A Structural Equation Approach - Annual International Conference

advertisement

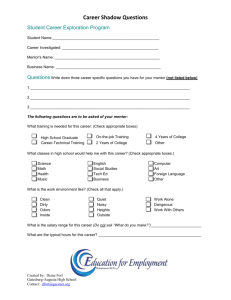

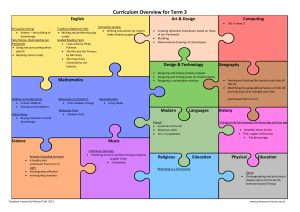

The size of the U.S.A. shadow economy: A Structural Equation Approach Adriana AnaMaria ALEXANDRU PhD Candidate, University Assistant, Department of Statistics and Econometrics University of Economics, Bucharest, Romania Scientific researcher National Scientific Institute in the field of Labour and Social Protection E-mail: adrianaalexandru@yahoo.com Ion DOBRE PhD, University Professor, Department of Economic Cybernetics University of Economics, Bucharest, Romania E-mail: dobrerio@ase.ro Catalin Corneliu GHINARARU Scientific researcher I National Scientific Institute in the field of Labour and Social Protection ghinararu@incsmps.ro Abstract: This paper aims to estimate the size of the U.S.A. shadow economy (SE) using a Structural Equation Approach using quarterly data for the period 1980-2009. In order to do that, the shadow economy is modeled like a latent variable using a special case of the structural equation models-the MIMIC model. The model includes tax burden (decomposed in personal current taxes, taxes on production and imports, taxes on corporate income and contributions for government social insurance), government unemployment insurance, unemployment rate, self-employment and government employment as causes of shadow economy and the labour force participation ratio and currency ratio as indicators of the unreported economy. The results confirm that taxes on corporate income, contributions for government social insurance, unemployment rate and the self-employment are the main causes of shadow economy. The size of the SE is estimated to be decreasing over the last two decades. Keywords: shadow economy, MIMIC models, USA JEL classification codes: C87, E26, H20, H50, O17 I. Measuring the shadow economy Studies trying to measure the dimension of shadow economy face the difficulty of how to define it. One commonly used working definition is: all currently unregistered economic activity which contributes to the officially calculated (or observed) Gross National Product1. Smith (1994) defines it as „market-based production of goods and services, whether legal or illegal that escapes detection in the official estimates of GDP.“ Clandestine by her nature, the shadow economy is difficult to evaluate. In the problem of measuring the dimension of shadow economy, there are various approaches who include using surveys of taxation compliance, using the discrepancy between national income and national expenditure; considering fluctuations in labour force participation rates; the monetary “transactions approach” of Feige (1979); modifications of currency demand equations, where the pioneer was Cagan (1958).One criticism of most of these approaches is that it focus on one cause of hidden economic activity, and one indicator. In contrast, The MIMIC(“Multiple Indicators, Multiple Causes”) model of Zellner(1970), Goldberger(1972), Jöreskog and Goldberger(1975), Jöreskog and Sörbom(1993)) allows for several 1 This definition is used by Feige (1989-„ economic activities include conscious efforts to avoid official detection) and by Schneider and Enste(2000- all economic activities which contribute to officially calculated gross national product). indicators variables and several causal variables in forming structural relationships to explain the latent variable. Frey and Weck-Hanneman (1984) estimated underground economy MIMIC models for a range of OECD countries; Aigner et al.