Mastering Correction..

advertisement

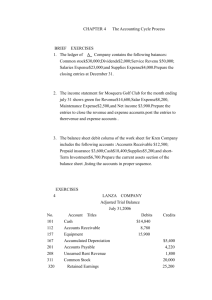

MASTERING CORRECTION OF ACCOUNTING ERRORS SOLUTIONS TO HOMEWORK EXERCISES Section 1–WHERE ERRORS OCCUR AND HOW THEY ARE FOUND 1. Match the following errors on the left with the type of error on the right. _h_ 1. A cash sale for $700 was recorded as $7,000. _f_ 2. Annual depreciation was calculated using a useful life of 8 years instead of 6 years. _ a _ 3. A purchase of supplies was never booked. _ g _ 4. A $740 customer check was recorded as $470. _ c _ 5. Payment for an ad was debited to Utilities Expense. _ a _ 6. At year end, no adjusting entry was recorded for annual depreciation expense. _ b _ 7. On March 1, a $1,200 check to pay the premium for a 24-month policy was debited to Prepaid Insurance. On December 31, the adjusting entry recognized insurance expense of $450. a. Omission b. Accrual or deferral error c. Classification error d. Arithmetic mistake e. Use of incorrect accounting principle f. Use of improper accounting estimate g. Transposition error h. Slide error i. Posting error 2. Match the following errors on the left with the type of error on the right. _ h _ 1. A $7,000 equipment purchase booked at $700. a. Omission _ c _ 2. A $1,000 equipment purchase debited to Supplies. b. Accrual or deferral error _ d _ 3. Four cash accounts with balances of $1,000, $4,200, $3,100 and $1,800 are totaled and entered as $10,000. _ f _ 4. GrowCo, which normally takes 2% of accounts receivable as bad debt, takes 3% this year. _ b _ 5. On Oct. 1, a firm receives $1,200 for 12 months’ rent and credits Rent Revenue. The year-end adjusting entry debits Rent Revenue and credits Rent Received In Advance for $300. Homework Solutions c. Classification error d. Arithmetic mistake e. Use of incorrect accounting principle f. Use of improper accounting estimate g. Transposition error h. Slide error i. Posting error 1 Mastering Correction of Accounting Errors Section 2THE BANK RECONCILIATION 1. Indicate for each of the following whether you must adjust the bank balance (“Bank”) or ledger Cash account (“Ledger Cash”) in your monthly reconciliation. a. A debit memo Book b. A deposit in transit Bank c. A bank service charge Book d. A credit memo Book e. An NSF check Book f. An outstanding check Bank g. Unrecorded interest Book h. Collection by the bank of a note receivable from a customer with accrued interest Book Homework Solutions 2 Mastering Correction of Accounting Errors 2. Below are items for October 200X that you are seeing for the first time. a. Indicate with a check mark whether each item should be added to or subtracted from the bank balance, book balance, or neither (i.e., it does not affect the bank reconciliation). Bank balance Add Deduct a. b. c. Book balance Add Deduct Not used X Interest earned on bank cash balance Bank service charge NSF check from a customer X X d. e. f. g. h. i. A night deposit made on October 31 when the bank was closed Checks written and mailed October 31 An October 12 deposit appearing on the bank statement as made on October 13 Another company’s check charged to our account Payment of a phone bill that appears on the bank statement but was never recorded Collection of principal and interest on a customer’s note collected by the bank X X X X X X b. Prepare the journal entries to conform the ledger Cash account balance with the reconciled bank balance as of October 31. a. Cash XXX b. Miscellaneous Expense Cash To record bank service charge XXX c. Accounts Receivable Cash To record NSF check returned by bank XXX h. Utilities Expense Cash To record utility expense XXX i Cash XXX Interest Income To record bank interest Note Receivable Interest Income To record N/R and interest collected by bank Homework Solutions XXX XXX XXX XXX XXX XXX 3 Mastering Correction of Accounting Errors 3. Fiori publishes ratings and reviews of hotels and restaurants for traveling salespeople. As of June 31, Fiori’s ledger Cash balance is $31,466. The June bank statement balance is $70,616, and includes the following items. Bank service charge for June, $50 NSF check returned with June bank statement, $2,300 Note collected for your company by the bank in June, $25,000 Interest on note collected by the bank in June, $2,500 