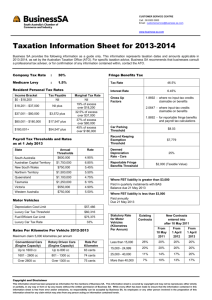

to 2014 Rate Sheet

advertisement

P J BEDDOW & CO Accountants & Registered Tax Agents ABN 83 441 523 120 Postal Address – PO Box 568 Castle Hill NSW 1765 Office Address – 59/15-17 Terminus Street Castle Hill NSW 2154 Lynette J Beddow NTAAF Peter J Beddow NTAAF Tele – 02 9659 8174 Email – beddowco@iprimus.com.au JUNE 2014 – TAX RATES, DEFINITIONS, DUE DATES, ETC INCOME TAX RATES PERSONAL – 2013/2014 (Excl Medicare) $0 - $18,200 Nil $18,201 - $37,000 19% excess > $18,200 $37,001 - $80,000 $ 3,572 + 32.5% excess > $37,000 $80,001 - $180,000 $17,547 + 37% excess > $80,000 $180,000 + $54,547 + 45% excess > $180,000 Medicare Levy – 1.5% Taxable Income (2.00% from 1/7/14) A Medicare levy surcharge is applied where no Private Hospital Health Insurance cover held & “ATI” exceeds – -Single > $88,000, Joint > $176,000 = 1% -Singles $102,000-$136,000, Joint $204,000-$272,000 = 1.25% -Singles >$136,001, Joint > $272,001 = 1.5% To be approved Hospital cover the excess must be less than – $500 for Singles & $1,000 for Families. If you suspend Health Cover while overseas you may be liable for the surcharge for that period. COMPANY TAX RATE 30% of Taxable Income (28.5% from 1/7/15) DEFINITIONS Adjusted Taxable Income (“ATI”) = - current taxable income + - salary sacrificed & reportable superannuation - reportable fringe benefits - losses on investments & rentals - tax free pensions & benefits - foreign employment income This “ATI” is used in a wide range of surcharge, rebate & benefits calculations. “Ordinary Times Earnings” for Superannuation Includes – - bonuses - commissions - allowances not fully expended - shift loadings - casual loadings - holiday pay when taken - sick leave when taken - long service leave when taken - directors fees - payment in lieu of notice Excludes – - fully expended allowances - reimbursed expenses - simple overtime - workers compensation payments including top-ups - annual leave loading - accured annual, long service & sick leave taken as lump sum on termination “ETP” – Eligible Termination Payment OTHER RATES Superannuation Employee Superannuation (On Ordinary Times Earnings) 9.25% - from 1 July, 2013. Remains at 9.25% for year ending 30 June, 2015 Superannuation – Maximum Annual Contribution Deductible/Concessional - Year Ended 30/6/14 - $35,000 – Age 60 - 75 -$25,000 – Age less than 60 Year Ended 30/6/15 - $35,000 – Aged 50 & over -$30,000 – Aged less than 50 Non-Deductible/Non-Concessional – $150,000pa – if aged over 65 must satisfy work test If aged less 65 may contribute $450,000 in one year then nothing for 3 years Superannuation Co-Contribution $1,000 after tax contribution will receive – $500 CoContribution were “ATI” < $33,516 & NIL where “ATI” > $48,516. Phasing between. -------------------------------------------------------------------------------Motor Vehicles -Luxury Car threshold for 2014 is $57,466 -Per KM Rate for 2013/2014 Year 0-1600 cc 1601-2600 cc 2601 + .65c .76c .77c -FBT Statutory Rate – Motor Vehicles Km’s Contracts . New Contracts . Travelled Pre 10/5/11 10/5/11 1/4/12 1/4/13 From to to to 31/3/12 31/3/13 31/3/14 1/4/14 Less15,000 26% 20% 20% 20% 20% 15,000-25,000 20% 20% 20% 20% 20% 25,000-40,000 11% 14% 17% 20% 20% More 40,000 7% 10% 13% 17% 20% -Business vehicles other than cars – e.g. Utes Where used privately the FBT Rate is 0-2500 cc < 2500 cc 1/4/13-31/3/14 $0.49 $0.59 -Complying Log Books – -Less 5 years old -Kept for 13 consecutive weeks ----------------------------------------------------------------------------------Interest Benchmark Rates – Year ended 31 March, 2014 6.45% Year ended 31 March, 2015 5.95% -----------------------------------------------------------------------------------Payroll Tax – Wages, Superannuation & Contractors Exceeding $750,000 – 5.45% Land Tax – Land held at 31/12/13 (NSW) Value below $412,000 = NIL Value $412,000-$2,519,000=$100+1.6% value >$412.000 Value >$2,519,000 = 2% of taxable -----------------------------------------------------------------------------HELP Repayment Threshholds - based on “ATI” < $51,309 – Nil >$51,309 is 4% rising to 8% > $95,288 ----------------------------------------------------------------------------- Health Insurance & Medical HEALTH INSURANCE REBATE - For Year Ended 30 June, 2014 – INCOME “ATI INCOME”ATI” NEW PRIVATE HEALTH INSURANCE REBATE Tier Singles Families Age < 65 Age 65-69 Age 70 & Over $0-$88,000 $0-$176,000 30% 35% 40% 1 $88,001-$102,000 $176,001-$204,000 20% 25% 30% 2 $102,001-$136,000 $204,001-$272,000 10% 15% 20% 3 $136,001 + $272,001 + 0% 0% 0% If you continue to claim the 30% Rebate & are not entitled to, you will have a tax debt at year end. ----------------------------------------------------------------- -Medicare Levy Surcharge – where no Private Health Cover “ATI” as per above Tiers – Tier 1 Tier 2 Tier 3 Surcharge 1.0% 1.25% 1.5% ----------------------------------------------------------Out of Pocket Medical Expenses Offset (This Offset only available if you made a claim in the 2012/2013 year). “ATI” <$86,000 Singles & <$176,000 Families 20% of net expenses above $2,162 “ATI” >$88,000 Singles & >$176,00 Families 10% of net expenses above $5,100 Offset still available to 1/7/19 for disability aids, attendant care & Aged care. ----------------------------------------------------------Definition of Medical Expenses – (Net for Family after all refunds – Medicare & Health Fund) Doctors Hospital Optical Dental Prescriptions Therapeutic treatments under direction of doctor Medical & surgical appliances Excludes – Cosmetic, Travel, Dietary Foods, Vitamins & supplements, not covered above. OTHER IMPORTANT INFORMATION SUB CONTRACTORS V EMPLOYEE Many sub-contractors (particularly where for the supply of Labour only) are classified by the ATO, Payroll Tax & Workers Compensation as defacto Employees, with all the attaching liabilities for the Employer. The ATO has developed a calculation tool to assist you in determining if a contactor is a deemed employee – http://www.ato.gov.au/businesses/content/00095062.htm? This area is attracting a lot of ATO attention & we strongly recommend that you review all current Contractors to ensure they are correctly classified. It is YOU the Employer who will have to pay the PAYG Withholding not deducted, 9.25% Superannuation & Workers Compensation if your current Contractors are deemed to be Employees. Property Transactions - ALL ATO developed a webpage that covers all tax related matters concerning property – GST, CGT, Income Tax. Using Property to run Business, Residential Rental, Property Development and Building & Renovation. www.ato.gov.au/property Please ask or check this website BEFORE entering Into property transactions RETENTION OF RECORDS - normal retention of records for tax purposes is 5 years - statute of limitations for being sued is normally 6 years however may be more under certain jurisdictions - workers compensation is 7 years - capital assets - purchase documents must be retained for 5 years from date of final sale - tax losses - you may need the records to prove the tax loss for 5 years from the date the losses are fully absorbed. Do not be too anxious to throw out records and remember to always dispose of your records safely – shredding. Remember there are penalties for reckless claims DISCLAIMER Information is current at time of printing No person should rely on the contents of this Memorandum without first obtaining advice from a qualified professional. The publisher expressly disclaims all and any liability and responsibility to any person in respect of anything and of the consequences of anything, done or omitted to be done by any such persons in reliance, whether partially, upon the whole or any part of the contents of this Memorandum. GST - Registration threshold $75,000 - Tax invoice threshold $75 GST exclusive --------------------------------------------------------------------------------- DUE DATES -PAYG Summaries to Employees due 14/7/14 -PAYG Summary to ATO due 14/8/14 - Employee Superannuation Due – Qtr Ended Due for Payment 30/6/14 Before 28/7/14 OR 30/6/14 for tax deduction in 2014 Year 30/9/14 28/10/14 31/12/14 28/1/15 (Not 28/2/15) 31/3/15 28/4/15 -Sub-Contractor Reporting – due 21/7/14 ------------------------------------------------------------------------------- 3/3