Equity Method Accounting Solutions Manual

advertisement

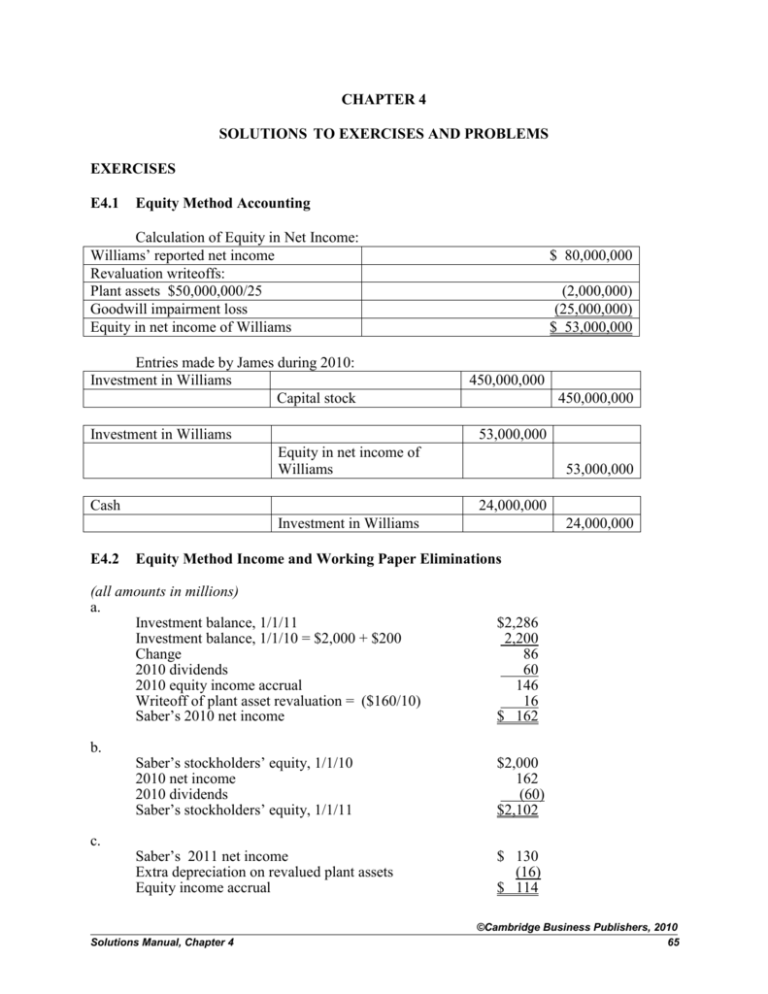

CHAPTER 4 SOLUTIONS TO EXERCISES AND PROBLEMS EXERCISES E4.1 Equity Method Accounting Calculation of Equity in Net Income: Williams’ reported net income Revaluation writeoffs: Plant assets $50,000,000/25 Goodwill impairment loss Equity in net income of Williams Entries made by James during 2010: Investment in Williams Capital stock Investment in Williams $ 80,000,000 (2,000,000) (25,000,000) $ 53,000,000 450,000,000 450,000,000 53,000,000 Equity in net income of Williams Cash 53,000,000 24,000,000 Investment in Williams E4.2 Equity Method Income and Working Paper Eliminations (all amounts in millions) a. Investment balance, 1/1/11 Investment balance, 1/1/10 = $2,000 + $200 Change 2010 dividends 2010 equity income accrual Writeoff of plant asset revaluation = ($160/10) Saber’s 2010 net income b. c. 24,000,000 $2,286 2,200 86 60 146 16 $ 162 Saber’s stockholders’ equity, 1/1/10 2010 net income 2010 dividends Saber’s stockholders’ equity, 1/1/11 $2,000 162 (60) $2,102 Saber’s 2011 net income Extra depreciation on revalued plant assets Equity income accrual $ 130 (16) $ 114 Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 65 d. (C) Equity income accrual 114 Dividends – Saber Investment in Saber 40 74 (E) Stockholders’ Equity – Saber 2,102 Investment in Saber 2,102 (R) Plant assets Goodwill 160 40 Accumulated depreciation Investment in Saber 16 184 (O) Depreciation expense 16 Accumulated depreciation e. 16 At the beginning of 2022, the plant assets are fully depreciated and the remaining balance for goodwill is $40 - $30 = $10. (R) Plant assets Goodwill 160 10 Accumulated depreciation Investment in S 160 10 Entry (O) is not needed since no revaluations are written off in 2022. E4.3 Consolidation at End of First Year a. The acquisition entry is as follows: Investment in Saddlestone Merger expenses 10,300,000 250,000 Capital stock Contingent consideration liability Cash Calculation of 2011 Equity in Net Income: Saddlestone’s reported net income Revaluation writeoff: Identifiable intangibles $2,000,000/5 Equity in net income of Saddlestone ©Cambridge Business Publishers, 2010 66 10,000,000 300,000 250,000 $ 3,000,000 (400,000) $ 2,600,000 Advanced Accounting, 1st Edition Peak’s equity method entries for 2011: Investment in Saddlestone 2,600,000 Equity in net income of Saddlestone Cash 2,600,000 1,000,000 Investment in Saddlestone b. 1,000,000 Calculation of goodwill is as follows: Acquisition cost Book value of Saddlestone Excess of acquisition cost over book value Identifiable intangibles Goodwill $ 10,300,000 (7,200,000) 3,100,000 (2,000,000) $ 1,100,000 Consolidation working paper eliminating entries for 2011: (C) Equity in net income of Saddlestone 2,600,000 Dividends – Saddlestone Investment in Saddlestone (E) Stockholders’ equity— Saddlestone, 1/1 1,000,000 1,600,000 7,200,000 Investment in Saddlestone (R) Identifiable intangibles Goodwill 7,200,000 2,000,000 1,100,000 Investment in Saddlestone (O) Amortization expense 400,000 Identifiable intangibles Solutions Manual, Chapter 4 3,100,000 400,000 ©Cambridge Business Publishers, 2010 67 E4.4 Eliminating Entries after First and Second Years a. Calculation of Equity in net income for 2012: Safeco’s reported net income Revaluation writeoffs: Equipment $500,000/5 Inventory 90% x $200,000 Goodwill impairment loss Equity in net income of Safeco $ 1,600,000 (100,000) (180,000) (50,000) $ 1,270,000 Peerless’s entries for 2012: Investment in Safeco 8,000,000 Cash 8,000,000 Investment in Safeco 1,270,000 Equity in net income of Safeco 1,270,000 Cash 600,000 Investment in Safeco 600,000 Calculation of goodwill is as follows: Acquisition cost Book value of Safeco Excess of acquisition cost over book value Fair value less book value: Equipment Inventory Goodwill $ $ 500,000 200,000 8,000,000 (7,000,000) 1,000,000 (700,000) $ 300,000 Consolidation working paper eliminating entries for 2012: (C) Equity in net income of Safeco 1,270,000 Dividends – Safeco Investment in Safeco (E) Stockholders’ equity—Safeco, 1/1 600,000 670,000 7,000,000 Investment in Safeco ©Cambridge Business Publishers, 2010 68 7,000,000 Advanced Accounting, 1st Edition (R) Equipment, net Inventory Goodwill 500,000 200,000 300,000 Investment in Safeco (O) Depreciation expense Cost of goods sold Goodwill impairment loss 1,000,000 100,000 180,000 50,000 Equipment, net Inventory Goodwill b. 100,000 180,000 50,000 Calculation of Equity in Net Income for 2013: Safeco’s reported net income Revaluation writeoffs: Equipment $500,000/5 Inventory 10% x $200,000 Equity in net income of Safeco $ 2,000,000 (100,000) (20,000) $ 1,880,000 Peerless’s equity method entries for 2013: Investment in Safeco 1,880,000 Equity in net income of Safeco Cash 1,880,000 800,000 Investment in Safeco 800,000 The Investment in Safeco balance at December 31, 2013 is $8,000,000 + 1,270,000 – 600,000 + 1,880,000 – 800,000 = $9,750,000. Consolidation working paper eliminating entries for 2013: (C) Equity in net income of Safeco 1,880,000 Dividends – Safeco Investment in Safeco (E) Stockholders’ equity—Safeco, 1/1 8,000,000 Investment