Outstanding checks as of the end of June, $21,000 Deposit in transit at the end of June, $7,000 a. Prepare Fiori’s June bank reconciliation. Fiori International Bank Reconciliation for June 30 Balance per bank, June 30 Deduct: Outstanding checks Corrected cash balance, June 30 $ 70,616 7,000 $ 77,616 21,000 $ 56,616 Balance per books, June 30 $ 31,466 Deduct: NSF check Bank service charge Corrected cash balance, June 30 $ 56,616 Add: Add: June 30 deposit in transit Note receivable collected by bank Interest collected by bank on note receivable 25,000 2,500 $ 58,966 2,300 50 b. Prepare the journal entries to conform Fiori’s ledger Cash account balance with the reconciled bank balance as of June 30. Cash 25,000 Notes Receivable To record collection of N/R by bank 25,000 Cash 2,500 Interest Income To record interest on note N/R by bank 2,500 Accounts Receivable 2,300 Cash 2,300 To record NSF check returned by the bank Miscellaneous Expense Cash To record bank service charge Homework Solutions 50 50 4 Mastering Correction of Accounting Errors 4. On July 31, Reed Co’s ledger Cash account balance is $25,110, its bank statement balance, $27,620. Use the data below to reconcile the two balances as of July 31, 20X9: Checks outstanding of $6,300 Check #244, to pay the June gas bill was correctly written for $270, but recorded on Reed’s books as $720 $60 for a safe-deposit box—but Reed does not rent one A debit memorandum for $200 for a $175 NSF check and $25 bank NSF fee. A $40 debit memorandum for bank service Reed is seeing for the first time A July 31 night deposit of that day’s cash receipts of $3,940 that is not on the bank statement a. Prepare Reed Co’s bank reconciliation for July 31, 20X9. Reed Co. Bank Reconciliation for July 31 Balance per bank statement, July 31 Add: $ 27,620 July 31 deposit in transit Erroneous safe deposit box charge Deduct: Outstanding checks Corrected cash balance, July 31 3,940 60 $ 31,620 6,300 $ 25,320 Balance per books, July 31 $ 25,110 Add: Error in recording check No. 244 Deduct: NSF check NSF fee Bank service charge 450 $ 25,560 175 25 40 Corrected cash balance, July 31 $ 25,320 b. Prepare the journal entries required to conform the company’s book balance with the reconciled bank balance as of July 31, 20X9. Cash 450 Utilities Expense To correct utilities expense book error 450 Accounts Receivable 175 Miscellaneous Expense 25 Cash To record NSF check and service charge 200 Miscellaneous Expense Cash To record bank service charge Homework Solutions 40 40 5 Mastering Correction of Accounting Errors 5. Below is Dekin Company’s September check register and September 30 bank statement. Use the information to prepare Dekin’s September bank reconciliation and adjusting journal entries. Date 1-Sep 1-Sep 1-Sep 2-Sep 2-Sep 4-Sep 4-Sep 5-Sep 7-Sep 8-Sep 8-Sep 9-Sep 11-Sep 12-Sep 12-Sep 13-Sep 14-Sep 20-Sep 22-Sep 27-Sep 30-Sep Party Ref # Check Deposit $12,505.35 Zambrano Theriot Cedeno Soto 446 447 448 449 $2,908.09 466.78 2,462.99 387.97 Fontenot Ramirez Lee Soriano Derosa Edmonds Dempster Soto 450 451 452 453 454 455 456 457 1,404.67 3,145.87 1,143.23 9,290.44 3,100.33 387.22 955.77 4,788.78 13,400.00 6,855.91 Zambrano Blanco Johnson Ramirez Homework Solutions 458 460 461 462 6,364.34 1,677.21 985.22 1,466.35 12,235.66 Balance $17,489.00 29,994.35 27,086.26 26,619.48 24,156.49 23,768.52 37,168.52 35,763.85 32,617.98 31,474.75 22,184.31 19,083.98 18,696.76 17,740.99 12,952.21 19,808.12 13,443.78 11,766.57 10,781.35 9,315.00 21,550.66 6 Mastering Correction of Accounting Errors The Friendly Bank THIS STATEMENT COVERS: 9/1/20X9 TO 9/30/20X9 STATEMENT FOR: Dekin Company 123 Bluffs Rd Anytown, UT 84098 MONTHLY SUMMARY CHECKING ACCOUNT # 434257 Previous statement balance on 8/31/20X9 + Total of 4 deposits for - Total of 14 withdrawals for + Interest earnings for - Service charges for = New balance CHECK CHECKS AND OTHER DEBITS $17,489.00 42,535.89 37,535.27 45.27 35.00 $22,499.89 DATE AMOUNT CHECK PAID 446 3-Sep $2,908.09 454 448* 5-Sep 2,462.99 456* 449 7-Sep 387.97 457 450 7-Sep 1,404.67 458 452* 10-Sep 1,143.23 459 453 11-Sep 9,290.44 460 Electronic funds transfer – Regions GasCo-op NSF returned check - maker BNC Services NSF fee Monthly service fee DATE PAID 12-Sep 