CCT's Ref - Commercial Taxes Department

advertisement

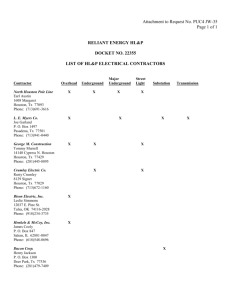

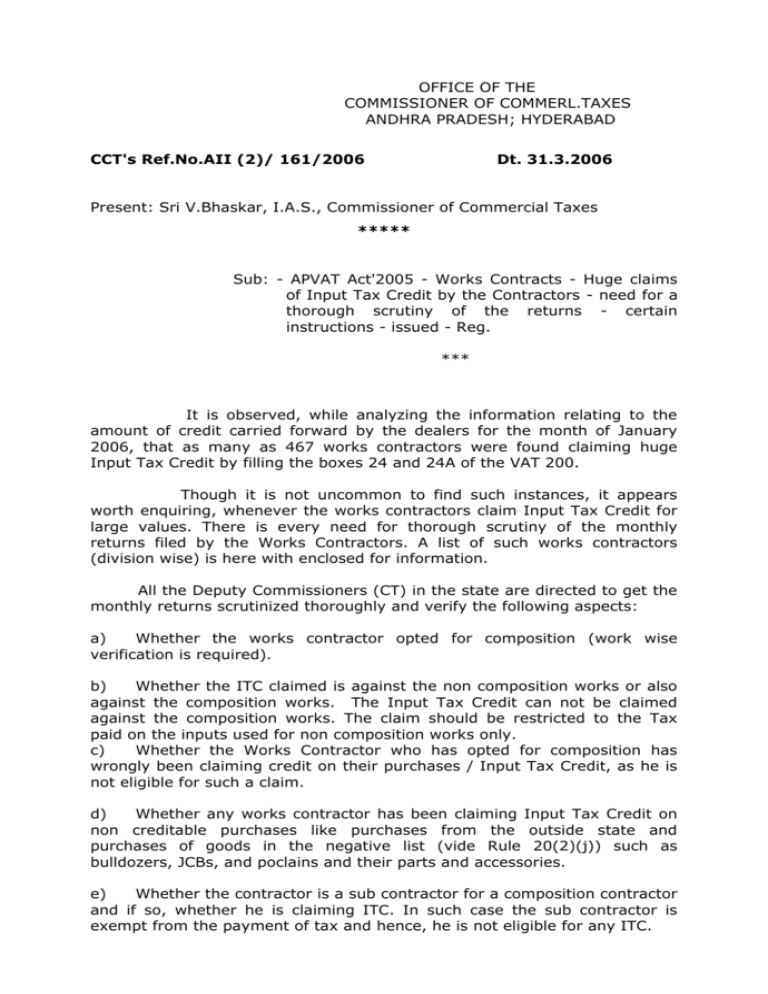

OFFICE OF THE COMMISSIONER OF COMMERL.TAXES ANDHRA PRADESH; HYDERABAD CCT's Ref.No.AII (2)/ 161/2006 Dt. 31.3.2006 Present: Sri V.Bhaskar, I.A.S., Commissioner of Commercial Taxes ***** Sub: - APVAT Act'2005 - Works Contracts - Huge claims of Input Tax Credit by the Contractors - need for a thorough scrutiny of the returns - certain instructions - issued - Reg. *** It is observed, while analyzing the information relating to the amount of credit carried forward by the dealers for the month of January 2006, that as many as 467 works contractors were found claiming huge Input Tax Credit by filling the boxes 24 and 24A of the VAT 200. Though it is not uncommon to find such instances, it appears worth enquiring, whenever the works contractors claim Input Tax Credit for large values. There is every need for thorough scrutiny of the monthly returns filed by the Works Contractors. A list of such works contractors (division wise) is here with enclosed for information. All the Deputy Commissioners (CT) in the state are directed to get the monthly returns scrutinized thoroughly and verify the following aspects: a) Whether the works contractor opted for composition (work wise verification is required). b) Whether the ITC claimed is against the non composition works or also against the composition works. The Input Tax Credit can not be claimed against the composition works. The claim should be restricted to the Tax paid on the inputs used for non composition works only. c) Whether the Works Contractor who has opted for composition has wrongly been claiming credit on their purchases / Input Tax Credit, as he is not eligible for such a claim. d) Whether any works contractor has been claiming Input Tax Credit on non creditable purchases like purchases from the outside state and purchases of goods in the negative list (vide Rule 20(2)(j)) such as bulldozers, JCBs, and poclains and their parts and accessories. e) Whether the contractor is a sub contractor for a composition contractor and if so, whether he is claiming ITC. In such case the sub contractor is exempt from the payment of tax and hence, he is not eligible for any ITC. f) Whether any works contractors, acting as non composition contractors, have been reporting outputs on ratio basis i.e. 70:30 or 60:40 as per the table in Rule 17 and simultaneously claiming input tax credit on the actual inputs, purchased and used in the execution of Works Contract. Such practice indicates that they are not maintaining correct books of accounts. As per Rule 17G, such contractor shall pay tax at the rate of 12.5% on the total consideration after allowing the standard deduction in the prescribed percentage. The contractor who wants to claim input tax credit should maintain correct books of accounts for the values of output (value of goods at the time of incorporation) in the non composition contracts. g) Whether composition works contractors and sub contractors are paying tax on purchase of inputs from non VAT dealers and from outside the state. Such