in Safeco Solutions Manual, Chapter 4 800,000 1,080,000 8,000,000 ©Cambridge Business Publishers, 2010 69 Stockholders’ equity—Safeco at 1/1/2013 = $7,000,000 + 1,600,000 – 600,000 = $8,000,000 (R) Equipment, net Inventory Goodwill 400,000 20,000 250,000 Investment in Safeco (O) Depreciation expense Cost of goods sold 670,000 100,000 20,000 Equipment, net Inventory 100,000 20,000 E4.5 Equity Method, Eliminating Entries, Several Years after Acquisition a. Calculation of total goodwill is as follows: Acquisition cost Book value of Brussels Excess of acquisition cost over book value Fair value less book value: Land Buildings Identifiable intangibles Long-term debt Goodwill b. $ $ 450,000 (400,000) 1,000,000 250,000 5,000,000 (2,000,000) 3,000,000 (1,300,000) $ 1,700,000 Calculation of Equity in net income for 2010: Brussels’ reported net income Revaluation writeoffs: Buildings $(400,000)/20 Long-term debt $250,000/10 Goodwill impairment loss Equity in net income of Brussels ©Cambridge Business Publishers, 2010 70 $ 400,000 20,000 (25,000) (50,000) $ 345,000 Advanced Accounting, 1st Edition c. Calculation of Investment in Brussels, 12/31/10 Investment in Brussels, 1/1/02 Brussels’ reported income, 2002-2009 Brussels’ reported dividends, 2002-2009 Revaluation writeoffs, 2002-2009: Buildings $[(400,000)/20] x 8 Identifiable intangibles (full balance) Long-term debt $[250,000/10] x 8 Goodwill impairment loss Investment in Brussels, 1/1/10 Equity in net income, 2010 Brussels’ dividends, 2010 Investment in Brussels, 12/31/10 d. $ 5,000,000 3,500,000 (1,000,000) 160,000 (1,000,000) (200,000) (300,000) 6,160,000 345,000 (90,000) $ 6,415,000 Consolidation working paper eliminating entries for 2010: (C) Equity in net income of Brussels 345,000 Dividends – Brussels Investment in Brussels 90,000 255,000 (E) Stockholders’ equity—Brussels, 1/1 4,500,000 Investment in Brussels 4,500,000 Stockholders’ equity, January 1, 2010 = $2,000,000 + 3,500,000 – 1,000,000 = $4,500,000. (R) Land Long-term debt Goodwill 450,000 50,000 1,400,000 Investment in Brussels 1,660,000 Buildings, net 240,000 Revaluations at January 1, 2010 = original revaluations less writeoffs for 2002-2009. (O) Interest expense Buildings, net Goodwill impairment loss 25,000 20,000 50,000 Long-term debt Depreciation expense Goodwill Solutions Manual, Chapter 4 25,000 20,000 50,000 ©Cambridge Business Publishers, 2010 71 E4.6 Consolidation after Several Years Calculation of total goodwill is as follows: Acquisition cost Book value of Baker Excess of acquisition cost over book value Fair value less book value: Buildings Goodwill $ 7,500,000 (5,000,000) 2,500,000 (1,000,000) $ 1,500,000 Calculation of Equity in Net Income for 2011: Baker’s reported net income Revaluation writeoffs: Buildings $1,000,000/25 Goodwill impairment loss Equity in net income of Baker $ 300,000 (40,000) (100,000) $ 160,000 Calculation of Investment balance at December 31, 2011: Investment in Baker, 12/31/04 Baker reported income, 2005-2010 Baker reported dividends, 2005-2010 Revaluation writeoffs, 2005-2010: Buildings ($1,000,000/25) x 6 Investment in Baker, 1/1/11 Equity in net income, 2011 Dividends, 2011 Investment in Baker, 12/31/11 $ 7,500,000 1,300,000 (400,000) (240,000) 8,160,000 160,000 (100,000) $ 8,220,000 Consolidation working paper eliminating entries for 2011: (C) Equity in net income of Baker 160,000 Dividends – Baker Investment in Baker (E) Stockholders’ equity—Baker, 1/1 100,000 60,000 5,900,000 Investment in Baker 5,900,000 Stockholders’ equity, January 1, 2011 = $5,000,000 + 1,300,000 – 400,000 = $5,900,000. ©Cambridge Business Publishers, 2010 72 Advanced Accounting, 1st Edition (R) Buildings, net Goodwill 760,000 1,500,000 Investment in Baker 2,260,000 Revaluations at January 1, 2011 = original revaluations less writeoffs for 2005-2010. (O) Depreciation expense Goodwill impairment loss 40,000 100,000 Buildings, net Goodwill E4.7 40,000 100,000 Goodwill Impairment Losses a. Goodwill is not a standalone asset, but represents the value of above-average future performance potential that cannot be assigned to identifiable assets such as property or specific intangible assets. Because performance potential is related to business operations, to measure impairments in its value it must be connected with a specific business unit. In the case of Time Warner, as discussed in the text of Chapter 4, goodwill is assigned to “Networks” as a business unit. The WB Network is one part of this business unit, but does not comprise the entire unit. b. Goodwill impairment testing is accomplished in two steps. First, the fair value of the business unit is compared with its book value. If book value exceeds fair value, we go on to the second step to determine the amount of the impairment, if any. The second step compares the fair value of the goodwill with its carrying value. An impairment loss is reported if its carrying value exceeds its fair value. Since The WB Network was shut down, its future performance potential will no longer benefit Time Warner, and the impairment charge is appropriate. c. Time Warner has a 50% interest in The CW, so under U.S. GAAP it does not have a controlling interest and reports its investment using the equity method. Time Warner’s equity in the net income of The CW is reported as part of consolidated other income. The investment balance is reported as part of consolidated assets. The CW’s individual assets, liabilities, revenues and expenses are not reported on the consolidated financial statements. Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 73 E4.8 Projecting Consolidation Entries a. (R) Land Equipment, net 80,000 18,000 Investment in Samson 98,000 Inventory has been sold, and the equipment revaluation as of the start of the third year is $30,000 – (2 x 6,000) = $18,000. (O) Depreciation expense 6,000 Equipment, net b. (R) Land 6,000 80,000 Investment in Samson 80,000 Inventory has been sold, and the equipment revaluation has been completely written off. Therefore no eliminating entry (O) is appropriate. c. No eliminating entries are necessary to recognize or write off the revaluations, because the assets requiring revaluation have been either sold or written off. E4.9 Identifiable Intangibles and Goodwill, U.S. GAAP Amortization expense for 2011: Customer relationships Favorable leaseholds Total $2,000,000/4 $6,000,000/5 $ 500,000 1,200,000 $1,700,000 Impairment testing – identifiable intangibles: Customer relationships Book value = $2,000,000 – 2 x ($2,000,000/4) = $1,000,000 Book value > Sum of undiscounted cash flows? $1,000,000 > $800,000: Yes Impairment loss = $1,000,000 - $650,000 = $350,000 Favorable leaseholds Book value = $6,000,000 – 1.5 x ($6,000,000/5) = $4,200,000 Book value > Sum of undiscounted cash flows? $4,200,000 < $4,500,000: No ©Cambridge Business Publishers, 2010 74 Advanced Accounting, 1st Edition Brand names Book value = $14,000,000 Book value > Sum of undiscounted cash flows? $14,000,000 > $12,000,000: Yes Impairment loss = $14,000,000 - $10,000,000 = $4,000,000 Impairment testing – Goodwill: Reporting Unit Unit FV < BV? Fair Value of GW GW impairment loss Asia $400,000,000 > $300,000,000: No $350,000,000> $200,000,000: No $500,000,000< $600,000,000: Yes $500,000,000 – 325,000,000 = 175,000,000 $250,000,000 – 175,000,000 = $75,000,000 South America Europe Summary: Amortization expense – identifiable intangibles Impairment losses – identifiable intangibles Goodwill impairment loss Total $ 1,700,000 4,350,000 75,000,000 $ 81,050,000 E4.10 Identifiable Intangibles and Goodwill, IFRS Amortization expense for 2011: Customer relationships Favorable leaseholds Total $2,000,000/4 $6,000,000/5 $ 500,000 1,200,000 $1,700,000 Impairment testing – identifiable intangibles: Customer relationships Book value = $2,000,000 – 2 x ($2,000,000/4) = $1,000,000 Book value > Sum of discounted cash flows? $1,000,000 > $650,000: Yes Impairment loss = $1,000,000 - $650,000 = $350,000 Favorable leaseholds Book value = $6,000,000 – 1.5 x ($6,000,000/5) = $4,200,000 Book value > Sum of discounted cash flows? $4,200,000 > $3,800,000: Yes Impairment loss = $4,200,000 – $3,800,000 = $400,000 Brand names Book value = $14,000,000 Book value > Sum of discounted cash flows? $14,000,000 > $10,000,000: Yes Impairment loss = $14,000,000 - $10,000,000 = $4,000,000 Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 75 Impairment testing – Goodwill: Reporting Unit Unit FV < BV? E. Asia Indonesia $310,000,000 > $200,000,000: No $90,000,000 < $100,000,000: Yes Brazil $125,000,000 < $130,000,000: Yes Mediterranean $180,000,000 < $220,000,000: Yes Scandinavia $190,000,000 < $300,000,000: Yes Summary: Amortization expense – identifiable intangibles Impairment losses – identifiable intangibles Goodwill impairment loss Total GW impairment loss $100,000,000 – 90,000,000 = $10,000,000 $130,000,000 – 125,000,000 = $5,000,000 $220,000,000 – 180,000,000 = $40,000,000 $300,000,000 – 190,000,000 = $110,000,000; impairment limited to full goodwill balance of $100,000,000. $ 1,700,000 4,750,000 155,000,000 $161,450,000 E4.11 Consolidated Income Statement a. (amounts in millions) Sales $5,000 + 2,000 Cost of goods sold $3,000 + 800 + 160 Gross margin Depreciation expense $500 + 140 – (200/10) Interest expense $100 + 60 + (100/5) Other expenses $600 + 700 Total operating expenses Net income $7,000 3,960 3,040 620 180 1,300 2,100 $ 940 b. Parson reports its own income of $800 million plus its equity in the income of Soaper of $140 million. Equity in the income of Soaper is Soaper’s reported income adjusted for write-offs of Soaper’s net asset revaluations. Consolidated income is Parson’s and Soaper’s reported revenues and expenses, with Soaper’s expenses adjusted for the revaluation writeoffs. Parson’s separately reported income and consolidated income therefore report the same items, packaged differently. ©Cambridge Business Publishers, 2010 76 Advanced Accounting, 1st Edition E4.12 Amortization and Impairment Testing of Identifiable Intangible Assets a. Technology Arroyo WebEx $15,000/5 x 9/12 = $312,000/4 x 1/12 = Customer Relationships Arroyo WebEx $14,000/7 x 9/12 = $153,000/6 x 1/12 = Total amortization expense $ 2,250 6,500 1,500 2,125 $ 12,375 b. Technology Arroyo WebEx Customer Relationships Arroyo WebEx 7/31/07 Book value> Book Undiscounted value cash