Dec 24, 2014

Walgreens Co.

(WAG-NASDAQ)

$76.51

Note to Readers: More details to come; changes are highlighted. Except where noted, and highlighted, no other

section of this report has been updated.

Reason for Report: Flash Update: 1Q15 Earnings

Prev. Ed: Nov 7: 4Q14 and FY14 Earnings (broker price and share price are as of Oct 9, 2014)

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in

the Valuation table. The extra figures in the Valuation table come from reports that did not have accompanying

spreadsheet models.

Flash Update

Walgreens Beats Q1 Earnings, Alliance Boots Deal Bears Fruit – Dec 23, 2014

Walgreens reported adjusted net earnings of $0.81 per share in 1Q15, up 12.5% from $0.72 of 1Q14.

The adjusted figure also beat the Zacks Consensus Estimate of $0.74 by 9.5%.

A year-over-year (y/y) high-single-digit increase in the revenues primarily resulted in this bottom-line

improvement.

In Aug 2012, Walgreens had entered into a strategic partnership with a global international pharmacy-led

health and beauty group Alliance Boots GmbH, in which it acquired a 45% stake for $6.7 billion. This

alliance fits Walgreens' strategy to advance community pharmacy and bring additional specialty

pharmacy products and services closer to patients.

So far, Walgreens' partnership with Alliance Boots has been yielding positive results, with combined

synergies reaching $140 million in 1Q15. Moreover, Alliance Boots contributed $0.11 per share to

Walgreens' 1Q15 adjusted net earnings.

Walgreens expects this joint synergy program to deliver approximately $650 million in FY15.

On a reported basis (including certain one-time items), net earnings came in at $809 million or $0.85 per

share, an improvement of 16.4% or 18.1% respectively from the net earnings of $695 million or $0.72 per

share of 1Q14.

Quarter in Detail

During 1Q15, Walgreens' total sales reached $19.6 billion registering sales growth of 6.7% y/yand a

comfortable beat over the Zacks Consensus Estimate of $19.4 billion. This sales result came in line with

the preliminary November sales figures posted by Walgreens in the first week of December.

In 1Q15, Walgreens delivered solid performance across both its pharmacy and retail products

businesses, which resulted in the top-line improvement.

© Copyright 2013, Zacks Investment Research. All Rights Reserved

Front-end comparable store (those open for at least a year) sales and basket size grew 1.5% and 4.2%,

respectively, in 1Q15. Overall, comparable store sales improved 5.7%. On the other hand, customer

traffic in comparable stores was down 2.7%.

Pharmacy sales (accounting for 66.8% of total sales in 1Q15) climbed 9% y/y while pharmacy sales in

comparable stores increased 8.1%. Moreover, Walgreens filled a record 222 million prescriptions (up

4.3% year over year) during 1Q15.

Prescriptions filled at comparable stores rose 4.1%. As of Nov 30, Walgreens retail prescription market

share on a 30-day adjusted basis reached 19%, as reported by IMS Health.

Notably, Walgreens has completed its financing to seal the Alliance Boots transaction. Walgreens

expects to close the second step of the transaction on Dec 31, 2014, following the special meeting of

shareholders to be held on Dec 29 in New York City.

Margins

Adjusted gross profit increased 2.6% y/y to $5.35 billion. However, as expected, adjusted gross margin

contracted 100 basis points (bps) to 27.3% as pharmacy gross profit was negatively impacted by lower

third-party reimbursement and generic drug price inflation, partially offset by an increase in the brand-togeneric drug conversions.

However, as expected, both pharmacy and front-end margins gained from purchasing synergies from the

company's joint venture with Alliance Boots.

Adjusted selling, general and administrative (SG&A) expenses scaled up 1.7% y/y to $4.3 billion.

Adjusted operating margin remained flat at 5.2%.

Details, other news update and broker comments will be provided in the next edition.

