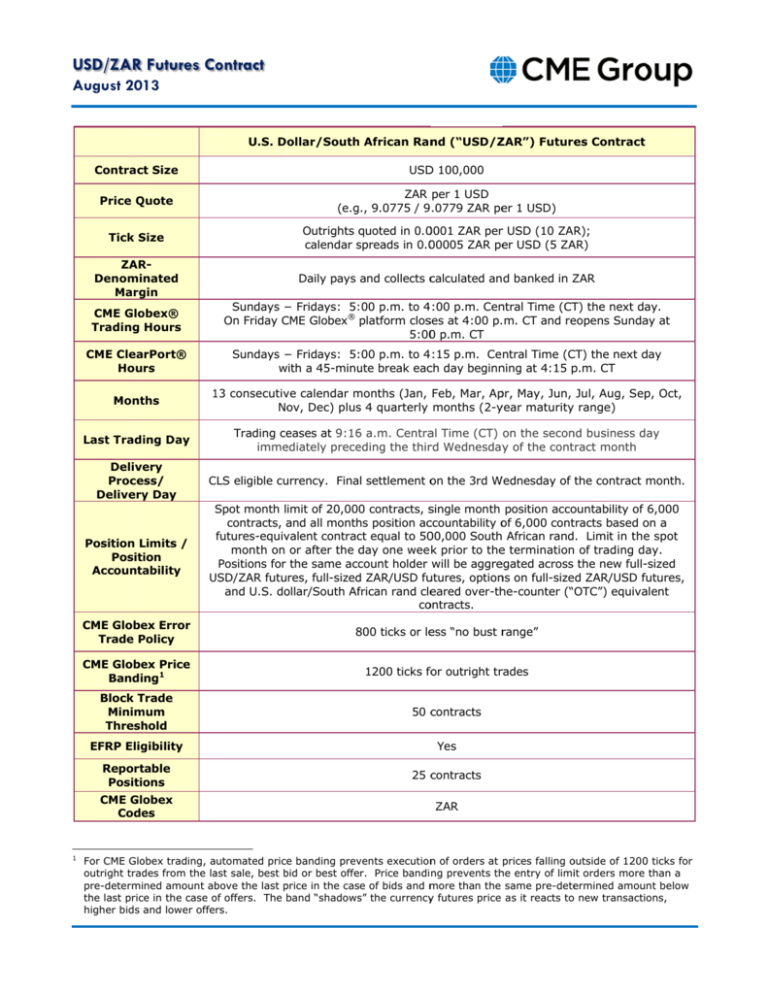

USD/ZAR Facftsheet

advertisement

USD/ZAR Futures Contract August 2013 U.S. Dollar/South h African Ran nd (“USD/Z ZAR”) Future es Contract 1 Contract Size USD D 100,000 Price Quote Q ZAR per 1 USD (e.g., 9.0775 / 9.0779 ZAR pe er 1 USD) Tick Size S Outrights quoted q in 0.0 0001 ZAR perr USD (10 ZAR); calendar spreads s in 0.0 00005 ZAR pe er USD (5 ZA AR) ZAR RDenominated Marg gin Daily pays and collects ccalculated and banked in Z ZAR CME Glo obex® Trading Hours Sundays − Fridays: 5::00 p.m. to 4:00 p.m. Cen ntral Time (CT T) the next da ay. On Friday CME C Globex® platform closses at 4:00 p.m. CT and re eopens Sunda ay at 5:00 0 p.m. CT CME ClearPort® Hours Sundays − Fridays: 5::00 p.m. to 4:15 p.m. Central Time (C CT) the next d day with w a 45-minu ute break eacch day beginn ning at 4:15 p p.m. CT Montths 13 1 consecutiv ve calendar months m (Jan, Feb, Mar, Ap pr, May, Jun, Jul, Aug, Sep p, Oct, No ov, Dec) plus s 4 quarterly months (2-y year maturity range) Last Tradiing Day Trading ce eases at 9:16 6 a.m. Centra al Time (CT) on the secon nd business day imme ediately prece eding the thirrd Wednesday y of the contract month Delive ery Process/ Delivery y Day CLS C eligible cu urrency. Final settlement o on the 3rd W Wednesday of the contract month. Position Limits L / Positiion Accounta ability Spot month limit of 20,000 contracts, ssingle month position acco ountability of 6,000 contracts, and a all month hs position acccountability o of 6,000 conttracts based o on a futures-equiv valent contrac ct equal to 50 00,000 South African rand. Limit in the e spot month on or after the day d one wee k prior to the e termination of trading da ay. Positions for the same acc count holder will be aggre egated across the new full--sized USD/ZAR U futures, full-sized d ZAR/USD fu utures, option ns on full-size ed ZAR/USD ffutures, and U.S. do ollar/South Affrican rand cle eared over-th he-counter (“OTC”) equiva alent co ontracts. CME Globe ex Error Trade Policy P 800 8 ticks or le ess “no bust rrange” CME Globe ex Price Banding1 1200 ticks fo for outright trrades Block Trade T Minim mum Thresh hold 50 ccontracts EFRP Elig gibility Yes Reporttable Positio ons 25 ccontracts CME Glo obex Code es ZAR For CME Glo obex trading, automated price e banding prev vents execution n of orders at prices falling o outside of 1200 0 ticks for outright trad des from the la ast sale, best bid b or best offe er. Price bandi ng prevents th he entry of limiit orders more than a pre-determined amount ab bove the last price p in the cas se of bids and m more than the same pre-dete ermined amount below the last price in the case of o offers. The band b “shadows s” the currency y futures price as it reacts to new transactions, higher bids and lower offers.