13-Sep 14-Sep 18-Sep 20-Sep 21-Sep 25-Sep 28-Sep 28-Sep 31-Sep AMOUNT Customer deposit Customer deposit Collection-Note receivable ($9,500 + interest) Customer deposit Interest earnings DATE 1-Sep 5-Sep 11-Sep 14-Sep 31-Sep AMOUNT $12,505.35 13,400.00 9,774.63 6,855.91 45.27 DEPOSITS AND OTHER CREDITS Homework Solutions $3,100.33 955.77 4,788.78 6,364.34 45.54 1,677.21 1,237.34 1,768.57 25.00 10.00 7 Mastering Correction of Accounting Errors Dekin Company Bank Reconciliation for September 30 Balance per bank statement, September 30 Add: $ 22,499.89 September 30, deposit in transit 12,235.66 $ 34,735.55 6,451.44 $ 28,284.11 Deduct: Outstanding checks Corrected cash balance, September 30 Balance per books, September 30 Add: Note receivable collected by bank Interest earned on note receivable Interest earned on average daily balance Deduct: NSF check NSF fee Check 459 not recorded Electronic funds transfer (Gas Co.) Bank service charge Corrected cash balance, September 30 Cash 9,774.63 Notes Receivable Interest Income To correct N/R and interest collected by bank 9,500.00 274.63 45.27 $ 31,370.56 1,768.57 25.00 45.54 1,237.34 10.00 $ 28,284.11 9,500.00 224.63 Cash 45.27 Interest Income To correct interest earned on cash balance 45.27 Accounts Receivable 1768.57 Miscellaneous Expense 25.00 Cash To record NSF check and service charge 1,793.57 Unknown* 45.54 Cash To record Check 459 not previously recorded $ 21,550.66 45.54 * There is no way to know which account to debit. It could be A/P, an expense or other account. Utilities Expense Cash To record bank service charge 1,237.34 Miscellaneous Expense Cash To record bank service charge 10.00 Homework Solutions 1,237.34 10.00 8 Mastering Correction of Accounting Errors Section 3–FINDING AND CORRECTING ERRORS USING THE UNADJUSTED TRIAL BALANCE 1. In the trial balance below, total debits do not equal total credits. Find and correct the likely error(s) to bring the totals into balance. Debit Credit Cash 410 Accounts Receivable 740 Supplies on Hand 1,850 Prepaid Insurance 6,500 Equipment 154,000 Accounts Payable 23,000 Long-term Notes Payable 30,000 W. Worthington, Capital 46,260 Constuction Revenues 112,000 Wage Expense 29,400 Interest Expense 900 Rent Expense 10,800 Totals 204,600 211,260 When you scan the accounts, all appear to have normal balances. But there is a difference between total debits and credits of $6,660. When we divided this by 2, we get $3,330. Yet there is no account balance for this amount. When we divide $6,660 by 9, we get $740. Scanning the columns, we see that Accounts Receivable has a balance of $740, so this is a slide error. The correct Accounts Receivable balance is $7,400. When we make the correction, the trial balance appears as follows: Cash Accounts Receivable Supplies on Hand Prepaid Insurance Equipment Accounts Payable Long-term Notes Payable W. Worthington, Capital Constuction Revenues Wage Expense Interest Expense Rent Expense Totals Homework Solutions Debit 410 7,400 1,850 6,500 154,000 29,400 900 10,800 211,260 Credit 23,000 30,000 46,260 112,000 211,260 9 Mastering Correction of Accounting Errors 2. In the trial balance below, total debits do not equal total credits. Find and correct the likely error(s) that bring the totals into balance. Cash Accounts Receivable Allowance for Doubtful Accounts Supplies on Hand Prepaid Insurance Equipment Accum. Depreciation Equipment Accounts Payable Long-term Notes Payable J. Smith, Capital Consulting Revenues Wage Expense Interest Expense Rent Expense Repairs Expense Utilities Expense Totals Debit 22,500 30,000 2,000 1,850 6,500 144,000 48,500 Credit 3,000 50,000 57,300 102,000 39,400 900 10,800 100 6,750 313,300 212,300 Eyeballing the accounts for normal balances, we see that Allowance for Doubtful Accounts and Accumulated Depreciation, both contra asset accounts, are in the debit column. But both of these accounts have a normal credit balance. When we move these two balances into the credit column and recompute, total debits equal total credits. Cash Accounts Receivable Allowance for Doubtful Accounts Supplies on Hand Prepaid Insurance Equipment Accum. Depreciation Equipment Accounts Payable Long-term Notes Payable J. Smith, Capital Consulting Revenues Wage Expense Interest Expense