Portfolio Manager Executive Summary

Walgreen Co. (WAG), or Walgreens, operates retail drugstore chains in the U.S. These drugstores sell

prescription and non-prescription drugs, and general merchandise. General merchandise includes beauty

care, personal care, household items, candy, photofinishing service, greeting cards, seasonal items, and

convenience food. Customers can have prescriptions filled at the drugstore counter as well as through

telephone, mail and the Internet.

Of the 21 firms covering Walgreens, 12 (57.1%) assigned positive ratings, 8 (38.1%) provided neutral

ratings and 1 (4.8%) conferred a negative rating on the stock.

Positive or equivalent outlook (12/21 firms): Bullish firms are satisfied with Walgreens’ in-line 4Q14

financial results. In 4Q14, the company’s prescription share of Medicare Part D exceeded its overall

retail prescription share. However, the volume growth could not offset the effects of lower

reimbursements and the firms expect this pattern to continue in FY15 as well. The firms believe that the

recently announced partnership of Walgreens with WebMed, under which the latter’s virtual wellness

coaching programs will be provided to Walgreens customers, will not be able to drive much earnings

growth for the company. However, they believe this partnership will elevate Walgreens’ position in the

digital market, by helping educate customers, encourage healthy behavior, manage chronic conditions,

and overall increase customer loyalty, thus possibly driving foot traffic at its stores.

According to firms, Walgreen’s “Balance Rewards” customer loyalty program is helping lower the

company’s print ad costs and is bringing individualized marketing benefits. Recent work to increase the

share of the company’s private brand products within the mix, as well as a new front-end merchandising

Zacks Investment Research

Page 2

www.zackspro.com

strategy, has the potential to positively impact same store sales and profits. Finally the bullish firms are

of the opinion that Walgreens will benefit from several tailwinds, including benefits from the AB deal,

higher volumes from the ACA, specialty drug launches and ongoing acquisition activity.

Neutral or equivalent outlook (8/21 firms): Neutral firms remain on the sidelines owing to Walgreens’

in-line 4Q14 financial results accompanied by the mixed outlook for the near term. The firms were

impressed with the contribution of Alliance Boots in 4Q14, which continued to be better-than-expected.

Moreover, they expect Walgreens’ base business will improve, particularly as the company's customerloyalty program continues to gain traction. They are optimistic that Walgreens will benefit from its

integration with Alliance Boots, which is currently doing well. However, at the same time, these firms are

concerned of the fact on Walgreens decision to continue operation at its original headquarter in Chicago,

following the accelerated acquisition of the Alliance Boots. They believe, had Walgreens moved its

headquarter to one of the European countries, it could have gained the benefits of tax inversion, which

might otherwise hamper earnings. Moreover, firms expect the rising pressure on drug pricing to

adversely impact the company’s profitability in the near term.

Given that management expects most of the current headwinds like overall reimbursement pressures,

generic drug inflation, and step downs for Med D reimbursement rates will persist through FY15, some

of the neutral firms have lowered their EPS estimates for FY15. However, with the flu season off to a

relatively healthy start and given the expectations that this season could be more pronounced than last

year’s, firms anticipate a further acceleration in script growth over the coming months. This in turn will

usher in profits for Walgreens.

Nov 7, 2014

Overview

Headquartered in Deerfield, IL, Walgreens is principally a retail drugstore chain that sells prescription and

non-prescription drugs and general merchandise. General merchandise includes, among other things,

household items, convenience and fresh foods, personal care, beauty care, photofinishing services and

candy. Customers can have prescriptions filled in retail pharmacies as well as through the mail, and may

also place orders by telephone and online.

