Microeconomic - Assumption University

advertisement

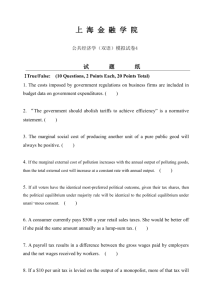

Microeconomic Chapter 1 Resources = Input, Factory of production They are used in production of goods and service 4 categories of resources 1. Land is all natural resource such as forests, mineral, oil, etc. 2. Labor are physical actions or mental activities 3. Capital 4. Entrepreneur ability Two types of goods 1. Consumer goods that satisfy wants directly such as food, clothes etc. 2. Capital goods that satisfy wants indirectly. Goods for future consumption such as tools, equipment and machine. Economic perspective 1. Scarcity and choices - Because scarce resource and limited good and service, we must make choices and choose the best thing that make opportunity cost - Opportunity cost = to obtain one more thing, society forgone the opportunity of getting the next best thing 2. Purposeful behavior = human behavior reflects ‘rational self-interest’ - Purposeful behavior means people make decision with some desire outcome in mind. - Utility are pleasure, happiness or satisfaction obtained from consuming goods and service. 3. Marginal analysis - Individual weight benefit and cost - Comparison of Marginal benefit and Marginal cost for decision making. - Marginal benefit = addition benefit when people consume one more unit of good and service - Marginal cost = addition cost when people consume one more unit of good and service - Mb > Mc = buy - Mb < Mc = not buy Theories, Principles and Models 1. Observe 2. Formulate hypothesis 3. Test hypothesis 4. Accept hypothesis -> theory -> Economic principle -> model 5. If reject modify hypothesis and do again Three things about Economic 1. Generalization 2. Ceteris paribus = other thing equal assumption 3. Graphic Expression Microeconomic and Macroeconomic 1. Microeconomic the part of economics concerns with decision making be individual households, and business firms. 2. Macroeconomic - Examine either the economy as a whole or its basic subdivision or aggregates - Total income, total output Positive and Normative economics Positive economics is objective and fact based, while normative economics is subjective and value based. Positive economic statements do not have to be correct, but they must be able to be tested and proved or disproved. Normative economic statements are opinion based, so they cannot be proved or disproved. Economic Pitfalls 1. Bias clouding thinking 2. Loaded terminology 3. Fallacy of composition - arises when one implies that something is true of the whole from the fact that it is true of some part of the whole 4. Post hoc fallacy - Post hoc ergo propter hoc (Latin: "after this, therefore because of this") is a logical fallacy (of the questionable cause variety) that states "Since event Y followed event X, event Y must have been caused by event X." It is often shortened to simply post hoc. It is subtly different from the fallacy cum hoc ergo propter hoc ("with this, therefore because of this"), in which two things or events occur simultaneously or the chronological ordering is insignificant or unknown. Post hoc is a particularly tempting error because temporal sequence appears to be integral to causality. The fallacy lies in coming to a conclusion based solely on the order of events, rather than taking into account other factors that might rule out the connection. 5. Correlation but not causation - This correlation dose not necessary mean that increase of x cause increase of y Individual’s Economizing Problems Unlimited want - Necessities goods - Luxuries goods Budget line A budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference map to analyze consumer choices. Both concepts have a ready graphical representation in the two-good case. - Attainable all combinations ON or INSIDE the line - Unattainable all combinations BEYOND the line Income change - Income increase = shift right - Income decrease = shift left Society’s Economizing Problems Limited resources so economy should choose what to produce Production Possibilities Curve (PPC) PPC is a graph representing production tradeoffs of an economy given fixed resources. The graph shows the various combinations of amounts of two commodities that an economy can produce (e.g., number of guns vs kilos of butter) using a fixed amount of each of the factors of production. Graphically bounding the production set for fixed input quantities, the PPF curve shows the maximum possible production level of one commodity for any given production level of the other, given the existing state of technology. By doing so, it defines productive efficiency in the context of that production set: a point on the frontier indicates efficient use of the available inputs, while a point beneath the curve indicates inefficiency. A period of time is specified as well as the production technologies and amounts of inputs available. The commodities compared can either be goods or services. Optimal allocation Economic Growth - PPC expands outward - Economic growth is the result of quantities of resources Improvement in resources quality Technological advance Present Choices and Future Possibility - Left graph is, produce a good of present for consuming more that produce capitals good - Right graph is future , produce capitals good more than good of present Chapter 3 Demand the demand curve is the graph depicting the relationship between the price of a certain commodity and the amount of it that consumers are willing and able to purchase at that given price. It is a graphic representation of a demand schedule.