11月網路模考會計考題

advertisement

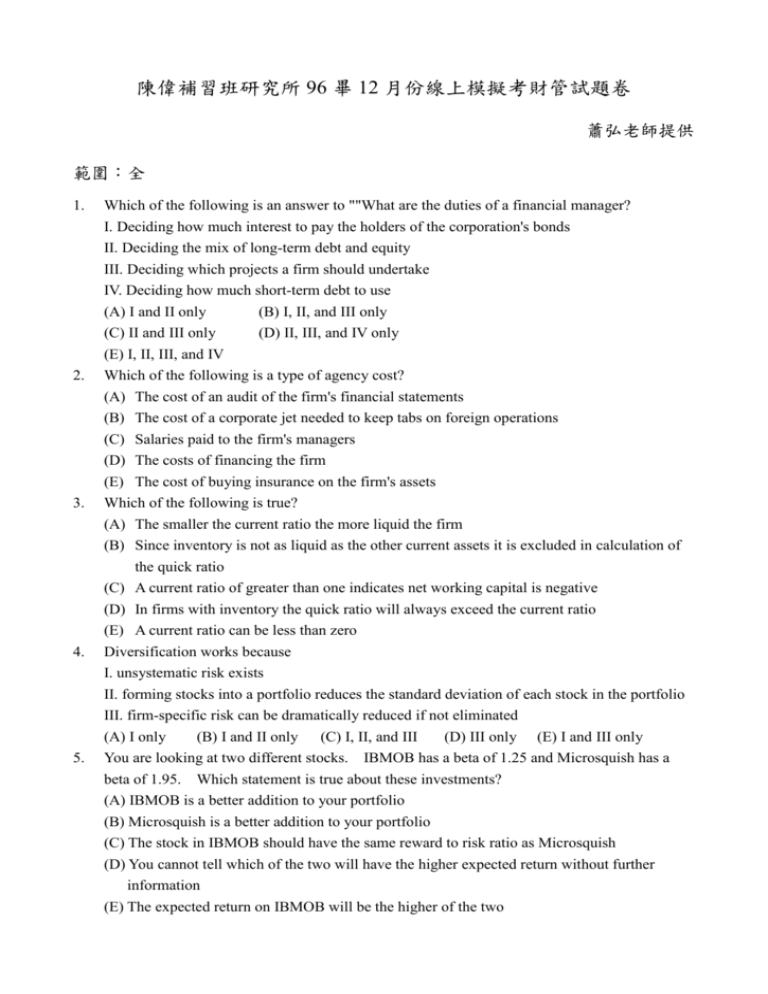

陳偉補習班研究所 96 畢 12 月份線上模擬考財管試題卷 蕭弘老師提供 範圍:全 1. 2. 3. 4. 5. Which of the following is an answer to ""What are the duties of a financial manager? I. Deciding how much interest to pay the holders of the corporation's bonds II. Deciding the mix of long-term debt and equity III. Deciding which projects a firm should undertake IV. Deciding how much short-term debt to use (A) I and II only (B) I, II, and III only (C) II and III only (D) II, III, and IV only (E) I, II, III, and IV Which of the following is a type of agency cost? (A) The cost of an audit of the firm's financial statements (B) The cost of a corporate jet needed to keep tabs on foreign operations (C) Salaries paid to the firm's managers (D) The costs of financing the firm (E) The cost of buying insurance on the firm's assets Which of the following is true? (A) The smaller the current ratio the more liquid the firm (B) Since inventory is not as liquid as the other current assets it is excluded in calculation of the quick ratio (C) A current ratio of greater than one indicates net working capital is negative (D) In firms with inventory the quick ratio will always exceed the current ratio (E) A current ratio can be less than zero Diversification works because I. unsystematic risk exists II. forming stocks into a portfolio reduces the standard deviation of each stock in the portfolio III. firm-specific risk can be dramatically reduced if not eliminated (A) I only (B) I and II only (C) I, II, and III (D) III only (E) I and III only You are looking at two different stocks. IBMOB has a beta of 1.25 and Microsquish has a beta of 1.95. Which statement is true about these investments? (A) IBMOB is a better addition to your portfolio (B) Microsquish is a better addition to your portfolio (C) The stock in IBMOB should have the same reward to risk ratio as Microsquish (D) You cannot tell which of the two will have the higher expected return without further information (E) The expected return on IBMOB will be the higher of the two Use the following to answer questions 6-10: Maturity: 10 years "Face value: $1,000" Conversion price: $65 Stock price at issue: $45 Annual coupon: $80 YTM on similar nonconvertibles: 7.5% 6. What is the conversion value if the current stock price is $69.50? (A) $1,034.32 (B) $939.00 (C) $778.43 (D) $1,070.30 (E) $867.39 7. What is the straight bond value? 8. (A) $1,034.32 (B) $867.39 (C) $939.00 (D) $778.43 (E) $983.64 What is the minimum value of this bond if the current stock price is $69.50 per share? (A) $1,034.32 (B) $1,070.30 (C) $939.00 (D) $778.43 (E) $867.39 9. What was the conversion premium at issuance? (A) 33.33% (B) 38.25% (C) 30.80% (D) 44.44% (E) 16.67% 10. What is the conversion ratio? (A) 15.4 (B) 22.2 (C) 12.3 (D) 9.8 (E) 16.7 11. If a firm revises its production process to use more labor and less machinery, the firm will have ____________, all else equal. (For simplicity, assume the operating cash flow doesn't change in this case.) I. an increased capital intensity II. a decreased accounting break-even III. an increased degree of operating leverage IV. smaller changes in OCF for a given change in sales quantity (A) and III only (B) I and IV only (C) I, II, and III only (D) II, III, and IV only (E) I, II, III, and IV 12. Which of the following is/are true about a project that breaks even on a financial basis? I. The project has an IRR = 0% II. The project has an IRR = -100% III. The project has a negative NPV IV. The project has an NPV of zero V. The project has an IRR equal to the firm's required return (A) I only (B) III only (C) IV and V only (D) I and III only (E) II and IV only 13. The managers of