DOC

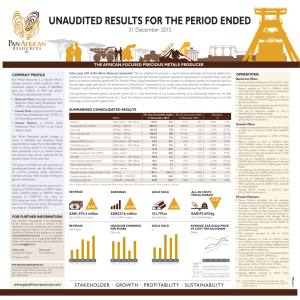

advertisement

May 2006 INVESTMENT OUTLOOK CONTENTS Bell Equipment Desmond Esakov & Leandro Gastaldi, Portfolio Managers. Bell Equipment Introduction Given the potential for depreciation in the currency we will highlight a company that could benefit. Although resource companies have traditionally been seen as the best way to hedge from ZAR weakness we feel that any weakness in the currency is likely to coincide with a correction in the commodity markets and related equities. As a result, we will focus on Bell which is a company that has lagged the overall market and should have limited downside in the event of a correction in the commodity markets. Bell is primarily exposed to the agricultural and infrastructural sectors; two areas of the economy that we expect will outperform over the next few years. Overview Bell Equipment distributes and supports a range of material handling equipment for the mining, construction and agricultural industries. The company’s main factory is located in Richards Bay and there are assembly facilities in Germany and the U.S. Results for year to end 31 December 2005 Revenue increased by 27% from ZAR 2.5bn to ZAR 3.2bn. This increase in revenue was largely on the back of strong demand in SA, North America and Europe. Exports increased by ZAR 555mn and sales exports now represent around 57% of the group’s turnover. Gross profit increased from ZAR 473mn to ZAR 508mn however the gross profit margin fell from 19% to 16%. This decline in the margin was largely attributed to increased competition, the strength of the ZAR and the loss making contract to supply Articulated Dump Trucks to the U.S. Warranty costs amounted to 23% of overhead costs. According to management the high Anglorand Securities: Investment Outlook –May 2006 Page 2 of 5 level of warranty is due to a number of design and component claims and specification which management now believes has largely been settled and corrected. Excluding warranty costs other overheads dropped by 10%. At the operating level profit for the year increased by ZAR 22mn to ZAR 47.3mn.89 Net cash flow from operating activities increased to ZAR 34.6mn fro a net cash outflow of ZAR 133.8mn. Fully diluted HEPS improved from a loss of 14cps to a loss of 11cps in 2005. Gearing although still relatively high improved from 55% to 51%.and management plans to bring this level down to 40% Earnings Outlook In a SENS announcement at the beginning of May Bell stated that after tax profits for Q1 of this year were ZAR 27mn which translated into HEPS of 28cps. This is as a result of a termination of contract with John Deere which was resulting in a gross loss. Bell will now produce Deere products locally and Deere will assemble Bell products in the U.S. to be done on royalty based scheme of arrangement. Given that we expect the ZAR to weaken in the future and we have a positive outlook on the construction (see April report), mining and agricultural sectors we expect company margins and profits to turnaround in the future. With a normalized net margin we forecast a strong turn around in the Bell price over the next three years. (See table above). Our long term forecast price for 2008 is ZAR 26. Summary Bell is generating healthy turnover and is now concentrating on improving profit margins. A number of cost cutting strategies have been implemented although the main driver of margins will be the value of the ZAR relative to other currencies especially the EUR and the USD. Given the prospects for ZAR depreciation we believe Bell offers excellent value. We value the stock at ZAR 26 and recommend that investors buy the share. Anglorand Securities: Investment Outlook –May 2006 Page 3 of 5 SENIOR STAFF David Palmer (Director/Head Dealer); Adriaan Kamper (Financial Director); Yulindi Taljaard (Compliance Officer/Settlements Manager). THE INVESTMENT COMMITTEE Richard Bonnichsen; Desmond Esakov, Gary Cahn, Richard Palmer, Nicolas Kunze. ANGLORAND SECURITIES Tel: (011) 484 7440 • Fax: (011) 484 6647 • Website: http://www.anglorand.co.za • Email: info@anglorand.co.za Address: 1st Floor, Broll Place, Sunnyside Office Park, 32 Princess of Wales Terrace, Parktown. Anglorand Securities: Investment Outlook –May 2006 Page 4 of 5 Anglorand Securities: Investment Outlook –May 2006 Page 5 of 5