4. Plant Hire Market

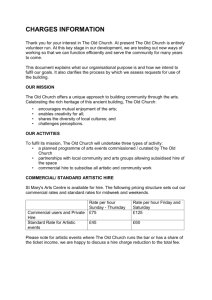

advertisement