AP ECONOMICS CHAPTER 5 QUIZ 1. The functional distribution of

advertisement

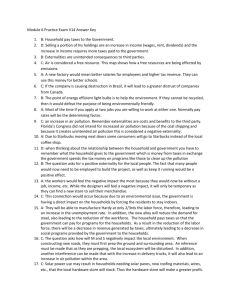

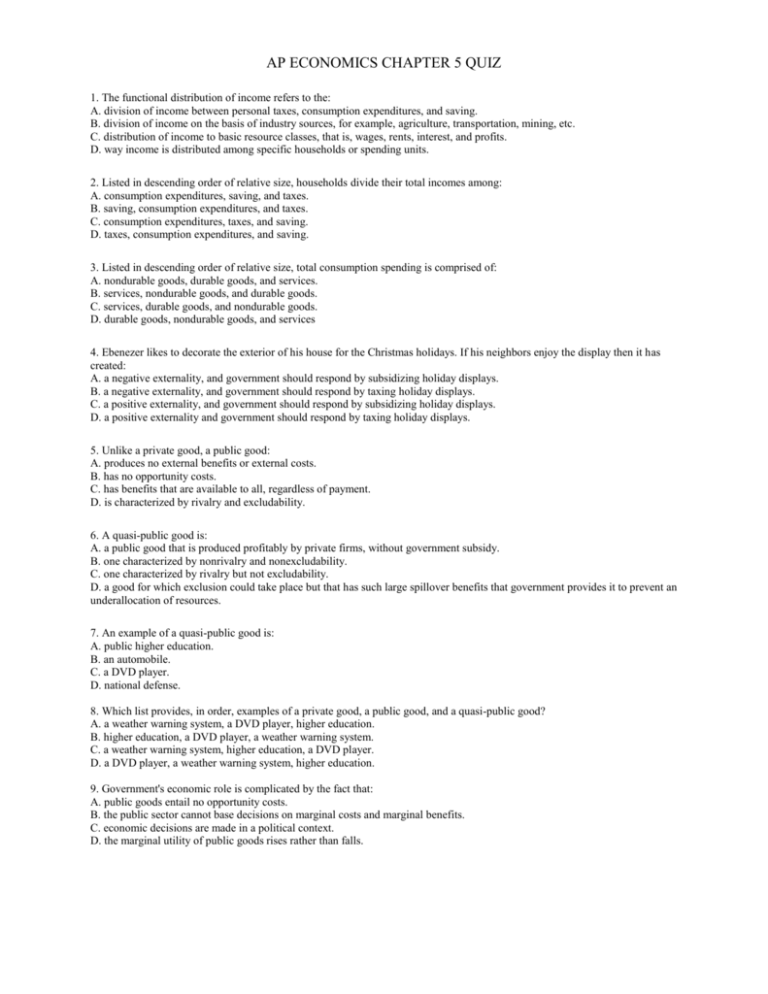

AP ECONOMICS CHAPTER 5 QUIZ 1. The functional distribution of income refers to the: A. division of income between personal taxes, consumption expenditures, and saving. B. division of income on the basis of industry sources, for example, agriculture, transportation, mining, etc. C. distribution of income to basic resource classes, that is, wages, rents, interest, and profits. D. way income is distributed among specific households or spending units. 2. Listed in descending order of relative size, households divide their total incomes among: A. consumption expenditures, saving, and taxes. B. saving, consumption expenditures, and taxes. C. consumption expenditures, taxes, and saving. D. taxes, consumption expenditures, and saving. 3. Listed in descending order of relative size, total consumption spending is comprised of: A. nondurable goods, durable goods, and services. B. services, nondurable goods, and durable goods. C. services, durable goods, and nondurable goods. D. durable goods, nondurable goods, and services 4. Ebenezer likes to decorate the exterior of his house for the Christmas holidays. If his neighbors enjoy the display then it has created: A. a negative externality, and government should respond by subsidizing holiday displays. B. a negative externality, and government should respond by taxing holiday displays. C. a positive externality, and government should respond by subsidizing holiday displays. D. a positive externality and government should respond by taxing holiday displays. 5. Unlike a private good, a public good: A. produces no external benefits or external costs. B. has no opportunity costs. C. has benefits that are available to all, regardless of payment. D. is characterized by rivalry and excludability. 6. A quasi-public good is: A. a public good that is produced profitably by private firms, without government subsidy. B. one characterized by nonrivalry and nonexcludability. C. one characterized by rivalry but not excludability. D. a good for which exclusion could take place but that has such large spillover benefits that government provides it to prevent an underallocation of resources. 7. An example of a quasi-public good is: A. public higher education. B. an automobile. C. a DVD player. D. national defense. 8. Which list provides, in order, examples of a private good, a public good, and a quasi-public good? A. a weather warning system, a DVD player, higher education. B. higher education, a DVD player, a weather warning system. C. a weather warning system, higher education, a DVD player. D. a DVD player, a weather warning system, higher education. 9. Government's economic role is complicated by the fact that: A. public goods entail no opportunity costs. B. the public sector cannot base decisions on marginal costs and marginal benefits. C. economic decisions are made in a political context. D. the marginal utility of public goods rises rather than falls. 10. Which of the following is an example of a public good? A. a fireworks display B. a hotdog C. a barbeque grill D. a personal computer 11. An example of a public good is: A. a movie theater. B. a freight train. C. the war on terrorism. D. Disneyland. 12. The free-rider problem is that: A. free public transportation is overcrowded. B. people will not voluntarily pay for something that they can obtain without paying. C. government supplies goods at no charge to people who can afford to pay for them. D. public goods often create large external costs. 13. If the aggregate income of households is $300 billion, consumption is $210 billion, and personal taxes are $60 billion, then personal saving: A. is $70 billion. B. is $30 billion. C. is $40 billion. D. cannot be determined from the information given. 14. Economists define durable goods as those products expected to last at least _____ year(s). A. 1 B. 3 C. 5 D. 10 15. Limited liability applies to: A. partnerships. B. proprietorships. C. all corporations. D. financial corporations but not to manufacturing corporations. 