contents - Cevdetkizil.com

advertisement

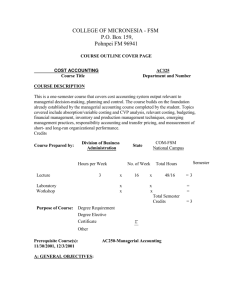

CONTENTS Introduction CHAPTER 1: FINANCIAL ACCOUNTING 1 1.1 BOOK-KEEPING AND ACCOUNTING 1 1.1.1 Book-keeping and Accounting in Business 1 1.1.2 Abilities of Book-keeping / Accounting System 2 1.1.3 Business Transactions 2 1.1.4 Some Accounting Terms 3 1.2 DOUBLE ENTRY AND ACCOUNTS 3 1.3 THE TRANSACTIONS 8 1.4 PURCHASES, SALES AND RETURNS 11 1.4.1 The Use of Purchases and Sales Accounts 12 1.4.2 Purchases for Cash or Check 12 1.4.3 Purchases on Credit 13 1.4.4 Sales for Cash or Check 14 1.4.5 Sales on Credit 14 1.4.6 More About Sales and Purchases Accounts 15 1.4.7 Returns Accounts 16 1.4.8 Returns Outwards Account 17 1.4.9 Returns Inwards Account 17 1.4.10 Purchases, Sales and Returns Accounts 18 1.5 BALANCING-OFF ACCOUNTS 20 1.5.1 Why Should We Balance the Accounts? 20 1.5.2 The Way to Balance-off the Accounts 21 1.5.3 Account Balancing Examples 22 1.6 THE TRIAL BALANCE 22 1.6.1 Getting to Know the Trial Balance 22 1.6.2 The Extraction of a Trial Balance 23 1.6.3 Locating the Errors Indicated by a Trial Balance 24 1.6.4 Preparing a Trial Balance from a List of Balances 24 1.7 EXPENSES AND INCOME; DRAWINGS 26 1.7.1 Accounts for Expenses 26 1.7.2 Accounts for Income 27 1.7.3 The Use of Drawings (Withdrawals) Account 28 1.8 TRADING ACCOUNT; PROFIT AND LOSS ACCOUNT 30 1.8.1 The Gross Profit or Loss 30 1.8.2 The Trading Account 31 1.8.3 The Profit and Loss Account 33 1.9 THE BALANCE SHEET 38 1.9.1 Definitions of the Balance Sheet 38 1.9.2 The Effect of Transactions on a Balance Sheet 39 1.9.3 A Business Balance Sheet 41 1.9.4 Format of the Balance Sheets 43 1.9.5 Goodwill 45 1.10 THE ASSET OF STOCK 45 1.10.1 Introduction 45 1.10.2 Stock Valuation 46 1.10.3 The Closing Stock and the Calculation of Gross Profit 46 1.10.4 The Opening Stock and the Closing Stock 47 1.10.5 Further with Gross Profit or Loss 49 a. Return Inwards and Return Outwards 49 b. Carriage Expenses 51 c. Other Expenses charged to the Profit or Loss Accounts 51 d. Goods Taken for Own Use 52 1.10.6 An Example 52 1.11. ACCRUALS AND PREPAYMENTS OF EXPENSES AND INCOME; CAPITAL AND REVENUE EXPENDITURES 54 1.11.1 Accruals of Expenses 55 1.11.2 Prepayments of Expenses 57 1.11.3 Accrual of Income 59 1.11.4 Prepayment of Income 61 1.11.5 Stocks of Office Supplies 63 1.11.6 Finding the Missing Figures 64 1.11.7 Private Expenses 1.11.8 Capital and Revenue Expenditures 1.11.9 Preparing Final Accounts from a Trial Balance 1.12 VALUE ADDED TAX (V.A.T.) 1.12.1 Value Added Tax 1.12.2 The Use of a VAT Account 1.12.3 VAT Calculations 1.13 THE LEDGER 1.14 THE JOURNALS 1.14.1 Uses of the General Journal 1.14.2 The Use of a Journal for Opening Entries 1.14.3 Purchase or Sale of Fixed Assets 1.14.4 Other Transfers 1.15 FIXED ASSET DEPRECIATION 1.15.1 Definition of Depreciation 1.15.2 Depreciation Methods 1.15.3 Straight-Line Depreciation 1.15.4 Reducing-Balance (or Diminishing-Balance) Depreciation 1.15.5 Straight-Line and Reducing-Balance Methods Compared 1.15.6 Depreciation and Double-Entry