As of Feb 28, 2014, Walgreens operated 8,681 locations in all 50 states, the District of Columbia, Puerto

Rico and Guam and the U.S. Virgin Islands, including 8,210 drugstores (138 more compared with the

year-ago period). The company also operates infusion and respiratory service facilities, worksite health

and wellness centers, specialty pharmacies and mail service facilities. Its Take Care Health Systems

subsidiary manages more than 750 in-store convenient care clinics and worksite health and wellness

centers. The company’s website is www.walgreens.com. The company’s fiscal year ends on Aug 31; all

calendar references differ from the fiscal year.

The firms identified the following factors for evaluating the investment merits of WAG:

Zacks Investment Research

Page 3

www.zackspro.com

Key Positive Arguments

Health & Wellness Division: Walgreens is

strengthening its health and wellness division with

acquisitions and is growing its presence in specialty

pharmacy, which has substantial growth potential.

Key Negative Arguments

Declining Margins: Over the past few years, increased

reimbursement pressure and generic drug cost inflation

has been hampering Walgreens’ margin, on a significant

level. The management does not expect this situation to

improve in the near term.

Initiatives: The company is constantly introducing

strategic initiatives to boost long-term growth. Many

firms believe that Walgreens’ recent partnership

with WebMed will elevate its position in the digital

market. Besides it also has the potential to drive

foot traffic at its stores.

Regulations: The continued efforts of health

maintenance organizations (HMOs), managed care

organizations, PBMs, and other third party payors,

including government agencies such as Medicaid, to cut

costs by reducing prescription drug costs and

reimbursement rates could pose a threat to Walgreens’

future operating performance.

Strong Balance Sheet: Based on a strong balance

sheet, the company returns value to shareholders

through dividends and share repurchases.

Moreover, a strong cash balance augurs well for

acquisitions.

Low Generic Drugs Introduction Rate: Walgreens

expects the trend of low introduction rate of new generic

drugs to continue in FY15. This has led few firms to lower

their EPS estimate for FY15.

Improved Supply Chain: The long-term deal with

AmerisourceBergen is another upside. The firms

are sanguine about improved supply chain

performance in the next fiscal. Moreover, they are

encouraged by the expected accretion from this

deal.

Nov 7, 2014

Long-Term Growth

Walgreens has long been considered as one of the premier chains in the drug retailing industry with its

superior execution and strong position in many major U.S. drug store markets that provide it with a

significant share in managed care. It is an industry leader commanding impressive market share and high

levels of execution and brand loyalty, which position it well to capture growth off the aging baby boomers

and a government-led expansion of prescription drug coverage.

Over the past several years, Walgreens has taken a number of strategic steps to stimulate customer

demand amid a challenging macroeconomic scenario. Subsequent to acquiring a 45% stake in Alliance

Boots GmbH for $6.7 billion, this leading retail pharmacy chain acquired a mid-South U.S.-based regional

drugstore chain for $438 million. While some firms take note of these bold strategic moves, others are of

the view that the Alliance Boots deal could lead to a loss of focus from the current issues in the U.S.

Walgreens also partnered with a number of hospitals and health systems to improve patient care, provide

greater access to important pharmacy and healthcare services, and reduce costs.

Over the long term, the firms believe that specialty utilization will drive earnings. It is expected that

management’s efforts will be successful in increasing the volume of generic drug introduction in the

upcoming quarters. This, in turn, is expected to improve front end margin in the long run.

The firms are also encouraged to note the company’s consistent efforts to support the positive

momentum going forward. During the 2Q13 conference call, Walgreens had disclosed a 10-year

comprehensive primary distribution agreement with AmerisourceBergen for branded and generic

products effective Sep 1, 2013, to improve its global pharmaceutical supply chain.

Zacks Investment Research

Page 4

www.zackspro.com

On Jan 8, 2014, Walgreens announced its plans for strategic developments in FY14. The management is

expecting the U.S. health care spending to grow 3% to 20% of gross domestic product by 2020. Aging

population and health care reforms are considered to be the major tailwinds. Walgreens is planning to

capitalize on the shift in payment models to pay-for-performance in health care. In an effort to strengthen

its foothold in the $2.6 trillion health care market, the company will focus on three strategic growth

drivers: creating a new and improved store format called Well Experience, advancing community

pharmacy and establishing an efficient global platform on behalf of its customers and shareholders.

