上 海 金 融 学 院

advertisement

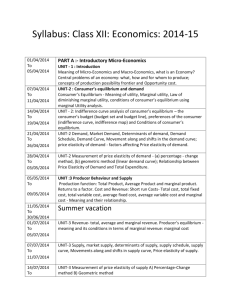

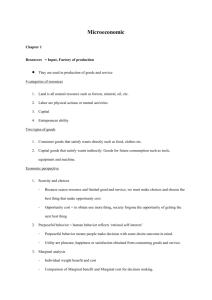

上 海 金 融 学 院 公共经济学(双语)模拟试卷4 试 题 纸 ⅠTrue/False: (10 Questions, 2 Points Each, 20 Points Total) 1. The costs imposed by government regulations on business firms are included in budget data on government expenditures. ( ) 2. “The government should abolish tariffs to achieve efficiency” is a normative statement. ( ) 3. The marginal social cost of producing another unit of a pure public good will always be positive. ( ) 4. If the marginal external cost of pollution increases with the annual output of polluting goods, then the total external cost will increase at a constant rate with annual output. ( ) 5. If all voters have the identical most-preferred political outcome, given their tax shares, then the political equilibrium under majority rule will be identical to the political equilibrium under unani¬mous consent. ( ) 6. A consumer currently pays $500 a year retail sales taxes. She would be better off if she paid the same amount annually as a lump-sum tax. ( ) 7. A payroll tax results in a difference between the gross wages paid by employers and the net wages received by workers. ( ) 8. If a $10 per unit tax is levied on the output of a monopolist, more of that tax will be shifted to con¬sumers than would be the case if the same good were produced by a competitive industry. ( ) 9. An income tax is an example of a price-distorting tax. ( ) 10. If the compensated elasticity of supply of labor is zero, then a tax on labor earnings will have zero excess burden. ( ) ⅡConcept: (10 Questions, 2 Points Each, 20 Points Total) 1. Public Sector Economics 2. Regulatory Budget 3. Observational Study 4. Pareto improvement 5. Commodity Egalitarianism 6. Command-And-Control Regulations 7. Agenda Manipulation 8. Regressive 9. Inverse Elasticity Rule 10. Horizontal Equity ⅢEssay Questions: (3 Questions, 20 Points Each, 60 Points Total) 1. The US government spends about $1.5 billion for research on alternative medicine, such as herb and “energy field” therapy. Is such research a public good? Is it sensible for the government to pay for such research? 2. The private marginal benefit for commodity X is given by 10-X, where X is the number of units consumed. The private marginal cost of producing X is constant at $5. For each unit of X produced, an external cost of $2 is imposed on members of society. In the absence of any government intervention, how much X is produced? What is the efficient level of production of X? what is the gain to society involved in moving from the inefficient to the efficient level of production? Suggest a Pigouvian tax that would lead to the efficient level. How much revenue would the tax raise? 3. A New York Times editorialist recently advocated a cut in the payroll tax. Among other advantages, he argued that it would “stimulate hiring, since employers shoulder half the burden of the tax”. Sketch a model that is consistent with this argument. Is it realistic? 上 海 金 融 学 院 公共经济学(双语)模拟试卷4 __________专业 _________班 姓名 __________学号 _______ 座位号 答 次 Ⅰ Ⅱ Ⅲ 应得分 20 20 60 题 题 Ⅳ Ⅴ 纸 Ⅵ Ⅶ Ⅷ Ⅸ Ⅹ 总分 100 实得分 阅卷教 师签名 得 分 Question Number ⅠTrue/False: (10 Questions, 2 Points Each, 20 Points Total) 1 2 3 4 5 6 7 8 9 10 Answer Question Number Answer 得 1. 2. 3. 4. 5. 分 ⅡConcept: (10 Questions, 2 Points Each, 20 Points Total) 6. 7. 8. 9. 10. 得 分 ⅢEssay Questions: (3 Questions, 20 Points Each, 60 Points Total) 1. 2. 3. 上 海 金 融 学 院 公共经济学(双语)模拟试卷4 答案及评分标准 ⅠTrue/False: (10 Questions, 2 Points Each, 20 Points Total) Question Number 1 2 3 4 5 Answer F T T F T Question Number 6 7 8 9 10 Answer T T F T T ⅡConcept: (10 Questions, 2 Points Each, 20 Points Total) 1. Public Sector Economics: The field of economics (1’) that analyzes government taxation and spending policies (1’). 2. Regulatory Budget: An annual statement of the costs economy by government regulations (1’) imposed on the (1’). 3. Observational Study: An empirical study that relies on observed data (1’) that are not obtained from an experimental setting (1’). 4. Pareto improvement: A reallocation of resources that makes at least one person better off (1’) without making anyone else worse off (1’). 5. Commodity Egalitarianism: The idea that some commodities ought to be made available (1’) to everybody (1’). 6. Command-And-Control Regulations: Policies that require a given amount of pollution reduction (1’) with limited or no flexibility with respect to how it may be achieved (1’). 7. Agenda Manipulation: The process of organizing the order (1’) in which votes are taken to ensure a favorable outcome (1’). 8. Regressive: A tax system under which an individual’s average tax rate decreases (1’) with income (1’). 9. Inverse Elasticity Rule: For goods that are unrelated in consumption (1’), efficiency requires that tax rates be inversely proportional to elasticities (1’). 10. Horizontal Equity: People in equal positions (1’) should be treated equally (1’). ⅢEssay Questions: (3 Questions, 20 Points Each, 60 Points Total) 1. Answer: Research on alternative medicine is a public good if the research leads to treatments or cures that are non-excludable, meaning that others besides those who discovered the treatment may profit from the treatments. (8’) This would happen if discoveries cannot be patented. (4’) Whether or not it is sensible for government to pay for such research depends on the potential benefits of the research, which could be substantial if alternative medicine provides effective treatments, and whether or not the treatments can be patented. (8’) 2. Answer: Private Marginal Benefit = 10 – X. (2’) Private Marginal Cost = $5. (2’) External Cost = $2. (2’) Without government intervention, PMB = PMC; X = 5 units. . (2’) Social efficiency implies PMB = Social Marginal Costs = $5 + $2 = $7; X = 3 units. (2’) Gain to society is the area of the triangle whose base is the distance between the efficient and actual output levels, and whose height is the difference between private and social marginal cost. Hence, the efficiency gain is ½ (5 - 3)(7 - 5) = 2. (5’) A Pigouvian tax adds to the private marginal cost the amount of the external cost at the socially optimal level of production. Here a simple tax of $2 per unit will lead to efficient production. This tax would raise ($2) (3 units) = $6 in revenue. (5’) 3. Answer: The imposition of a payroll tax has no effect on employment when the supply of labor is perfectly inelastic, as shown below. (2’) If, on the other hand, the supply of labor is upward-sloping, the imposition of a payroll tax would cause equilibrium employment to fall, and cutting the tax would then have a positive effect on hiring, as suggested by the editorial. (2’) It is realistic to assume that, although labor supply is inelastic, it is not perfectly inelastic. (2’) Wage Rate per hour SL W1 W 2 DL D’L Hours per year L1 = L2 (5’) The next graph shows an upward-sloping supply, and illustrates how the tax reduces equilibrium employment. (2’) Cutting the tax would cause the demand curve to shift back to the right, toward the original demand curve, and cause equilibrium employment to move back toward L1. (2’) Wage Rate per hour SL W1 W 2 DL D’L L2 (5’) L1 Hours per year