Book-Keeping a. Direct Method b. Indirect Method 1.16 DISPOSALS OF FIXED ASSETS 1.17 BAD CREDITS AND PROVISION FOR BAD AND DOUBTFUL CREDITS 1.17.1 Introduction 1.17.2 Written Off and Provision for Bad and Doubtful Credits 1.18 ERRORS NOT SHOWN BY A TRIAL BALANCE 1.18.1 Errors not indicated by a Trial Balance 1.18.2 Correcting Errors not indicated by a Trial Balance 1.19 ERRORS INDICATED BY A TRIAL BALANCE 1.20 STOCK RECORDS 1.20.1 Storekeeping Procedures 1.20.2 Manual Stock Record Cards 1.20.3 Stock Losses 1.20.4 Computerized (Electronic) Stock Records 1.20.5 Stock Valuations a. Average Cost Methods b. FIFO and LIFO Methods 1.20.6 Journal Entries of Stock Valuation a. Valuation of the Stock with Average Cost Method at the end of the period b. Valuation of the Stock with Weighted Average Cost Method c. Valuation of the Stock with FIFO Method d. Valuation of the Stock with LIFO Method e. Entries of the Journal 1.21 WAGES BOOKS AND RECORDS 1.21.1 Wages and Salaries 1.21.2 Time Basis 1.21.3 Piecework Basis 1.21.4 Deductions from the Wages 1.21.5 Income Tax 1.21.6 National Insurance Contributions 1.21.7 Superannuation / Pension Contributions 1.21.8 The Entry of the Journal 1.22 MANUFACTURING ACCOUNT 1.22.1 The Process of Manufacturing 1.22.2 The Manufacturing Account 1.22.3 Accounts of Manufacturing 1.23 FINANCIAL STATEMENT ANALYSIS 1.23.1 The Objectives of Financial Statement Analysis 1.23.2 Horizontal Analysis 65 66 67 71 71 72 74 75 75 76 76 78 79 80 80 82 83 84 84 85 85 88 91 91 91 92 96 96 98 101 101 102 104 105 105 106 107 107 107 108 108 109 109 110 110 110 111 112 113 113 115 115 116 117 117 120 121 129 129 129 1.23.3 Vertical Analysis 1.23.4 Benchmarking 1.24 ACCOUNTING RATIOS 1.24.1 Introduction 1.24.2 Cost of Goods Sold & Profit and Loss Accounta 1.24.3 Ratios and Calculations of the Balance Sheet 1.25 CASHFLOW STATEMENTS 1.25.1 The Advantages and Importance of Cashflow Statements 1.25.2 Cashflows CHAPTER 2 : COST ACCOUNTING 2.1 CLASSIFICATION OF COSTS 2.1.1 Cost Classification of Costs for Cost Accounting 2.1.2 General Classification of Costs for a Manufacturer 2.1.3 Cost Classification of Costs for Decision Making a. Absorbed and Variable Costs b. Sunk and Committed Costs c. Opportunity and Incremental Costs d. Avoidable and Unavoidable (or Incurred) Costs e. Fixed and Variable Costs f. Controllable and Non- Controllable Costs g. Standard Costs h. Post-Manufacturing Costs i. Life-Cycle Costing 2.1.4 Estimating Cost Behavior a. Mathematical Conventions b. Definition and Description of Cost Behavior d. Numeric Illustration of Cost Behavior e. Scatter Graphs f. Analysis of Accounts Technique for Cost Behavior Prediction 2.1.5 Arithmetical Prediction of Cost Behavior a. The High-Low Technique b. Arithmetical Prediction with the High-Low Technique 2.2 ABSORPTION COSTING 2.2.1 Definition of Absorption Costing 2.2.2 Choosing the best Overhead Absorption Rate (OAR) 2.2.3 The predetermined aspects of OARs 2.2.4 Consequences of using predetermined OARs: under-absorption and over-absorption of overheads 2.2.5 Departmental