purchases are not eligible for input tax credit. h) Whether the claim for Transition Sales Tax Relief (already paid) has been restricted (AxB/C) with reference to the extent of inputs used for non composition works only. The contractor has to file VAT 200G during the months of adjustment of sales tax relief claim and inputs relating to composition works should be disallowed. i) Whether the contractor, having both Government and nonGovernment contracts is adjusting the TAX COLLECTED AT SOURCE (TCS) (GOVT CONTRACTS) against liability, arising from non government contracts and other contracts. The contractor cannot adjust TCS amount towards other liabilities since TCS is the ultimate liability, whether or not the contractor opts for composition for such works. He even cannot be allowed to carry forward the TCS amount from one tax period to other. j) Whether the returns, filed, are in commensurate with the observations made above. The returns have to be got rectified when the contractor has to file the consolidated adjustment returns in form VAT 200 F and VAT 200 H, which are to be filed every year end. While scrutinizing all the returns as suggested above, the Deputy Commissioners (CT) are also directed to take up the audit of some cases wherever required. At the time of Audit, please check whether as per rule 17(1)(a), the works contractor, who has not opted for composition in respect of any work, has been reporting the output tax as and when the goods are incorporated in the execution of Works Contract. He is not permitted to postpone the tax to a date on which he receives his payment. Further, the returns filed by the contractors, who undertake both composition and non composition works, should be analyzed as follows: 1) List out all the works undertaken by the contractor. 2) Identify composition and non composition works. 3) Ascertain the value of the total purchases made during the month / period. Deduct purchases, ineligible for input tax credit under Rule 20. Let this be "P" 4) Ascertain the purchases directly attributable to composition works, say "Q". 5) Ascertain the purchases directly attributable to non-composition works, say "R". 6) Arrive at the value of the purchases attributable to the common inputs, while excluding ineligible inputs like "Proclainers, Trucks, bulldozers, JCBs" etc., (P-Q-R), say "S". 7) Allow Input Tax Credit to the extent of 90% of the tax paid on the inputs attributable to the non-composition works, say "T". 8) Disallow Input Tax Credit to the extent of the tax paid on the inputs attributable to composition works. 9) Apply the formula, A X B / C, and restrict the Input Tax Credit to the extent of the proportion of the "S", i.e., the tax paid on the value of the common inputs, attributable to non-composition works, say "U". 10) The total Input Tax Credit that can be allowed is "T+U". All the Deputy Commissioners (CT) in the state are requested to ensure that all the cases of Works Contractors with claims of input tax credit are thoroughly verified and a consolidated report on the results thereof is sent on or before 30-04-2006. Encl: as above Sd/- V. BHASKAR Commissioner (C