Bank Islam (L) Ltd - Labuan International Financial Exchange

advertisement

Offering Circular

FIRST GLOBAL SUKUK INC.

(Incorporated in Labuan International Offshore Financial Centre, Malaysia with limited liability)

Serial Islamic Lease Sukuk Issuance

U.S.$50,000,000 Trust Certificates due 2004, Series A

U.S.$100,000,000 Trust Certificates due 2006, Series B

Advisers

Structuring & Shariah

Financial

Bank Islam (L) Ltd

ABN AMRO

Lead Arranger

Bank Islam (L) Ltd

Co-Arranger

Aseambankers Malaysia Berhad

Global Coordinator

ABN AMRO

Middle East Coordinator

Shamil Bank of Bahrain E.C.

________________

The date of this Offering Circular is December 24, 2001

2

The U.S.$50,000,000 Trust Certificates due 2004, Series A (the "Series A Certificates") will be

issued on 24th December, 2001 (the "Closing Date") and will be redeemed upon the dissolution of the

related Trust (as defined below) on the Periodic Distribution Date (as defined below) falling in

December, 2004 (the "Series A Scheduled Dissolution Date"). The U.S.$100,000,000 Trust

Certificates due 2006, Series B (the "Series B Certificates" and, together with the Series A

Certificates, the "Certificates" or the "Sukuk") will be issued on the Closing Date and will be

redeemed upon the dissolution of the related Trust on the Periodic Distribution Date falling in

December, 2006 (the "Series B Scheduled Dissolution Date" and, together with the Series A

Scheduled Dissolution Date, the "Scheduled Dissolution Dates").

Bank Islam (L) Ltd (the "Trustee"), pursuant to the terms of a declaration of trust entered into by the

Trustee in respect of each Series of Certificates (each a "Trust Agreement"), will hold the assets

conveyed to it in respect of each Series of Certificates (the "Trust Assets") upon trust (the "Trusts")

for the holders of the respective Series of Certificates.

First Global Sukuk Inc., a special purpose company incorporated in Labuan, Malaysia under the

Offshore Companies Act, 1990 (the "SPV"), will enter into four purchase agreements (each a

"Purchase Agreement") with certain Malaysian subsidiaries (each a "Seller") of Kumpulan Guthrie

Berhad ("Guthrie"). Pursuant to each Purchase Agreement, the relevant Seller will declare itself a

bare trustee of its interests in the parcels of land owned by it and identified therein for the benefit of

the SPV and convey the beneficial interest in such parcels of land to the SPV. Thereafter the SPV

will lease the beneficial interest in such parcels of land to Guthrie pursuant to two series of lease

agreements (each a "Lease Agreement"). Pursuant to the Trust Agreements, the SPV will convey to

the Trustee its beneficial interest in such parcels of land and assign to the Trustee all its rights, title,

interest and benefit, present and future, in, to and under the Lease Agreements and the Purchase

Agreements. Such interests, together with all proceeds therefrom, will comprise the Trust Assets. The

Trusts will be dissolved on the relevant Dissolution Dates.

Each Suk'kun represents solely an undivided ownership interest in the relevant Trust Assets.

Holders of Series A Certificates will have no recourse to the Trust Assets in respect of the Series

B Certificates. Likewise, holders of Series B Certificates will have no recourse to the Trust

Assets in respect of the Series A Certificates. Creditors of the SPV and the Trustee (in any

capacity other than as trustee in respect of the Certificates), including, in particular, holders of

certificates relating to other trusts, will have no recourse to the Trust Assets. Proceeds of the

Trust Assets are the sole source of payments on the Certificates. The Certificates do not

represent an interest in or obligation of any of the SPV, the Trustee, Guthrie or any of their

affiliates. Accordingly, Certificateholders will have no recourse to any assets of the SPV, the

Trustee (including, in particular other assets comprised in other trusts), Guthrie (to the extent it

fulfills all of its obligations under the relevant Lease Agreements) or any of their affiliates in

respect of any shortfall in the expected amounts from the Trust Assets.

The Sukuk do not and are not intended to convey ownership in the Land Parcels within the

meaning of the (Malaysian) National Land Code 1965. Any transfer, under the National Land

Code 1965, of the Land Parcels into the name of any third party would be subject to the

provisions of the National Land Code 1965, including but not limited to the provisions in

relation to procuring the consents of the relevant authorities therefor.

The Sukuk have not been and will not be registered under the United States Securities Act of

1933, as amended (the "Securities Act") or with any securities regulatory authority of any state

or other jurisdiction of the United States and may not be offered, sold or delivered within the

United States or to U.S. persons except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and applicable state securities

3

laws. The Sukuk are being offered, sold or delivered to Persons (other than U.S. Persons) (each

as defined in Regulation S) outside the United States in reliance on Regulation S ("Regulation

S") under the Securities Act. Each purchaser of the Sukuk will be deemed to have made the

representations described in "Transfer Restrictions" and is hereby notified that the offer and

sale of Sukuk to it is being made in reliance on the exemption from the registration

requirements of the Securities Act provided by Regulation S.

Distributions on each Certificate will be made on each date (each a "Periodic Distribution Date")

which falls six months after the preceding Periodic Distribution Date or, in the case of the first

Periodic Distribution Date, after the Closing Date. Each holder of a Series A Certificate will receive

on each Periodic Distribution Date, out of the relevant Trust Assets, a return equal to 1.5 per cent. per

annum above the London inter-bank offered rate for U.S. dollar deposits for the principal amount of

Series A Certificates held by such holder for each Profit Accumulation Period. Each holder of a Series

B Certificate will receive on each Periodic Distribution Date, out of the relevant Trust Assets, a return

equal to 2.0 per cent. per annum above the London inter-bank offered rate for U.S. dollar deposits for

the principal amount of Series B Certificates held by such holder for each Profit Accumulation Period.

See "Conditions of the Certificates - Periodic Distributions". Each Certificate will be in the

denomination of U.S.$500,000. Each Series of Certificates will be redeemed only upon the dissolution

of the related Trust. Each Trust will be dissolved on the related Dissolution Date and at no other time.

See "Conditions of the Certificates - Dissolution of Trust".

Application has been made to the Labuan International Financial Exchange Inc ("LFX") for the

listing of the Certificates on LFX. LFX takes no responsibility for the contents of this document,

makes no representations as to its accuracy or completeness and expressly disclaims any liability

whatsoever for any loss howsoever arising from or in reliance upon any part of the contents of this

document. Investors are advised to read and understand the contents of this document before

investing. If in doubt, the investors should consult his or her adviser.

The Certificates have been given an international rating of BBB+is by MARC International Ltd. A

rating is not a recommendation to buy, sell or hold securities and may be subject to revision,

suspension or withdrawal at any time by the assigning rating organisation.

Each Series of Certificates will be represented by a global certificate (each a "Global Certificate")

which will be deposited on or about the Closing Date with the Labuan International Financial

Exchange Inc as custodian and clearing system for the Certificates (the "Depository"). Interests in

each Global Certificate will be exchangeable for definitive Certificates only in certain limited

circumstances. See "Description of Global Certificates".

Prospective investors should be aware of the risks involved in investing in any Certificate. See

"Investment Considerations".

The directors of the SPV and Guthrie have seen and approved this Offering Circular and they

individually and collectively accept full responsibility for the accuracy of the information given herein

and confirm that there are no other facts the omission of which would make any statement herein

misleading.

The SPV accepts responsibility for the information contained in this Offering Circular. To the best of

the knowledge and belief of the SPV (having taken all reasonable care to ensure that such is the case)

the information contained in this Offering Circular is in accordance with the facts and does not omit

anything likely to affect the import of such information.

