Off-Balance Sheet Arrangements Letters of credit are issued to

advertisement

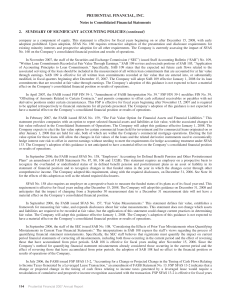

Off-Balance Sheet Arrangements Letters of credit are issued to support purchase obligations and commitments (as reflected on the Contractual Obligations and Commitments table) as follows (In millions) : Insurance Inventory obligations Real estate development Other $ 265 69 13 8 Total $ 355 We have no off-balance sheet arrangements other than those disclosed on the Contractual Obligations and Commitments table and a credit agreement guaranty on behalf of SureScripts-RxHub, LLC. This agreement is described more fully in Note 11 in the Notes to Consolidated Financial Statements. Both on-balance sheet and off-balance sheet financing are considered when targeting debt to equity ratios to balance the interests of equity and debt (including real estate) investors. This balance allows us to lower our cost of capital while maintaining a prudent level of financial risk. Recent Accounting Pronouncements In December 2007, the FASB issued Statement of Financial Accounting Standard (SFAS) No. 141(R), Business Combinations. This statement establishes principles and requirements for how the acquirer recognizes and measures identifiable assets acquired, liabilities assumed and any noncontrolling interest in a business combination. In addition, the statement provides a revised definition of a business, shifts from the purchase method to the acquisition method, expenses acquisition-related transaction costs, recognizes contingent consideration and contingent assets and liabilities at fair value and capitalizes acquired in-process research and development. This statement, which will be effective for the first quarter of fiscal 2010, will be applied prospectively to business combinations. We adopted the provisions of SFAS No. 157, Fair Value Measurements, for financial assets and liabilities beginning in the first quarter of fiscal 2009. FASB Staff Position (FSP) No. 157-2 deferred the effective date of nonfinancial assets and liabilities until fiscal year 2010. We do not expect to have a material impact in the first quarter of fiscal 2010, when we apply the statement to our nonfinancial assets and liabilities. In April 2009, the FASB issued FSP FAS 107-1 and Accounting Principles Board Opinion (APB) 28-1, Interim Disclosures about Fair Value of Financial Instruments. This FSP amends SFAS No. 107, Disclosures about Fair Values of Financial Instruments, to require disclosures about fair value of financial instruments in interim financial statements as well as in annual financial statements. This FSP also amends APB Opinion No. 28, Interim Financial Reporting, to require those disclosures in all interim financial statements. We will adopt FSP FAS 107-1 and APB 28-1 and provide the additional required disclosures in the first quarter of fiscal 2010. In June of 2009, the FASB approved its Accounting Standards Codification, or Codification, as the single source of authoritative United States accounting and reporting standards applicable for all non-governmental entities, with the exception of the SEC and its staff. The Codification, which changes the referencing of financial standards, is effective for interim or annual financial periods ending after September 15, 2009. Therefore, in the first quarter of fiscal 2010, all references made to US GAAP will use the new Codification numbering system prescribed by the FASB. As the Codification is not intended to change or alter existing US GAAP, it is not expected to have any impact on our consolidated financial position or results of operations. In June 2009, the FASB issued SFAS No. 167, Amendments to FASB Interpretation No. 46(R), which amends the consolidation guidance applicable to variable interest entities. The amendments will significantly affect the overall consolidation analysis under FASB Interpretation No. 46(R). This statement, which will be effective for the first quarter of fiscal 2011, is not expected to have a material impact on our consolidated financial position or results of operations. Cautionary Note Regarding Forward-Looking Statements Certain statements and projections of future results made in this report constitute forward-looking information that is based on current market, competitive and regulatory expectations that involve risks and uncertainties. Please see Walgreen Co.’s Form 10-K for the period ended August 31, 2009, for a discussion of important factors as they relate to forward-looking statements. Actual results could differ materially. In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interest in Consolidated Financial Statements – an amendment of Accounting Research Bulletin No. 51. The objective of this statement is to improve the relevance, comparability and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. The statement significantly changes the accounting for transactions with minority interest holders. This statement, which will be effective for the first quarter of fiscal 2010, is not expected to have a material impact on our consolidated financial position or results of operations. 2009 Walgreens Annual Report Page 23