Lesson 4 Comments

advertisement

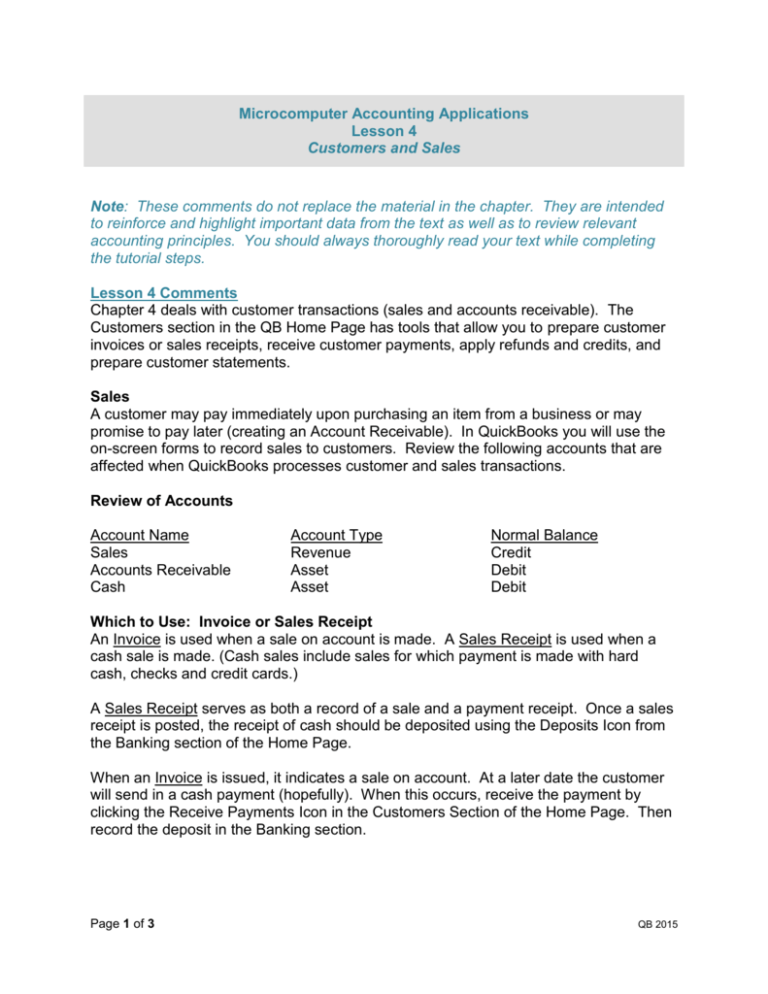

Microcomputer Accounting Applications Lesson 4 Customers and Sales Note: These comments do not replace the material in the chapter. They are intended to reinforce and highlight important data from the text as well as to review relevant accounting principles. You should always thoroughly read your text while completing the tutorial steps. Lesson 4 Comments Chapter 4 deals with customer transactions (sales and accounts receivable). The Customers section in the QB Home Page has tools that allow you to prepare customer invoices or sales receipts, receive customer payments, apply refunds and credits, and prepare customer statements. Sales A customer may pay immediately upon purchasing an item from a business or may promise to pay later (creating an Account Receivable). In QuickBooks you will use the on-screen forms to record sales to customers. Review the following accounts that are affected when QuickBooks processes customer and sales transactions. Review of Accounts Account Name Sales Accounts Receivable Cash Account Type Revenue Asset Asset Normal Balance Credit Debit Debit Which to Use: Invoice or Sales Receipt An Invoice is used when a sale on account is made. A Sales Receipt is used when a cash sale is made. (Cash sales include sales for which payment is made with hard cash, checks and credit cards.) A Sales Receipt serves as both a record of a sale and a payment receipt. Once a sales receipt is posted, the receipt of cash should be deposited using the Deposits Icon from the Banking section of the Home Page. When an Invoice is issued, it indicates a sale on account. At a later date the customer will send in a cash payment (hopefully). When this occurs, receive the payment by clicking the Receive Payments Icon in the Customers Section of the Home Page. Then record the deposit in the Banking section. Page 1 of 3 QB 2015 You will note that the Sales Receipts and Invoices windows are very similar with only a few minor differences. An additional option is to accept a credit card for a customer payment. If your company accepts credit cards, you can use the Accept Credit Cards icon in the Customers Section of the Home Page. To use this option, you must apply to additional online services with QuickBooks. Since this is not possible for our tutorial company, you will not practice any credit card transactions. Journal Entries While you will use the on-screen forms to record sales transactions, QuickBooks records “behind-the-scenes” journal entries. When a sale on account is recorded using the invoice form, a journal entry debiting (increasing) Accounts Receivable and crediting (increasing) Sales is created. When a cash sale is recorded using the sales receipts form, a journal entry debiting (increasing) Cash and crediting (increasing) Sales is created. If sales tax is applicable in either of the above situations, QuickBooks will also credit (increase) the Sales Tax Payable account. Also note that credit card sales are treated as cash sales. A debit to Cash and a credit to Sales would be recorded at the time of the sale. The only difference in a credit card sale and a cash sale is that a fee is generally charged by the credit card company. This fee would be recorded as a business expense by the company selling the merchandise. Customer List The Customer List contains important customer information that is automatically entered in the appropriate fields when a customer is chosen on an invoice or sales receipt. The more information you can enter when setting up a customer, the more efficiently QB can process customer transactions. Customer billing can be to a general customer account, or you can set up jobs as “subaccounts” for each customer. The option to set up jobs will depend on the type of business you operate. Rock Castle Construction uses the jobs option because it works with customers on individual, distinct projects. On the other hand, a small retail business selling candles would not want to set up a separate job for each type of candle a customer purchased! Page 2 of 3 QB 2015 Schedule of Accounts Receivable Recall from Principles of Accounting that a Schedule of Accounts Receivable is a listing of each customer with a balance due and the amount owed to the company. The Schedule of Accounts Receivable differs from the Accounts Receivable Aging (discussed below) in that the schedule lists only the customer name and amount owed without regard to the length of time the account has been outstanding. QuickBooks does not use the report title Schedule of Accounts Receivable, but this data can be generated by running a Customer Balance Summary. It is recommended that you set the date to ALL when running a Customer Balance Summary. Internal Control When issuing credit to customers, it is very important to carefully monitor accounts receivable. The Customer Reports in QuickBooks provide information that helps you track customer activity and receivables. One of the most important tools in monitoring accounts receivable is the aging (called the Accounts Receivable Aging Summary Report in QB). Recall from your principles course that an accounts receivable aging is a listing of all credit customers with their outstanding balances broken down by aging categories such as current, 30-day past-due, etc. The general rule is, the longer an account is outstanding, the less likely it is to be collected. Page 3 of 3 QB 2015