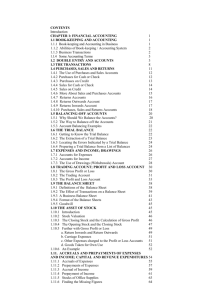

the full Table of Contents

advertisement

Contents Preface INTRODUCTION vii TO MANAGEMENT ACCOUNTING: A USER PERSPECTIVE CHAPTER 1 Management Accounting: Its Environment and Future 1 What Is Management Accounting? 2 Where Accounting Fits in a Company 5 The Origin and Evolution of Management Accounting 6 Challenges and Trends in Management Accounting 11 Consumers of Management Accounting Information 13 Summary 14 Key Terms 14 Review the Facts 14 Apply What You Have Learned 15 CHAPTER 2 Classifying Costs Major Cost Classifications 19 Product Cost Identification for Merchandising Firms 22 Product Cost Identification for Manufacturing Firms 24 Product Cost Identification for Service Firms 35 Hybrid Firms 38 Merchandising, Manufacturing, and Service Firms—A Comparison Summary 41 Appendix—Recording Basic Manufacturing Costs 41 Appendix Summary 44 Key Terms 45 Review the Facts 45 Apply What You Have Learned 46 17 38 CHAPTER 3 Determining Costs of Products 67 Accumulating Product Cost—Cost Accounting 68 Units of Product as Cost Objects 68 Traditional Manufacturing Overhead Allocation 69 Manufacturing Overhead Allocation Using Activity-Based Costing 71 Product Costing Methods 74 Job Order Costing 76 Process Costing 90 Summary 93 Appendix—Recording Manufacturing Costs and the Allocation of Manufacturing Overhead 94 Appendix Summary 97 Key Terms 97 Review the Facts 98 Apply What You Have Learned 98 CHAPTER 4 Cost Behaviour Common Cost Behaviour Patterns 119 Relevant Range 123 Mixed Costs 125 Identifying the Fixed and Variable Elements of a Mixed Cost Summary 136 Key Terms 137 Review the Facts 137 Apply What You Have Learned 138 CHAPTER 5 118 126 Business Decisions Using Cost Behavior 150 The Contribution Income Statement 152 Cost-Volume-Profit Analysis 155 Summary 169 Key Terms 169 Review the Facts 170 Apply What You Have Learned 170 CHAPTER 6 Making Decisions Using Relevant Information Relevant Costs 186 Equipment Replacement 188 Special Orders 192 Outsourcing: The Make-or-Buy Decision 194 Summary 199 Key Terms 199 Review the Facts 200 Apply What You Have Learned 200 iv Contents 185 CHAPTER 7 The Capital Budget: Evaluating Capital Expenditures The Business Planning Process 219 The Capital Budget: What Is It? 223 The Cost of Capital and the Concept of Scarce Resources Evaluating Potential Capital Projects 229 Capital Budgeting Decision Methods 231 Factors Leading to Poor Capital Project Selection 240 Summary 242 Appendix: The Time Value of Money 242 Key Terms 249 Review the Facts 250 Apply What You Have Learned 250 CHAPTER 8 218 225 The Operating Budget 268 Part One: An Overview of the Operating Budget 270 Benefits of Budgeting 270 Contents of the Operating Budget 273 Different Approaches to Budgeting 278 The Sales Forecast 282 Part Two: Preparing and Using the Operating Budget 284 Using (and Misusing) the Operating Budget 301 Summary 306 Key Terms 307 Review the Facts 307 Apply What You Have Learned 308 CHAPTER 9 Standard Costing 330 Why Is Standard Costing Used? 331 Standards—A Closer Look 332 Basic Standard Costing for a Manufacturer 337 Setting Direct Material Standards 338 Setting Direct Labour Standards 340 Setting Variable Manufacturing Overhead Standards 341 Setting Fixed Manufacturing Overhead Standards 342 Variance Analysis 343 Using Standard Cost Variances to Manage by Exception 357 Summary 357 Appendix—Recording Product Cost Using Standard Costing 357 Appendix Summary 363 Key Terms 364 Review the Facts 365 Apply What You Have Learned 365 Contents v CHAPTER 10 Evaluating Performance Business Segments 385 The Segment Income Statement 386 The Pitfall of Allocating Common Fixed Costs—A Closer Look Service Department Cost Allocation 391 Activity-Based Service Department Cost Allocation 392 Approaches to Segment Management 394 Evaluation of Business Segments 395 Return on Investment 398 Residual Income 401 Transfer Pricing 403 Nonfinancial Performance Measures 405 Just-in-Time Philosophy 409 Summary 411 Key Terms 412 Review the Facts 412 Apply What You Have Learned 413 GLOSSARY INDEX vi Contents OF ACCOUNTING TERMS 384 389 424 431