Summer 2001

advertisement

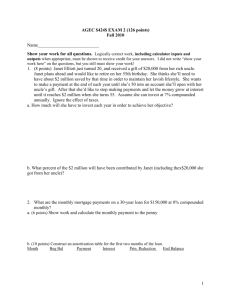

Name: ________________________________ Student Number: _______________________ Commerce 2FA3: Introduction to Finance Mid term exam, summer session 2001 Instructor: K. Brewer Time allowed for this test: 3 hours. July 11, 7 - 10 p. m. Instructions: a) This exam has 13 pages, including this one. Please check that you are not missing any pages and bring any problems to the attention of the invigilator. b) Each multiple-choice question has only one right answer. Circle the letter of the most appropriate answer on the exam page. Right answers will be worth 2 marks and wrong or missing answers will be worth zero. There is no correction factor. c) Long answer questions are to be answered on the question paper. All work must be shown to receive full marks. If you are running short of space and decide to continue the answer on another page, indicate where the rest of the answer is located. The marker cannot give you marks for an answer that they cannot find. d) A formula sheet will be distributed with this exam, no other references are allowed. e) Use of the McMaster calculator (Casio FX-991) only is allowed for this exam. Multiple choice /50 Problem 1 /10 Problem 2 /10 Problem 3 /10 Problem 4 /10 Problem 5 /10 Commerce 2FA3 Mid term exam Total July 11, 2001 /100 Page 2 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Multiple choice questions: 2 marks each. 1) The primary objective of the financial manager should be to; a) maximize revenue b) maximize net income c) maximize company size d) maximize shareholder wealth e) ensure regular dividend payments 2) Purchasing a 91-day T-bill from a securities dealer is best characterized as what type of transaction? a) A primary market transaction in the money market b) A primary market transaction in the capital market c) A secondary market transaction in the money market d) A secondary market transaction in the capital market e) An over the counter transaction in an auction market 3) Which of the following is not a feature of the form of business organization? a) A sole proprietorship requires the least amount of paperwork to set up. b) Partnerships are subject to double taxation. c) It is easier to raise capital and transfer ownership with a corporation. d) A partnership has the most limited life. e) Limited partners do not have unlimited liability. 4) Six months ago you purchased a bond for $945. It has just paid a coupon of $45. If the current price of that bond is $935, what was your return on this purchase on an effective annual basis? a) -1.06% b) 3.70% c) 7.41% d) 7.54% e) none of the above Page 3 of 14 Commerce 2FA3 5) Mid term exam July 11, 2001 If you put $500 into a bank account that earns interest at an interest rate of 5% APR with monthly compounding, what will the account balance be at the end of 3 years? a) $580.92 b) $580.74 c) $578.81 d) $575.00 e) none of the above 6) If you are indifferent between receiving $500 today and receiving $700 in five years, what is your discount rate to the nearest percent? a) 7% b) 8% c) 9% d) 10% e) none of the above 7) You want to retire as a millionaire. How much would you have to deposit at the end of each month for the next 25 years (to the nearest dollar) to reach that goal, assuming that you are able to earn 7.75% as an effective annual rate of return? a) $1,088 b) $1,095 c) $1,135 d) $1,142 e) none of the above Page 4 of 14 Commerce 2FA3 8) Mid term exam July 11, 2001 You have decided to buy furniture worth $5,000. You can pay it off with 36 equal monthly installments. The first payment is due today. The interest rate is 18% APR with monthly compounding. What are your monthly payments to the nearest dollar? a) $178 b) $181 c) $228 d) $237 e) none of the above 9) You've been quoted an interest rate of 10% simple interest for 3 years. What would this be if converted to an APR with monthly compounding? a) 8.8% b) 9.1% c) 10.0% d) 10.5% e) 11.0% 10) To settle a debt of $3,000, a friend of yours has offered to pay you $185 per month for 18-months. What is the implied EAR in these terms? a) 7.3% b) 7.6% c) 13.5% d) 14.3% e) none of the above 11) If the terms of a loan agreement call for you to make periodic payments that include accumulated interest plus an amount towards the principal and a balloon payment at the end of the term, this type of a loan is a a) consol b) amortized loan c) interest only loan d) pure discount loan e) partial amortization loan Page 5 of 14 Commerce 2FA3 Mid term exam July 11, 2001 12) If the YTM of a bond is 7% and it has a coupon rate of 6% the bond will be selling at a) a premium b) a discount c) par d) it