16. Limited liability means that: A. creditors have no legal claim on the personal assets of a proprietor. B. corporations cannot be sued. C. creditors have no legal claim on the personal assets of a corporate stockholder. D. corporations have a legal life independent of their owners and managers. 17. The Pure Food and Drug Act is an illustration of: A. governmental provision of public goods. B. the redistributional function of government. C. governmental provision of a suitable legal framework for the market system. D. governmental action designed to enhance competition. 18. Government may lessen income inequality by: A. providing transfer payments to the poor. B. directly modifying market prices as, for example, by establishing a legal minimum wage. C. using the tax system to tax the wealthy relatively more heavily than the poor. D. doing All of these. 19. Welfare checks and food stamps are examples of _____________ used by the government to redistribute income. A. transfer payments. B. market intervention. C. taxation. D. corporate subsidies. 20. In a competitive market: A. demand will not always reflect all external benefits. B. demand will always reflect all external benefits. C. supply will always reflect all external costs. D. supply will always reflect all external benefits. 21. Negative externalities arise: A. when firms pay more than the opportunity cost of resources. B. when the demand curve for a product is located too far to the left. C. when firms "use" resources without being compelled to pay for their full costs. D. only in capitalistic societies. 22. Positive externalities refer to: A. benefits that accrue to parties other than the producer and buyer of a good. B. the benefits that resource suppliers obtain from the production and sale of a good. C. the benefit that a consumer receives from buying a good. D. the combined benefits that buyer and seller receive from a voluntary market transaction. 23. An external cost or external benefit is also known as a(n): A. marginal benefit. B. principal-agent problem. C. transfer payment. D. spillover. 24. Externalities: A. relate to costs only. B. relate to benefits only. C. relate to both costs and benefits. D. have been legislated out of existence. 25. When the production or consumption of a good involves an externality: A. resources are necessarily overallocated to the product. B. resources are necessarily underallocated to the product. C. someone not involved in buying or selling the good is affected. D. the market will efficiently allocate resources to its production. 26. If the production of a good or service creates sizable positive externalities, government might correct for the: A. underallocation of resources to its production by imposing an excise tax. B. overallocation of resources to its production by imposing an excise tax. C. underallocation of resources to its production by granting a subsidy. D. overallocation of resources to its production by granting a subsidy. 27. For which of the following goods or services would a government subsidy be most likely to improve the allocation of resources? A. wheat B. cancer research C. newspaper publishing D. toys 28. Pollution: A. should be corrected by the subsidization of offending firms. B. is not an economic problem because it is external to the market system. C. is an example of private production costs. D. is an example of an external cost. 29. Which of the following is most likely to be accompanied by external benefits? A. the construction of a nuclear power plant B. studying in the library C. eating dinner at an expensive French restaurant D. being immunized for measles 30. Susie lives in a dorm and likes to play loud music in her room. Her neighbor Kara enjoys the same type of music and gets pleasure from Susie turning up the music. Her other neighbor, Alex, can't stand Susie's music and gets mad when she turns it up for all to hear. When Susie plays her music loudly, she creates: A. a positive externality for Kara, and a negative externality for Alex. B. a negative externality for Kara, and a positive externality for Alex. C. positive externalities for both Kara and Alex. D. negative externalities for both Kara and Alex. Key 1. C 2. C 3. B 4. C 5. C 6. D 7. A 8. D 9. C 10. A 11. C 12. B 13. B 14. B 15. C 16. C 17. C 18. D 19. A 20. A 21. C 22. A 23. D 24. C 25. C 26. C 27. B 28. D 29. D 30. A