Given the ongoing wave of generic launches, a shift toward lower-cost providers of care, the increasing

prevalence of specialty and Walgreens’ sophisticated operational infrastructure, firms are optimistic about

Walgreen’s growth trajectory over the long term.

Management is also strengthening its presence globally. Walgreens and Alliance Boots will utilize their

resources to achieve this goal. Walgreens is aiming to make the global pharmaceutical distribution

channel more efficient. It is focusing on establishing leading positions in markets beyond the U.S and

Europe and also in some of the emerging markets.

The firms believe that key drivers for long-term growth include the improved supply chain due to

AmerisourceBergen relationship, incremental Alliance Boots synergies, and new initiatives along with

accelerated cost savings. With the current generic wave, the generic prescription drug volume growth is

projected to accelerate over the next few years. The firms also believe that this will benefit Walgreens as

the rate of generic drug introduction is expected to increase for the company in the upcoming years.

Walgreens is optimistic about the financial and operational benefits from the AmerisourceBergen deal for

FY14 with margin expansion and bottom-line accretion. Given this backdrop, the firms are also optimistic

about the long-term deal which should boost Walgreens’ presence in the retail drug purchasing space.

However, during the 3Q14 earnings call Walgreens withdrew its FY16 outlook.

Nov 7, 2014

Target Price/Valuation

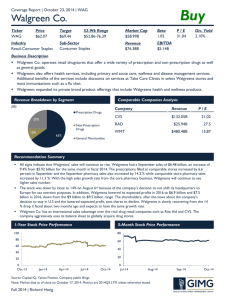

Rating Distribution

Positive

57.1%↓

Neutral

38.1%↑

Negative

4.8%↓

Avg. Target Price

$69.77↓

Maximum Target

$83.00↓

Minimum Target

$56.00↑

No. of Analysts with Target price/Total

17/21

Upside from current

13.4%

Maximum Upside from current

34.8%

Minimum Downside from current

9%

Risks to the target price include lower-than-expected growth in the retail business, increased industry

regulation or changes to the existing health care law, or a material loss of business, weak front-end

business compelling the company to take a promotional stance, or inability to meet the synergy goals.

Zacks Investment Research

Page 5

www.zackspro.com

Recent Events

On Sep 30, 2014, Walgreens reported fiscal 4Q14 and FY14 results. Highlights are as follows:

Walgreens reported adjusted EPS of $0.74 in 4Q14, up 1.4% y/y. In FY14, Walgreens reported

adjusted EPS of $3.28, up 5.1% y/y.

Revenues in 4Q14 increased 6.2% y/y to $19.06 billion. In FY14, the same increased 5.8% y/y to

$76.39 billion.

Guidance: The company estimates that accretion from the Alliance Boots deal in fiscal 1Q15 will be

an adjusted $0.10–$0.11 per share. Further, it estimates the joint synergy program to deliver combined

synergies of $650 million in FY15.

On Oct 7, 2014, Walgreens announced that it has more than doubled its preferred network relationships

with national Medicare Part D plan sponsors for 2015 and will be a part of preferred networks for nine

plan sponsors. The networks are designed to offer greater access to pharmacy services and cost savings

opportunities.

On Oct 6, 2014, Walgreens announced that it is conducting a developer contest to encourage integration

of its Balance Rewards application program interface (API), which allows users of other apps to earn

Balance Rewards loyalty program points for making healthy choices. Rewards points can be redeemed

for merchandise in-store or online.

On Oct 2, 2014, Walgreens reported that it has partnered up with WebMD Health to improve health and

wellness in America by helping and incenting consumers to make healthier choices at home, work and

on-the-go. In the coming months, the two companies will work together to provide WebMD’s virtual

wellness-coaching programs directly to Walgreens customers.