(1988) applied a dynamic MIMIC model to U.S. data; and Tedds (1998) used this approach to model the Canadian underground economy. II. Modeling the shadow economy In the process of econometric modelling of U.S.A. shadow economy (SE) we used a different type of models-Structural Equations Models (SEM).The SEM represents statistical relationships among latent (unobserved) and manifest (observed) variables. Bollen (1989, p.1) presents the fundamental hypothesis for structural equation modelling as: S () , where is the observed population covariance matrix, is a vector of model parameters, and S is the covariance matrix implied by the model. When the quality expressed in the equation holds, the model is said to “fit” the data. Thus, the goal of structural equation modelling is to explain the patterns of covariance observed among the study variables. A special case of SEM is the Multiple Indicators and Multiple Causes model. It allows to consider the SE as a “latent” variable linked, on the one hand, to a number of observable indicators (reflecting changes in the size of the SE) and on the other, to a set of observed causal variables, which are regarded as some of the most important determinants of the unreported economic activity(Dell’Anno, 2003). Frey and Weck-Hanneman (1984) have been the first economists that consider the dimension of the hidden economy as an “unobservable variable”. This type of models is composed by two sorts of equations, the structural one and the measurement equations system. The equation that captures the relationships among the latent variable (η) and the causes (Xq) is named “structural model” and the equations that links indicators (Yp) with the latent variable (non-observed economy) is called the “measurement model”. A MIMIC2 model of the shadow economy is formulated mathematically as follows: X (1) Y (2) where: is the scalar latent variable(the size of shadow economy); Y (Y1 ,....Y p ) is the (1 p ) vector of indicators of the latent variable; X ( X 1 ,... X q ) is the ( 1 q ) vector of causes of ; ( p1) and ( q1) vectors of parameters; ( p1) and ( q1) vectors of scalar random errors; The and are assumed to be mutually uncorrelated: ( E ( t t ' ) E ( t t ' ) 0 ). Since the structural equation model (1) only partially explains the latent variable , the error term represents the unexplained component. The MIMIC model assumes that the variables are measured as deviations from their means and that the error term does not correlate to the causes E (t ) E ( xt ) E ( t ) 0 and E ( xt t ' ) E ( t xt ' ) 0 . The variance of t is abbreviated by and is the ( q q ). covariance matrix of the causes xt . 2 A detailed presentation of the MIMIC model is realized by Bühn A., Schneider F.” Mimic Models, Cointegration and Error Correction: An Application To The French Shadow Economy”, Cesifo working paper no.2200/2008 The measurement model (2) represents the link between the latent variable and its indicators; the latent unobservable variable is expressed in terms of observable variables. Their ( p p ) covariance matrix is given by . Like the MIMIC model’s causes, the indicators are directly measurable and expressed as deviations from their means, E ( yt ) E ( t ) 0. It is assumed that the error terms in the measurement model do not correlate either to the causes xt or to the latent variable, t . E ( xt t ' ) E ( t xt ' ) 0 and E (t t ' ) E ( tt ' ) 0. Substituting (2) into (1), the MIMIC model can be written as: Y X z (3) where: , z . The error term z in equation (3) is a (p ×1) vector of linear combinations of the white noise error terms and from the structural equation and the measurement model, z (0, ) . The covariance matrix is given as cov( z ) , cov( , ) , cov( , ) the diagonal covariance matrix of . The multivariate regression equation (3) has a regressor matrix of rank one, and the error covariance matrix is also constrained, and that is the raison for which it is impossible to obtain cardinal estimates of all of the parameters. The estimation of (1) and (2) requires a normalization of the parameters in (1), and a convenient way to achieve this is to constrain one element of to some pre-assigned value (Giles, Tedds, 2000). To facilitate the identification of SEM some