Manage remuneration and employee benefits

advertisement

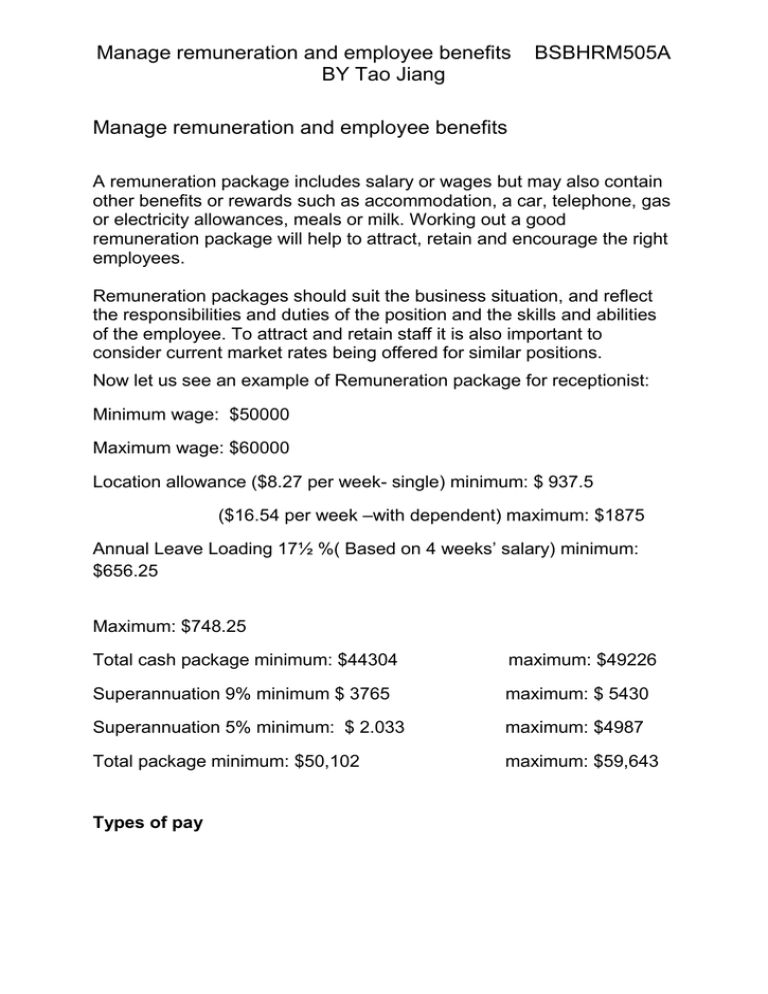

Manage remuneration and employee benefits BY Tao Jiang BSBHRM505A Manage remuneration and employee benefits A remuneration package includes salary or wages but may also contain other benefits or rewards such as accommodation, a car, telephone, gas or electricity allowances, meals or milk. Working out a good remuneration package will help to attract, retain and encourage the right employees. Remuneration packages should suit the business situation, and reflect the responsibilities and duties of the position and the skills and abilities of the employee. To attract and retain staff it is also important to consider current market rates being offered for similar positions. Now let us see an example of Remuneration package for receptionist: Minimum wage: $50000 Maximum wage: $60000 Location allowance ($8.27 per week- single) minimum: $ 937.5 ($16.54 per week –with dependent) maximum: $1875 Annual Leave Loading 17½ %( Based on 4 weeks’ salary) minimum: $656.25 Maximum: $748.25 Total cash package minimum: $44304 maximum: $49226 Superannuation 9% minimum $ 3765 maximum: $ 5430 Superannuation 5% minimum: $ 2.033 maximum: $4987 Total package minimum: $50,102 maximum: $59,643 Types of pay Manage remuneration and employee benefits BY Tao Jiang BSBHRM505A Pay for ordinary hours Ordinary hours of work are usually the hours agreed to between the employer and the employee as being the hours which will be worked before any overtime or penalty rates are payable. Ordinary hours of work is an important concept in remuneration, because it is often used to calculate the various leave entitlements and termination payments. Ordinary pay for your employee may be the minimum award rate or federal or state minimum wage or an agreed higher rate. Overtime pay Overtime payments are a type of penalty rate and usually involve an additional percentage of the ordinary rate of pay to compensate the employee for working in excess of the ordinary number of hours or outside the ‘spread of ordinary hours’. Pay for weekend work and public holidays Payment for working on days other than the ordinary days of the business (e.g. on weekends and public holidays) is another form of penalty rate. Awards usually specify the level of payment for work done on weekends and public holidays. Bonuses Bonuses are designed to reward employees who meet set targets or goals, for example, higher productivity. Performance measures might be milk production over a particular period, annual profit, or incidence of mastitis. Other benefits Although remuneration is mostly thought of as wages, the value of accommodation, a car, telephone, gas or electricity allowances, meals or milk and any other benefits can be considered when putting together a total package. Superannuation Manage remuneration and employee benefits BY Tao Jiang BSBHRM505A Superannuation is not technically part of the employment remuneration package as, apart from the exceptions listed below, all employers must pay superannuation for all employees. However, some employers choose to pay an increased rate of superannuation to attract employees and in this case superannuation may form part of the remuneration package. The superannuation guarantee legislation requires employers to provide superannuation contributions for employees as a percentage of their ‘ordinary time earnings’. This amount must be paid to the superannuation provider at least every quarter, and a record kept of all contributions made. Task2 Conduct a gap analysis Remuneration can be defined as basic components of employee’s composition. There are two different types of remuneration which are fixed and variable remuneration. Firstly remuneration is based on the monetary reward that employer have to pay for employees. Secondly, variable remuneration is refers to other additional pay that could be change every month, therefore it could motivate the employees to achieve best performance and