flows? Impairment loss $ 12,750 $12,750>$14,000? No --305,500 $305,500>$300,000? Yes $305,500-250,000= $ 55,500 -12,500 $12,500>$16,000? No $150,875-100,000= 150,875 $150,875>$140,000? Yes Total impairment loss -50,875 $106,375 c. Arroyo WebEx 7/31/07 book value Solutions Manual, Chapter 4 Technology $ 12,750 250,000 $ 262,750 Customer Relationships $ 12,500 100,000 $ 112,500 ©Cambridge Business Publishers, 2010 77 PROBLEMS P4.1 Condensed Consolidated Financial Statements One Year after Acquisition a. Calculation of Equity in net income for 2010: Santo’s reported net income Revaluation writeoffs: Inventory (1) Plant assets $8,000,000/8 Patents $1,500,000/4 Long-term debt $1,000,000/10 Goodwill impairment loss Equity in net income of Santo $ 5,000,000 (2,000,000) (1,000,000) (375,000) 100,000 (400,000) $ 1,325,000 (1) Santo’s beginning inventory on its own books is $3,000,000 (= $5,200,000 + 4,000,000 – 6,200,000). Since Santo’s cost of goods sold is $4,000,000, its beginning inventory is completely sold in 2010, and the revaluation is written off. b. Consolidation Working Paper, December 31, 2010 Trial Balances Taken From Books Dr (Cr) Eliminations Consolidated Cash and receivables Inventory Plant assets, net Investment in Santo Patents Goodwill Current liabilities Long-term debt Capital stock Retained earnings, Jan. 1 Sales Equity in income of Santos Cost of goods sold Depreciation and amortization expense Interest and other expenses GW impairment loss Ponon Santo $ 4,500,000 5,000,000 8,000,000 26,325,000 $ 3,100,000 5,200,000 12,000,000 -- --(5,100,000) (20,000,000) (8,000,000) (4,800,000) (30,000,000) (1,325,000) 18,000,000 2,000,000 --(2,000,000) (3,300,000) (6,000,000) (4,000,000) (13,200,000) -4,000,000 3,200,000 $ 5,400,000 --0- $ ©Cambridge Business Publishers, 2010 78 1,000,000 --0- Dr Cr Balances $ (R) 2,000,000 (R) 8,000,000 (R) 1,500,000 (R) 4,500,000 (O-4) 100,000 (E) 6,000,000 (E) 4,000,000 2,000,000 (O-1) 1,000,000 (O-2) 1,325,000 (C) 10,000,000 (E) 15,000,000 (R) 375,000 (O-3) 400,000 (O-5) 1,000,000 (R) (C) 1,325,000 (O-1) 2,000,000 (O-2) 1,000,000 (O-3) 375,000 100,000 (O-4) (O-5) 400,000 _______ $ 31,200,000 $31,200,000 7,600,000 10,200,000 27,000,000 -- 1,125,000 4,100,000 (7,100,000) (24,200,000) (8,000,000) (4,800,000) (43,200,000) -24,000,000 6,575,000 6,300,000 400,000 $ -0- Advanced Accounting, 1st Edition c. Consolidated Statement of Income and Retained Earnings For the Year 2010 Sales $ 43,200,000 Costs of goods sold (24,000,000) Gross margin 19,200,000 Operating expenses: Depreciation and amortization expense $ 6,575,000 Interest and other expenses 6,300,000 Goodwill impairment loss 400,000 (13,275,000) Net income 5,925,000 Retained earnings, beginning balance 4,800,000 Retained earnings, ending balance $ 10,725,000 Consolidated Balance Sheet, December 31, 2010 Assets Cash and receivables Inventory Plant assets, net Patents Goodwill Total assets Liabilities and stockholders’ equity Current liabilities Long-term debt Capital stock Retained earnings Total liabilities and stockholders’ equity $ 7,600,000 10,200,000 27,000,000 1,125,000 4,100,000 $ 50,025,000 $ 7,100,000 24,200,000 8,000,000 10,725,000 $ 50,025,000 P4.2 Equity Method and Eliminating Entries Three Years after Acquisition a. Calculation of Equity in Net Income for 2012: Sea Coast’s reported net income for 2012 Revaluation writeoffs: Plant assets ($100,000)/10 Identifiable intangibles $300,000/20 Equity in net income of Sea Coast Solutions Manual, Chapter 4 $ 130,000 10,000 (15,000) $ 125,000 ©Cambridge Business Publishers, 2010 79 b. Calculation of Investment balance at December 31, 2012: Investment in Sea Coast, December 31, 2009 Sea Coast’s reported income, 2010-2012 Sea Coast’s reported dividends, 2010-2012 (60% of reported income) Revaluation writeoffs, 2010-2012: Plant assets [($100,000)/10] x 3 Identifiable intangibles ($300,000/20) x 3 Investment in Sea Coast, December 31, 2012 $ 2,000,000 400,000 (240,000) 30,000 (45,000) $ 2,145,000 Note to instructor: Under LIFO and increasing inventory, the acquisition date revalued inventory is assumed to still be on hand. c. Consolidation working paper eliminating entries for 2012: (C) Equity in net income of Sea Coast 125,000 Dividends – Sea Coast (.6 x $130,000) Investment in Sea Coast (E) Stockholders’ equity—Sea Coast, 1/1 78,000 47,000 1,508,000 Investment in Sea Coast 1,508,000 Sea Coast’s stockholders’ equity, December 31, 2009 = $1,400,000 (acquisition cost $2,000,000 less excess over book value $600,000). Sea Coast’s stockholders’ equity, January 1, 2012 = $1,400,000 + (1 - .6)(400,000 – 130,000) = $1,508,000. (R) Inventory Identifiable intangibles 400,000 270,000 Plant assets, net 80,000 Investment in Sea Coast 590,000 Revaluations at January 1, 2012 = original revaluations less writeoffs for 2010 and 2011. ©Cambridge Business Publishers, 2010 80 Advanced Accounting, 1st Edition (O) Plant assets, net Amortization expense 10,000 15,000 Depreciation expense Identifiable intangibles 10,000 15,000 d. Pelican’s income from its own operations plus equity in net income of Sea Coast = consolidated net income: $500,000 + $125,000 = $625,000. P4.3 Consolidation at End of