conditions are available but, unfortunately, none of these are necessary and sufficient conditions (Bollen, 1989). The necessary (but not sufficient) condition, so-called t-rule, enunciates that the number of nonredundant elements in the covariance matrix of the observed variables must be greater or equal to the number of unknown parameters in the model-implied covariance matrix.3 A sufficient (but not necessary) condition of identification, is that the number of indicators is two or greater and the number of causes is one or more, provided that is assigned a scale to η (MIMIC rule). For assigning a scale to the latent variable it is needed to fix one λ parameter to an exogenous value. Although several econometric improvements are introduced in the last years, the most important criticism to the MIMIC method is the strong dependence of the outcomes by the (exogenous) choice of the coefficient of scale (λ). Given an estimate of the vector, and setting the error term to its mean value of zero, equation (2) enables us to “predict” ordinal values for which is the relative size of the hidden economy, at each sample point. Then, if we have a specific value for at some sample point, obtained from some other source, we can convert the within-sample predictions for into a cardinal series. We use an average value from other estimations realized using the currency demand model to calibrate the time-series of the hidden economy. Giles (1999a) was the first author to “calibrate” such MIMIC model hidden economy results formally, by using the output from a completely separate demand-for-cash model to convert the ordinal predictions into cardinal ones in the context of New Zealand data. III. Data issues The variables used in the estimation are defined in Appendix A. The data series are quarterly from 1980:Q1 to 2009:Q2. All the series have been seasonally adjusted. The series in levels or differences have been tested for unit roots using the Augmented-Dickey Fuller (ADF) test. We test I(2) against I(1) and if we reject I(2), we test I(1) against I(0) as 3 Bollen K.A. (1989), pp. 93. More clearly, the number of observed variances and covariances must be equal to or greater than the number of parameters to be estimated (including variance of latent factor, variances of disturbances, covariances among observed variables). appropriate(Appendix A). All the data has been differentiated for the achievement of the stationarity. While all the variables have been identified like integrated on first order, the latent variable is estimated in the same transformation of independent variables (first difference). IV. Estimating the MIMIC model of the shadow economy In our econometrical demarche of estimating the size of shadow economy, the causal variables considered in the model are: tax burden decomposed into personal current taxes ( X 1 ), taxes on production and imports( X 2 ), taxes on corporate income( X 3 ), contributions for government social insurance( X 4 ) and government unemployment insurance( X 5 ), unemployment rate( X 6 ), selfemployment in civilian labour force ( X 7 ),government employment in civilian labour force ( X 8 ) called bureaucracy index. The indicator variables incorporated in the model are: real gross domestic product index ( Y1 ), currency ratio M1 M 2 ( Y2 ) and civilian labour force participation rate ( Y3 ). The main elements of tax burden, government unemployment insurance and index of real gross domestic product are expressed as percentages of gross domestic product while government employment, self-employment, unemployment rate and civilian labour force participation rate are calculated like percentages of civilian labour force. A detailed presentation of the variables is realised in (Dobre, Alexandru, 2008)4. The identification procedure of the best model starts from the most general model specification (MIMIC 8-1-3) and continues removing the