4

Guthrie accepts responsibility for the information relating to itself and the Group contained in this

Offering Circular. To the best of Guthrie's knowledge and belief (having taken all reasonable care to

ensure that such is the case) the information contained in this Offering Circular insofar as it relates to

Guthrie and the Group is in accordance with the facts and does not omit anything likely to affect the

import of such information. Guthrie, having made all reasonable enquiries, confirms that this Offering

Circular contains or incorporates all information on itself and the Group which is material in the

context of the Sukuk, that the information contained or incorporated in this Offering Circular on itself

and the Group is true and accurate in all material respects and is not misleading, that the opinions and

intentions expressed in this Offering Circular on itself and the Group are honestly held and that there

are no other facts the omission on itself and the Group of which would make this Offering Circular or

any of such information or the expression of any such opinions or intentions misleading. Guthrie

accepts responsibility accordingly.

No person has been authorised to give any information or to make any representation other than those

contained in this document in connection with the offering of the Sukuk and, if given or made, such

information or representations must not be relied upon as having been authorised by Guthrie, the SPV,

the Trustee or the Initial Purchasers (as defined under "Plan of Distribution" below). Neither the

delivery of this document nor any sale made hereunder shall, under any circumstances, constitute a

representation or create any implication that there has been no change in the affairs of the Group since

the date hereof. This document does not constitute an offer of, or an invitation by, or on behalf of,

Guthrie, the SPV, the Trustee or the Initial Purchasers to purchase any of the Sukuk. This document

does not constitute an offer, and may not be used for the purpose of an offer to, or a solicitation by,

anyone in any jurisdiction or in any circumstances in which such an offer or solicitation is not

authorised or is unlawful.

Guthrie shares are listed and traded on the Kuala Lumpur Stock Exchange (the "KLSE") and

accordingly Guthrie is subject to the listing requirements of the KLSE which include the

publication of audited accounts and the filing with the KLSE of certain notices and reports

(including Guthrie's circulars to it shareholders), each of which is a public document. All

filings, reports, circulars and notices from Guthrie to the KLSE and/or its shareholders issued

or published on or prior to the date of this Offering Circular shall be deemed to be incorporated

in, and to form part of, this Offering Circular.

This Offering Circular is not intended to provide the basis of any credit or other evaluation and

should not be considered as a recommendation by Guthrie, the SPV, the Trustee or the Initial

Purchasers that any recipient of this Offering Circular should purchase any of the Sukuk.

The Initial Purchasers have entered into a purchase agreement with Guthrie, the SPV and the Trustee

pursuant to which they have severally agreed, subject to the satisfaction of certain specified

conditions, to purchase the aggregate principal amount of Sukuk to be issued as described in this

Offering Circular. See "Plan of Distribution".

Guthrie's financial statements have been prepared in accordance with generally accepted accounting

principles in effect from time to time in Malaysia as approved by the Malaysian Accounting Standards

Board under the Financial Reporting Act 1997 ("Malaysian GAAP"), which differ in certain

significant respects from United States generally accepted accounting principles, and are subject to

Malaysian auditing standards, and are thus not comparable to the financial statements of a United

States company.

All references in this document to "U.S. dollars" and "U.S.$" refer to the lawful currency of the

United States of America, to "Rupiah" and "Rp" refer to the lawful currency of Indonesia and to

"Malaysian Ringgit", "Ringgit" and "RM" refer to the lawful currency of Malaysia. For

convenience (i) certain amounts in Ringgit have been translated into U.S. dollars based on the

5

prevailing exchange rate of RM3.80 = U.S.$1.00 at which the U.S. dollar, as of the date of this

Offering Circular, is pegged against the Ringgit and (ii) certain amounts in Rupiah have been

translated into (a) U.S. dollars based on the prevailing exchange rate of Rp10,135 = U.S.$1.00 and (b)

Ringgit based on the prevailing exchange rate of Rp2,671= RM1.00, each the buying exchange rate on

transactions published by Bank Indonesia on 21st December, 2001.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements in this Offering Circular constitute "forward-looking statements". Such forwardlooking statements involve known and unknown risks, uncertainties and other factors that may cause

the actual results, performance and financial conditions of Guthrie and the Group, or industry results,

to be materially different from any future results, performance or financial condition express or

implied by such forward-looking statements. Such factors include, among other things, the economic

and political conditions in Malaysia and the rest of Southeast Asia, changes in interest rates or

exchange rates, various business and regulatory factors affecting the oil palm business in Malaysia

and the rest of Southeast Asia, the lack of an established market for the Sukuk and other factors

referenced in this Offering Circular. See "Investment Considerations".

6

_______________________________________________

TABLE OF CONTENTS

Page

Summary of the Offering

Investment Considerations

Conditions of the Certificates

Description of the Global Certificates

Use of Proceeds

Ratings

Plan of Distribution

The Trusts

The Trustee

The Leases (Ijarah)

Description of the SPV

Description of the Group

Capitalisation of the Group

Summary of Financial Information of the Group

Overview of the Palm Oil Industry

Listing, Clearance and Settlement

Transfer Restrictions

Tax Considerations

General Information

Legal Matters

Independent Accountants

Appendix A - Index of Defined Terms

Appendix B - Accountant's Report

Appendix C - Audited Financial Statements for the years 1999 and 2000

______________________________________________

7

19

26

42

44

45

46

47

49

50

52

54

65

66

73

84

86

87

89

91

91

A-1

B-1

C-1

7

SUMMARY OF THE OFFERING

The following summary does not purport to be complete and is qualified in its entirety by reference to

the detailed information appearing elsewhere in this Offering Circular and related documents

referred to herein. Certain capitalised terms used in this Offering Circular are defined in the Index of

Defined Terms included as Appendix A hereto.

Parties

SPV

:

First Global Sukuk Inc., a bankruptcy remote, special

purpose company incorporated in Labuan under the

Offshore Companies Act, 1990. The SPV has been

incorporated solely for the purpose of participating in the

transactions contemplated in the Transaction Documents.

SPV Ownership/Administration of

the SPV

:

The issued share capital of the SPV is U.S.$2.00 divided

into two ordinary shares of par value U.S.$1.00 each.

Pursuant to the SPV Administration Agreement, the SPV's

ordinary shares are owned by BIMB International Islamic

Trust (Labuan) Sdn Bhd as SPV Administrator, which also

provides certain administrative services on behalf of the

SPV.

Sellers

:

Kumpulan Jerai Sdn Bhd (the "Series A Seller"), Kumpulan

Linggi Sdn Bhd and Kumpulan Kamuning Sdn Bhd

(together, the "Series B Sellers"), each a subsidiary of

Kumpulan Guthrie Berhad. The Series A Seller will declare

itself a bare trustee, for the benefit of the SPV, over all its

rights, title and interests in the Series A Land Parcels

pursuant to the Series A Purchase Agreement and each of

the Series B Sellers will declare itself a bare trustee, for the

benefit of the SPV, over all its rights, title and interests in

the Series B Land Parcels pursuant to the Series B Purchase

Agreements and will convey to the SPV the beneficial

interest in such Land Parcels pursuant to the relevant

Purchase Agreement.

Guthrie

:

Kumpulan Guthrie Berhad has its origins in a firm

established in 1821 and was converted to a public company

under the Companies Act, 1965 on 2nd September, 1987.

Guthrie's shares have been listed and traded on the KLSE

since 25th August, 1989. Guthrie will lease from the SPV (i)

the Series A Land Parcels on the terms set out in the Series

A Lease Agreement for a period of three years commencing

on the Closing Date and terminating, with the acquisition of

the Series A Land Parcels from the SPV, on the Series A

Scheduled Dissolution Date, and (ii) the Series B Land

Parcels on the terms set out in the Series B Lease

Agreement for a period of five years commencing on the

Closing Date and terminating, with the acquisition of the

Series B Land Parcels from the SPV, on the Series B

Scheduled Dissolution Date, and will operate and maintain

the Land Parcels in the ordinary course of its business.

8

Initial Purchasers

:

Bank Islam (L) Ltd, Maybank International (L) Ltd, Shamil

Bank of Bahrain E.C., Bumiputra Commerce Bank (L) Ltd,

AMMB International (L) Ltd, ABN AMRO Bank N.V.,

Labuan Branch, Bank Muamalat Malaysia Berhad, Labuan

Offshore Branch, and RHB Bank (L) Limited as initial

purchasers under the Certificate Purchase Agreement,

pursuant to which they have each agreed to purchase the

aggregate principal amount of the Sukuk.