First Year, Preacquisition Contingency a. Calculation of Equity in Net Income for 2011: Sanders’ reported net income for 2011 Revaluation writeoffs: Inventory $80,000 x 60% Equipment $200,000/10 Equity in net income of Sanders Perkins’entries for 2011: Investment in Sanders Merger expenses Restructuring expenses $ 500,000 (48,000) (20,000) $ 432,000 4,000,000 50,000 100,000 Cash 4,150,000 Investment in Sanders 432,000 Equity in net income of Sanders 432,000 Cash 150,000 Investment in Sanders b. 150,000 Consolidation working paper eliminating entries for 2011: (C) Equity in net income of Sanders 432,000 Dividends – Sanders Investment in Sanders (E) Stockholders’ equity— Sanders, 1/1 2,200,000 Investment in Sanders Solutions Manual, Chapter 4 150,000 282,000 2,200,000 ©Cambridge Business Publishers, 2010 81 (R) Inventory Equipment, net In-process research and development Goodwill 80,000 200,000 300,000 1,305,000 Lawsuit liability Investment in Sanders 85,000 1,800,000 Note: Because the change in the lawsuit liability occurs within the measurement period, the increased liability value increases acquisition date goodwill. (O) Cost of goods sold Depreciation expense 48,000 20,000 Inventory Equipment, net P4.4 48,000 20,000 Consolidated Balance Sheet Working Paper, Bargain Purchase (see related P3.4) (all amounts in millions) a. Calculation of Equity in Net Income for 2013: Saxon’s reported net income for 2013 ($10,000 + 10 – 8,000 – 40 – 25 – 1,600) Revaluation writeoffs: Inventory Marketable securities Buildings and equipment $300/20 Long-term debt $110/5 Equity in net income of Saxon $ 345 (100) 50 (15) (22) $ 258 Calculation of Investment balance, December 31, 2013: Investment balance, December 31, 2012 (1) Equity in net income for 2013 Dividends for 2013 Investment balance, December 31, 2013 (1) $2,000 258 (100) $2,158 Paxon acquired Saxon for $1,800, but there is a bargain gain that increases the investment balance by $200, as follows: ©Cambridge Business Publishers, 2010 82 Advanced Accounting, 1st Edition Calculation of gain on acquisition: Acquisition cost Book value ($100 + 350 + 845) Excess of acquisition cost over book value Excess of fair value over book value: Inventory Marketable securities Land Buildings and equipment Long-term debt (discount) Gain on acquisition $ 1,800 (1,295) 505 $ 100 (50) 245 300 110 $ 705 200 Therefore Paxon’s entry to record the acquisition was: Investment in Saxon 2,000 Cash Gain on acquisition 1,800 200 b. Consolidation Working Paper, December 31, 2013 Trial Balances Taken From Books Dr (Cr) Eliminations Consolidated Paxon Saxon Cash and receivables Inventory Marketable securities Investment in Saxon $ 3,100 2,260 -2,158 $ Land Buildings and equipment, net Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Dividends Sales revenue Equity in income of Saxon Gain on sale of securities Cost of goods sold Depreciation expense Interest expense Other operating expenses 650 3,600 (2,020) (5,000) (500) (1,200) (2,610) 500 (30,000) (258) -26,000 300 250 2,770 $ -0- 300 1,150 (1,200) (450) (100) (350) (845) 100 (10,000) -(10) 8,000 40 25 1,600 $ -0- Solutions Manual, Chapter 4 800 940 --- Dr Cr (R) 100 (O-2) 50 100 (O-1) 50 (R) 158 (C) 1,295 (E) 705 (R) (R) 245 (R) 300 (R) 110 (E) 100 (E) 350 (E) 845 15 (O-3) 22 (O-4) 100 (C) (C) 258 50 (O-2) (O-1) 100 (O-3) 15 (O-4) 22 ______ $ 2,495 _______ $ 2,495 Balances $ 3,900 3,200 --- 1,195 5,035 (3,220) (5,362) (500) (1,200) (2,610) 500 (40,000) -(60) 34,100 355 297 4,370 $ -0- ©Cambridge Business Publishers, 2010 83 c. Consolidated Statement of Income and Retained Earnings For the Year 2013 Sales $ 40,000 Costs of goods sold (34,100) Gross margin 5,900 Operating expenses: Depreciation expense $ 355 Interest expense 297 Other operating expenses 4,370 (5,022) Income before other gains 878 Gain on sale of securities 60 Net income 938 Retained earnings, January 1 2,610 Dividends (500) Retained earnings, December 31 $ 3,048 Consolidated Balance Sheet, December 31, 2013 Assets Cash and receivables Inventory Land Buildings and equipment, net Total assets Liabilities and stockholders’ equity Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings Total liabilities and stockholders’ equity P4.5 $ 3,900 3,200 1,195 5,035 $ 13,330 $ 3,220 5,362 500 1,200 3,048 $ 13,330 Goodwill Allocation and Impairment a. Identifiable assets acquired Liabilities assumed Net identifiable assets acquired Total acquisition cost Total goodwill ©Cambridge Business Publishers, 2010 84 $ 53,000,000 (19,000,000) 34,000,000 50,000,000 $ 16,000,000 Advanced Accounting, 1st Edition Allocation to business units: Identifiable assets acquired Liabilities assumed Net assets assigned Fair value of reporting unit Less: Net assets assigned Increase in fair value Tentative allocation of goodwill Total tentative allocation is $20,000,000; goodwill to be assigned is $16,000,000. 