variables which have not structural parameters statistically significant. The results of estimating the structural equation models, by Maximum Likelihood, using the LISREL 8.8 package, over the period 1990-2009 appear in table 1.The estimates of the coefficients ( ) of the causal variables(x) in the structural equation for the shadow economy ( ) in equation (2) provides the basis for estimating over the sample period.The coefficient of the index of real GDP5 is normalised to -1 to sufficiently identify the model ( 1 1 ).This indicates an inverse relationship between the official and shadow economy. The results presented in table 1 suggest a negative none statistically significant relationship between the size of the shadow economy and civilian labor force participation rate. Also, between the dimension of the shadow economy and the currency ratio there is a positive none statistically significant relationship. Although the causal variables have the anticipated signs, many of them lack individual significance. The unemployment rate and social insurance contributions are the only causal variable positively significant in all MIMIC models. The other causal variables from the model are not statistically significant. The positive sign of the unemployment rate according with the negative one obtained by the civilian labor force participation rate point out the fact that many workers from the official economy go underground when they are laid off. The positive sign of the unemployment rate indicates the existence of a flow of resources from official to shadow economy in recession cycles. 4 Dobre, I., Alexandru, A., “The impact of unemployment rate on the dimension of the shadow economy in Spain: A structural Equation Approach”, European Research Studies Journal, Volume XIII, issue 4, 2009, pg.179-197, ISSN: 1108-2976. 5 Index real GDP Re al GDPt Re al GDP1990 Table 1 : Estimated Coefficients6 of the MIMIC Models Models Tax personnal/ GDP Tax production/ GDP X1 X2 -0.01 (-0.08) -0.01 (-0.08) -0.01 (-0.08) -0.01 (0.08) -0.02 (-0.14) -0.02 (-0.14) -0.02 (-0.14) 0.83 (0.89) 0.42 (0.52) 0.83 (0.89) ------ ----- MIMIC 8-1-3 MIMIC 8-1-2a MIMIC 8-1-2b MIMIC 7-1-3 MIMIC 6-1-3 MIMIC 6-1-2a MIMIC 6-1-2b MIMIC 5-1-2 MIMIC 4-1-3a MIMIC 4-1-3b MIMIC 4-1-3c MIMIC 4-1-2 MIMIC 3-1-3 MIMIC 3-1-2 ----------------- Tax corporat./ GDP X3 -0.27 (-0.82) -0.37 (-1.10) -0.27 (-0.82) -0.27 (-0.81) -0.30 (-0.89) -0.30 (-0.89) -0.30 (-0.89) -0.29 (-0.88) Social insurance contr./GDP Governm.unempl. .insurance/GDP Unempl. Rate X4 X5 X6 2.88* (3.85) -1.80* (-2.85) 2.88* (3.85) 3.06* (4.22) 2.98* (4.20) 2.98* (4.20) 2.98* (4.20) 2.97* (4.20) 2.89 (1.89) -0.41 (-0.28) 2.89 (1.89) 2.89 (1.89) 2.89 (1.89) 2.89 (1.89) 2.89 (1.89) 2.85 (1.89) 2.75 (1.68) ----- ----- ----- ---- ----- -0.13 (-0.79) 1.93 (1.68) ----- ----- ----- ----- -0.99* (-2.58) -0.24 (-0.73) -0.24 (-0.73) -0.15 (-0.46) -0.15 (-0.46) 2.21* (2.41) 3.00* (4.17) 3.00* (4.17) 2.93* (4.03) 2.93* (4.03) ----- ---- ----- ---- --------------- Self Empl. Index Bureac. M1/M2 Lab.Force Partic. X7 X8 Y2 Y3 1.06* (3.73) 1.48* (4.99) 1.06* (3.73) 1.09* (3.82) 1.08* (3.80) 1.08* (3.80) 1.08* (3.80) 1.09* (3.83) 1.14* (3.92) 0.98 (1.67) 0.85 (1.72) 0.98 (1.67) 1.02 (1.73) 1.01 (1.73) 1.01 (1.73) 1.01 (1.73) 1.01 (1.72) 0.70 (1.12) 0.62 (0.53) -0.15 (-0.15) 0.62 (0.53) 0.61 (0.51) 0.05 (1.11) -0.01 (-0.89) -0.02 (-0.79) ---- ---- ----- 1.49* (7.99) 1.49* (7.99) 1.45* (7.74) 1.45* (7.74) 1.01 (1.70) 1.01 (1.70) ----- ----0.05 (1.11) 0.05 (1.11) 0.05 (1.11) ------ ------ ------ 0.05 (1.11) ------ ------ -0.24 (-0.19) 0.05 (1.11) 0.05 (1.11) 0.05 (1.11) --------- ------ ------ ------ 0.05 (1.11) ------ ------ ------- -----0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) ------0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) -0.01 (-0.89) Chi-square RMSEA (p-value)7 (p (p-value)8 39.18 (0.0017) 27.66 (0.000) 10.49+ (0.232) 35.67 (0.002) 