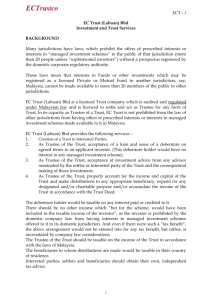

Trustee

:

Bank Islam (L) Ltd, a company incorporated in Labuan

under the Offshore Companies Act, 1990 and licensed under

the Offshore Banking Act, 1990, in its capacity as trustee on

behalf of the Sukukholders in respect of the Trusts in

accordance with the Trust Agreements. Pursuant to the

Series A Trust Agreement, the Trustee holds the Series A

Trust Assets on behalf of the Series A Sukukholders.

Pursuant to the Series B Trust Agreement, the Trustee holds

the Series B Trust Assets on behalf of the Series B

Sukukholders.

Transaction Administrator

:

ABN AMRO Bank N.V., Labuan Branch, as transaction

administrator under the Transaction Administration

Agreement. Among other things, the Transaction

Administrator operates the Transaction Accounts and the

Reserve Accounts, receives payments from Guthrie under

the Lease Agreements and makes payments on the Sukuk.

Listing Sponsor

:

Bank Islam (L) Ltd, in its capacity as listing sponsor in

respect of the Sukuk, has applied for the Sukuk to be listed

on LFX.

Sukuk

:

U.S.$50,000,000 Trust Certificates due 2004, Series A and

U.S.$100,000,000 Trust Certificates due 2006, Series B.

Additional Sukuk

:

Guthrie and its subsidiaries may hereafter desire to sell

other land parcels to the SPV which the SPV will lease to

Guthrie pursuant to lease agreements on terms similar to the

Lease Agreements. In connection therewith the SPV may

establish additional trusts similar to the Trusts which may

issue additional trust certificates, the proceeds of which will

be used to acquire the SPV's rights, titles and interests in

such further land parcels and lease agreements.

Distributions on such further trust certificates will be

derived from Guthrie's payments under such lease

agreements, on terms similar to the Conditions. It is

currently anticipated that the aggregate principal amount of

such further trust certificates will not exceed

U.S.$245,000,000.

Closing Date

:

24th December, 2001, or such other date on which the

Sukuk will be issued.

Summary of Certificates

9

Issue Price

:

100 per cent of the aggregate principal amount of the Sukuk.

Rate of Return on Trust Assets

:

Each holder of a Series A Suk'kun will receive on each

Periodic Distribution Date, out of the Series A Trust Assets,

a return equal to 1.5 per cent. per annum above LIBOR for

the principal amount of Series A Sukuk held by such holder

for each Profit Accumulation Period.

Each holder of a Series B Suk'kun will receive on each

Periodic Distribution Date, out of the Series B Trust Assets,

a return equal to 2.0 per cent. per annum above LIBOR for

the principal amount of Series B Sukuk held by such holder

for each Profit Accumulation Period. See "Conditions of the

Certificates - Periodic Distributions".

Scheduled Dissolution of the Trust

:

Under each Lease Agreement, the SPV will have the option

(the "Put Option"), which it will assign to the Trustee for

the benefit of the holders of the related Series of Sukuk

pursuant to the related Trust Agreement, to require Guthrie

to purchase the beneficial interest in the related Land

Parcels at a price equal to the principal amount of such

Series of Sukuk plus the aggregate Periodic Distribution

Amount payable on the Sukuk on the date of such

redemption (the "Dissolution Distribution Amount"):

(a) on the Periodic Distribution Date immediately

following the occurrence of a Dissolution Event; and

(b) on the Scheduled Dissolution Date in respect of such

Series of Certificates; and

Under each Lease Agreement, Guthrie will have the option

(the "Call Option") to require the SPV or, after the

assignment to the Trustee of the SPV's interests in such

Lease Agreement pursuant to the relevant Trust Agreement,

the Trustee to sell the beneficial interest in the relevant

Land Parcels to it on the related Scheduled Dissolution Date

at the related Dissolution Distribution Amount.

In respect of a Scheduled Dissolution of a Trust, on each

Partial Deposit Date, Guthrie will deposit in the relevant

Transaction Account an amount equal to 20 per cent. of the

related Dissolution Distribution Amount. Such monies may

not be withdrawn or transferred until the exercise of the Put

Option or the Call Option. In respect of an Unscheduled

Dissolution of a Trust, Guthrie will deposit the aggregate

Dissolution Distribution Amount into the relevant

Transaction Account prior to the Unscheduled Dissolution

Date in accordance with the instructions of the Trustee

issued in connection with its exercise of the Put Option.

Upon the exercise of either the Put Option or the Call

Option in respect of a Lease Agreement, the Trustee will

use the Dissolution Distribution Amount standing to the

10

credit of the relevant Transaction Account to redeem the

relevant Series of Sukuk.

Unless previously dissolved pursuant to the occurrence of a

Dissolution Event, (a) the Series A Trust will be dissolved

on the Periodic Distribution Date falling in December, 2004

(the "Series A Scheduled Dissolution Date") and the

related Dissolution Distribution Amount will be used by the

Trustee to redeem the Series A Sukuk on the Series A

Scheduled Dissolution Date, and (b) the Series B Trust will

be dissolved on the Periodic Distribution Date falling in

December, 2006 (the "Series B Scheduled Dissolution

Date") and the related Dissolution Distribution Amount will

be used by the Trustee to redeem the Series B Sukuk on the

Series B Scheduled Dissolution Date.

Early Dissolution of the Trusts

:

The Trusts will not be subject to dissolution, and the Sukuk

will not be redeemed, prior to their respective Dissolution

Dates.

Form and Denomination

:

The Sukuk (or Certificates) will be issued in bearer form,

serially numbered and in denominations of U.S.$500,000

each. Title to the Certificates will pass by delivery.

Each Series of Certificates will be represented by a Global

Certificate which will be deposited on the Closing Date with

the Depository. Interests in the Global Certificate will be

exchangeable for Definitive Certificates only in certain

limited circumstances. See "Description of Global

Certificates".

Status

:

Each Series A Suk'kun represents an undivided 1.0%

ownership interest in the Series A Trust Assets and will

rank pari passu, without any preference, with the other

Series A Sukuk. Each Series B Suk'kun represents an

undivided 0.5% ownership interest in the Series B Trust

Assets and will rank pari passu, without any preference,

with the other Series B Sukuk.

Trusts

:

Pursuant to each Trust Agreement, the SPV will:

(a) convey to the Trustee its beneficial interest in the

relevant Land Parcels; and

(b) assign to the Trustee all its rights, title, interest

benefit, present and future, in, to and under

relevant Purchase Agreement, Lease Agreement

Service Agency Agreement and all proceeds of

foregoing.

and

the

and

the

Such interests, together with the relevant Reserve Account

and Transaction Account and the monies deposited therein

comprise the "Trust Assets".

11

Transaction Accounts

:

The Transaction Administrator will maintain and operate

the Series A Transaction Account and the Series B

Transaction Account on behalf of the Series A Trust and the

Series B Trust respectively. Distributions from the relevant

Trust Assets to holders of the related Series of Sukuk will

be made out of funds standing to the credit of the related

Transaction Account.

Reserve Accounts

:

The Transaction Administrator will maintain and operate

the Series A Reserve Account and the Series B Reserve

Account on behalf of the Series A Trust and the Series B

Trust respectively. Guthrie shall ensure that there shall at all

times be standing to the credit of each Reserve Account an

amount equal to the return, in accordance with the

Conditions, expected to be distributed on the related Series

of Sukuk on the next Periodic Distribution Date. The

monies deposited in each Reserve Account may be used to

meet any distributions on the related Series of Sukuk to the

extent that there is an insufficient amount standing to the

credit of the related Transaction Account to make when due

any distribution on the Sukuk. Any such amount withdrawn

from any Reserve Account shall be replenished by Guthrie

at least one month prior to the next Periodic Distribution

Date.