[1] The demand curve for all consumers together follows from the demand curve of every individual consumer: the individual demands at each price are added together. Law of demand - Price decrease Quantity Demanded increase - Price increase Quantity Demanded decrease Market demand The aggregate of the demands of all potential customers (market participants) for a specific product over a specific period in a specific market. Determinants of Demand 1. consumer tastes and preferences 2. market size 3. income 4. prices of related goods 5. consumer expectations Change in demand (change in determinants) Change in Quantity Demand (change in price) - move from one point to another point Supply In economics, graphic representation of the relationship between product price and quantity of product that a seller is willing and able to supply. Product price is measured on the vertical axis of the graph and quantity of product supplied on the horizontal axis. Law of Supply - Price increase Quantity Demanded increase - Price decrease Quantity Demanded decrease Determinants of Supply 1. technology changes - technology aids a producer in minimizing his cost of production; mass production is possible with technology 2. resource supplies - the producer also has to pay for other resources such as raw materials and labor. if his money is short on supplying a certain number of products because of an increase in resource supplies, then he has to reduce his supply. 3. tax/ subsidy - a producer aims to minimize his profit, but an increase in tax will only increase his expenses, decreasing his capacity to buy resource supplies and forcing him to reduce his supply. 4. price of other goods produced - a producer may not only produce on product but other products as well. a producer's money is limited and if he increases his supply in one product, he would have to decrease his supply in the other product, not unless his sales increase. 5. Producer expectation 6. Number of Sellers Change in Quantity Supply (change in price) - move from one point to another point Change in demand (change in determinants) Market Equilibrium Consumers and producers react differently to price changes. Higher prices tend to reduce demand while encouraging supply, and lower prices increase demand while discouraging supply. Economic theory suggests that, in a free market there will be a single price which brings demand and supply into balance, called equilibrium price. Both parties require the scarce resource that the other has and hence there is a considerable incentive to engage in an exchange. The operation of the market depends on the interaction between suppliers and demanders. Market equilibrium exists when quantity supplied is equal to quantity demanded. Note that there is just one price where this is true! The equilibrium price is the price that will generally prevail in a perfectly competitive market that is not subject to governmental intervention. As you might remember from your chemistry classes, a system is in equilibrium when there is no tendency for it to change under existing conditions. When a market is in equilibrium, there is no tendency for the market price to change. In other words, the equilibrium price is stable under the existing market conditions. Consider, for example, the soybean market depicted in the following figure: change in supply demand and equilibrium Changes in demand stem from changes in factors affecting consumers, such as household tastes, income, wealth, or price of goods (that are either substitutes or complements in consumption). When demand changes, price and quantity change as follows: Government set prices 1. Price ceiling Price ceilings are intended to benefit the consumer and set a maximum price for which the product may be sold. To be effective, the ceiling price must be below the market equilibrium. Some large metropolitan areas control the price that can be charged for apartment rent. The result is that more individuals want to rent apartments given the lower price, but apartment owners are not willing to supply as many apartments to the market (i.e., a lower quantity supplied). In many cases when price ceilings are implemented, black markets or illegal markets develop that facilitate trade at a price above the set government maximum price. In a competitive market, the economic surplus which is the combined area of the consumer and producer surplus is maximized. 2. Price floor A price floor sets a minimum price for which the good may be sold. Price floors are designed to benefit the producers providing them a price greater than the original market equilibrium. To be effective, a price floor would need to be above the market equilibrium. At a price above the market equilibrium the quantity supplied will exceed the quantity demanded resulting in a surplus in the market. Microeconomics Chapter4 Elasticity Price Elasticity of Demand - Measures buyers’ responsiveness to price changes - Elastic demand • Sensitive to price changes • Large change in quantity - Inelastic demand • Insensitive to price changes • Small change in quantity Price Elasticity of Demand Formula - Formula for price elasticity of demand Ed = - Use the midpoint formula - Ensures consistent results Ed = - Use percentages • Unit free measure • Compare responsiveness across products - Eliminate the minus sign • Easier to compare elasticities Interpretation of Elasticity of Demand - Ed > 1 demand is elastic (% change in Q > % change in P) - Ed = 1 demand is unit elastic (% change in Q < % change in P) - Ed < 1 demand is inelastic (% change in Q = % change in P) - Extreme cases - Perfectly inelastic - Perfectly elastic Ed = 0 Ed = infinity Extreme Cases Total Revenue Test Total Revenue = Price x Quantity Inelastic demand • P and TR move in the same direction P x Qd = TR P x Qd = TR Elastic demand • P and TR move in opposite directions P x Qd = TR P x Qd = TR Unit Demand = Total revenue remain unchange Determinants of Elasticity of Demand - Substitutability • More substitutes, demand is more elastic • Depends on how narrow the product is defind - Proportion of Income • Higher proportion of income, demand is more elastic - Luxuries vs. Necessities • Luxury goods, demand is more elastic • Necessities, price