15.50+ (0.28) 7.44+ (0.28) 7.02+ (0.31) 7.44+ (0.19) 26.88 (0.001) 13.81+ (0.13) 10.20+ (0.33) 4.41+ (0.35) 8.83+ (0.27) 4.05+ (0.26) 0.11 (0.021) 0.15 (0.0049) 0.052+ (0.42) 0.11 (0.021) 0.041+ (0.53) 0.046+ (0.45) 0.038+ (0.49) 0.065+ (0.33) 0.13 (0.011) 0.07+ (0.30) 0.034+ (0.55) 0.03+ (0.50) 0.047+ (0.45) 0.055+ (0.37) AGFI9 Df10 0.78 17 0.69 8 0.88 8 0.79 15 0.90 13 0.91 6 0.91 6 0.90 5 0.81 9 0.90 9 0.92 9 0.93 4 0.93 7 0.93 3 6 The estimations has been made with the software LISREL 8.8 The SEM permits to consider and estimate the correlations between the X-variables and between the Y’s. In our analysis greater number of models estimated, the covariances between the observed variables are often not statistically different from zero. Yet, if we decide to estimate these parameters changes in the estimates of structural coefficients are slightness, therefore the covariances are fixed equal to zero in order to have more degrees of freedom (Dell’Anno, 2004). If the structural equation model is correct and the population parameters are known, then the matrix S(Sample covariance 7 matrix) will equal to ( ) (model implied covariance matrix) therefore the perfect fitting correspond to p-value=1.0.This test has a statistical validity if there are large sample and multinormal distributions. 8 P-value for Test of Close Fit (RMSEA<0.05). + means good fitting (p-value>0.05). 9 Adjusted goodness-of-fit index, AGFI.This indicator takes values into the interval [0, 1]. 10 The degrees of freedom are determined by 0.5(q+p)(q+p+1)-t, where p=number of indicators, p=numbers of causes, t=number of free parameters.. V. Obtaining the size of the U.S.A. shadow economy The econometrical results reveal that the main causes of shadow economy are: taxes on corporate income, contributions for government social insurance, unemployment rate and self-employment. Starting from MIMIC 8-1-3 and removing the variables which have not structural parameters statistically significant, we obtain MIMIC 4-1-2 as the best model. The MIMIC 4-1-2 model has four causal variables (taxes on corporate income, contributions for government social insurance, unemployment rate and self-employment) and two indicators (index of real GDP and civilian labour force participation rate). The choice of the model is based on: the statistical significance of parameters, the parsimony of specification, the p-value of chi-square, and the Root Mean Square Error of Approximation (RMSEA) test, adjusted goodness-of-fit index (AGFI). Fig.1.Path diagram of 4-1-2 MIMIC Taking into account the reference variable ( Y1 , Re al GDPt ) the shadow economy is Re al GDP1990 scaled up to a value in 1990, the base year, and we build an average of several estimates from this year for the U.S.A. shadow economy. Table 2: Estimates of the size of U.S.A. shadow economy (1990) Author Johnson et. Al(1998) Method Size of Shadow Economy Currency Demand 13.9% Approach Lacko(1999) Physical 10.5% Input(Electricity) Schneider and Enste(2000) Currency Demand 7.5%* Approach Mean 1990 10.6% *means for 1990-1993 The index of changes of the shadow economy in United States measured as percentage of GDP in the 1990 is linked to the index of changes of real GDP as follow: GDPt GDPt 1 ~ ~t 1 t Measurement Equation: (4) GDP1990 GDP1990 The estimates of the structural model are used to obtain an ordinal time series index for latent variable (shadow economy): ~t 0.24X 3t 3.00X 4 t 1.49X 6t 1.01X 7 t Structural Equation: (5) GDP1990 The index is scaled to take up to a value of 10.6% in 1990 and further transformed from changes respect to the GDP in the 1990 to the shadow economy as ratio of current GDP.These operations are show in the benchmark equation11: * ~t 1990 GDP GDP1990 ˆt (6) ~ 1990 GDP1990 GDP1990 1990 GDPt GDPt where: ~t I. is the index of shadow economy calculated by eq. (5). GDP1990 * 1990 10.6% is the exogenous estimate of shadow economy. GDP1990 ~ III. 1990 is the value of index estimated by eq.