Income Tax Bracket - dp.hightechhigh.org

advertisement

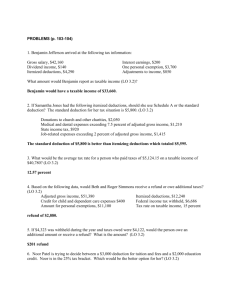

Income Tax Bracket (No, you don’t get to keep all that money) If you work, you’re going to have to pay taxes. The government takes a good chunk of your precious paycheck, on both the federal and state levels. That’s right. You get taxed twice. And then you have to pay for Social Security (govt. sponsored retirement). This means that what you thought you’d be making…you’re not. Here they are: STATE TAXES: This changes from state to state. For this project, you will use a state tax of 9.3%, unless you happen to live in one of the states where there is no state income tax. BUT, for the purposes of this project, you will have to pay state income taxes. So you’ll need to find 9.3% of whatever your TAXABLE INCOME is and deduct that from your total. Example: If you make $50,000 a year, you would pay (.093)(50,000) or $4,650 in state taxes. So instead of $50,000, you’re down to $45,350 Social Security: This is government funded retirement income; everyone has to pay it so when you get old and can’t work anymore, you still have money. So you pay a little out of your paycheck while you are working now! For our purposes, you will pay 7.5% on your yearly TAXABLE INCOME. Example: If you make $50,000 a year, you would pay (.075)(50,000) or $3,750 FEDERAL INCOME TAX: This is the big chunk and most complicated! So, Bewar The more money you make, the more you pay! Here is the basic idea and way to calculate your federal taxes. First, take your gross salary and subtract your deductions (this depends on each individual person such as single, married, children, no children) and personal exemptions to get your TAXABLE INCOME. This number is what the government taxes you on. Use the following table to figure your tax bracket and how much you will pay in taxes: (see http://www.fairmark.com/refrence/index.htm#keytax) First, complete these questions to calculate YOUR TAXABLE INCOME: 1. What is your gross salary? __________________ 2. Are you married? __________________ 3. Personal Exemptions: If YES, enter $7,300. If NO, enter $3,650. __________________ 4. Standard Deductions: i. Single, enter $5,700 ii. Married, enter $11,400 iii. Head of Household, enter $8,350 __________________ 5. Total Items #3 & #4 _________________ Dependents (Children) (do this section only if you have children) 6. How many children do you have? 7. Dependent: Personal Exemption Multiply answer (6) by $3,650 and enter 8. Dependent: Standard Deduction Multiply answer (6) by $950 and enter 9. Total Items 7 & 8 _______________ _________________ _______________ _______________ 10. Total Deductions: _______________ Add Items #5 & #9 11. Taxable Income: Subtract Item #10 (Total Deductions) from Item #1 (Gross Salary) i. Your Taxable Income Use this Chart if you are SINGLE (Not Married) and no children Based on 2009 tax rate for SINGLE income earners. If married, See MARRIED FILING JOINTLY chart! Taxable Income is over $0 $8,350 $33,950 $82,250 $171,550 $372,950 But not over… The tax is… $8,350 $33,950 $82,250 $171,550 $372,950 Of the amount over… Plus 10% 15% 25% 28% 33% 35% $0 $835 $4,675 $16,750 $41,754 $108,216 $0 $8,350 $33,950 $82,250 $171,550 $372,950 For example, if you earn $80,000 a year. Taxable Income: $80,000 - $9,350 (Deductions) = $70,650 You are in the 25% tax bracket! You pay $4,675 in taxes plus 25% of the amount over $33,950 which is $70,650 - $33,950 = $36,700. Now multiply .25 times $36,700 = $9,175 Federal Taxes you pay: $4,675 .25($31,000)= $9,175 $13,850 Federal Taxes you pay Use this Chart if you are MARRIED. Married Filing Jointly Taxable income is over $0 16,700 67,900 137,050 208,850 372,950 But not over 16,700 67,900 137,050 208,850 372,950 The tax is Plus Of the amount over $0.00 1,670.00 9,350.00 26,637.50 46,741.50 10% 15% 25% 28% 33% $0 16,700 67,900 137,050 208,850 100,894.50 35% 372,950 For example, if you and your spouse earn $145,000 combined with no children. Taxable Income: $145,000 - $18,700 (Deductions) = $126,300 You are in the 25% tax bracket! You pay $9,350 in taxes plus 25% of the amount over $67,500 which is $126,300 - $67,500= $58,800. Now multiply .25 times $58,800 = $14,700 Federal Taxes you pay: $9,350 .25($58,800)= $14,700 $24,050 Federal Taxes you pay Bringing It All Together…. For your Personal Finance Page, you will need to show the calculations you made for your salary. This includes showing ALL your work. A chart like the one I just showed you should be made for the federal income tax, computing the total amount to be deducted. Then you need to figure out what percentage that is of your entire salary. (Don’t Forget this!) You also need to show your work for computing the State Taxes and Social Security. This should look professional and neat! No pencil scratching. Show your work and then put it in a table and maybe even display it as a pie graph. As you can see, what you earn is not what you get to take home! Try it yourself on the space below. If you figured them out, you’re ready to go. The final product will be graded on presentation and accuracy, so double check your work. If you calculate your taxes wrong, the IRS (Mr. Holmes and Mrs. Hetrick) will levy tax penalties! Tax Calculation Worksheet Your Salary: minus $________ = Your taxable income Deductions Federal Tax: State Tax: Social Security Tax: divide by12__________ divide by12_________ divide by 12________ See Tax Rate Chart! Find your tax bracket and see amount you pay and then calculate the amount over the bottom amount to add to the tax you pay…. Net Income: (Salary – All Taxes) ***Note: The above figures will each need to be divided by 12 to put into your Personal Monthly Budget!