Revenue

Revenues in 4Q14 increased 6.2% y/y to $19.06 billion. In FY14, Walgreens reported revenues of $76.39

billion reflecting a rise of 5.8% y/y.

The Zacks Digest total revenue in 4Q14 was in line with the company’s report.

Provided below is a summary of segment revenue as compiled by Zacks Digest:

Revenue ($ in million)

4Q13A

2013A

3Q14A

4Q14A

2014A

1Q15E

2Q15E

2015E

2016E

Digest Average

$17,941.0

$72,217.0

$19,401.0

$19,057.0

$76,392.0

$19,278.9↑

$20,538.5

$80,660.2↑

$83,612.0↓

Digest High

$17,941.0

$72,217.0

$19,401.0

$19,057.0

$76,392.0

$19,417.0↑

$20,660.0

$81,301.7↑

$83,612.0↓

Digest Low

$19,057.0

$76,391.5

$19,098.0↓

$20,432.0

$79,678.0↑

$83,612.0↓

5.2%↑

4.8%

5.6%↑

3.7%↓

4.1%↑

3.7%

$17,941.0

$72,217.0

$19,401.0

Y/Y Growth

5.1%

0.8%

5.9%

6.2%

Same-Store sales

-1.0%

-1.0%

5.0%

Store growth

2.4%

1.4%

1.1%

Zacks Investment Research

2.4%

Page 6

5.8%

1.1%

www.zackspro.com

Total sales in comparable stores improved 5.4% y/y in 4Q14, while front-end comparable store sales

(those open for more than a year) rose 1.3% y/y. However, customer traffic in comparable stores was

down 2.2% while basket size increased 3.5% in 4Q14.

Prescription sales (accounting for 65.7% of sales in 4Q14) moved up 9.3% y/y, and prescription sales in

comparable stores increased 7.8%. Moreover, during 4Q14, Walgreens filled 211 million prescriptions

(up 4.2% y/y). Prescriptions filled at comparable stores climbed 3.9% y/y. The company consistently

observed strong growth in prescriptions filled for Medicare Part D patients, which increased 9.2% y/y in

4Q14.

Walgreens gained retail prescription market share of 30 basis points (bps) to scale 19.0% in FY14.

Moreover, in FY14, Walgreens filled a record 856 million prescriptions. Since the beginning of FY13,

Walgreens Medicare Part D prescription market share has grown more than twice as fast as its overall

retail prescription market share.

In 4Q14, Walgreens opened/acquired 46 new drug stores, compared to 33 opened/acquired in 4Q13.

New Strategic Developments:

On Aug 13, 2014, Walgreens reported that it is expanding its Healthcare Clinic retail locations with entry

into the Dallas-Fort Worth market. The company plans to bring 13 Healthcare Clinic at select Walgreens

locations to the Dallas Metroplex by the end of 2014. The first clinic opened July 28 in Southlake.

On Aug 6, 2014, Walgreens announced that it has exercised its option to complete the second step of its

strategic transaction with Alliance Boots GmbH ahead of the original option period, which was between

February and August 2015. This action follows the launch of the companies’ long-term strategic

partnership in June 2012, when Walgreens acquired a 45 percent equity ownership in Alliance Boots,

with the option to proceed to a full combination by acquiring the remaining 55 percent of Alliance Boots in

three years’ time. Walgreens expects to close the transaction in the first quarter of calendar 2015.

On July 22, 2014, Walgreens introduced its new “Balance Rewards for healthy choices” initiative to help

participants modify behavior risk factors associated with the nation’s most urgent public health issues.

This initiative, one of the pillars of Walgreens 81 million active member Balance Rewards loyalty

program, will incant adoption of healthy habits and reward those choices with Balance Rewards points.

