . . 2 2 Maturity Risk Premium 0.1% 0.2 0.3 0.5 . . . 1.0 2.0 Estimated Interest Rates 15.1% 13.2 12.0 10.7 . . . 10.1 10.6 Interest Rate (%) 15.0 12.5 10.0 7.5 5.0 2.5 0 2 4 6 8 10 12 14 16 18 20 Years to Maturity d. The “normal” yield curve is upward sloping because, in “normal” times, inflation is not expected to trend either up or down, so IP is the same for debt of all maturities, but the MRP increases with years, so the yield curve slopes up. During a recession, the yield curve typically slopes up especially steeply, because inflation and consequently shortterm interest rates are currently low, yet people expect inflation and interest rates to rise as the economy comes out of the recession. e. If inflation rates are expected to be constant, then the expectations theory holds that the yield curve should be horizontal. However, in this event it is likely that maturity risk premiums would be applied to long-term bonds because of the greater risks of holding long-term rather than short-term bonds: Percent (%) Actual yield curve Maturity risk premium Pure expectations yield curve Years to Maturity Answers and Solutions: 4 - 7 If maturity risk premiums were added to the yield curve in Part e above, then the yield curve would be more nearly normal; that is, the long-term end of the curve would be raised. (The yield curve shown in this answer is upward sloping; the yield curve shown in Part c is downward sloping.) 4-8