PonchoParts, Inc. plan to manufacture engine blocks for classic cars from the 1960s. They expect to sell 250 blocks annually for the next 5 years. The necessary foundry and machining equipment will cost a total of $800,000 and will be depreciated on a straight-line basis to zero over the project's life. The firm expects to be able to sell the equipment for $150,000 at the end of 5 years. Labor and materials costs total $500 per engine block, fixed costs are $125,000 per year. Assume a 35% tax rate and a 12% discount rate. What will be the annual depreciation tax shield? (A) $20,000 (B) $56,000 (C) $100,000 (D) $104,000 (E) $120,000 14. You are considering investing in a process that is a cost cutting proposal. Net income from the project is expected to equal $27.50 each of the three years of the project's life. The process has an initial cost of $125 and will be depreciated straight-line over 3 years to a salvage value of $0. Assume a 34% tax bracket and a discount rate of 15%. What is the value of the tax shield in each period from the investment in the process? (A) $6.80 (B) $8.50 (C) $14.17 (D) $27.50 (E) $41.67 15. Asset A has a reward to risk ratio of .075 and a beta of 1.5. the expected return on A? (A) 12.25% (B) 16.25% (C) 14.25% (D) 11.25% (E) 13.50% The risk free rate is 5%. What is 16. Which of the following statements are true regarding options on common stock? I. Buying a call gives you the right to purchase shares. II. Selling a call may give you the obligation to sell shares. III. Buying a put gives you the right to sell shares. IV. Selling a put may give you the obligation to buy shares. (A) None of the above (B) I and IV only (C) II and III only (D) I, II, and IV only (E) I, II, III and IV 17. The BB Drum Company recently raised several million dollars in an initial public offering. BB received $22.00 per share from the underwriter, the offering price was $25.00 per share, and the market price rose to $28.00 on the day of the offering. The spread paid by BB was ______. (A) 12.0 percent (B) 28.0 percent (C) 27.3 percent (D) 13.6 percent (E) 24.0 percent 18. Two stocks are available for purchase: one with a low dividend payout rate and one with a high dividend payout rate. Which of the following types of investors would likely prefer the firm with the high dividend payout rate? I. A corporate investor II. A tax-exempt investor III. An investor who does not need current income IV. An investor in a relatively high personal income tax bracket (A) I and II only (B) "I, II, III and IV " (C) III only (D) III and IV only (E) II and IV only 19. You purchase 100 shares of stock for $20.00 per share cum dividend just before the market closes on Thursday. The ex dividend date is Friday and the dividend is $1.50 per share. Assuming there are no taxes, just after the market opens on Friday morning your total wealth (all else equal) ______________. (A) will fall from the previous day's wealth by $150 (B) will increase by the amount of the dividend received (C) "will still be equal to $2,000 " (D) will increase by the amount of the dividend since you can now sell the stock for $18.50 per share and keep the dividend (E) will fall from the previous day's wealth by $300 20. Picard Industries requires $250,000 a week to pay bills. The fixed cost of transferring money is $65 per transfer. The standard deviation of the weekly cash flows is $25,000 and the lower cash balance limit is $40,000. Assume the applicable annual interest rate is 5%. Using the BAT model, what is the optimum initial cash balance? (A) $183,848 (B) $91,924 (C) $367,696 (D) $97,735 (E) $205,470 21. The Lawrence Stone-Age Pottery Co. receives 50 checks per month from customers. Average payments and clearing times