FinMan_Managerial_12e_TM_Ch14_Final

advertisement

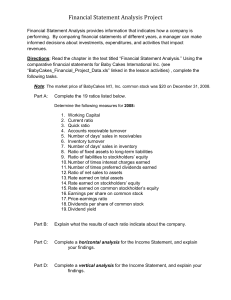

Transparency Master 14-1 HORIZONTAL ANALYSIS Using the income statement for Nike, compute the percentage change for the following items: Percentage Change 2010–2011 Net sales (Gross Margin) Cost of sales Selling & admin. expense Income before taxes Net income 2009–2010 Transparency Master 14-2 HORIZONTAL ANALYSIS Solution Using the income statement for Nike, compute the percentage change for the following items: Percentage Change 2010–2011 Net sales (Gross Margin) Cost of sales Selling & admin. expense 8% 11.1% 5.8% Income before taxes 13% Net income 11.9% 2009–2010 2.3% (3.4)% 2.9% 28.6% 28.3% Transparency Master 14-3 VERTICAL ANALYSIS Nike, Inc. Consolidated Income Statement For the Year Ended May 31, 2011 Revenues ............................................................. 219.4% Cost of sales ........................................................ 119.4% Gross margin ................................................. 100.0% Expenses: Selling & administrative ............................... 70.4% Income B4 Taxes ....................................... 29.9% Net Income ..................................................... 22.4% Transparency Master 14-4 SOLVENCY MEASURES 1. Current Position Analysis a. Working capital b. Current ratio c. Quick ratio 2. Accounts Receivable Analysis a. Accounts receivable turnover b. Number of days’ sales in receivables 3. Inventory Analysis a. Inventory turnover b. Number of days’ sales in inventory 4. Ratio of Fixed Assets to Long-Term Liabilities 5. Ratio of Liabilities to Stockholders’ Equity 6. Number of Times Interest Charges Earned Transparency Master 14-5 SOLVENCY MEASURES Ace Co. Current Year Ace Co. Industry Prior Year Average Current ratio ................... 2.5 2.4 2.2 Quick ratio ...................... 1.2 1.2 1.0 Accounts receivable turnover ....................... 7.6 7.9 10.1 Number of days’ sales in receivables ............. 48 46 36 Inventory turnover ......... 4.7 4.6 4.3 Number of days’ sales in inventory ................. 77 79 85 Ratio of fixed assets to long-term liabilities .... 3.6 3.6 3.7 Ratio of liabilities to stockholders’ equity .. 0.6 0.7 0.9 Number of times interest charges earned ........... 8.2 8.0 9.5 Transparency Master 14-6 PROFITABILITY MEASURES 1. Ratio of net sales to assets 2. Rate earned on total assets 3. Rate earned on stockholders’ equity 4. Rate earned on common stockholders’ equity 5. Earnings per share on common stock 6. Price-earnings ratio 7. Dividends per share 8. Dividend yield Transparency Master 14-7 PROFITABILITY MEASURES Ace Co. Current Year Ace Co. Prior Year Industry Average Ratio of net sales to assets .............. 1.4 1.3 1.1 Rate earned on total assets .............. 12% 12% 11% Rate earned on stockholders’ equity ...................... 18% 17% 15% Earnings per share on common stock ............................... $1.80 $1.72 Price-earnings ratio ........................... 10.2 10.5 12.4 Dividend yield .................................... 4% 4% 3% Transparency Master 14-8 SECTIONS OF A CORPORATE ANNUAL REPORT 1. Financial highlights 2. President’s letter 3. Financial statements 4. Notes to the financial statements 5. Management’s discussion and analysis 6. Management report 7. Independent auditors’ report 8. Historical summary Transparency Master 14-9 INDEPENDENT AUDITORS’ REPORT 1. Introductory Paragraph Lists the financial statements that were audited. States that management has overall responsibility for the financial statements; the auditors’ responsibility is simply to express an opinion on the statements prepared by management. 2. Scope Paragraph Describes the nature of the audit process. States that audits are conducted in accordance with generally accepted auditing standards and include tests needed to obtain “reasonable assurance” that financial statements do not include material misstatements. 3. Opinion Paragraph Gives the auditors’ opinion on the financial statements. In an unqualified opinion, the auditor affirms that the financial statements present fairly, in all material respects, a company’s financial position, results of operations, and cash flows in conformity with generally accepted accounting principles. Transparency Master 14-10 WRITING EXERCISE Many annual reports include a Historical Summary section, which shows key financial data for the past five to ten years. Why would information that is five to ten years old be presented in an annual report? Transparency Master 14-11 WRITING EXERCISE 1. Why are the results of discontinued operations and extraordinary items shown in separate sections at the bottom of the income statement? 2. Why are discontinued operations and extraordinary items shown net of tax?