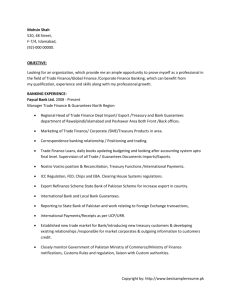

SALMAN ZAMAN

advertisement

SALMAN M.ZAMAN Phone: +92 333 217 56 35 (Mobile) - Email: salmanmzaman@gmail.com Summary: A banker with 20 years of professional experience in Pakistan & Middle East equipped with MBA (Banking & Finance) and CA (Intermediate) qualifications. Specialties: Treasury Operations, Corporate Customer Service, Treasury Product Control. PROFESSIONAL EXPERIENCE Sheikh & Chaudhri Tax & Management Consultants Business & Management Consultant and Financial Advisor October 2012 – Present To provide financial advisory and management consultancy to various clients involved in manufacturing and trading businesses. New Horizons Pakistan Limited Director Franchise Development August 2011 – October 2012 To develop relationship with Organizations of the same nature and to sell the Franchise within Pakistan. Citi Bank Pakistan Vice President & Head of Citi Service Pakistan January 2011 – July 2011 To lead day-to-day operations of CitiService Pakistan and facilitate corporate clientele with their requirements. Assistant Vice President (AVP) & Head of CitiService Pakistan January 2009 – December 2010 Responsible for facilitation of the needs of Corporate Customers and cater their requirements from CitiServices. Manager Treasury Operations & Head of CitiService Pakistan May 2007 – December 2008 Rejoined Citibank as Manager Treasury Operations after serving ABN Amro Dubai. In March 2008 was transferred to lead the CitiService Pakistan, a responsibility I have carried till date (2011). ABN AMRO Bank (Dubai, United Arab Emirates) Manager Financial Market Operations August 2006 – April 2007 Based on my experience and exposure with CitiBank Pakistan, I was hired by ABN Amro to look after Financial Market (Treasury) Operation in Dubai. (ABN Amro N.V. is now known as RBS Bank) Citi Bank Pakistan Assistant Manager, Product Control Unit May 2004 – August 2006 Responsibilities To perform Price verification and rate reasonability on the basis of policies formulated in conjunction with Market Risk. Provide assistance to financial control accounting and policies unit for accounting policies regarding all treasury activities / products. Providing computation methodologies to Operations for Market Value Adjustments for all Trading Portfolio with consultation of Market Risk Management. Investigate and report any P&L differences between treasury and bankbooks. Investigate and report to the management of any closing balances differences between treasury and bankbooks. Confirmation of transactions done by treasury for all FX, Govt. Securities, Money Market, FX Currency Options, Interest Rate Swaps and other Derivative transactions. Generating ageing reports of all type of unconfirmed deals and reporting to senior management. Authorized Signer, Treasury Control Unit June 1999 – April 2004 As authorized signatory I was responsible for reconciling Bank & Treasury books and monitor various institutional & treasury regulatory limits. Responsibilities Liquidity Risk management, that may arise from a bank’s inability to meet its obligations. Interest Rate Risk management, which may arise from parallel movements in interest rates and focusing on the value implications for accrual portfolio, through EAR (Earning at Risk) report. Monitoring of overbought and oversold foreign exchange position limits. Monitoring of FSL (Factor Sensitivity Limit) and VAR (Value at Risk) limits. Monitoring of CCFL (Cross Currency Funding Limit). Monitoring of ACL (Aggregate Contract Limit) of FX outstanding contracts. Mark to Market of all FX and Government Securities outstanding contracts. Confirmation of all FX and Money Market contracts being done by the Treasury. Senior Administrative Assistant, Investment Banking & Treasury Operations October 1993 – January 1996 Investment banking Operations (CIBPL) Responsibilities Mainly responsible for the smooth operation of the following products and activities; Marketable Equity Securities Certificate of Investment (Local & Foreign Currency) Demand Promissory Notes (DPN) and Demand Promissory Notes “Repo”. Government / Corporate Debt Securities Repo, Rev. Repo and Out-right Sale/Purchase deals. All expense payments and month end activities such as depreciation of fixed assets etc. All operational Controls and processes for the above products including month and year end activities. January 1996 to May 1999 Treasury Operations Processing/Supervision of all Treasury products and their financial reporting, record keeping and settlements. EDUCATION AWU – American World University MBA, Banking and Finance - 2001 – 2003 Secured 3.14 CGPA with first class first position Activities and Societies: Initiated Banking and Finance Society Institute of Chartered Accountants of Pakistan CA Inter, Auditing and Accounts - 1996 – 1997 Karachi University Bachelors of Commerce - 1986 – 1987 TRAININGS & CERTIFICATIONS Workshop on Leadership Skills in Dubai, UAE – 2010 Workshop on Citi Asset Liability Management (CALM) in Manama, Bahrain – 2006 Certificate of Attendance - Treasury Skills / Bourse Game – 2004 Certificate of Achievement - General Banking Training – 2003 Certificate of Achievement - Business Skills Training – 2003 Certificate of Attendance - Fraud Awareness – 2000 HONOURS & AWARDS The Citicorp Service Excellence Award - 1997 Team Member of 2nd Position - Foreign Exchange Workshop / Bourse Game – 2004 References: Will be furnished upon request