are as follows. Five checks: $21,000, 2 days; Fifteen checks: $58,000, 3 days; Twenty five checks: $37,000, 4 days; and the remainder: $10,000, 5 days. Assume a 360 day year. What is the weighted average delay in receiving the funds? (A) 5.93 days (B) 4.23 days (C) 2.98 days (D) 3.47 days (E) 5.01 days 22. A put option with exercise price $30 and 3 months to expiration sells for $1.55. The continuously-compounded risk-free rate is 6% annually, and the stock sells for $35. How much must a call option sell for with the same exercise price and expiration? (A) $3.45 (B) $5.00 (C) $7.00 (D) $8.55 (E) $9.25 23. Firms A and B are competitors. Both have similar assets and business risks and are all equity firms. Firm A has an after-tax cash flow of $20,000 per year forever and Firm B has an after-tax cash flow of $150,000 per year forever. If the two firms merge, the after-tax cash flow will be $179,000 per year forever. If the appropriate discount rate is 15% what is the MOST B will pay for A? (A) $9,000 (B) $20,000 (C) $60,000 (D) $133,333 (E) $193,333 24. Assume the lessor borrows to purchase an asset, and then leases it to another firm. If the lease is a(n) ____________ and the lessee subsequently defaults, the lessor must continue making the loan payments. (A) leveraged lease (B) operating lease (C) single investor lease (D) sale-and-leaseback arrangement (E) conditional sales agreement lease 25. Your company is considering purchasing a fleet of cars for $195,000. It can borrow at 8.5%. The cars can be lease for 4 years at $55,000 per year and will be worthless at the end of 4 years. The corporate tax rate is 34%. You use straight-line depreciation. If you do not expect to pay taxes for the next 4 years, what is the net advantage to leasing? (A) $9,000 (B) $11,455 (C) $14,842 (D) $14,767 (E) $15,217 26. DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for four years. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. If the equipment is worth $100,000 at the end of four years, what is the net advantage to leasing? Use straight-line depreciation to a salvage of zero. (A) $38,873 (B) $41,132 (C) $42,269 (D) $48,706 (E) $52,062 27. Assume a firm is currently operating at full capacity. Sales are forecasted to increase by 20% next year. Management could do each of the following EXCEPT (A) attempt to restrain sales growth so that no new fixed assets are needed (B) increase the firm's investment in fixed assets to meet the added demand (C) subcontract with other manufacturers to produce the firm's products in order to meet the added demand (D) lease additional equipment to meet the added demand (E) acquire more current assets in order to meet the added demand 28. Pickup Industries has a profit margin of 15% and a dividend payout of 40%. Last year's sales were $600 million and total assets were $400 million. None of the liabilities vary directly with sales, but assets and costs do. If the growth rate for Pickup is 20%, how much external financing is needed? (A) $5.2 million (B) $13.1 million (C) $15.2 million (D) $21.3 million (E) $26.0 million 29. Five years from now you will begin to receive cash flows of $75 per year. These cash flows will continue forever. If the discount rate is 6%, what is the present value of these cash flows? (A) $799.68 (B) $894.22 (C) $934.07 (D) $990.12 (E) $1,104.67 30. If a representative product increases in price from $3,651 to $9,463 over the next year, what is the rate of inflation? (A) 636.80% (B) 318.40% (C) 159.20% (D) 79.60% (E) 39.80% 1. Ans D 2. 3. 4. 5. 6. 7. 8. 9. 10. A B E C D A B D A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B C B C B E D A C A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. D C E C C A E C D C