Rent Expense Repairs Expense Utilities Expense Totals Homework Solutions Debit 22,500 30,000 1,850 6,500 144,000 39,400 900 10,800 100 6,750 262,800 Credit 2,000 48,500 3,000 50,000 57,300 102,000 262,800 10 Mastering Correction of Accounting Errors 3. In the trial balance below, total debits do not equal total credits. Find and correct the likely error(s) that bring the totals into balance. Cash Accounts Receivable Allowance for Doubtful Accounts Supplies on Hand Prepaid Insurance Equipment Accum. Depreciation Equipment Accounts Payable Long-term Notes Payable S. Jones, Capital Consulting Revenues Wage Expense Interest Expense Rent Expense Repairs Expense Utilities Expense Totals Debit 27,500 40,000 Credit 2,000 1,850 6,500 104,000 28,500 13,000 40,000 47,300 122,000 38,400 6,900 15,400 5,500 6,750 252,800 306,800 All the accounts appear to have their normal balance, but there is a difference between total debits and credits of $54,000. When we divide this by 2, we get $27,000. But there is no balance for this amount, so it’s not a doubling error. However, when we divide $54,000 by 9, we get $6,000. If this is a transposition, the difference between the 4th and 5th digits from the right will be 6 (5 [first digit in $54,000] +1). The only candidate is Accumulated Depreciation. The correct balance for Accumulated Depreciation must be $28,500. When we correct this, the trial balance looks appears as follows. Cash Accounts Receivable Allowance for Doubtful Accounts Supplies on Hand Prepaid Insurance Equipment Accum. Depreciation Equipment Accounts Payable Long-term Notes Payable S. Jones, Capital Consulting Revenues Wage Expense Interest Expense Rent Expense Repairs Expense Utilities Expense Totals Homework Solutions Debit 27,500 40,000 1,850 6,500 104,000 38,400 6,900 15,400 5,500 6,750 252,800 Credit 2,000 28,500 13,000 40,000 47,300 122,000 252,800 11 Mastering Correction of Accounting Errors 4. In the trial balance below, total debits do not equal total credits. Find and correct the likely error(s) to bring the totals into balance. Cash Accounts Receivable Land Accounts Payable Note Payable JT Howzer, Capital Revenues Wage Expense Rent Expense Interest Expense Totals Debit 24,732 75,109 Credit 647,604 54,811 176,400 587,332 649,998 423,788 110,000 7,308 217,149 2,539,933 Both Land and Wages Expense both have a normal debit balances so these two are in the wrong column. When these errors are corrected, the trial balance appears as follows. Cash Accounts Receivable Land Accounts Payable Note Payable JT Howzer, Capital Revenues Wage Expense Rent Expense Interest Expense Totals Debit 24,732 75,109 647,604 423,788 110,000 7,308 1,288,541 Credit 54,811 176,400 587,332 649,998 1,468,541 The difference between total debits and total credits is $180,000 which, when divided by 9, equals $20,000. Take the first digit of the difference, 1, add 1 and you get 2. If it is a transposition error, there will be a difference of 2 between the 5th and 6th digits from the right. On the trial balance, we see three possible candidates: Land, Wage Expense and Revenues. But if we flip the first two digits of Land or Wage Expense, total debits go down and that does not solve the problem. That leaves Revenues. When we flip the 4 and the 6, we get $469,998 and the trial balance appears as follows. Homework Solutions 12 Mastering Correction of Accounting Errors Cash Accounts Receivable Land Accounts Payable Note Payable JT Howzer, Capital Revenues Wage Expense Rent Expense Interest Expense Totals Debit 24,732 75,109 647,604 423,788 110,000 7,308 1,288,541 Credit 54,811 176,400 587,332 469,998 1,288,541 5. In the trial balance below, total debits do not equal total credits. Find and correct the likely error(s) to bring the totals into balance. Cash Office Supplies Equipment Accum. Depreciation— Equipment Accounts Payable Wages Payable W. Shannon, Capital W. Shannon, Withdrawals Entertainment Revenue Rent Expense Gas and Oil Expense Wage Expense Advertising Expense Legal Expense Totals Debit 158,000 Credit 25,000 180,000 44,000 47,700 13,000 20,970 25,000 338,000 26,800 3,000 219,700 12,500 11,400 636.400 488,670 Office Supplies is an asset account, so it should have a normal debit balance. When this error is corrected, the