target. Gap Analysis compares your current situation with the future state that you want to achieve once your project is complete. By conducting a Gap Analysis, you can identify what you need to do to "bridge the gap" and make your project a success. You can use Gap Analysis at any stage of a project to analyze your progress, but it's most useful at the beginning. Manage remuneration and employee benefits BY Tao Jiang BSBHRM505A To carry out a Gap Analysis, first identify your project's objectives. Then analyse your current situation, making sure that you gather information from the right sources. Finally, identify how you'll bridge the gap between your current situation and the desired future state. However, employee benefits are something uses to supplement compensation. This is extra allowance for employees, for instance, product discounts relevant to the organisations industry or production; salary sacrifice options; additional leave entitlements; relevant association memberships and subscriptions. Identify which awards or industrial agreements apply to receptionist. Individual transitional employment agreement: It is an individual written agreement between you and your employer setting out the terms and conditions of your employment. These include things like how much you are paid, your hours of work, and other things relating to your job. It will be assessed against the no disadvantage test to ensure that your ITEA does not disadvantage you against an applicable collective agreement, or an applicable award. Employee collective agreement: A collective agreement may cover businesses run by more than one employer. An employee collective agreement is made between your employer and the employees employed at the time who will be covered by the agreement. Employer greenfields agreement: it is made by a single employer before the employment of any workers to be employed as part of a new business, new project or undertaking. They have no counterpart in any previous Act. Competitiveness: The job description of reception staff has expanded quite a bit due to the increased use of technology in the workplace. In addition to their usual tasks, many reception staff also assist their companies with payroll, bookkeeping, receivables collection, and a variety of other office tasks. In many cases a receptionist is expected to perform multiple tasks quickly and efficiently. Manage remuneration and employee benefits BY Tao Jiang BSBHRM505A Consider other benefits Once you have determined the current market rate you can then add other benefits into the equation. For instance, the face value of a wage for a dairy farm employee may not appear to be attractive compared with other industries. However, when the total package is measured you may be surprised at its value to the employee. What changes to the approach the organization takes to remuneration and benefits for that position. Research occupational groups to determine those which are industrial agreement-based Access market rates surveys regularly to ensure the organisation’s required level of competitiveness for particular occupational groups is maintained; ensure that employees receive at least their minimum entitlements in accordance with organisational policies and legal requirements; ensure salary packages comply with organisational policies and legal requirements including fringe benefits tax and superannuation; ensure incentive arrangements, if included, comply with the organisation’s remuneration strategy. They can provide some reward options like, incentive plans which are a formal process of assessing goals in a role at standard performance with performance at a higher level; performance bonuses may be for high performance against a special project or one-one activity; sales commissions are very specific to roles that can impact direct sales results. Share plans allocations are unique to publicly listed organisations and are generally applied to the achievement of a specific ownership and loyalty to the organisation.