Periodic Distributions

:

The Series A Lease Payments and the Series B Lease

Payments will be made by Guthrie on each Periodic

Distribution Date. An amount equal to each such Lease

Payment will be paid, on the date falling one month prior to

each Periodic Distribution Date, directly to the related

Transaction Account. The deposit of such monies will not

constitute a Lease Payment, and may not be withdrawn or

transferred by the Transaction Administrator or the Trustee,

until the relevant Periodic Distribution Date upon which the

Transaction Administrator will withdraw such monies on

deposit in the relevant Transaction Account and use such

amount to make payments on, among other things, the

related Sukuk in the order of priority set out below.

If such funds are insufficient to make the full amount of the

payment due to be distributed to Sukuk holders in

accordance with the Conditions on the relevant Series of

Sukuk, the Transaction Administrator may withdraw from

the related Reserve Account an amount equal to such

shortfall.

Priority of Distributions for each :

Trust

Pursuant to each Trust Agreement, the Trustee holds the

relevant Trust Assets for and on behalf of the holders of the

related Series of Sukuk.

12

On each Periodic Distribution Date, the Transaction

Administrator shall apply (i) the monies standing to the

credit of the related Transaction Account, (ii) to the extent

that the monies referred to in (i) above are insufficient to

meet the distributions set out in paragraph (a) below, an

amount equal to the shortfall from the related Reserve

Account or (iii) if such Periodic Distribution Date is a

Dissolution Date in respect of the relevant Series of Sukuk,

all monies standing to the credit of the related Reserve

Account, in the following order of priority:

(a) first, in or towards payment pari passu and rateably of

all amounts due and unpaid on such Series of Sukuk in

respect of Periodic Distributions

(b) second, only if such payment is made on the related

Dissolution Date, in or towards payment pari passu

and rateably of all principal due and unpaid in respect

of such Series of Sukuk; and

(c) third, only if such payment is made on the related

Dissolution Date, in payment of the surplus (if any) to

Guthrie.

Investment of Monies in Accounts

:

Pursuant to the Transaction Administration Agreement, the

Transaction Administrator may invest the monies from time

to time standing to the credit of the Reserve Accounts and

the Transaction Accounts in U.S. dollar denominated

Islamic time deposits of depository institutions licensed to

carry on business in Labuan which become due not later

than one Business Day before the next Periodic Distribution

Date or can be withdrawn at any time without penalty (the

"Eligible Investments").

Limited Recourse

:

Each Suk'kun represents solely an undivided ownership

interest in the relevant Trust Assets. Holders of Series A

Sukuk will have no recourse to the Series B Trust Assets.

Likewise, holders of Series B Sukuk will have no recourse

to the Series A Trust Assets. Creditors of the SPV and the

Trustee (in any capacity other than as trustee in respect of

the Sukuk), including, in particular, holders of certificates

relating to other trusts, will have no recourse to the Trust

Assets. Proceeds of the Trust Assets are the sole source of

payments on the Sukuk. The Sukuk do not represent an

interest in or obligation of any of the SPV, the Trustee,

Guthrie or any of their affiliates.

Accordingly,

Sukukholders will have no recourse to any assets of the

SPV, the Trustee (including, in particular other assets

comprised in other trusts), Guthrie (to the extent it fulfils all

of its obligations under the related Lease Agreements) or

any of their affiliates in respect of any shortfall in the

expected amounts from the Trust Assets.

13

Negative Pledge

:

So long as any of the Sukuk remains outstanding, the SPV

has undertaken that it will not create or have outstanding

any Security Interest upon, or with respect to, any of its

present or future business, undertaking, assets or revenues

(including any uncalled capital).

Guthrie's Covenants

:

Under the terms of each Lease Agreement, Guthrie will

agree, among other things:

(a) to maintain a Gearing Ratio of not more than 1.5;

(b) to maintain a Debt Service Coverage Ratio of not less

than 1.5; and

(c) not to declare or pay any dividend on its shares for so

long as:

(i)

the Debt Service Coverage Ratio is less than 1.5;

or

(ii) the amount deposited in any Reserve Account is,

either before or after such declaration or payment

of dividend, less than the amount required to be

deposited in such Reserve Account pursuant to

Condition 3(1),

provided that Guthrie shall, notwithstanding the above,

be allowed to declare and pay an annual gross dividend

of 5.0 per cent. (or such other percentage stipulated, as

amended from time to time, under the (Malaysian)

Trustee Act, 1949) of its paid-up capital at the time of

such declaration on each of its shares for so long as the

payment of such dividend constitutes one of the

criteria that must exist, under Section 4(2)(b) of the

(Malaysian) Trustee Act 1949, before a trust fund may

invest in the shares of any particular company. For

projections on the Debt Service Coverage Ratio of the

Group, see "Summary of Financial Information of the

Group - Selected Financial Information of the Group Projections".

Dissolution Events

:

Each of the following events, among others, constitutes a

Dissolution Event (each as more fully described in

Condition 10) in respect of each Trust:

(a) if default is made on any Lease Payments forming part

of the Trust Assets of such Trust and the default

continues for a period of 14 days; or

(b) if default is made in the payment of any amounts due

in respect of any Suk'kun of the Series related to such

Trust and such default continues for 14 days;

14

(c) if the Put Option or the Call Option is exercised in

respect of the Land Parcels forming part of the Trust

Assets of such Trust and Guthrie fails to deliver the

Dissolution Distribution Amount and complete its

purchase of such Land Parcels in accordance with the

related Lease Agreement;

(d) if Guthrie is subject to winding-up proceedings;

(e) if it is or will become unlawful for the Trustee to

perform or comply with any of its obligations under or

in respect of such Series of Sukuk or the related Trust

Agreement or any of such obligations shall be or

become unenforceable or invalid; or

(f) if the lease constituted by the related Lease Agreement

is terminated prior to the Scheduled Dissolution Date

in respect of such Series of Sukuk;

(g) if any event occurs which under the laws of the

relevant jurisdiction has or may have, in the Trustee's

opinion, an analogous effect to any of the events

referred to in paragraphs (d) and (e) above.

In the case of any event described above, the Trustee will

give notice of the occurrence of such Dissolution Event to

the holders of Series of Sukuk relating to such Trust with a

request to such holders to indicate if they wish such Trust to

be dissolved. If so requested in writing by the holders of at

least three-quarters in principal amount of such Series of

Sukuk then outstanding or if so directed by an Extraordinary

Resolution of the holders of such Series of Sukuk, the

Trustee shall (subject in each case to being indemnified to

its satisfaction), give notice to all the holders of such Series

of Sukuk that such Trust is to be dissolved and such Series

of Sukuk are, and they shall accordingly forthwith become,

due and repayable at their Dissolution Distribution Amount

on the Periodic Distribution Date following the date of such

notice (the "Unscheduled Dissolution Date").

Enforcement

:

Following the distribution of the Trust Assets in respect of a

Series of Sukuk to the related Sukukholders in accordance

with the Conditions and the relevant Trust Agreement, the

Trustee shall not be liable for any further sums or assets,

and accordingly such Sukukholders may not take any action

against the Trustee or any other person to recover any such

sum or asset in respect of such Sukuk or Trust Assets.

The Trustee shall not in any circumstances take any action

to enforce or to realise such Trust Assets or take any action

against Guthrie under the relevant Lease Agreement unless

and to the extent directed to do so by such Sukukholders

and then only to the extent indemnified to its satisfaction.

15

No Sukukholders shall be entitled to proceed directly

against Guthrie or enforce such Trust Assets unless (i) the

Trustee, having become bound so to proceed, fails to do so

within two months of becoming so bound and such failure is

continuing and (ii) the relevant Sukukholder (or such

Sukukholder together with the other Sukukholders who

propose to proceed directly against Guthrie or enforce such

Trust Assets) holds at least 75 per cent. of the outstanding

principal amount of the relevant Series of Sukuks.