20% reduction Allocation of goodwill b. Unit X $ 30,000,000 (12,000,000) $ 18,000,000 Unit Y $16,000,000 (5,000,000) $11,000,000 Unit Z $ 7,000,000 (2,000,000) $ 5,000,000 Total $ 53,000,000 (19,000,000) $ 34,000,000 Unit X $ 24,000,000 (18,000,000) __ N/A___ Unit Y $ 15,000,000 (11,000,000) ___N/A___ Unit Z $ 10,000,000 (5,000,000) ___N/A___ $ 5,000,000 6,000,000 4,000,000 5,000,000 5,000,000 (1,200,000) $ 4,800,000 (800,000) $ 3,200,000 (1,000,000) $ 4,000,000 (1,000,000) $ 4,000,000 Unit J Step 1 of impairment test: Compare the fair value of each reporting unit at December 31, 2010 with its book value at that date. Unit X Unit Y Unit Z Unit J Fair value at December 31, 2010 $26,000,000 $ 12,000,000 $ 5,000,000 $ 63,000,000 Carrying amount at December 31, 2010 25,000,000 13,000,000 7,000,000 65,000,000 Difference $ 1,000,000 $(1,000,000) $(2,000,000) $(2,000,000) Preliminary Not impaired May be May be May be conclusion impaired impaired impaired Step 2 of the impairment test: For those reporting units where goodwill may be impaired, calculate the implied fair value of goodwill at December 31, 2010 and compare to the carrying amount of goodwill at that date. Unit Y Unit Z Unit J Fair value of reporting unit $ 12,000,000 $ 5,000,000 $63,000,000 Fair value of identifiable net assets at December 31, 2010 7,000,000 4,000,000 58,000,000 Implied value of goodwill 5,000,000 1,000,000 5,000,000 Carrying amount of goodwill 3,200,000 4,000,000 4,000,000 Difference $ 1,800,000 $(3,000,000) $ 1,000,000 Conclusion Goodwill is not Goodwill is Goodwill is impaired impaired not impaired Goodwill is impaired for Reporting Unit Z. A $3,000,000 goodwill impairment loss should be recorded at December 31, 2010. Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 85 P4.6 Intangible Assets and Goodwill: Amortization and Impairment 2013 amortization expense: Customer lists $500,000/5 Developed technology $800,000/10 Total $ 100,000 80,000 $ 180,000 2013 impairment test for identifiable intangibles: Original carrying amount Less: amortization 2011 2012 2013 Carrying amount, December 31, 2013 Customer lists $ 500,000 Developed technology $ 800,000 Internet domain name $ 1,300,000 (100,000) (100,000) (100,000) $ 200,000 (80,000) (80,000) (80,000) $ 560,000 – – ___–_____ $ 1,300,000 Step 1 of impairment test: To determine whether impairment has occurred, compare the undiscounted future cash flows from the asset to its carrying value. Customer Developed Internet lists technology domain name Future undiscounted cash flows $ 250,000 $ 500,000 $ 1,000,000 Carrying amount 200,000 560,000 1,300,000 Difference $ 50,000 $ (60,000) $ (300,000) Conclusion Not impaired Impaired Impaired Step 2 of impairment test: For intangibles that are deemed impaired in Step 1, calculate amount of impairment as the difference between discounted cash flows and carrying value. Developed Internet technology domain name Future discounted cash flows $ 420,000 $ 750,000 Carrying amount 560,000 1,300,000 Impairment $ 140,000 $ 550,000 2013 goodwill impairment test: Step 1 of impairment test: compare fair value of reporting unit at December 31, 2013 to the carrying amount of the unit at that date. Fair value of reporting unit $17,000,000 Carrying amount 18,500,000 Difference $(1,500,000) Conclusion: Goodwill may be impaired. ©Cambridge Business Publishers, 2010 86 Advanced Accounting, 1st Edition Step 2 of impairment test: Calculate the implied fair value of goodwill at December 31, 2013 and compare to the carrying amount at that date. Fair value of reporting unit $ 17,000,000 Fair value of identifiable net assets 14,200,000 Implied fair value of goodwill 2,800,000 Carrying amount of goodwill 6,200,000 Difference $ (3,400,000) Conclusion: Goodwill impairment loss is $3,400,000. Summary: Amortization expense for 2013: Customer lists Developed technology Impairment write-offs for 2013: Developed technology Internet domain name Goodwill Total expense for 2013 $ $ 100,000 80,000 140,000 550,000 3,400,000 $ 180,000 4,090,000 $ 4,270,000 P4.7 Consolidated Balance Sheet Working Paper, Three Years after Acquisition related P3.2) (see (all amounts in millions) a. Calculation of Equity in Net Income for fiscal 2011, 2012, and 2013: Saxon’s reported net income (loss) Revaluation writeoffs: Property, plant and equipment $(60)/20 Patents and trademarks $10/5 Long-term debt $(3)/3 Advanced technology $5/5 Customer lists impairment loss Goodwill impairment loss Equity in net income of Saxon 2011 $ 15 2012 $ (2) 3 (2) 1 (1) 3 (2) 1 (1) (2) _(3) $ (6) _(2) $ 14 2013 $ 12 (1) 3 (2) 1 (1) (4) _(2) $ 7 (1) $12 = $900 – 800 – 88 Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 87 Calculation of Investment balance, June 30, 2013: Investment balance, June 30, 2010 (adjusted to remove earnings contingency) Equity in net income for fiscal 2011 Equity in net income for fiscal 2012 Equity in net income for fiscal 2013 Increase in GOC’s AOCI for fiscal 2011-2013 (= $5 – 3) Investment balance, June 30, 2013 $ 110 14 (6) 7 __2 $ 127 b. Consolidation Working Paper, June 30, 2013 Trial Balances Taken From Books Dr. (Cr.) Eliminations Consolidated ITI Current assets Property, plant and equipment, net Identifiable intangible assets $ Investment in GOC Goodwill (1) Current liabilities Long-term liabilities Common stock Additional paid-in capital Retained earnings, July 1 Accumulated other comprehensive income Treasury stock Sales revenue Equity in income of Saxon Cost of goods sold