File

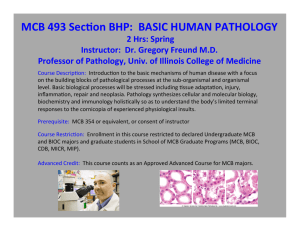

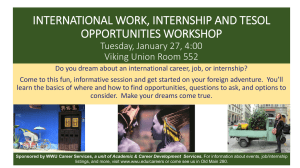

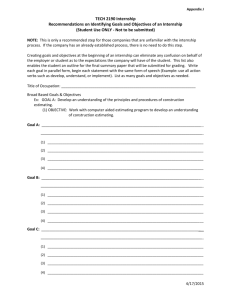

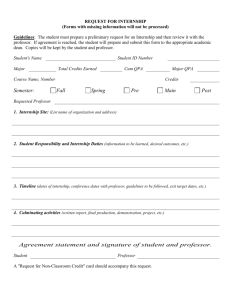

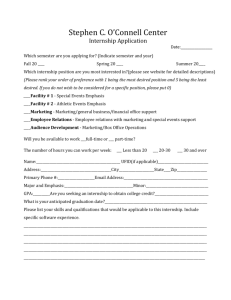

advertisement