The foregoing is subject to the following. After enforcing

or realising such Trust Assets and distributing the net

proceeds in accordance with Condition 3(2), the obligations

of the Trustee in respect of such Sukuk shall be satisfied and

no holder of such Sukuk may take any further steps against

the Trustee to recover any further sums in respect of such

Sukuk and the right to receive any such sums unpaid shall

be extinguished. In particular, no holder of such Sukuk shall

be entitled in respect thereof to petition or to take any other

steps for the winding-up of the SPV or the Trustee nor shall

any of them have any claim in respect of the trust assets of

any other trusts (including the Trust in respect of the other

Series of Sukuk) established by the Trustee.

Taxation

:

All distributions in respect of the Sukuk by or on behalf of

the Trust shall be made without withholding or deduction

for, or on account of, any present or future Taxes imposed

or levied by or on behalf of Labuan, unless the withholding

or deduction of the Taxes is required by law. In that event,

no additional amounts will be distributed to the

Sukukholders and distributions in respect of the Sukuk will

be made after withholding or deduction for, or on account

of, such Taxes. See "Conditions of Certificates - Taxation".

Use of Proceeds

:

The net proceeds of the issue of the Sukuk (after deducting

issuance expenses and the initial deposits required to be

made to the Series A Reserve Account and the Series B

Reserve Account) will be applied by the Trustee to acquire

from the SPV the relevant Trust Assets. Such proceeds will

be used by the SPV to purchase the beneficial interests in

the Land Parcels from the Sellers pursuant to the Purchase

Agreements. The Sellers will lend such proceeds to Guthrie

to be used to refinance a portion of the financing facilities

totalling RM1.5 billion entered into by Guthrie and its

subsidiaries to fund its Indonesian acquisition and

operations.

Listing

:

Application has been made to LFX to list the Sukuk on

LFX.

Rating

:

The Sukuk have been given an international rating of

BBB+is by MARC International Ltd. The letters "is" denote

Islamic Sukuk, asset-based instruments.

16

Offers of Sukuk

:

The Sukuk will be offered by way of private placement and

will be initially purchased by the Initial Purchasers pursuant

to the Certificate Purchase Agreement. See "Plan of

Distribution".

Transfer Restrictions

:

For a description of certain restrictions on offers, sales and

deliveries of the Sukuk and the distribution of offering

material relating to the Sukuk, see "Transfer Restrictions".

Governing Law

:

Each of the Trust Agreements, the Certificate Purchase

Agreement, the Transaction Administration Agreement and

the Sukuk will be governed by, and construed in accordance

with, New York law. The Lease Agreements and the

Purchase Agreements will be governed by Malaysian law.

17

Transaction Diagram

Sukuk

9

6

Semi-annual

distributions

derived from

Lease

Payments

Sukuk are issued, each of which

represents an undivided ownership

interest in the Trust Assets

5

Trustee

7

8

Proceeds of

Sukuk issue

paid directly to

Acquisition

Facility

Financiers to

fund

Acquisition

Facility Call

Option

SPV

Convey to Trustee for the benefit of

Sukukholders (i) beneficial interest in

Land Parcels and (ii) all rights under

Lease Agreements

Semiannual

Lease

Payments

4

Lease beneficial interest in

Land Parcels to Guthrie

Guthrie

1

3

Transfer

beneficial

interest in

the Land

Parcels to

the SPV

Seller

Transfer beneficial interest in Land

Parcels back to the Seller

Acquire

beneficial

interest in

Land Parcels

via

Acquisition

Facility Call

Option

2

Acquisition

Facility

Financiers

The above diagram sets out the principal terms for the issue of each Series of Sukuk. The Trust related

to each Series of Sukuk will only be dissolved on the relevant Dissolution Date. Upon such

dissolution, the beneficial interest in the relevant Land Parcels will be sold to Guthrie and the

purchase price paid by Guthrie will be used to redeem the relevant Series of Sukuk and the relevant

Trust will thereafter be dissolved.

18

Funds Flow Diagram

Transaction

Administrator

Sukukholders

d

Trustee

Trustee

owns the

designated

accounts

Transaction

Account

Sukuk

Proceeds

Account

Reserve

Account

a

b

c

Guthrie

a.

Lease Payments shall be deposited into the Transaction Account one month before each

Periodic Distribution Date. Principal payment for purchase of the Land Parcels under the

Lease Agreements shall be deposited into the Transaction Account in five equal instalments

on each of the Partial Deposit Dates.

b.

At any one time the amount equal to the following Lease Payment shall be deposited in the

Reserve Account. Guthrie shall top up if the amount in the Reserve Account falls below the

amount equal to the following Lease Payment.

c.

The net proceeds from the Sukuk issue (after deduction of expenses of the issue and the

amounts to be deposited into the Reserve Account) shall be deposited into the Sukuk Proceeds

Account and transferred thereafter to the Acquisition Facility Financiers.

d.

Transaction Administrator manages the payment, remittance and distribution of all payments

on the Sukuk.

19

INVESTMENT CONSIDERATIONS

The purchase of the Sukuk may involve substantial risks and is suitable only for sophisticated

investors who have the knowledge and experience in financial and business matters necessary to

enable them to evaluate the risks and the merits of an investment in the Sukuk. The following is a

summary of certain aspects of the issue about which prospective holders of the Sukuk should be

aware, but it is not intended to be exhaustive. Prospective purchasers of Sukuk should consider

carefully, in the light of their own financial circumstances and investment objectives, all the

information set forth in this Offering Circular before making an investment decision.

Considerations relating to Guthrie and its Business

Credit Risk

Proceeds of the Trust Assets are the sole source of payments on the Sukuk and such proceeds are

derived ultimately from Lease Payments made by Guthrie under the Lease Agreements. Accordingly,

payment due on the Sukuk will be directly related to Guthrie's creditworthiness and financial

condition. A prospective purchaser of Sukuk should have such knowledge and experience in financial

and business matters and expertise in assessing such credit risk that it is capable of evaluating the

merits, risks and suitability of investing in the Sukuk including the credit risk associated with Guthrie

and the Trust Assets. In particular, each prospective purchaser of Sukuk should note the investment

considerations set out below in respect of Guthrie and the Group.

Financial and Economic Factors Affecting Malaysia and Indonesia

Malaysia remains one of Guthrie's more important markets, with 15% of Malaysia's production

consumed domestically and remaining 85% exported in the form of refined palm oil products. No

assurances can be made as to future growth rates of Malaysia or the palm oil export markets as this

may be affected by (among others): (i) adverse developments in the economies of countries to which

Malaysia exports; (ii) changes in inflation and interest rates; (iii) taxation; (iv) the Malaysian

Government's budget deficit/surplus and (v) political and social developments affecting Malaysia.

The Federation of Malaysia currently maintains long-term investment grade foreign currency ratings

of Baa2 and BBB with a Stable outlook by both S&P and Moody's respectively.

In November 2000, Guthrie decided to venture into Indonesia through the Share Acquisition. The

long-term business and growth prospects in Indonesia will be dependent on the political stability and

economic policies of the country. At the present time there is uncertainty as to the political and

economic stability of Indonesia. S&P and Moody's current long-term foreign currency rating for

Indonesia are CCC+ and Caa1with a Stable outlook.

Issues relating to the Indonesian Acquisition

On 27th November, 2000, Guthrie entered into two sale and purchase agreements (each an

"Acquisition SPA") with PT Holdiko Perkasa and PT Gemahripah Pertiwi (together, the "Share

Vendors") and the Indonesian Bank Restructuring Agency ("IBRA"). Pursuant to one of the

Acquisition SPAs (the "Group A Acquisition SPA"), Guthrie acquired from the Share Vendors

shares in PT Salim Sawitindo and PT Bhaskaramulti Permata, each an Indonesian holding company

which provided Guthrie with indirect interests in a group of Indonesian companies ("Group A

Companies") involved in the palm oil industry. Under the second Acquisition SPA (the "Group B

Acquisition SPA"), Guthrie acquired from the Share Vendors shares in PT Anugerah Sumbermakmur

and PT Minamas Gemilang (together with PT Salim Sawitindo and PT Bhaskaramulti Permata, the

"Acquiree Companies"), each an Indonesian holding company, which provided Guthrie with indirect

interests in other Indonesian companies ("Group B Companies") involved in the palm oil industry.

