Homework No

advertisement

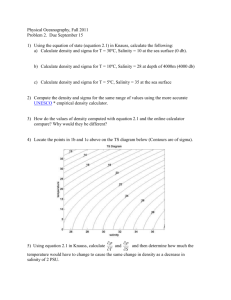

Homework No. 2 -- This homework combines skills from chapters 4 and 5. Problem 5.6 B on page 240-241, Touchtone Talent Agency Do not follow the book instructions. Do the following instead. Requirements: 1. Study the web-page file named "Sigma." The page of the spreadsheet named "WorkSheet" shows an easy method of recording adjusting entries. New accounts required for adjusting entries are in blue. Touchtone will need three new accounts for the adjustments. Go to the “Touchtone” file and print the worksheet on the “Worksheet” page of the spreadsheet (or use the form handed out in class). Use Landscape printing. Note that space has been provided for the three new accounts. Complete the Adjustments columns and the Adjusted Trial Balance columns by hand. USE NUMBERS (1-9) TO LINK THE ADJUSTMENT DEBITS AND CREDITS, just as the letters (a-h) are used in the Sigma example. In actual accounting, the adjusting entries must eventually be journalized and posted, but those steps are not part of this homework. 2. Prepare an Adjusted Trial Balance. Use "Ledger3" paper or the form handed out in class. It should look like the trial balance you prepared in HW1, or like the Adjusted Trial Balance page in the Sigma example. Accounts should be listed in the same order as they are in the Worksheet. 3. Prepare an Income Statement for fiscal 2007 in multiple-step format. There is no Cost of Goods Sold and therefore no Gross Margin. All the expenses except Interest Expense and Income Taxes Expense are Operating Expenses. Use "Ledger3" paper. Refer to the Sigma example and page 643 of the textbook. 4. Prepare a Retained Earnings Statement for fiscal 2007. Use "Ledger3" paper. Refer to the Sigma example. 5. Prepare a Balance Sheet as of December 31, 2007. The Balance Sheet should be a classified Balance Sheet. Among the assets, the only non-current one is Office Equipment. Among the liabilities, all are current liabilities. Use "Ledger3" paper. The Cash Flow Statement is not required. Refer to the Sigma example and page 638 of the textbook. 6. Journalize the four closing entries. Use "Ledger3" paper. Be sure that the dollar amount of the third closing entry is the same as the Net Income for fiscal 2007. Closing entries are dated December 31. Refer to the "Closing Entries" page of the Sigma file for examples. 7. Compute the following and show the computation: a. Working Capital b. Current Ratio c. Net Income Percentage (Profit Margin) d. Return on Equity (do not average the stockholders' equity, just use the ending amount) 8. Prepare a Post (After)-Closing Trial Balance on “Ledger3” paper or the form handed out in class. See the Sigma example. A ledger is not required. Refer to “HW Guide” from the Part I of the course as you do your work. All papers must be hand-written originals. Due at the time of Quiz 2. BTW: “SilverLining” (p. 231) and “Next Job” (p. 239) are from our current text. Looking at them, especially the adjusting entries, may be helpful..