would depend on the time to maturity e) it would depend on the default risk of the issuer 13) If a $1,000 face value 10% coupon bond with 6 years to maturity is trading at $1,111, what is it's YTM? a) 8% or less b) between 8% and 9% c) less than 10% but more than 9% d) exactly 10% e) over 10% 14) Which of the following features will decrease the value of a bond a) callable b) retractable c) extendable d) convertible e) all of the above 15) Assume you have two $1,000 face value bonds, with the same coupon rate, from the same company. One will mature in 10 years, the other in 5 years. Which bond will decrease more in price if market interest rates fall? a) the price decrease will be the same b) the 5 year bond will decease more in price c) the 10 year bond will decease more in price d) it would depend on the coupon rate e) the bond prices will actually increase Page 6 of 14 Commerce 2FA3 Mid term exam July 11, 2001 16) When specific assets such as land, plant or equipment are pledged as collateral, a debt issue is called a a) sinking fund b) mortgage bond c) debenture d) preferred share e) all of the above 17) What is the value of a bond that pays $90 per year forever? a) $800 if k=12% Both b and c are correct answers. Either answer will be marked as correct. b) $1,000 if k=9% c) $1,500 if k=6% d) $1,250 if k=16% e) $2,000 if k=4% 18) Duration is a) A measure of default risk b) A measure of interest rate risk c) A measure of reinvestment risk d) A measure of unsystematic risk e) The same as time to maturity for a high coupon paying bond 19) You have a portfolio of 3 pure discount bonds, with a face value of $1,000 each. The bonds are priced to yield 8% on an effective annual basis. If the bonds have times to maturity of 2, 5, and 8 years, what is the duration of this portfolio? a) 4.54 Years b) 5.00 Years c) 5.33 Years d) 8.00 Years e) It would depend on the level of default risk. Page 7 of 14 Commerce 2FA3 Mid term exam July 11, 2001 20) Currently available interest rates are 6% for a 4-year term deposit and 6.5% for a 5-year term deposit. What is the implied forward rate for the fifth year? a) 6.50% b) 8.42% c) 8.50% d) 8.52% e) 9.00% 21) XYZ Inc. has just paid an annual dividend of $2.00. Dividends are expected to grow at an annual rate of 6%. What price should XYZ Inc.’s common stock trade at if the appropriate discount rate for XYZ is 14%? a) $11.40 b) $14.29 c) $25.00 d) $26.50 e) none of the above 22) HiTek Inc. has never paid a dividend. EPS is currently $2.50 and is growing at a rate of 30% annually. This growth rate is expected to continue for 5 years. After that time they are expected to start paying dividends. The first dividend, six years from today, is expected to be $5 and is expected to grow at 5% indefinitely. At what price should HiTek's share be trading today if the required rate of return is 16%? a) There is not enough information to find the price b) $18.66 c) $21.64 d) $22.72 e) $45.45 Page 8 of 14 Commerce 2FA3 Mid term exam July 11, 2001 23) Paradise Properties is trading at $15 per share. According to their annual report their earnings last year were $8,500,000. There are 8.5 million shares of Paradise Properties outstanding. If investors require a return of 15% to invest in Paradise Properties, what percentage of that $15 per share represents the growth potential of the company? a) 15 b) 8.33 c) 55.6 d) 6.67 e) 66.67 24) BSB Inc. is has a current dividend yield of 4% and cost of capital of 14%. If the current price of BSB's shares is $23, what price should you expect BSB's shares to be trading at one year from now? a) $23.00 b) $23.92 c) $25.30 d) $26.22 e) none of the above 25) A preferred share feature that means that any missed dividends have to be paid to the preferred shareholders before the common shareholders can receive dividends is called a) retractable b) participating c) convertible d) senior e) cumulative Page 9 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Problem 1 George is planning to buy a car. The car that he wants to buy costs $23,000. a) What would his monthly payments be if he made an $8,000 down payment and financed the balance with a 5-year loan at an effective annual interest rate of 9.0%? b) What would his monthly payment be if he used lease financing instead? With a lease he would put no money down, but at the end of 4 years he would still owe $8,000. The lease would also have an EAR if 9.0%. Since both payments are made monthly, we need the monthly rate. The rate per year is 9% so: 1.09 = (1 + r)12 and r = 0.72%. 