20

On 12th December, 2000, the Acquisition SPAs were amended, modified and varied by two

designation agreements among the Share Vendors, Guthrie and IBRA designating Guthrie

International Investments (L) Limited and Laverton Holdings (Mauritius) Limited, newly incorporated

wholly-owned subsidiaries of Guthrie (together, the "Share Purchasers") as purchasers of the shares

in the Acquiree Companies (the "Acquired Shares") in place of Guthrie. The acquisition by Guthrie

of the Acquired Shares is referred to as the "Share Acquisition".

The aggregate purchase price for the Acquired Shares was U.S.$368 million (equivalent to

approximately RM1.398 billion) (the "Acquisition Purchase Price"). The Acquisition Purchase Price

was paid by Guthrie in cash and financed by bank financing in the form of a RM1.5 billion Islamic

Al-Ijarah Al-Muntahiyah Bit-Tamlik syndicated financial facility (the "Acquisition Facility").

Guthrie had arranged for the disbursement of funds for the settlement of the Acquisition Purchase

Price in view of the fulfillment of all conditions precedent set out in the Acquisition SPAs. Hence,

with the receipt in full of the funds by the Share Vendors on 15th March, 2001, the acquisition of

interests in the Group A Companies and Group B Companies were regarded as completed.

The terms of the Acquisition SPAs include certain representations from the Share Vendors. In respect

of certain of these representations ("Acquisition Recission Representations"), the Share Purchasers'

have been advised by their Indonesian counsel that their remedy for any breach thereof consists of a

recission of the Share Acquisition. If the Share Purchasers are successful in seeking to exercise their

rights of recission, they will be entitled to transfer all of the Acquired Shares back to the Share

Vendors and obtain a refund of the Acquisition Purchase Price (without interest or other costs). The

Share Purchasers have been further advised that such right of recission expires on the earlier of 1st

February, 2004 and any date on which IBRA ceases to exist. If the Share Purchasers decide to

exercise the rights of recission referred to above, there can be no assurance that the Share Vendors

will return to the Share Purchasers the total Acquisition Purchase Price.

One of the Acquisition Recission Representations is the representation that the shares in and the assets

of the Acquiree Companies and the Group B Companies are free from, inter alia, any third party

claim, property interest or other interest or right of ownership. After the completion of the Share

Acquisition, Guthrie conducted a post-closing due diligence exercise. In relation to the transfer of

certain shares in the Acquiree Companies and the Group B Companies:

(i)

there was no evidence of spousal consents having been obtained in respect of such transfers as

required under Indonesian Marital Law (Law No. 1/1974), which stipulates that all assets

owned or acquired by married couples during their marriage are deemed to be joint assets

(harta bersama) and that husband and wife should act jointly in relation to such joint assets,

unless a pre-nuptial agreement is entered into prior to a marriage which provides for a

separation of their assets owned or acquired during such marriage; and

(ii)

certain sale and purchase documents relating to such transfers had stipulated as a condition

precedent to the effectiveness of such transfers that the consent of certain named banks be

obtained and there has been no evidence that such bank consent has been obtained.

Guthrie has written to the Share Vendors and IBRA to seek their assistance in obtaining the spousal

consents or pre-nuptial agreements (if any). Guthrie has also asked the Share Vendors and IBRA, in

relation to those transfers in which the consent of a bank was made a condition precedent to the

effectiveness of such transfers, to obtain such consent for verification by Guthrie.

In respect of certain other representations ("Acquisition Escrow Representations"), U.S.$18 million

was deposited by the Share Vendors into an escrow account (the "Acquisition Escrow Account")

maintained with ABN AMRO Bank N.V., Jakarta Branch. A breach of any of such Acquisition

Escrow Representations would entitle the Share Purchasers to be paid damages from the monies in the

21

Acquisition Escrow Account. In the post-completion due diligence exercise conducted by Guthrie, it

was discovered that the Share Vendors may be in breach of certain of such Acquisition Escrow

Representations.

A first escrow claim for approximately U.S.$11,000,000 has been submitted to the Share Vendors.

The Share Vendors have accepted part of the amount claimed and have disputed the remainder,

amounting to approximately U.S.$9,000,000. The Share Purchasers are in the process of resolving

with the Share Vendors the disputed claims and the exchange rate at which such claims should be

calculated.

A second potential claim against the Acquisition Escrow Account relates to certain employee benefits

issues. The employees' manual of the Group B Companies includes a provision to the effect that if any

employees of the Group B Companies were to resign within a period of two years from a change in

ownership or change of status of the Group B Companies, such employees would be entitled to

compensation payment as provided under Presidential Decree 150, commonly referred to as "Kep

Men 150". Such amount may be claimed from the Acquisition Escrow Account.

In order to claim any amounts in the Acquisition Escrow Account, the Share Purchasers must submit

all escrow claims by the date (the "Acquisition Escrow Termination Date") which is the later of (i)

12th September, 2001 and (ii) the date 60 days after the date of receipt by the Share Purchasers of the

last of the "Final Tax Clearance" letters or "Surat Ketetapan Pajak" which are to be issued upon

completion of the tax audit by the Indonesian tax authorities on PT Anugerah Sumbermakmur, PT

Minamas Gemilang and the Group B Companies. To date only a few Final Tax Clearance letters

have been issued. Any balance on deposit in the Acquisition Escrow Account will be released to the

Share Vendors on the later of the Acquisition Escrow Termination Date and the first date as of which

there is no pending claim against the Acquisition Escrow Account.

Guthrie's post-completion due diligence exercise is ongoing and, as a result, further issues relating to

the Share Vendors' representations and warranties in the Acquisition SPAs may be discovered.

Relationship with the Government of Malaysia

The substantial shareholders of Guthrie as at 31st October, 2001 were as follows:

Shareholders

Permodalan Nasional Berhad ("PNB")#

Sekim Amanah Saham Bumiputera ("ASB")

Employees Provident Fund Board

+

*

#

Stake (%)

41.83+

27.20*

6.74

13.50% of the shares are held by Mayban Nominees (Tempatan) Sdn. Bhd. as nominee for PNB

The shares are held by Amanah Raya Nominees (Tempatan) Sdn Berhad as nominee for ASB

Together with the shares held by the various units trusts (including ASB) managed by PNB, PNB holds 72.04% of the shares in Guthrie

PNB is wholly-owned by the Malaysian government. The Minister of Finance, Incorporated holds

one share in PNB and the remainder of the shares are held by Yayasan Pelaburan Bumiputra

(Bumiputra Investment Foundation). Yayasan Pelaburan Bumiputra ("YPB") is a company

incorporated in Malaysia and limited by guarantee. The Board of Trustees of YPB comprises Hon.

Datuk Seri Dr. Mahathir Mohamad, the Prime Minister of Malaysia, Hon. Datuk Seri Abdullah

Ahmad Badawi, the Deputy Prime Minister of Malaysia, Hon. Datuk Paduka Rafidah Aziz, the

Minister of International Trade and Industry, Hon. Tan Sri Dato' Seri Ahmad Sarji Abdul Hamid, the

Chairman of PNB and Hon. Tan Sri Geh Ik Cheong.

The principal activities of the PNB group of companies consist of investment holding, management of

property, property trusts and unit trusts, providing management services, acting as investment agent

and portfolio manager and providing equity financing to companies. PNB is principally involved in

22

the acquisition and holding of shares to promote greater ownership of share capital in the corporate

sector in Malaysia by the Bumiputera (indigenous people).

By virtue of PNB's shareholding in Guthrie (including PNB's indirect interest through the unit trusts

managed by it), out of Guthrie's 10 directors and two alternate directors, five of Guthrie's directors

(including the Chairman) and one of Guthrie's alternate directors are nominees of PNB.