trial balance appears as follows. Homework Solutions 13 Mastering Correction of Accounting Errors Cash Office Supplies Equipment Accum. Depreciation— Equipment Accounts Payable Wages Payable W. Shannon, Capital W. Shannon, Withdrawals Entertainment Revenue Rent Expense Gas and Oil Expense Wage Expense Advertising Expense Legal Expense Totals Debit 158,000 25,000 180,000 25,000 26,800 3,000 219,700 12,500 11,400 661.400 Credit 44,000 47,700 13,000 20,970 338,000 463,670 The difference between total debits and credits is now $197,730. Divide it by 9, and you get $21,970. If it is a slide error, we need to find a balance in which the decimal point was moved. Wage Expense has the right digits for a slide error and, when corrected to $21,970, changes the trial balance to appear as follows. Cash Office Supplies Equipment Accum. Depreciation— Equipment Accounts Payable Wages Payable W. Shannon, Capital W. Shannon, Withdrawals Entertainment Revenue Rent Expense Gas and Oil Expense Wage Expense Advertising Expense Legal Expense Totals Homework Solutions Debit 158,000 25,000 180,000 25,000 26,800 3,000 21,970 12,500 11,400 463,670 Credit 44,000 47,700 13,000 20,970 338,000 463,670 14 Mastering Correction of Accounting Errors Section 4–CORRECTING CURRENT PERIOD ACCRUAL ERRORS 1. On August 1 of 20X0, your company borrows $100,000 and signs a 5-year note with an annual interest rate of 8%. Principal and all accrued interest will be paid at maturity. In January of 20X1, before the books are closed, you discover that no interest was accrued for 20X0. a. What is the correcting journal entry? Interest Expense Interest Payable 3,333 3,333 $100,000 × 8% × 5/12 = 3,333 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to recognize interest expense, the income statement will overstate net income by $3,333 and the balance sheet will both overstate retained earnings and understate liabilities (interest payable) by the same $3,333. 2. On May 1, 20X0, your company borrows $100,000 and signs a 10%, 5-year note agreeing to pay the principal and all accrued interest at maturity. In January of 20X1, before the books are closed, you discover that no interest was accrued for 20X0. a. What is the correcting journal entry? Annual interest is $10,000 ($100,000 × 10%), so the journal entry to record interest for 20X0 would be a debit to Interest Expense and credit to Interest Payable for $10,000. But interest expense for 20X0 should be $6,667 ($100,000 × 10% × 8/12 of the year). Interest Expense Interest Payable 6,667 6,667 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? c. Without a correcting entry to recognize interest expense, the income statement will overstated net income by $6,667 and the balance sheet will both overstate retained earnings and understate liabilities (interest payable) by the same $6,667. 3. On July 1, 20X0, your company lends a supplier $10,000 at an annual interest rate of 12%, with principal and all accrued interest due at the end of 3 years. In January of 20X1, before the books are closed, you discover that no interest was accrued for 20X0. a. What is the correcting journal entry? Interest Receivable Interest Income $10,000 × 12% × 6/12 = $600 600 600 (continued) Homework Solutions 15 Mastering Correction of Accounting Errors b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to recognize interest income, the income statement will overstate income by $6,667 and the balance sheet will overstate both retained earnings and assets (interest receivable) by the same $6,667. 4. On June 1, 20X0, your company sublets warehouse space to James, Inc. for $500 a month. James’s last rent payment was for October, 20X0. In January of 20X1, before the books are closed, you discover that your company neither received nor recorded rent for November and December. a. What is the correcting journal entry? Rent Receivable Rent Revenue 1,000 1,000 $500 × 2 months = $1,000 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? If rent revenue is not recorded, the income statement will understate net income by $1,000 and the balance sheet will understate both retained and assets (rent receivable) by the same $1,000. 