1 1 r PVa CF PVIFAr , n CF r n With the loan, the amount borrowed is $15,000 = PVa, since the loan is for 5 years n = 60. The monthly payment is the missing CF. PVIFA(r, 60) = 48.57 CF = $308.82 Using the lease finance method you need to know the effect of the $8,000 balloon payment at the end of the lease. $8,000 = PV x (1 + r)n PV = $5,667.40 PV of amortized loan = $23,000 - $5,667.40 = $17,332.60 PVIFA(r, 48) = 40.46 CF = $428.44 In this case the monthly payments are $308.82 for the loan and $428.44 with the lease. But with the lease George gets to keep his $8,000 for a while. Page 10 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Problem 2 Six months ago Larry paid $925 for a $1,000 face value, 5% coupon bond. The bond has just paid its semi-annual coupon and is trading at a YTM of 6.5% with five years to maturity. What was Larry's holding period return? Convert this holding period return to an effective annual rate, to an APR with semi-annual compounding, and also to a stated rate with continuous compounding. Step 1: find the present value of the bond today. YTM=0.065, so r = 0.0325 per six months. Face x coupon rate = $50 so each coupon payment is $25, there are 5 years to maturity so n = 10 six month periods. PVbond = PVcoupons + PVface PVbond = $936.83 Step 2: the holding period return is simply the final value of the investment divided by the cost of the investment - one. r = ($25 + $936.83)/$925 - 1 = 3.98% per six months. Step 3: convert to EAR, APR, and CC EAR = (1 + r)2 -1 = 8.12% APR = r x 2 = 7.96% CC = 2 x ln(1 + r) = 7.81% from FVIF = PV x ert EAR = FVIF -1 Page 11 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Problem 3 A $1,000 face value bond, originally issued with a 20-year maturity, has 7 years remaining until it matures. The bond pays a 10% coupon (semi-annual payments) and it is currently trading at a YTM of 7% a) What is the price of that bond? b) If the bond were callable in 2 years at a 10% premium, how much would the bond be worth? c) If the firm offered to trade the call provision for the next coupon payment, should the bondholders agree to that deal? Why? Part a) 6 month rate = 3.5%, coupon = $50, n = 14 PVbond = PVcoupons + PVface PVbond = $1,163.81 is the price if not callable. Part b) 6 month rate = 3.5%, coupon = $50, n = 4, face + call = $1,100 PVbond = PVcoupons + PVface PVbond = $1,142.24 is the price if the bond is callable. Part c) the bondholders have the opportunity to move the price from $1,142.24 to $1,163.81 - PVcoupon 1. The new value would be $1115.50, which is lower than the price with the call provision so they should reject the offer. Page 12 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Problem 4 Virtual Light Inc. has been growing their dividends at a rate of 6% for the past 7 years and this growth rate is expected to continue indefinitely. The dividend oneyear from now is expected to be $2.50. Investors require a 12% rate of return to invest in VLI common stock. a) What is the current price of VLI common stock? b) What is the dividend yield that is expected this year? c) How much should the stock be worth 5 years from today? Use the Gordon Growth Model D1/(r - g): D1 = $2.50, r = 0.12, g = 0.06. P0 = 2.50/(0.12 - 0.06) = $41.67 The expected dividend yield is simply the expected dividend divided by the price that you paid. Dividend Yield = $2.50/$41.67 = 6% The stock should be expected to increase in value by g per year since the required return can be broken down into dividend yield + capital gains yield. P5 = P0 x (1 + r)5 = $41.67 x (1 + 0.06)5 = $55.76 Page 13 of 14 Commerce 2FA3 Mid term exam July 11, 2001 Problem 5 KTH Inc. shares are trading at a P/E ratio of 15. The latest EPS figure was $4. The dividend last year was $2. Dividends have been growing at a rate of 6% and are expected to continue to grow at that rate? a) What is the current price of KTH Inc.'s shares? b) What is the required rate of return on KTH? c) What is the net present value of growth opportunities per share (NPVGO)? d) If KTH's management decided to switch strategies and pay out all earnings as dividends, reducing the growth rate to zero, what would happen to KTH's stock price? Use the P/E ratio and earnings per share to find current price. P/E = 15 and E = $4 P0 = 15 x $4 = $60.00 Use the Gordon Growth Model to find the required return. r=[D0 x (1 + g)/ P0] + g = $2 x 1.06 /$60 + 0.06 = 9.53% The NPVGO can be found using P/E, E and r P/E = 1/r + NPVGO/E 15 = 1/0.0953 + NPVGO/$4 NPVGO = $18.04 If management changes strategy, they would be throwing away the NPVGO, which is worth $18.04. The share price would fall by $18.04 to $41.96. You can get the same new price using the dividend growth model. D1 = $4, g = 0 and r = 9.53% P0 = $4/0.0953 = $41.96 Page 14 of 14