Chapter 14

advertisement

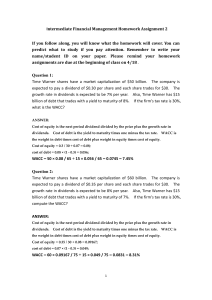

Ch 14 (ADD A FINAL QUESTION THAT MAKES STUDENTS CALCULATE WACC AND NPV WITH FLOTATION COSTS!!!) April 13th, 2012 Ch. 14 Cost of Capital I. Cost of Equity II. Cost of Debt III. Cost of Preferred Stock IV. Weighted Average Cost of Capital (Additional Considerations) V. Flotation Costs Chapter deals with the COC = is discount rate which is used when calculating NPV Ch 15. shows how to come up with cost of capital (COC). Different approaches, WACC is most prominent (=COC for firm as a whole) COC = required rate of return = discount rate required rate of return is the return investors require to be compensated for lending the firm their money (view of investor) COC is the rate that the firm must earn to compensate investors for using their money (is same as RRR) (view of firm) ***COC is dependent on the risk of project = on use of funds*** WACC = reflects the COC on firms assets as a whole (equity & debt). We need to calculate COE and COD and use a mixture of these to come up with WACC I. Cost of Equity (R E ) return the equity investors (shareholders) require on their investment most difficult because it cannot be easily observed and is estimated in two ways (we have discussed both): 1. Dividend Growth Model Approach Dt x (1 g ) Dt 1 RE g RE g D RE t 1 g Pt Pt 1 D and P can be easily obtained for public company (WSJ) but g has to be estimated either by 1. using forecasts from different sources (financial services, investment companies) if you have different forecasts: average them 2. or: g=ROE x retention ratio or 3. using past growth rates from dividend info: year dividend % change 2004 1.23 n/a 2005 1.30 (1.30 - 1.23)/ 1.23 = .057 2006 1.36 (1.36 - 1.30)/1.30 = .046 2007 1.43 (1.43 - 1.36)/1.36 = .051 2008 1.50 (1.50-1.43)/ 1.43 = .049 take average of g’s (5.7 + 4.6 + 5.1 + 4.9) / 4 = 5.1% advantage of approach: is easy disadvantages: - this approach is only applicable to stocks that pay dividends -assumes that dividend grows at constant rate (is normally not the case) - R E sensitive to g - does not consider risk of investment 2. Security market line approach (SML approach) RE R f [ R M R f ] E (capital asset pricing model) advantage for risk: it adjusts for risk applicable if stocks do not grow constantly disadvantage: depends on past and the estimates of market risk and beta Beta and market risk premium can change over time. If all info given to calculate both ways: take average of the two results) 2 Example: Assume that a firm’s average past dividend growth rate is 5%. The firm just paid a $3 dividend and its stock is trading at $40 per share. The current Tbill rate is 1%. The firm’s beta is 1.5 and the market risk premium is 7%. What is your best estimate of the cost of equity for the firm? DGM: 3(1.05)/40 + .05 = 3.15/40 + .05 = .07875 + .05 = .12875 CAPM: .01 + 1.5(.07) = .01 + .105 = .115 Cost of Equity =( .12875+.115) /2 = .24375/2 = .121875 II. Cost of Debt ( R D ) interest rate of debt is observable from financial markets if the firm already has debt outstanding, use the yield to maturity of those bonds (= market required rate on the firm’s debt) or find out what interest rate on newly issued bonds with similar risk is (debt rating) one more consideration: taxes cash flows are determined on after-tax cash flow bases, so appropriate discount rate also is expressed on aftertax basis interest payments paid by firms are tax deductible, so we need to consider the effect of taxes on the cost of debt. R D x (1 - T C ) Example: Assume that a firm has bonds outstanding with 25 years left to maturity that make semi-annual payments. The current price of the bonds is $1,090 and the coupon rate is 6% APR. What is the firm’s cost of debt? 1,000 FV 25x 2 = 50 N -$1,090 PV 6/2 = 3% .03 x 1,000 = $30 CPT I/Y = 2.6717 x 2 = 5.3434 III. Cost of Preferred Stock (R P ) preferred stock pays constant dividend forever = perpetuity PV = D/R R P = D/P 0 = dividend yield 3 if firm has several different issues of preferred stock: calculate both required returns and average them Example: A firm has preferred stock outstanding that pays a $6 dividend and currently trades at $80. What is the firm’s cost of preferred stock? 6/80 = .075 IV. Weighted Average Cost of Capital firm’s assets are made up of equity + debt + preferred stock we know how to calculate R E , R D , and R P we need to know the weights of these assets. The weights are determined by capital structure (discussed in more detail in Ch.17) equity weight = E/V (state in decimal) debt weight = D/V preferred stock weight = P/V (where V= total market value of firm) (100% = weight of equity + weight of debt + weight of preferred stock D usage is 25% and E usage is 75%. Cap. structure can also be expressed in the D/E ratio D D V to convert D/A ratio into D/E use : .25/.75 = .33 = 1/3 D 1 V E example: market value of stocks = $150 million market value of bonds : $25 million total market value of assets: $175 million equity weight = 150/175 = .86 debt weight = 25/175 = .14) WACC formula: WACC = (E/A) x R E + (D/A) x R D x (1 - T C ) + (P/A) x R P Example 1: Capital Structure weights: Assume that a firm carries debt, common stock and preferred stock. The firm’s debt has a total market value of $4,000,000, the firm’s common stock currently trades at $5 per share and there are 1 million shares outstanding and the firm’s preferred stock trades at $2 per share and there are 500,000 shares outstanding. What are the firm’s capital structure weights? V = 4 mil + 5 mil + 1 mil =10 mil D/V: 4/10 = 40% E/V = 5/10 = 50% P/V = 10% 4 Example 2: Capital Structure weights: Assume that a firm only carries debt and common stock. The firm’s D/E ratio is 0.5. What are the firm’s capital structure weights for debt and equity? D/E = .5 = .5/1 D+E = V = .5 +1 = 1.5 D/V = .5/1.5 = 1/3 