Remuneration

advertisement

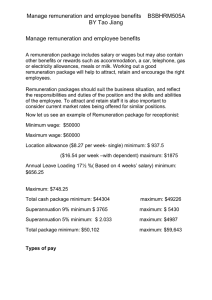

REMUNERATION Remuneration is based on the requirements of the role as detailed in the position description. Awards, industrial agreements and minimum wage orders all provide guidelines for the setting of remuneration. General industry awards contain a limited range of employment conditions, while Pay and Classification Scales provide minimum pay scales. Individual contracts of employment, and/or your organisation’s Conditions of Employment can provide for terms and conditions better than those contained in awards and agreements but cannot provide terms less favourable than these. Verbal agreements where employees are paid less than an applicable award, agreement are unacceptable and may result in financial liabilities or penalties for your organisation. 1. Determining Remuneration First of all, employers need to determine whether there are any minimum entitlements that are required to be adhered to. Minimum wages may be specified by legislation, state awards, certified agreements or minimum wage orders. These may also set overtime rates or allowances (such as meals or clothing allowances). The applicable minimums will depend on which industrial system the employer operates under. If no minimum entitlement applies to a particular position, then the employer and employee are free to negotiate a mutually agreeable rate of pay. However, employers can check awards which govern comparable work for an indication of the lower range of acceptable pay. 2. Remuneration Components Remuneration refers not only to the employee’s cash salary, but also to all non-cash benefits provided to the employee – motor vehicle, laptop or mobile phone. 3. Employment Contract The employer must ensure that an employee’s employment contract clearly sets out their remuneration and what monetary and non-monetary benefits it comprises. These details should be contained in a schedule to the employment contract and include the following: Superannuation (including whether it is calculated on the salary component or, for packaged salaries, on the full packaged value) Use of a motor vehicle Mobile phone / laptop Overtime (or time in lieu provisions) Travelling expenses Fringe Benefit Tax Valuing Our People – a practical guide for employing staff and volunteers. 1 4. Superannuation The federal superannuation contribution guarantee scheme (SG) sets a minimum level of superannuation contributions which all Australian employers are obliged to pay in respect of employees. This money is paid into a complying superannuation fund and is preserved for the employee until retirement. Superannuation contributions are only required when the employee earns more than $450 in a calendar month. As a matter of parity for Church employees, it is recommended that employers consider paying superannuation for all employees earning above the threshold of $450 in a calendar month. 5. Taxation Employers must be aware of their obligations in respect of income tax, fringe benefits tax and payroll tax. Income Tax law requires employers to register with the ATO, to withhold tax from salary, wages, commission, bonuses or allowances paid to employees, and to send this tax to the ATO. Fringe Benefits Tax (FBT) is a tax on non-cash benefits paid or given to employees in respect of the employee’s employment. Employers are required to pay this tax, not the employee. Examples of benefits subject to FBT include: o A motor vehicle provided at the employer’s expense. o Subsidising personal costs (including home rental, or payment of school fees). o Providing the employee with an advantage, such as cheap housing, transport, meals or entertainment. Fringe Benefits Tax in the Church Fringe benefits provided to religious practitioners principally in relation to pastoral duties, are exempt from FBT. A religious institution is a rebatable employer and is also entitled to a 48% rebate on any FBT incurred in relation to benefits provided to employees. Public Benevolent Institutions and Health Promotion Charities receive an FBT exemption on up to $30,000 grossed up value of fringe benefits per employee. Pay-roll Tax is a state tax which generally must be paid by all employers who pay wages in excess of the relevant ‘tax-free threshold’. Valuing Our People – a practical guide for employing staff and volunteers. 2 6. Salary Packaging Salary packaging is another consideration. Employer and employee can negotiate an arrangement whereby remuneration is received in a combination of cash salary and non-salary benefits. To be effective, this must be in the form of a salary sacrifice agreement. 7. Remuneration Review It is good practice to review employees’ wages/salary annually, although it is recognised that government funding or other income sources will often dictate or constrain what an employer can do. Often the employment contract refers to a ‘regular review’. Where appropriate, wages should be increased to keep up with inflation. Employers should also consider granting pay increases in recognition of good performance or increased duties or responsibility, especially where employees are receiving the minimal rates such as those set by state awards or the Australian Fair Pay Commission. Valuing Our People – a practical guide for employing staff and volunteers. 3