3. Balance of Harms - National Housing Law Project

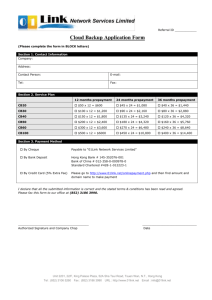

advertisement