Chapter 11: Stockholders' Equity

advertisement

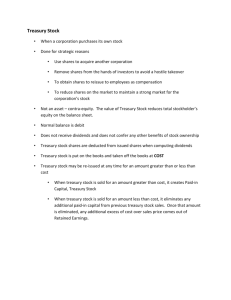

Chapter 11: Stockholders’ Equity 1.Debt versus equity 2.Preferred stock 3.Common stock 4.Accounting for preferred and common stock 5.Treasury stock 6.Retained Earnings and dividends 7. Statement of stockholders’ equity 1. Debt versus Equity Fixed maturity date No fixed maturity date Fixed periodic payments Discretionary dividends Security in case of default Residual asset interest No voice in management Voting rights - common Formal legal contract No legal contract Interest expense deductible Dividends not deductible Double taxation 2. Preferred Stock Advantages – – – – Preference over common in liquidation Stated dividend Variety of features regarding dividends Preference over common in dividend payout Disadvantages – Subordinate to debt in liquidation – Stated dividend can be skipped – No voting rights (versus common) Debt or equity? – components of both – usually (but not always) classified with equity 3. Common Stock Advantages – Voting rights: election of board of directors vote on significant activities of management – Rights to residual profits (after preferred) Disadvantages – Last in liquidation – No guaranteed return 4. Accounting for Common Stock (CS) and Preferred Stock (PS) Par value - initially established to create a “minimum legal capital”. – Ex: Minimum legal capital in some states is $1,000 for new corporations, so issue: 1,000 shares at $1par, or 100 shares at $10 par, or other combination. . . Par value is not market value. Credit CS or PS for par value. Excess over par credited to “Paid in Capital in Excess of Par or Stated Value” or abbreviated: “Additional Paid-in Capital” (APIC). Some newer stock issues (for common stock) are “no par” stock. 4. Journal Entries Issue PS at greater than par value: Cash xx mkt. value Preferred Stock xx total par APIC - PS xx excess(plug) Issue CS at greater than par value: Cash xx mkt. value Common Stock xx total par APIC - CS xx excess(plug) Note: most states do not allow companies to issue at less than par value. 4. Journal Entries -continued Issue no par common stock: Cash xx Common Stock xx mkt. value mkt. value Note: many companies have newer stock issues that are no par, but most companies still have older stock issues which contain a par value and APIC. The Stockholders’ Equity section of the balance sheet of Sample Company (next slide) illustrates many of the components of SE discussed in this chapter. 4.Sample Co. Stockholders’ Equity Common stock, $1 par value, 500,000 shares authorized, 80,000 shares issued, and 75,000 shares outstanding $ 80,000 Preferred stock, $100 par value, 1,000 shares authorized, 100 shares issued and outstanding 10,000 Paid in capital on common Paid in capital on preferred 25,000 $ 20,000 5,000 Retained earnings 22,000 Less: Treasury stock, 5,000 shares (at cost) (6,000) Total Stockholders’ Equity $131,000 4. Journal Entries-Sample Co. Now, using Sample Company information, record the following additional issues of common and preferred stock: Issued 100 shares of PS at $102 per share: Issued 500 shares of CS at $5 per share: 5. Treasury Stock Created when a company buys back shares of its own common stock. Reasons for buyback: – reissue to employees for compensation. – hold in treasury (or retire) to increase market price and earnings per share. – reduce total dividend payouts while maintaining per share payouts. – thwart takeover attempts by reducing proportion of shares available for purchase. – give cash back to existing shareholders. 5. Treasury Stock - continued The debit balance account called “Treasury Stock” is reported in stockholders’ equity as a contra (reduces SE). Note: not an asset. The stock remains issued, but is no longer outstanding. – does not have voting rights – cannot receive cash dividends May be reissued (to the market or to employees) or retired. No gains or losses are ever recognized from these equity transactions. 5. Treasury Stock(TS) - Journal Entries There are two techniques for recording TS transactions (Par Value method and Cost method). We will use only the Cost method. This technique establishes a “cost” for TS equal to the amount paid to acquire the TS. Par value is not used for TS transactions. To record purchase of TS from market: TS xx “cost” Cash xx market (cost equals the cash paid) 5. Treasury Stock(TS) - Journal Entries To reissue TS to market at greater than cost: Cash xx market APIC - TS xx over cost TS xx cost To reissue TS to market at less than cost: Cash xx market APIC - TS xx if available Retained Earnings xx if needed* TS xx cost *debit RE if no APIC-TS available to absorb the remaining debit difference. 5. TS - Example Problem TT Corporation has 100,000 shares of $1 par value stock authorized, issued and outstanding at January 1, 2008. The stock had been issued at an average market price of $5 per share, and there have been no treasury stock transactions to this point. Assume that, in February of 2008, TT Corp. repurchases 10,000 shares of its own stock at $7 per share. In July of 2008, TT Corp. reissues 2,000 shares of the treasury stock for $8 per share. In December of 2008, TT Corp. reissues the remaining 8,000 shares for $6 per share. Prepare the journal entries for 2008 regarding the treasury stock. 5. TS Example -Journal Entries Feb: repurchase 10,000 sh. @ $7 = $70,000. July: reissue 2,000 sh @ $ 8 = $16,000 (cost = 2,000 @ $7 = 14,000) 5. TS Example -Journal Entries Dec: reissue 8,000 sh. @ $ 6 = $48,000 (cost = 8,000 sh.@ $7 = 56,000) Now we need to debit one or more accounts to compensate for the difference. (1) debit APIC-TS (but lower limit is to -0-). (2) debit RE if necessary for any remaining balance (this is only necessary when we are decreasing equity). 6. Retained Earnings - Cash Dividends As cash dividends are declared: Dividends (RE) - common xx Dividends (RE)- preferred xx Dividends Payable As cash dividends are paid: Dividends Payable xx xx Cash xx Preferred dividends may be issued with extra privileges such as “cumulative” and “participating. Cumulative preferred dividends that are skipped in a particular year must be settled before any dividends are paid to common shares. Participating preferred stock may receive a cash dividend in excess of its stated amount. 7. Statement of Stockholders’ Equity In this chapter, we have discussed the Statement of Retained Earnings as the link between the balance sheet and the income statement. However, earlier chapters introduced the Statement of Stockholders’ Equity, which has become the default statement for large companies in recent years. The Statement of Stockholders’ Equity details the change in retained earnings, including all the changes discussed in this chapter, and it also shows the change during the year in all of the stockholders’ equity accounts.