On Jun 25, 2014, Walgreens completed the sale of a majority interest in its subsidiary, Take Care

Employer Solutions to Water Street Healthcare Partners (Water Street). At the same time, Water Street

made an investment in CHS Health Services (CHS), an unrelated entity, and merged CHS with Take

Care Employer to create a leading worksite health company dedicated to improving the cost and quality

of employee health care. Water Street owns a majority interest in the new company while Walgreens

owns a significant minority interest and has representatives on the new company's board of directors.

Walgreens recorded an immaterial gain from the transaction.

On Oct 1, 2013, Walgreens and Alliance Boots had arrived at a long-term and strategic relationship with

AmerisourceBergen. Per the announcement made during Mar 2013, Walgreens and AmerisourceBergen

have successfully begun implementing their 10-year agreement for pharmaceutical distribution from early

Sep 2013. In addition, AmerisourceBergen has also teamed up with Alliance Boots and Walgreens under

a three-pronged agreement that underlines a strategic collaboration, equity alignment and distribution

agreement.

As per the Branded and Generic Pharmaceutical Distribution agreement, AmerisourceBergen will be the

distributor and supplier of branded pharmaceutical products and generic pharmaceutical products of

Zacks Investment Research

Page 7

www.zackspro.com

Walgreens. Walgreens will be benefited by substantial operational benefit and enhanced supply chain

from this deal. The company expects modest accretion from this market- based contract for fiscal 2014.

As per the Global Supply Chain Opportunities branched agreement, the company will benefit from

AmerisourceBergen’s expertise in its wholesale distribution and specialty and manufacturer services

business across the United States. This move is also expected to facilitate avenues for new projects and

services.

With the view of strengthening the long-term relationship under the equity position pronged agreement,

Walgreens together with Alliance Boots granted the right to purchase a minority equity position in

AmerisourceBergen in the open market. The same did not include the obligation to purchase up to 7% of

fully diluted equity of AmerisourceBergen. Since 2Q14 AmerisourceBergen has begun distributing

generic pharmaceutical products that Walgreens previously used to self-distribute. The levels of generic

pharmaceuticals distributed have increased throughout the fiscal year and AmerisourceBergen

distributed substantially all of these pharmaceuticals for the Company as of August 31, 2014.

Walgreens’ partnership with Alliance Boots is yielding positive results, with synergies for FY14 scaling

approximately $491 million. In 4Q14, the Alliance Boots deal was accretive to adjusted earnings by $0.06

per share. The company estimates accretion from Alliance Boots in 1Q15 at an adjusted $0.10–$0.11 per

share.

This alliance fits Walgreens’ strategy to advance community pharmacy and bring additional specialty

pharmacy products and services closer to patients. The company expects this to expand its centralized

specialty and mail service pharmacy operations.

Loyalty Card: On Sep 16, 2012, Walgreens launched a complete customer loyalty program ‘Balance

Rewards' to stimulate spending through points and rewards earned by customers. This program includes

over 7,900 Walgreens and Duane Reade stores in the U.S. and offers multi-channel access to join the

program. At the end of FY14, the company’s Balance Rewards loyalty program had 82 million active

members. Walgreens integrated its award winning Paperless coupons into this program and had nearly

1.5 million people enrolled in Balance Rewards for healthy choices program. Currently, Walgreens is

offering store-wide events designed to further build loyalty.

The firms are expecting the revenues to improve as Walgreens is focusing on products with higher profit

and demands.

Outlook: Walgreens estimates the joint synergy program to deliver FY15 combined synergies of

approximately $650 million.