Goodwill impairment loss Other operating expenses $ GOC Dr $ 12 140 (R) 5 (O-1) 3 1,100 30 (R) 6 (R) 3 (R) 23 127 -- -(175) (1,125) (22) (580) (118) -(10) (105) (4) (60) 12 (20) 8 (2,000) (7) 1,400 -580 (5) 2 (900) -800 -88 232 600 _____ _____ -0- $ -0- ©Cambridge Business Publishers, 2010 88 Balances Cr (R) 83 (O-3) 1 (E) 4 (E) 60 $ 54 (R) 2 (O-2) 1 (O-4) 4 (O-5) 7 (C) 55 (E) 65 (R) 2 (O-6) 1 (R) 12 (E) (E) 5 2 (E) (C) 7 (O-6) 2 (O-2) 2 3 (O-1) (O-4) 1 1 (O-3) (O-5) 4 _______ $ 209 $ 209 249 689 1,155 -- 81 (185) (1,230) (22) (580) (118) (20) 8 (2,900) -2,200 2 ____671 $ -0- Advanced Accounting, 1st Edition (1) Acquisition-date goodwill is calculated as follows: Acquisition cost (adjusted) GOC’s book value Excess of acquisition cost over book value Excess of fair value over book value: Inventory Property, plant and equipment Patents and trademarks Advanced technology Customer lists Long-term debt Goodwill $ 110 (40) 70 $ 5 (60) 10 5 25 (3) c. Consolidated Statement of Income and Retained Earnings For Fiscal 2013 Sales revenue Costs of goods sold Gross margin Operating expenses: Goodwill impairment loss $ 2 Other operating expenses _671 Net income Retained earnings, beginning balance Retained earnings, ending balance Consolidated Balance Sheet, June 30, 2013 Assets Current assets Property, plant and equipment, net Identifiable intangible assets Goodwill Total assets Liabilities and stockholders’ equity Current liabilities Long-term liabilities Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income Treasury stock Total liabilities and stockholders’ equity Solutions Manual, Chapter 4 _(18) $ 88 $ 2,900 (2,200) 700 __673 27 __118 $ 145 $ 249 689 1,155 __81 $ 2,174 $ 185 1,230 22 580 145 20 __(8) $ 2,174 ©Cambridge Business Publishers, 2010 89 P4.8 Working Paper Eliminating Entries, Partial Year Consolidation (see related P3.3) (all numbers in millions) a. Calculation of Equity in net income for 2003: Pharmacia’s reported net income Revaluation writeoffs: Inventory Property, plant and equipment [$(317)/20] x [8.5/12] In-process research and development Developed technology rights $31,596/11 x (8.5/12) Long-term debt Other assets $(15,606)/10 x (8.5/12) Equity in net income of Pharmacia b. $ 5,000 (2,939) 11 (716) (2,035) 12 1,105 $ 438 Consolidation working paper eliminating entries for 2003: (C) Equity in net income of Pharmacia 438 Investment in Pharmacia (E) Stockholders’ equity—Pharmacia, 4/16/03 438 7,236 Investment in Pharmacia (R) Inventory Long-term investments In-process R&D Developed technology rights Goodwill 2,939 40 5,052 37,066 21,304 Property, plant and equipment Long-term debt Other assets Investment in Pharmacia ©Cambridge Business Publishers, 2010 90 7,236 317 1,841 15,606 48,637 Advanced Accounting, 1st Edition (O) Cost of goods sold Property, plant and equipment Impairment loss Amortization expense Long-term debt Other assets 2,939 11 716 2,035 12 1,105 Inventory Depreciation expense In-process research and development Developed technology rights Interest expense Other operating expenses P4.9 2,939 11 716 2,035 12 1,105 Goodwill Impairment Testing, IFRS and U.S. GAAP a. BP’s 2007 annual report states the following: The future cash flows are usually adjusted for risks specific to the asset and discounted using a pre-tax discount rate of 11% (2006 10%). This discount rate is derived from the group’s post-tax weighted average cost of capital. In some cases the group’s pre-tax discount rate may be adjusted to account for political risk in the country where the asset is located. Cash flows are adjusted for risk before they are discounted, thereby taking into consideration differences in the uncertainty of the business environment. Most likely the cash flows of Exploration and Production segment CGUs are more uncertain than those of Refining and Marketing, although the two segments are closely related. If the cash flows were not adjusted, the discount rate should be adjusted to reflect differences in risk. Solutions Manual, Chapter 4 ©Cambridge Business Publishers, 2010 91 b. Exploration and Production CGU UK US Rest of world Total Value in use Carrying value $ 9,000 $ 1,114 35,000 6,144 2,500 2,840 $ 46,500 $ 10,098 Impairment loss None None $ 340 Refining and Marketing CGU Refining Retail Lubricants and other Total Value in use Carrying value Impairment loss $ 13,000 $ 1,557 None 6,000 1,938 None 4,000 4,880 $ 880 $ 23,000 $ 8,375 Total goodwill impairment loss is $340 + 880 = $1,220 c. $2,840 – 2,140 = $700, suggesting a GW impairment loss of that amount. However, total goodwill allocated to the Rest of World CGU is $515. Therefore, the goodwill impairment loss is $515, and other assets of the CGU would be written down, based on appropriate impairment tests. d. U.S. GAAP requires goodwill to be assigned to reporting units, in this case Exploration and Production, and Refining and Marketing. Goodwill is then evaluated using a two-step test. Goodwill is tested for impairment only if the fair value of the reporting unit is less than its carrying value. Because fair value is generally calculated using discounted cash flows, we assume it can be approximated by value in use. For both reporting