overhead rates a. Cost allocation and Cost Apportionment b. Overhead apportionment calculations c. Allocation of the service departments' overheads to the production departments d. The direct method e. The Step Method (sequential method) f. Reciprocal Method of Allocation 2.3 JOB AND BATCH COSTING 2.3.1 Introduction 2.3.2 Basic product costing systems 2.3.3 Job costing 2.3.4 Batch Costing 2.4 PROCESS COSTING 2.4.1 The nature of processing industries 2.4.2 Cost accumulation 2.4.3 Process cost accounts 2.4.4 Normal loss 2.4.5 Normal losses with a scrap value 2.4.6 Abnormal losses 2.4.7 Abnormal gains 2.4.8 Work in progress 2.4.9 Equivalent units 2.4.10 Calculation of equivalent units 131 133 133 133 134 137 146 146 147 154 154 155 157 162 162 163 164 165 165 166 166 167 167 168 168 169 169 170 172 173 174 175 177 177 183 184 185 186 186 189 191 192 194 197 201 201 202 202 203 204 204 204 205 206 207 207 209 209 210 212 2.4.11 Opening stocks of work in progress 2.4.12 The weighted average method of valuation 2.4.13 Losses in proces CHAPTER 3: MANAGERIAL ACCOUNTING 3.1 COST- VOLUME PROFIT ANALYSIS 3.1.1 Breakeven analysis 3.1.2 Graphical analysis of the breakeven point 3.1.3 The influence of fixed costs on the breakeven point 3.1.4 Contribution and contribution ratio 3.1.5 Contribution amount 3.1.6 The margin of safety (contribution rate) 3.1.7 The unit breakeven point 3.1.8 The profit/volume (P/V) table 3.1.9 The multiproduct p/v table 3.2 BUDGETING AND BUDGETARY CONTROL 3.2.1 Definitions 3.2.2 Budgetary control 3.2.3 The benefits of budgeting 3.2.4 Applicability of budgeting and budgetary control 3.2.5 The budgeting process 3.2.6 Budgetary control 3.2.7 Interrelationship of budgets 3.2.8 Cash budgeting 3.2.9 Budgetary control: an introduction to variance analysis 3.3 FLEXIBLE BUDGETING 3.3.1 Flexible Budgeting 3.3.2 Flexible budgeting and variable costing 3.3.3 Flexible budgeting only explains volume effects 3.4 STANDARD COSTING 3.4.1 Standards and standard costing 3.4.2 Standards and flexible budgeting 3.4.3 Fixed overhead variances a. Fixed overhead total variance b. Fixed overhead expenditure variance c. Fixed overhead volume variance 3.4.4 Defition of variances 3.4.5 Reconciliation of budgeted and actual profit 3.4.6 Setting standards a. Setting standards for direct materials b. Setting standards for direct labor c. Setting standards for overheads d. Activity levels and fixed overhead rates 3.5 ACTIVITY-BASED COSTING 3.5.1 Introduction to ABC 3.5.2 The benefits of ABC: diversity and complexity 213 218 220 224 224 224 225 227 227 229 230 232 232 233 234 234 235 235 236 237 245 245 246 247 248 248 249 253 253 253 255 259 260 260 260 262 262 262 263 263 264 264 265 265 267 CHAPTER:4 PROBLEMS 270 4.1 COST ACCOUNTING PROBLEMS 4.2 MANAGERIAL ACCOUNTING PROBLEMS APPENDIX Appendix 1: Chart of Accounts Appendix 2: Detailed Balance Sheet Appendix 3: Detailed Statement of Income Appendix 4: Statement of Cost of Sales Appendix 5: Cash Flow Statement Appendix 6: Fund Flow Statement REFERENCES 270 293 319 318 328 332 333 334 335 336