5. On April 1, 20X0, your company sublets office space to Babin, Co. for $1,000 a month on a lease that runs from April 1, 20X0, to November 30, 20X0. While preparing the trial balance at year end, you see that December rent was accrued for Babin even though the lease expired at the end of November. a. What is the correcting journal entry? Rent Revenue Rent Receivable 1,000 1,000 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to reduce the amount of revenue recognized for the year, the income statement will overstate net income by $1,000 and the balance sheet will overstate both retained earnings and assets (rent receivable) by the same $1,000. 6. In January 20X1, before closing the books for 20X0, you notice that the December 20X0 utility bill of $600 was neither paid nor recorded? a. What is the correcting journal entry? Utilities Expense Utilities Payable 600 600 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? With a correcting journal entry to recognize utilities expense, the income statement will overstate net income by $600 and the balance sheet will both overstate retained earnings and understate liabilities (utilities payable) by the same $600. Homework Solutions 16 Mastering Correction of Accounting Errors Section 5–CORRECTING CURRENT PERIOD DEFERRAL ERRORS 1. During 20X0, your company purchases $2,000 of supplies and books the amount as an asset. As you prepare the trial balance on December 31, you see that there is no 20X0 supplies expense. A quick physical count reveals $700 of supplies on hand. a. What is the correcting journal entry? Supplies Expense Supplies on Hand 1,300 1,300 $2,000 supplies purchased $700 supplies on hand = $1,300 used up b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to recognize supplies expense for the year, the income statement will overstate net income by $1,300 and the balance sheet will overstate both retained earnings and assets (supplies on hand) by the same $1,300. 2. On March 1, 20X0, your company prepays $1,800 to rent equipment for 12 months and you book the amount as an asset. A review of year-end adjusting entries shows a debit to Rent Expense and credit to Prepaid Rent for $1,800. a. What is the correcting journal entry? Rent expense for 10 months is $1,500 ($1,800/12 × 10 months). That means $300 of rent expense must be deferred to next year. So, the correcting entry is: Prepaid Rent Rent Expense 300 300 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to adjust rent expense for the year, the income statement will understate net income by $300 and the balance sheet will understate both retained earnings and assets (prepaid rent) by the same $300. 3. On June 1, 20X0, your company takes out a 1-year insurance policy for $3,600 and prepays the entire amount, recording the amount as an asset. At year-end 20X0, you discover an adjusting entry that records one year’s insurance expense of $1,800. a. What is the correcting journal entry? Insurance expense for the year is $2,100 ($3,600/12 7 months). So we need to recognize another $300 ($2,100 $1,800). So, the correcting entry is: Insurance Expense Prepaid Insurance 300 300 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to recognize the additional insurance expense, the income statement will overstate net income by $300 and the balance sheet will overstate both retained earnings and assets (prepaid insurance) by the same $300. Homework Solutions 17 Mastering Correction of Accounting Errors 4. On May 1, 20X0, your company takes out a 2-year insurance policy for $2,400 a year and prepays the entire $4,800, recording the amount as an expense. At year-end 20X0, you discover an adjusting entry defers $3,600 of insurance expense. a. What is the correcting journal entry? The adjusting entry recognized $1,200 of insurance expense ($4,800 $3,600). But 20X0 insurance expense is $1,600 ($2,400/12 8 months), so we need to record an additional $400 ($1,600 - $1,200) and reduce the balance in Prepaid Insurance by the same amount. So, the correcting entry is: Insurance Expense Prepaid Insurance 400 400 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry, too little insurance expense will be recognized. As a result, the income statement will overstate net income by $400 and the balance sheet will overstate both retained earnings and assets (prepaid insurance) by the same $400. 