E/V = 1/1.5 = 2/3 Example 1 WACC: a company has: 1.2 million shares outstanding the stock sells for $25 per share face value of debt is $4 million, but is priced in the market at 98% of face value yield to maturity of debt is currently 14% risk free rate = 5% market risk premium = 8% beta = 1.3 tax rate = .34 equity: market value : 1.2 x 25 = $30 mil R E = .05 + (.08 x 1.3) = .154 debt: market value: 4 x .98 = $3.92 mil R D = yield to maturity = 14% Total assets = $33.92 mil WACC = 30/33.92 x .154 + 3.92/33.92 x .14 x (1-.34) = .1362 + .0107 = .1469 this is a second example on how to calculated the WACC: Assume a company has bonds outstanding that sell for $950, have a $1,000 face value, have a 6% coupon rate and 18 years left to maturity. The bonds make annual payments. The firm’s stock has a beta of 1.4. The growth rate is 3% and the dividend yield is 5%. The T-bill rate is 4% and the return of the S&P500 index is 10%. If the D/E ratio is 0.6 and company’s tax rate is 34%, what is the WACC? 5 Again we are only using the formula with two parts for equity and debt as the preferred stock is missing. This time the D/E ratio is given as opposed to the market value information on debt and equity. Here, we need to convert the D/E ratio into the Debt ratio and Equity ratio first. First we will address how to calculated the debt ratio and the equity ratio: D/E=0.6, as this is the same as .6/1 → D=0.6, E =1 and the market value of the firm D+E=V=1.6 →D/V= w D =0.6/1.6=0.375 and E/V= w E =1/1.6 = 0.625 cost of equity can be calculated in two different ways: first with the CAMP: RE = 0.04 + 1.4 (0.10 – 0.04) = 0.124 and second with the Dividend growth model:RE =dividend yield + g= 0.05 + 0.03 = 0.08 Now we take the average RE = (0.124+0.08)/2= 0.102 Next we calculate the cost of debt, which is the YTM of its existing debt: as the YTM is not directly given, you have to use your TMV keys to do a bond calculation where you solve the YTM. 1000 FV, -950 PV, 60 PMT, 18N, CPT I/Y R D=YTM= 0.0648 (note: convert the answer from the % form into the decimal form) Now we are ready to calculated the WACC WACC=0.625 x 0.102 + 0.375 x 0.0648 x (1-.34) = It is the weight of equity times the cost of equity (STO1) plus the weight of debt times the cost of debt times 1-t (STO2) RCL1 0.06375 + RCL 2 0.016038 = .0798 or 7.98% Note: For the WACC calculation, you don’t need to round the decimals to more than 4 (in decimal format which of course is two in % format). 6 Some additional Considerations with respect to the WACC it is important to realize that the COC (WACC) depends on type of project (cap. Budgeting decision/use of funds) not on financing decision (not the source of funds) In the WACC we are using the firm’s current cost of equity and debt that are corresponding to the current firm’s products and services and therefore to the current firm’s level of risk. Therefore we can only use the WACC approach if the project that is being evaluated is very similar to the existing projects of the firm (that is: new project’s risk class is similar to the overall firm’s risk class) If the project is an integral part of the overall business of the firm then that would be the case. If the project has a very different risk from firm’s overall risk there is a chance that an unprofitable project is accepted or that a profitable project is rejected. Fin. managers who understand this issue with the WACC will often use the so called subjective approach. They calculate the WACC and adjust it upward for risky projects or downward for low risk projects. For example if a new project involves investing in a foreign county, the WACC might be adjusted up ward by 1% because the project faces additional political and exchange rate risk. Another problem exists, if a company has several divisions with different levels of risk, a separate COC should be estimated for each division. For example: In the case of American express: the firm has both a credit card business & travel agency services. If AMEX is considering a project only related to travel agency division, it should use the information it needs for the WACC from another company, which is involved in that particular business (in this example another large travel agency) = this method is called the pure play approach 7 V. Flotation costs: costs of issuing stock to the public Def: Cost of issuing or floating securities. 6 types of costs when selling stock (flotation costs) 1. spread between the offering price and the price the issuer (company) receives: fees paid to underwriting syndicate 2. other direct expenses: filing fees, legal fees, taxes (reported on prospectus) 3. indirect expenses: management time spend on issue (not reported “ “) 4. stock price drop when new stock is issued (asymmetric info theory) 5. underpricing: loss from selling stock below correct value (high for IPO) 6. green shoe option: gives underwriter the option to purchase additional stock (to cover excess demand) at offer price (which is below market price). The investment banking firm rather issues too few shares and then have the option to sell more shares so stock will not be “undersubscribed”. Flotation costs are important and should be included in NPV calculation. Flotation cost for equity and debt is given (usually in % terms), as well as debt and equity weights, weighted average flotation cost is calculated as: f ( E / V ) xf E ( D / V ) xf D ( P / V ) xf P cost of project with f = cost of project without f / (1- flotation cost) example: a firm has 75% equity an 25% debt. Flotation costs of equity are 18% Flotation costs for debt are 5% If a project costs $50 million without considering flotation costs, how much money actually has to be raised (actual costs) when flotation costs are considered? f = .75 x .18 + .25 x .05 = .15 50/(1 - .15) = $58.8 million (8.8 mil are flotation costs) 8