Margins

Adjusted gross profit increased 2.6% y/y to $5.32 billion in 4Q14, primarily owing to the improvements

observed in script comps and front-end comp sales. However, adjusted gross margin contracted 100

bps to 27.9% primarily driven by a decline in pharmacy gross margin. The pharmacy gross margin

decrease was a result of increasing third-party reimbursement pressure particularly due to a few contract

step downs, increases in Medicare Part D mix including the strategy to continue driving 90-day

prescriptions at retail, pronounced generic drug inflation and the mix of specialty drugs. However, the

positive effect of the increased rate of introductions of new generics in 3Q14 versus 3Q13 and

purchasing synergies in the pharmacy partially neutralized these decreases in the pharmacy margin. The

LIFO provision was $132 million in FY14 versus $239 million in FY13.

The Zacks Digest average gross margin in 4Q14 was in line with the company’s report.

Zacks Investment Research

Page 8

www.zackspro.com

With selling, general and administrative (SG&A) expenses increasing 4.8% y/y to $4.5 billion,

adjusted operating margin (excluding equity earnings in Alliance Boots) during 4Q14 contracted 67 bps

to 4.4%. The Zacks Digest average operating margin in 4Q14 was above the company’s report.

Provided below is a summary of margins as compiled by Zacks Digest.

Margins ($ in million)

4Q13A

2013A

3Q14A

4Q14A

2014A

1Q15E

2Q15E

2015E

Gross

28.9%

29.3%

28.1%

27.9%

28.3%

27.4%↓

28.0%

27.3%↓

Operating

5.9%

5.7%

5.9%

5.9%

5.9%

Pre-Tax

4.6%

4.9%

5.0%

4.9%

4.9%

4.6%

5.6%

5.0%

2016E

Note: As per the Zacks Digest model, cost of goods sold (COGS) is expected to increase 7.3% y/y in

FY14 and increase 8.0% y/y in FY15; SG&A expense is expected to increase 2.3% y/y in FY15. In

comparison, revenue is expected to increase 5.8% y/y in FY14 and 5.6% y/y in FY15.

Please refer to the Zacks Research Digest spreadsheet on WAG for total forward margin estimates and details.

Earnings per Share

In 4Q14, Walgreens reported adjusted EPS of $0.74 up 1.4% y/y. Including one-time items, Walgreens

reported loss of $0.25 per share, against earnings of $0.69 in 4Q13.

The reported earnings results of Walgreens in 4Q14 was negatively affected by non-cash loss of $866

million or $0.90 per diluted share owing to the amendment and exercise for the company's Alliance Boots

call option.

In FY14, Walgreens reported adjusted EPS of $3.28, up 5.1% y/y. Including one-time items, Walgreens

reported earnings of $2.00 per share, down 21.9% y/y.

The Zacks Digest average EPS in 4Q14 was much below the company’s report.

Provided below is a summary of earnings per share as compiled by Zacks Digest:

EPS

4Q13A

2013A

3Q14A

4Q14A

Digest High

$0.69

$2.67

$0.88

Digest Low

$0.61

$2.62

Digest Average

$0.64

Y/Y Growth

35.1%

2014A

1Q15E

2Q15E

2015E

$0.71

$0.75

$0.91

$3.28↓

$0.73

$0.62

$0.65

$0.80

$3.00↑

$2.65

$0.79

$0.66

$0.70

$0.86

$3.14↓

5.2%

4.0%

3.0%

-5.0%

0.6%

2016E

Outlook: The company estimates that accretion from Alliance Boots in 1Q15 will be an adjusted $0.10–

$0.11 per share, including a benefit of $0.02 related to Alliance Boots’ acquisition of its partner’s interest

in a joint venture. This estimate does not include amortization expense, the impact of AmerisourceBergen

warrants or one-time transaction costs.

Please refer to the Zacks Research Digest spreadsheet on WAG for additional details on EPS forecasts.

Zacks Investment Research

Page 9

www.zackspro.com

Nov 7, 2014

Analyst

Aparajita Dutta

Content Ed.

No. of brokers reported/Total

brokers

QCA

21/21

Aniruddha Ganguly

Lead Analyst

Urmimala Biswas

Reason for Update

Flash Update

Zacks Investment Research

Page 10

www.zackspro.com