(5). GDP1990 GDP1990 IV. is to convert the index of changes respect to base year in shadow economy respect to GDPt current GDP. ̂ V. t is the estimated shadow economy as a percentage of official GDP. GDPt II. 11 As the variables are all differenced to same degree, to calculate the levels of the latent variable multiplying the structural coefficients for raw (unfiltered) data, it is equivalent to compute the changes in the index by multiplying coefficients for the differenced causes and then to integrate them. Fig.2. U.S.A. shadow economy as % of official GDP 18 16 % of official GDP 14 12 10 8 6 4 2 0 1980 1981 1983 1984 1986 1987 1989 1990 1992 1993 1995 1996 1998 1999 2001 2002 2004 2005 2007 2008 The shadow economy measured as percentage of official GDP records the value of 13.41% in the first trimester of 1980 and follows an ascendant trend reaching the value of 16.77% in the last trimester of 1982. At the beginning of 1983, the dimension of USA shadow economy begins to decrease in intensity, recording the average value of 6% of GDP at the end of 2007. For the last two year 2008 and 2009, the size of the unreported economy it increases slowly, achieving the value of 7.3% in the second quarter of 2009. The results of this estimation are not far from the last empirical studies for USA (Schneider 1998, 2000, 2004, 2007, Schneider and Enste 2001).Schneider estimates in his last study, the size of USA shadow economy as average 2004/05, at the level of 7.9 percentage of official GDP. VI. Conclusions In this paper, we estimate the size of the shadow economy in the U.S.A. using the MIMIC model. Our results show that the size of the shadow economy varies from thirteen to seventeen percent between 1980 and 1983 and then decreases steadily up to 7 percent of official GDP in 2009. The results of this estimation are not far from the last empirical studies for USA (Schneider 1998, 2000, 2004, 2007, Schneider and Enste 2001).Schneider estimates in his last study, the size of USA shadow economy as average 2004/05, at the level of 7.9 percent of official GDP. References Aigner, D., Schneider, F. and Ghosh, D.(1988). Me and my shadow: estimating the size of the US hidden economy from time series data, in W. A. Barnett; E. R. Berndt and H. White (eds.):Dynamic econometric modeling, Cambridge (Mass.): Cambridge University Press, pp. 224-243. Bollen, K. A., (1989). Structural equations with latent variables, John Wiley & Sons,New York. Bollen, K A, and Long, S J (1993). Testing Structural Equation Models. SAGE Focus Edition, vol. 154. Browne M. W. (1982). Covariance structures. In D. M. Hawkins, ed., Topics in Multivariate Analysis.Cambridge University Press, pp. 72-141. Bühn A., Schneider F. Mimic Models, Cointegration and Error Correction: An Application To The French Shadow Economy, Cesifo working paper no.2200/2008. Cagan, P.(1958). The demand for currency relative to the total money supply, Journal of Political Economy, vol.66, no.3, pp. 302-328. Chatterjee, S., K. Chaudhuri, and F. Schneider, (2003.)The size and development of the Indian shadow economy and a comparison with other 18 Asian countries: An empirical investigation, Discussion Paper 2003-02, Department of Economics, Johannes Kepler University of Linz. Curran, P. J., West, S. G, & Finch, J. F. (1996). The robustness of test statistics to nonnormality and specification error in confirmatory factor analysis. Psychological Methods, 1, 16-29. Dell’Anno, R., (2003).Estimating the shadow economy in Italy: A structural equation approach, Working Paper 2003-7, Department of Economics, University of Aarhus. Dell’Anno, R., M. Gomez, and A. Alañón Pardo, (2007).Shadow economy in three different Mediterranean countries: France, Spain and Greece. A MIMIC approach, Empirical Economics 33, 51-84. Dell’Anno, R., and F.Schneider, (2004).The Shadow Economy of Italy