Exercise 1-1

advertisement

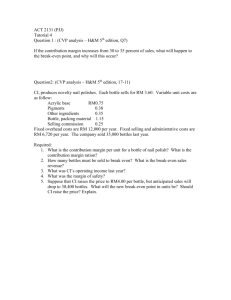

CHAPTER 3 PROFITABILITY ANALYSIS AND PLANNING Exercise 3-3 a. Sales Variable costs Contribution margin $800,000 (380,000) $420,000 Contribution margin ratio = $420,000/$800,000 = 0.525 Annual break-even dollar sales volume = $210,000/0.525 = $400,000 b. Annual margin of safety in dollars: Sales $800,000 Break-even sales dollars (400,000) Margin of safety $400,000 c. To determine the variable and total costs lines, it is necessary to compute the variable cost ratio: Variable = variable costs = $380,000 = 0.475 cost ratio sales $800,000 At a volume of $1,000,000 sales dollars, variable costs are $475,000. $1,000,000 Profit = $210,000 Total Revenues and Total Costs $750,000 Fixed costs = $210,000 $500,000 Variable costs = $380,000 $250,000 $0 $0 $250, $500, $750, $1,00 000 000 000 0,000 Total Revenues d. Revised annual break-even dollar sales: ($210,000 + $52,500)/0.525 = $500,000 59 60 Chapter 3 Exercise 3-8 a. Contribution margin Sales Contribution margin ratio $380,000 950,000 0.40 Break-even point in sales dollars = $190,000/0.40 = $475,000 b. Current sales Break-even sales Margin of safety $950,000 (475,000) $475,000 c. Current fixed costs Impact of increase New fixed costs $190,000 50,000 $240,000 Revised break-even point = $240,000/0.40 = $600,000 d. Required before-tax income = $200,000/(1 0.36) = $312,500 Sales volume required to provide an after-tax income of $200,000: ($190,000 + $312,500)/0.40 = $1,256,250 e. Sales Variable costs (60% of sales) Contribution margin (40% of sales) Fixed costs Net income before taxes Income taxes (36%) Net income after taxes $1,256,250 (753,750) $ 502,500 (190,000) $ 312,500 (112,500) $ 200,000 Profitability Analysis and Planning 61 Problem 3-16 Once the following, or a similar, format is established, each case is solved by filling in the given information and working toward the unknowns. Case 1 1,000 Unit sales $20,000 Case 2 800 Case 3 4,300?* Sales revenue Variable costs: Unit Unit sales Total Contribution margin Fixed costs Net income $ 10 1,000 ( 10,000) $10,000 ? (8,000) $ 2,000 ? $ 1 $ 12 800 4,300 (800) (51,600 $ 800 $ 86,000 ? (400)? (80,000) $ 400 $ 6,000?# $ 5? 3,000? 15,000 ? $45,000 ? (30,000) ? $15,000?# Unit cont. margin: Cont. margin Unit sales Unit contribution $10,000 ? 1,000 $ 10 ? $ 800 800 $ 1? $86,000 ? 4,300 ? $ 20 ? $45,000 ? 3,000 ? $ 15 Break-even point: Fixed costs $8,000 Unit cont. margin $10 ? Unit break-even point 800 ? $ 400 $1 ? 400 ? $ 80,000 $20 ? 4,000 $30,000 ? $15 2,000 Margin of safety (unit sales less unit breakeven point) 200 ? $ 1,600? $137,600? Case 4 3,000?* 400 ? $60,000 300 *Solved as the unit break-even point plus the margin of safety. #Solved as the unit contribution margin times margin of safety. 1,000 62 Chapter 3 Problem 3-19 a. Prior to solving this problem it is necessary to determine the variable costs per unit, the fixed costs per year, and the unit selling price. Using the high-low method: Variable costs per unit = ($90,000 $75,000)/(8,000 5,000) = $5 Fixed costs = $90,000 $5(8,000) = $50,000 or = $75,000 $5(5,000) = $50,000 Unit selling price = $65,000/5,000 = $104,000/8,000 = $13 Unit contribution margin = $13 $5 = $8 Break-even point = $50,000/$8 = 6,250 units b. Sales volume required to earn a profit of $10,000: ($50,000 + $10,000)/$8 = 7,500 units Profitability Analysis and Planning 63 Problem 3-22 a. Contribution margin ratio of Touring model = ($80.00 $52.80)/$80.00 = 0.34 b. Required before-tax profit = $24,000/(1 0.40) = $40,000 Required sales of touring model = ($316,800 + $40,000)/($80.00 $52.80) = 13,118 pairs c. Profit of Mountaineering model = Profit of Touring model Let X = unit sales $88.00X ($369,600 + $52.80X) = $80.00X ($316,800 + $52.80X) $35.2X $369,600 = $27.2X $316,800 $8X = $52,800 X = $52,800/$8 X = 6,600 pairs Before-tax profit or (loss): Mountaineering: ($88.00 $52.80)6,600 $369,600 = $(137,280) Before-tax profit or (loss): Touring: ($80.00 $52.80)6,600 $316,800 = $(137,280) d. Contribution margin ratio of Mountaineering model = ($88.00 $52.80)/$88.00 = 0.40 Contribution margin ratio of Touring model = ($80.00 $52.80)/$80.00 = 0.34 Profit of Mountaineering model = Profit of Touring model 0.40X $369,600 = 0.34X $316,800 0.06X = $52,800 X = $52,800/0.06 X = $880,000 Before-tax profit or (loss): Mountaineering: 0.40($880,000) $369,600 = $(17,600) Before-tax profit or (loss): Touring: 0.34($880,000) $316,800 = $(17,600) 64 Chapter 3 Problem 3-22 (cont.) e. The Siberian Ski Company should produce the Mountaineering model. This model is shown, below, to have a higher profit at a sales volume of 12,000 pairs. Because it has a higher unit contribution margin, this profit advantage will increase beyond 12,000 pairs. Minimum profit of Mountaineering model = ($88.00 $52.80)12,000 $369,600 = $52,800 Minimum profit of Touring model = ($80.00 $52.80)12,000 $316,800 = $9,600 f. Break-even point of Mountaineering model = $369,600/($88.00 $52.80) = 10,500 pairs The problem is to find the variable costs for the Touring model that will produce the same break-even point. Let b represent this cost. Then: $316,800/($80.00 b) = 10,500 ($80.00 b)/$316,800 = 1/10,500 $80 b = $316,800/10,500 $80 b = $30.17 b = $80 $30.17 b = $49.83 Current variable costs Variable cost to produce desired break-even point Decrease in variable costs per pair g. New variable costs: $52.80 0.90 = $47.52 New fixed costs: $316,800 1.10 =$348,480 New break-even point = $348,480/($80.00 $47.52) of touring ski = 10,729 pairs $52.80 (49.83) $ 2.97