5. On July 1, 20X0, your company sublets warehouse space for $600 a year. ABC takes a 2-year lease and pays $1,200 upon signing, which you record as a liability. At year-end 20X0, you discover that the adjusting entry recognizes $600 in rent revenue. a. What is the correcting journal entry? Rent revenue for the year is $300 ($600/12 6 months), but $600 was recognized. That means we need to reduce the balance in rent revenue by $300 ($600 $300) and transfer it to a liability account. So, the correcting entry is: Rent Revenue Rent Received in Advance 300 300 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to reduce the amount of rent revenue recognized for the year, the income statement overstate net income by $300 and the balance sheet will both overstate retained earnings and understate liabilities (rent received in advance) by the same $300. Homework Solutions 18 Mastering Correction of Accounting Errors 6. On October 1, 20X0, your company sublets warehouse space to for $900 a year to DEF, which pays in full upon signing and the amount is recorded as revenue. At year-end 20X0, you discover an adjusting entry that defers $300 of revenue. a. What is the correcting entry? The adjusting entry debited Rent Revenue for $300 and credited Rent Received in Advance for $300. That means your company recognized $600 of rent revenue for the year ($900 $300)—but earned only $225 ($900/12 3 months). To recognize the correct amount of only $225, your company should have deferred $675 ($900 $225). To correct this, we need to reduce rent revenue by $375 ($675 $300) and transfer $375 from Rent Revenue to a liability account. So the correcting entry is: Rent Revenue Rent Received in Advance 375 375 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to reduce the amount of rent revenue recognized for the year, the income statement will overstate net income by $375 and the balance sheet will both overstate retained earnings and understate liabilities (rent received in advance) by the same $375. 7. On June 1, 20X0, your company sublets warehouse space for $1,800 a year to GHI, which pays in full upon signing and that you record as revenue. At year-end 20X0, you discover an adjusting entry that transfers $900 from Revenue to Deferred Revenue. a. What is the journal correcting entry? The adjusting entry debited Rent Revenue for $900 and credited Rent Received in Advance for $900. But your company should recognize rent revenue of $1,050 ($1,800/12 7 months). To correct this error, we need to increases the amount of rent revenue recognized to $150 ($900 $750) and reduce the liability account by the same amount. So, the correcting entry would be: Rent Received in Advance Rent Revenue 150 150 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to increase the amount of rent revenue recognized for the year, the income statement will understate net income by $150 and the balance sheet will both understate retained earnings by $150 and overstate liabilities (rent received in advance) by $150. Homework Solutions 19 Mastering Correction of Accounting Errors 8. On July 1, 20X0, your company takes out a 2-year insurance policy for $2,400 a year and pays the entire amount upon signing, recording the amount as an expense. At yearend 20X0, you discover an adjusting entry that defers $1,800 by debiting Prepaid Insurance. a. What is the correcting journal entry? The adjusting entry debited Prepaid Insurance and credited Insurance Expense for $1,800. This resulted in recognizing insurance expense for the year of $3,000 ($4,800 $1,800). But the correct amount of insurance expense for 20X0 is $1,200 ($2,400/12 6 months). We need to reduce the balance in Insurance Expense by $1,800 ($3,000 $1,200) and increase Prepaid Insurance by the same amount. So, the correcting entry is: Prepaid Insurance Insurance Expense 1,800 1,800 b. If no correcting journal entry is recorded, how are the 20X0 income statement and balance sheet, respectively, affected? Without a correcting entry to reduce the amount of insurance expense recognized for the year, the income statement will understate net income by $1,800 and the balance sheet will understate both retained earnings and assets (prepaid insurance) by the same $1,800. Homework Solutions 20