and other OECD Countries: What do we know?, Mimeo. Dobre I., and A. Alexandru, (2007).Posibilitati de estimare a dimensiunii economiei informale, Revista Studii si Cercetari de Calcul Economic si Cibernetica Economica, 41/3, 17-35. Dobre I., and A. Alexandru, (2008). The impact of unemployment rate on the dimension of shadow economy in Spain: A Structural Equation Approach, International Conference on Applied Business and Economics (ICABE 2008), Thessaloniki, Greece, published in European Research Studies Journal, Volume XIII, issue 4, 2009, pg.179-197, ISSN: 1108-2976 Dobre, I. and A. Alexandru (2009). “Estimating the size of the shadow economy in Japan: A structural model with latent variables”, Economic Computation and Economic Cybernetics Studies and Research, vol.43 1/2009, pg.67-82, cotaţia A, ISSN 0424 – 267 X. Alexandru A., Dinu M. and O. Lepas(2009). „L’estimation de l’économie cachée en Espagne et Portugal utilisant les modèles d’équations structurelles : une analyse comparative”, Revista Studii si Cercetari de Calcul Economic si Cibernetica Economica, vol.43,nr.1-2/2009, pg.113124, cotatia B+, ISSN 0585 – 7511. Feige, E. L., (1989). The Underground Economies, Tax Evasion and Information Distortion, Cambridge, Cambridge University Press. Frey, B. S. and H. Weck-Hannemann, (1984).The hidden economy as an “unobservable” variable, European Economic Review 26, 33–53. Giles, D.E.A., (1998). The underground economy: Minimizing the size of government, Econometrics Working Papers 9801, Department of Economics, University of Victoria. Giles, David, E.A.(1999a). Measuring the hidden economy: Implications for econometric modelling, The Economic Journal, vol.109, no. 456, pp.370-380. Giles, David, E.A.(199b). Modelling the hidden economy in the tax-gap in New Zealand, Empirical Economics,vol. 24, no.4,pp.621-640. Giles, David, E.A.(1999c). The rise and fall of the New Zealand underground economy: are the reasons symmetric?, Applied Economic Letters no.6, pp.185-189. Giles, D. E.A., and L.M. Tedds, (2002). Taxes and the Canadian Underground Economy, Canadian Tax paper 106, Toronto, Canadian Tax Foundation. Hoyle, R H (ed) (1995) Structural Equation Modeling: Concepts, Issues, and Applications. SAGE. Johnson, S., Kaufmann, D., Zoido-Lobatón, P. -Regulatory discretion and the unofficial Economy, The American Economic Review, 88/ 2, pp. 387-392, 1998a. Johnson, S., Kaufmann, D., Zoido-Lobatón, P.- Corruption, public finances and the unofficial economy, American Economic Review, vol. 88, no. 2, Papers and Proceedings, 1998b, pp. 387392. Jöreskog K., Goldberger, A.S.(1975). Estimation of a model with multiple indicators and multiple causes of a single latent variable, Journal of the American Statistical Association, 70, pg.631639. Jöreskog, K., Sörbom, D.(1993a). LISREL 8: Structural Equation Modeling With the SIMPLIS Command Language (Scientific Software International, Chicago). Jöreskog, K., Sörbom, D.(1993b).LISREL 8 User’s Reference Guide (Scientific Software International, Chicago). Kaplan, D.(2000). Structural Equation Modeling: Foundations and Extensions. SAGE, Advanced Quantitative Techniques in the Social Sciences series, vol. 10. Kelloway, E.K. (1998). Using LISREL for Structural Equation Modeling. SAGE Publications, Inc. Thousand Oaks, CA. Kline, R. B. (2005). Principles and Practice of Structural Equation Modeling. The Guilford Press. Lackó, M.