inelastic - Time • More time available, demand is more elastic • Longer the time period Price Elasticity of Supply Determinant of price elasticity of supply (แบ่ งเป็ น 3 ช่ วง) 1. The market period - Fixed quantity supplied - No increase in output 2. The short – run - Plant capacity in presumed fixed - Firm ใหม่ยงั ไม่เข้า firm เก่าก็ออกไม่ได้ 3. The long-run (most elastic) - Sufficiently long, all desired resource adjustment Measures sellers’ responsiveness to price changes - Elastic supply, producers are responsive to price changes - Inelastic supply, producers are not responsive to price changes o Formula to compute elasticity o Es > 1 supply is elastic o Es < 1 supply is inelastic Cross Elasticity of Demand - Measures responsiveness of sales to change in the price of another good Substitutes – positive sign Complements – negative sign Independent goods - zero *** = = Ex,y = = Income Elasticity of Demand - Measures responsiveness of buyers to changes in income - Normal goods – positive sign - Inferior goods – negative sign Ei = = = Ch9. Consumer Behavior Law of Diminishing Marginal Utility - Utility is the satisfaction one gets from consuming a good or service • Not the same as usefulness • Subjective • Difficult to quantify - Util is one unit of satisfaction or pleasure - Total utility is the total amount of satisfaction - Marginal utility(is the change in total utility) is the extra satisfaction from an additional unit of the good MU = ΔTU/ΔQ - As consumption of a good or service increases, the marginal utility obtained from each additional unit of the good or service decreases - Explains downward sloping demand, price must decrease in order for quantity demand to increase Total Utility and Marginal Utility Theory of Consumer Behavior Consumer choice and budget constraint 1. 2. 3. 4. Rational behavior : Satisfaction Utility Preferences : Clear-cut Budget constraint : The consumer has a fixed Prices : Consumer cannot buy everything. Utility Maximizing Rule Consumer allocates his or her income so that the last dollar spent on each product yields the same amount of extra (marginal) utility Algebraically Deriving the Demand Curve Income and Substitution Effects Income effect : The impact that a price change has on a consumer’s real income Substitution effect : The impact that a change in a product’s price has on its relative expensiveness Prospect Theory - How people actually deal with life’s ups and downs - People judge things relative to the status quo - People experience: • Diminishing marginal utility for gains • Diminishing marginal disutility for losses - People are loss adverse Losses and Shrinking Packages - Consumers see any price increase as a loss relative to the status quo - Producers are reducing package size instead of raising prices Framing Effects and Advertising - Consumers evaluate events in a particular mental frame - New information alters the frame in which the consumer defines whether situations are gains or losses The Endowment Effect - Market transactions may be affected by the endowment effect because: o The seller has a tendency to demand a higher price o The buyer has a tendency to offer a lower price Ch10. Businesses and the Costs of Production Economic Costs - The payment that must be made to obtain and retain the services of a resource - Explicit Costs o Monetary payments - Implicit Costs o Value of next best use o Self-owned resources o Includes normal profit Accounting Profit and Normal Profit Accounting profit = Revenue – Explicit Costs Economic profit = Accounting Profit – Implicit Costs Economic profit (to summarize) = Total Revenue – Economic Costs = Total Revenue – Explicit Costs – Implicit Costs Economic Profit Short Run and Long Run Short Run Long Run - Some variable inputs Fixed plant All inputs are variable Variable plant Firms enter and exit Short-Run Production Relationships • Total Product (TP) = Total Qantity • Marginal Product (MP) = The extra output • Average Product (AP) = Also calle labor productivity The Law of Diminishing Returns It states that as successive units of variable resources (vr ex.labor) are added to a fixed resorce (fr ex. Capital, land), beyond some point, the marginal prodct of each additional unit of the variable resouce will decline Short-Run Production Costs Fixed Costs (TFC) : Costs do not vary with output Variable Costs (TVC) : Costs vary with output Total Costs (TC) : Sum of TFC and TVC TC = TFC + TVC Short-Run Production Costs Per-Unit, or Average, Costs - Average Fixed Costs (AFC) Average Variable Costs(AVC) Average Total Costs (ATC) Marginal Costs(MC) AFC = TFC/Q AVC = TVC/Q ATC = TC/Q MC = ΔTC/ΔQ Marginal Cost MC and Marginal Product Long-Run Production Costs - The firm can change all input amounts, including plant size. - All costs are variable in the long run. - Long run ATC o Different short run ATCs Economies and Diseconomies of Scale Economies of scale(EOS) - As plant size increases, average costs of production will be lower due to; 1. Labor specialization 2. Managerial specialization 3. Efficient capital 4. Other factors Diseconomies of scale(DEOS) - As plant size increases, average costs of production will be higher • Control and coordination problems • Communication problems • Worker alienation • Shirking Constant Returns to scale - In some industries there many be a rather wide range of output between the output at which economics of scale end and the output at which diseconomies of scale begin. MES and Industry Structure • Minimum Efficient Scale (MES): • Lowest level of output where long- run average costs are minimized • Can determine the structure of the industry This picture with an extend range of constant returns to scale Don’t Cry Over Sunk Costs Sunk costs Costs have already been incurred and thus are irrecoverable • Rule: Do not engage in any activity where MB < MC • Rule: Ignore sunk costs o They are irrecoverable