Ch12-- Fiscal Policy

advertisement

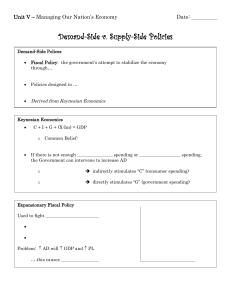

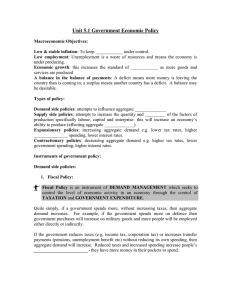

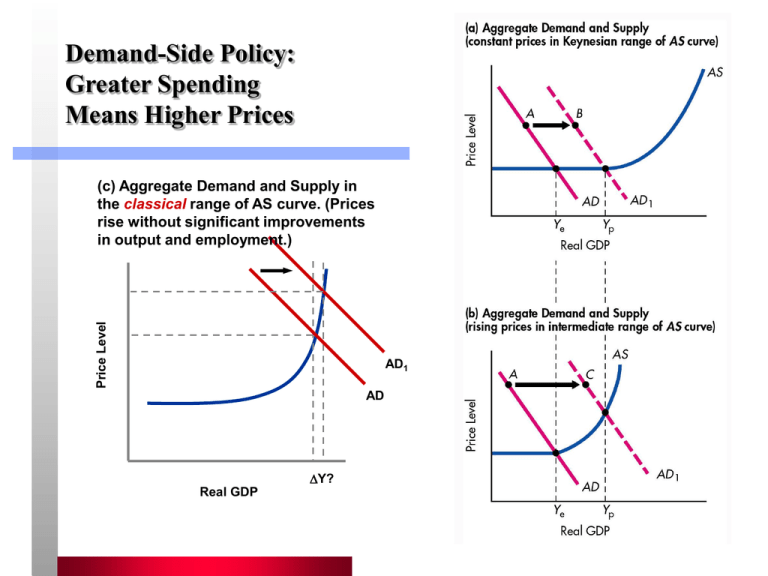

Demand-Side Policy: Greater Spending Means Higher Prices Price Level (c) Aggregate Demand and Supply in the classical range of AS curve. (Prices rise without significant improvements in output and employment.) AD1 AD Y? Real GDP 1 Analysis of a Tax-and-Spend Policy Government increases spending, but finances it with tax increases. The increase in spending shifts AD to the right, but the increase in taxes reduces the incentive to work(???), shifting AS to the left. 2 Crowding Out Government Deficit Borrowing by Government Government Demand for Credit Interest Rates UP. Higher interest rates Investment Spending DOWN investment is “crowded out” by debt-financed public (gov’t) spending. Private 3 Other impacts of Budget Deficits and National Debt Crowding out of private investment Future capital stock DOWN Future Output DOWN . Interest rates UP Currency Appreciation Foreign Goods Cheaper Imports UP Net Exports DOWN GDP DOWN National Debt UP Interest paid by government UP. 4 U.S. Government Revenues and Expenditures 5 U.S. Government Expenditures as a Percentage of GDP 6 7 Fiscal Policy: Some Definitions Demand-side policies: spending and tax policies designed to stimulate or slow aggregate demand. Supply-side policies: policies designed to increase productivity and enterprise. Discretionary Fiscal Policy: changes in government spending and/or taxation aimed at achieving a policy goal. Automatic Stabilizer: an element of fiscal policy that changes automatically as income changes. 8 Automatic Stabilizers Progressive Taxes – As income falls, the tax rate also falls, helping to maintain buying power and hence aggregate demand Transfer Payments – – Examples: Unemployment insurance, welfare, subsidies Insure that buying power is not reduced at the same rate as income 9 Taxes: Some Definitions Direct taxes: on individuals and firms. Examples: income taxes and value-added taxes (VAT). Indirect taxes: on goods and services Tax rate structures: – – – progressive tax: rate increases with higher income. regressive tax: rate falls with higher income. proportional tax: rate is constant. 10 Central Government Spending by Functional Category 11 Supply-Side Economics and the Laffer Curve •Taxes are a disincentive to productive activity. •At marginal tax rates greater than t, the tax base shrinks at a faster rate than the increases in marginal tax rate. •Net result: increases in marginal tax rates beyond t result in reduced tax revenues. 12 13