(1999). Hidden economy an unknown quantitiy? Comparative analyses of hidden economies in transition countries in 1989-95, working paper 9905, Department of Economics, University of Linz, Austria. Schneider, F., (2005). Shadow economies around the world: What do we really know, European Journal of Political Economy 21, 598-642. Schneider, F., and D. H. Enste, (2000).Shadow economies: size, causes and consequences, Journal of Economic Literature 38, 77-114. Schneider, F., (2007).Shadow Economies and Corruption all over the world: New estimates for 145 Countries, Economics 2007/9, 1-47. Schumacker, R.E. and R.G. Lomax. (1996). A Beginner’s Guide to Structural Equation Modeling. Lawrence Erlbaum Associates, Inc. Mahwah, NJ. Smith, P., (1994). Assessing the size of the underground economy: The statistics Canada perspectives, Canadian Economic Observer, Catalogue 11-010, 3.16-33, at 3.18.Spiro, P.S. (1993): "Evidence of a Post-GST Increase in the Underground Economy;" Canadian Tax Journal/ Revue Fiscale Canadienne, 41/2, 247-258 Ullman. J.B.(1996). Structural equation modeling (In: Using Multivariate Statistics, Third Edition, B.G. Tabachnick and L.S. Fidell, Eds.). HarperCollins College Publishers. New York, NY. pp. 709-819. Zellner, A.(1970). Estimation of Regression Relationships Containing Unobservable Variables, International Economic Review, 11, pp.441-454. *** www.bea.gov , U.S.Economic Accounts *** www.bls.gov , U.S. Department of Labor *** Federal Reserve banks *** Eviews 6.0 software *** Lisrel 8.80 software Appendix A: Analysis Of Non-Stationarity In order to discover the unit roots and the order of integration of the time series used in the model the Augmented Dickey-Fuller (ADF) Test is used; to choose a number of lags sufficient to remove serial correlation in the residuals and the automatic selection of bandwidth we have employed the Schwarz information criterion (ADF) and the Newey-West test using Bartlett Kernel (KPSS). We have reported in the following table the p-value of the ADF test, while the null hypothesis is the presence of the unit root, and therefore a value greater than 0.05 indicates non-stationary time series. A second unit root test is applied, the Kwiatkowski, Phillips, Schmidt and Shin Test. This test differs from the others in that the series is assumed to be (trend-) stationary, according to the null hypothesis. The table 1 shows the statistical test: we test I(2) against I(1) and if we reject I(2), we test I(1) against I(0) as appropriate, if the estimated values exceed the respective critical values, stationarity must be rejected. The critical values for the LM test statistics are: - KPSS test equation with constant critical values: 0.347 (10%), 0.463 (5%), 0.739 (1%); - KPSS test equation with constant and trend: 0.119 (10%), 0.146 (5%), 0.216 (1%). The econometric software Eviews 6.0 was used in to perform this analysis. Table 1: Unit-root analysis Source CAUSES X1 Tax burden/GDP ( X2 X3 X4 X2 Personal current taxes/GDP X3 Taxes on production and imports/GDP Taxes on corporate income/GDP X4 X5 X6 X7 X8 X9 X5 ) Contributions for government social insurance/GDP Government unemployment insurance Unemployment rate Self-employment/Civilian labour force Index of bureaucracy Unit root analysis Level First diff. Second diff. ADF KPSS ADF KPSS ADF KPSS Transf.. used BEA I(1) C 0.128 0.162* 0.052 0.171* 0.000* 0.172* ( X 1 ) BEA I(1) C 0.119 0.098* 0.000* 0.143* 0.000* 0.212* ( X 2 ) BEA I(1) C 0.045* 0.301* 0.000* 0.182* 0.000* 0.110* ( X 3 ) BEA I(1) C 0.001* 0.046* 0.000* 0.076* 0.000* 0.240* ( X 4 ) BEA I(1) T&C 0.415 0.314 0.000* 0.092* 0.000* 0.050* ( X 5 ) BEA I(1) C 0.020* 0.401* 0.002* 0.155* 0.000* 0.269* ( X 6 ) BLS I(1) C 0.227 0.677 0.001* 0.169* 0.000* 0.318* ( X 7 ) BLS I(1) C 0.782 0.848 0.000* 0.352* 0.000* 0.195* ( X 8 ) BLS I(1) T&C 0.239 0.081* 0.000* 0.111* 0.000* 0.099* ( X 9 ) I(1) T&C 0.527 0.248 0.130 0.079* 0.000* 0.092* (Y1 ) I(1) T&C 0.737 0.262 0.000* 0.063* 0.000* 0.095* (Y2 ) I(1) T&C 0.983 0.304 0.000* 0.054* 0.000* 0.086* (Y3 ) INDICATORS Y1 M1/M2 Y2 Index of Real GDP12 Civilian labour force participation rate Y3 Federal Reserve Banks BEA BLS For ADF show the MacKinnon (1996) one-sided p-values; the statistical tests are shown for KPSS; * means stationary at 0.05 level 12 Real Gross Domestic Product, Chained Dollars. Billions of chained (2500) dollars. Seasonally adjusted at annual rates/ Re al GDP1990Q1