Foreign Exchange Exposure and Exchange Controls

Changes in exchange rates influence Guthrie's results of operations. Guthrie's crude palm oil sales are

based on the traded crude palm oil price, which is quoted in U.S. dollars. As of the date hereof, the

U.S. dollar is pegged against the Ringgit at a rate of RM3.80 to U.S.$1.00. This acts as a natural

hedge for Guthrie's U.S. dollar indebtedness. Due to this peg, any rise in the crude palm oil price in

U.S. dollars will be earnings positive to Guthrie as this will be similarly be reflected in a matching rise

in Guthrie's operating income. There can be no assurance that the Ringgit peg will continue nor, if it

is removed, that the impact thereof will not have a negative effect on Guthrie and its financial

conditions and prospects.

Malaysia has in place limited currency controls for the purposes of economic stability. These apply

primarily in respect of short-term equity investments. In respect of external borrowing, Malaysian

residents are required to obtain the permission of the Malaysian Controller of Foreign Exchange (the

"FX Controller") before they can obtain credit facilities, including financial guarantees from nonresidents, in foreign currency equivalent to more than RM10.0 million in aggregate. Permission has

generally been given for all foreign loans raised on reasonable terms to finance productive activity in

Malaysia and for foreign exchange income generating investments overseas.

Guthrie has obtained the permission of the FX Controller for the remittance of the RM1.5 billion

raised earlier for the payment of the Acquired Shares. The FX Controller has asked that Guthrie refinance this sum via a U.S. dollar financing. It is anticipated therefore, that the FX Controller will

provide the requisite approvals for Guthrie to remit the lease payments under the Lease Agreements to

the Trusts in order for the Trusts in turn to meet its payment obligations incurred under the Sukuk.

Currently, there are no restrictions on the repatriation of profits, capital derived from investments in

Indonesia and on the transfer of funds abroad. There are also no restrictions on foreign exchange

operations, specifically including the purchase and sale of foreign exchange and transfers and all other

types of international settlements. However, there can be no assurance that there will be no

restrictions on the repatriation of profits, capital derived from investments in Indonesia and on the

transfer of funds abroad in the future.

Competition

The demand for crude palm oil is dependent upon the world-wide traded prices for competing oils,

such as soya, rapeseed, sunflower seed and other such substitutes for palm oil . As such, good soya

harvests will normally lower the price and impact demand levels for palm oil. Similarly, palm kernel

oil demand is closely tied to that for coconut oil, as they are close substitutes. The demand for these

lauric oils is driven by non-food uses where they have an environmental advantage over mineral oil.

Aside from world-wide demand, supply and price of oils and fats, there are a number of other factors

affecting the movement of palm oil prices (some of which are interrelated and unpredictable), which

could cause price volatility in the world vegetable oils market. These include: (i) import and export

tariff barriers; (ii) agricultural policies imposed by importing and exporting countries; and (iii)

weather and other agricultural influences.

23

Environmental Issues

Guthrie and its operations are required to comply with various environmental laws relating to water,

air, noise pollution and the disposal of waste materials. Although Guthrie believes that it is in

compliance in all material respects to these environmental laws, some risks of environmental costs

and liabilities is inherent in its operations and there can be no assurance that material costs and

liabilities will not be incurred in the future in this regard. Compliance with environmental laws and

regulations may add extra costs to the development and replanting of oil palm.

Accounting Standards

Guthrie prepares its financial statements using generally accepted accounting principles in Malaysia

issued by the Malaysian Accounting Standards Board which differ in certain respects from

international accounting standards. As a result, Guthrie's financial statements and results of

operations may differ from those of companies in other countries.

Cashflow Projections

The primary source of repayment for the Sukuk is expected to be from Guthrie's operational

cashflows. A summary of Guthrie’s projected cashflow is appended to this Offering Circular as

Appendix B hereto. The cashflow is dependent on various key assumptions and has been prepared to

the best of Guthrie's current market knowledge.

Considerations relating to the Sukuk

Limited Recourse

Each Suk'kun represents solely an undivided ownership interest in the relevant Trust Assets. Holders

of Series A Sukuk will have no recourse to the Series B Trust Assets. Likewise, holders of Series B

Sukuk will have no recourse to the Series A Trust Assets. Creditors of the SPV and the Trustee (in

any capacity other than as trustee in respect of the Sukuk), including, in particular, holders of

certificates relating to other trusts, will have no recourse to the Trust Assets. Proceeds of the Trust

Assets are the sole source of payments on the Sukuk. The Sukuk do not represent an interest in or

obligation of any of the SPV, the Trustee, Guthrie or any of their affiliates. Accordingly,

Sukukholders will have no recourse to any assets of the SPV, the Trustee (including, in particular

other assets comprised in other trusts), Guthrie (to the extent it satisfies all of its obligations under the

related Lease Agreements) or any of their affiliates in respect of any shortfall in the expected amounts

from the Trust Assets.

Interest in the Land Parcels

The issue of the Sukuk and the related transactions involve the transfer of the beneficial interest in the

Land Parcels by the Sellers to the SPV. Such transfer of only the beneficial interest in (and not the

legal title to) the Land Parcels is (i) to facilitate the issue of the Sukuk and (ii) does not and is not

intended to convey ownership in the Land Parcels to the SPV within the meaning of the National Land

Code 1965 of Malaysia. Consequently, the Trustee also would only acquire a beneficial interest in the

Land Parcels. If for any reason the Land Parcels or any part thereof are proposed to be sold by the

Trustee, such sale would be subject to the consent or approval of the relevant land authority. By virtue

of Section 214A of the National Land Code 1965, any sale of the Land Parcels to two or more persons

would require the consent of the Estate Land Board as the Land Parcels fall within the meaning of

estate land as defined in Section 214A. By virtue of Part Thirty-Three (A) of the National Land Code

1965, a foreigner or a foreign company may acquire land only after having obtained the approval of

the relevant State Authority.

24

Limited Liquidity

No secondary market for the Sukuk currently exists and, in the event that a secondary market in the

Sukuk does develop, whether as a result of the Initial Purchasers offering to buy such Sukuk or

otherwise, there can be no assurance that it will continue. Accordingly, the purchase of a Suk'kun is

suitable only for investors who can bear the risks associated with a lack of liquidity in the Sukuk and

the financial and other risks associated with an investment in the Sukuk.

Provision of Information

None of the Trustee, the Initial Purchasers or any of their affiliates makes any representation as to the

credit quality of Guthrie or the Trust Assets. Any of such persons, whether by virtue of the types of

relationships described herein or otherwise, may have acquired, or during the term of any Sukuk may

acquire, non-public information with respect to Guthrie or the Trust Assets. None of such persons is

under any obligation to make such information directly available to any Sukukholder.

Restrictions on Malaysian Residents Acquiring Sukuk

Residents of Malaysia are not permitted to purchase the Certificates without first having had and

obtained all the necessary approvals from all relevant regulatory authorities, including but not limited

to all the necessary approvals from Bank Negara Malaysia. The onus of obtaining such approvals is on

the residents concerned and none of the Trustee, the Initial Purchasers, the SPV or Guthrie accepts

any responsibility for the purchase of any Sukuk by the residents as aforesaid without the necessary

approvals being in place. Malaysian residents are advised to seek independent professional advice as

may be necessary before making any such purchase.

Business Relationships

The Trustee, the Initial Purchasers or any of their affiliates may have existing or future business

relationships with Guthrie or any other member of the Group (including, but not limited to, lending,

depository, risk management, advisory and banking relationships), and will pursue actions and take

steps that they deem or it deems necessary or appropriate to protect their or its interests arising

therefrom without regard to the consequences for such member of the Group or for any Sukukholder

or otherwise (including, without limitation any action which might constitute or give rise to a

Dissolution Event).

Legality of Purchase

None of the Trustee, the Initial Purchasers, Guthrie or any of their affiliates has or assumes

responsibility for the lawfulness of the acquisition of any Sukuk by a prospective purchaser of any

Sukuk, whether under the laws of the jurisdiction of its incorporation or the jurisdiction in which it

operates (if different), or for compliance by that prospective purchaser with any law, regulation or

regulatory policy applicable to it.

Independent Review and Advice

Each prospective purchaser of a Suk'kun must determine, based on its own independent review and

such professional advice as it deems appropriate under the circumstances, that its acquisition of the

Sukuk (i) is fully consistent with its (or if it is acquiring the Sukuk in a fiduciary capacity, the

beneficiary's) financial needs, objectives and condition, (ii) complies and is fully consistent with all

investment policies, guidelines and restrictions applicable to it (whether acquiring the Sukuk as

principal or in a fiduciary capacity) and (iii) is a fit, proper and suitable investment for it (or if it is

25

acquiring the Sukuk in a fiduciary capacity, for the beneficiary), notwithstanding the clear and

substantial risks inherent in investing in or holding the Sukuk.

Withholding Tax

If the Trustee is obliged to deduct or withhold for or on account of Taxes as set out in Condition 8, or

if any tax or duty is deducted or withheld from payments received by the Trustee on the Trust Assets,

the Trustee shall be under no obligation to pay, and the other assets (if any) of the Trustee (including,

in particular, other assets constituting other trust funds) will not be available for payment of, the

resultant shortfall.

Rating

It is a condition of the issuance of the Sukuk that the Sukuk be assigned, on issue, an international

rating of BBB+is by MARC International Ltd for timely payment on the Sukuk. The rating will

address the likelihood of the receipt by Sukukholders of the distributions to which they are entitled

under the Conditions which is a function of Guthrie's ability to make payments under the Lease

Agreements. A rating is not a recommendation to buy, sell or hold securities and may be subject to

revision, suspension or withdrawal at any time. There is no assurance that a rating will remain for any

given period of time or that a rating will not be lowered or withdrawn entirely by the relevant rating

agency if in its judgment circumstances in the future so warrant. The rating of the Sukuk will be

based, inter alia, on the structure of the issue.

26

CONDITIONS OF THE CERTIFICATES

The following is the text of the Conditions of the Certificates which (subject to modification) will be

endorsed on each Certificate in definitive form (if issued):

Each of the U.S.$50,000,000 Trust Certificates due 2004, Series A (the "Series A Certificates")

represents an undivided 1.0 per cent. ownership interest in the assets (the "Series A Trust Assets")

held on trust (the "Series A Trust") for the holders of such Certificates pursuant to a declaration of

trust (the "Series A Trust Agreement") dated the Closing Date made between the SPV (as defined in

Condition 3(1)) and Bank Islam (L) Ltd, as trustee (the "Trustee", which expression shall include its

successor(s)) for the holders of the Series A Certificates (the "Series A Certificateholders") and as

authentication agent (in such capacity, the "Authentication Agent").

Each of the U.S.$100,000,000 Trust Certificates due 2006, Series B (the "Series B Certificates")

represents an undivided 0.5 per cent. ownership interest in the assets (the "Series B Trust Assets"

and, together with the Series A Trust Assets, the "Trust Assets") held on trust (the "Series B Trust"

and, together with the Series A Trust, the "Trusts") for the holders of such Certificates pursuant to a

declaration of trust (the "Series B Trust Agreement" and, together with the Series A Trust

Agreement, the "Trust Agreements") dated the Closing Date made between the SPV and the Trustee

as trustee for the holders of the Series B Certificates (the "Series B Certificateholders" and, together

with the Series A Certificateholders, the "Certificateholders") and as Authentication Agent.

In these Conditions, the Series A Certificates and the Series B Certificates shall collectively be

referred to as the "Certificates" and any reference to a "Series" of Certificates shall be deemed to be

a reference to either the Series A Certificates or the Series B Certificates, as the context requires.

References in these Conditions to "Certificates" shall be references to the Certificates as represented

by a global Certificate or definitive Certificates, as described in Condition 1.

Payments relating to the Certificates will be made pursuant to a transaction administration agreement

dated the Closing Date (the "Transaction Administration Agreement") made among Kumpulan

Guthrie Berhad ("Guthrie"), Bank Islam (L) Ltd, as Trustee and as Authentication Agent and ABN

AMRO Bank N.V., Labuan Branch as transaction administrator (the "Transaction Administrator",

which expression shall include any successor transaction administrator).

The statements in these Conditions include summaries of, and are subject to, the detailed provisions of

the Trust Agreements and the Transaction Administration Agreement. In these Conditions, words and

expressions defined and rules of construction and interpretation set out in the Master Definitions

Schedule dated the Closing Date signed by, among others, the SPV, the Trustee and the Transaction

Administrator (the "Master Definitions Schedule") shall, unless the context otherwise requires, have

the same meanings herein. Copies of the Trust Agreements, the Transaction Administration

Agreement and the Master Definitions Schedule are available for inspection during normal business

hours by the Certificateholders at the principal office for the time being of the Trustee, being at the

date of issue of the Certificates at Level 15, Block 4, Financial Park Complex, Jalan Merdeka, 87000

Labuan F.T., Malaysia and at the specified office of the Transaction Administrator. The

Certificateholders are entitled to the benefit of, are bound by, and are deemed to have notice of, all the

provisions of the relevant Trust Agreement and the Transaction Administration Agreement applicable

to them.

27

1.

FORM, DENOMINATION AND TITLE

(1)

Form and Denomination

The Certificates are in bearer form, serially numbered, in the denominations of U.S.$500,000

each.

(2)

Title

Subject as set out below (i) title to the Certificates will pass by delivery and in accordance

with applicable law in accordance with these Conditions and the provisions of the relevant

Trust Agreement and (ii) the bearer of any Certificate will (except as otherwise required by

law) be treated as the absolute owner thereof (whether or not overdue and notwithstanding

any notice of ownership or writing thereon or notice of any previous loss or theft thereof) for

all purposes.

Each Series of Certificates will be represented by a global Certificate (the "Global

Certificate") in bearer form, without coupons for the payment of distributions attached,

which will be deposited on behalf of the purchasers of the Certificates with Labuan

International Financial Exchange Inc, as custodian and clearing system for the Certificates

(the "Depository") on or prior to the Closing Date, date of issue of the Certificates. Each

Global Certificate will only be exchangeable for related definitive Certificates upon the

occurrence of an Exchange Event. For these purposes, "Exchange Event" means that (i) a

Dissolution Event has occurred or (ii) the Depository has been closed for business for a

continuous period of 14 days (other than by reason of holiday, statutory or otherwise) or has

announced an intention permanently to cease business or have in fact done so and no

alternative clearing system satisfactory to the Trustee is available.

(3)

Global Certificates

For so long as any of the Certificates represented by a Global Certificate is held by the

Depository, each person who is for the time being shown in the records of the Depository as

the holder of a particular principal amount of such Certificate or interests in such Certificate

(in which regard any certificate or other document issued by the Depository as to the principal

amount of such Certificate or interests in such Certificate standing to the account of any

person shall be conclusive and binding for all purposes save in the case of manifest error)

shall be treated by the Trustee and the Transaction Administrator as the holder of such

principal amount of such Certificate or interests in such Certificate for all purposes other than

with respect to payments in respect of such Certificate or interests in such Certificate, for

which purpose the bearer of the relevant Global Certificate shall be treated by the Trustee and

the Transaction Administrator as the holder of such nominal amount of such Certificate or

interests in such Certificate in accordance with and subject to the terms of the relevant Global

Certificate. The expressions "Certificateholders" and "holder of Certificates" and related

expressions shall be construed accordingly.

2.

STATUS; LIMITED RECOURSE

(1)

Status

Each Series A Certificate evidences an undivided 1.0 per cent. ownership interest in the Series

A Trust Assets and will rank pari passu, without any preference, with the other Series A

Certificates. Each Series B Certificate evidences an undivided 0.5 per cent. ownership interest

in the Series B Trust Assets and will rank pari passu, without any preference, with the other

Series B Certificates. Holders of Series A Certificates will have no recourse to the Series B

28