units above, value in use significantly exceeds carrying value, so no impairment loss is reported. Because reporting units aggregate CGUs, it is likely that CGUs with carrying value greater than value in use will be offset by those with a value in use that is greater than carrying value when applying the first step for impairment testing under U.S. GAAP. ©Cambridge Business Publishers, 2010 92 Advanced Accounting, 1st Edition P4.10 Consolidation One and Two Years after Acquisition a. The investment cost under SFAS 141R amounts to $598,000,000 [= ($590,000,000 – $15,000,000) + $23,000,000], and the $248,000,000 excess of acquisition cost over book value ($598,000,000 – $350,000,000) is allocated as follows, with goodwill being the residual at the bottom: Excess of acquisition cost over book value Allocation to identifiable items: Inventories Identifiable intangibles (5-year life) In-process research and development (IPRD) Plant assets (20-year life, straight-line) Goodwill (unallocated balance) b. $ 248,000,000 (30,000,000) (40,000,000) (60,000,000) (50,000,000) $ 68,000,000 2007 equity income accrual: Essex’s reported net income Revaluation write-offs: FIFO inventory sold (.4 X $30,000,000) Amortization of identifiable intangibles ($40,000,000/5) Depreciation of plant assets ($50,000,000/20) Goodwill impairment Equity income accrual $ 140,000,000 (12,000,000) (8,000,000) (2,500,000) (15,000,000) $ 102,500,000 December 31, 2007 working paper eliminations: (C) Equity income accrual 102,500,000 Dividends – S (.55 x $140,000,000) Investment in S (E) Stockholders’ equity – Essex, 1/25/07 350,000,000 Investment in S Solutions Manual, Chapter 4 77,000,000 25,500,000 350,000,000 ©Cambridge Business Publishers, 2010 93 (R) Inventories Identifiable intangibles In-process research and development Plant assets Goodwill 30,000,000 40,000,000 60,000,000 50,000,000 68,000,000 Investment in S (O) Cost of goods sold Amortization expense Depreciation expense Goodwill impairment loss 248,000,000 12,000,000 8,000,000 2,500,000 15,000,000 Inventories Identifiable intangibles Accumulated depreciation Goodwill c. 12,000,000 8,000,000 2,500,000 15,000,000 2008 equity income accrual: Essex’s reported net income Revaluation write-offs: Amortization of identifiable intangibles ($40,000,000/5) Depreciation of plant assets ($50,000,000/20) IPRD impairment Equity income accrual December 31, 2008, working paper eliminations: (C) Equity income accrual Dividends – S (.55 x $160,000,000) Investment in S (E) Stockholders’ equity – Essex, 1/1/08 (1) (1) Investment in S $350,000,000 + $140,000,000 - $77,000,000 ©Cambridge Business Publishers, 2010 94 $160,000,000 (8,000,000) (2,500,000) (20,000,000) $129,500,000 129,500,000 88,000,000 41,500,000 413,000,000 413,000,000 Advanced Accounting, 1st Edition (R) Inventories (.6 x $30,000,000) Identifiable intangibles In-process research and development Plant assets Goodwill 18,000,000 32,000,000 60,000,000 50,000,000 53,000,000 Accum. depreciation Investment in S (O) Amortization expense Depreciation expense IPRD impairment loss 2,500,000 210,500,000 8,000,000 2,500,000 20,000,000 Identifiable intangibles Accumulated depreciation IPRD 8,000,000 2,500,000 20,000,000 P4.11 Intangibles under IFRS a. Whereas the double-declining balance rate is twice the straight-line rate, 150% declining balance is 1.5 x 10% straight-line rate, or 15%. Following the conventional declining-balance calculations, we have this amount of amortization expense for 2011, the second year after acquisition: Amortization expense = .15 x [€50,000,000 – (.15 x €50,000,000)] = €6,375,000 b. At December 31, 2010, the carrying amount is €9,000,000 after 2010 amortization of €1,000,000, and the market value of these intangibles is €9,500,000. December 31, 2010 entries are: Amortization expense 1,000,000 Intangible assets Intangible assets 500,000 Revaluation surplus (OCI) Solutions Manual, Chapter 4 1,000,000 500,000 ©Cambridge Business Publishers, 2010 95 December 31, 2011, entries are: Amortization expense 1,055,555 Intangible assets 1,055,555 €9,500,000/9 = €1,055,555 Revaluation surplus (OCI) Loss 500,000 944,445 Intangible assets 1,444,445 At this point the ending carrying amount is €7,000,000 (= €10,000,000 – €1,000,000 + €500,000 – €1,055,555 – €1,444,445], equal to the market value on that date. c. IFRS impairment loss = carrying amount – greater of (value in use, €15,300,000; market value, €14,000,000) = €17,000,000 – €15,300,000 = €1,700,000. U.S. GAAP impairment loss = 0 (sum of undiscounted cash flows €18,000,000 > carrying amount, €17,000,000, indicating “no impairment”). The two-step test in U.S GAAP removes some potential impairments from consideration. IFRS goes immediately to an amount lower than the sum of the undiscounted cash flows, and will likely recognize more impairment losses over time than U.S. GAAP. P4.12 Consolidation in First Year, Intangible Asset Issues (all dollar amounts in millions) a. Net Assets $26,900 Liabilities Liabilities = = = = Assets - Liabilities $(20,800 + 9,400 + 4,800) – Liabilities $35,000 – $26,900 $8,100 b. Going “by the book,” the question is simply whether useful lives can be reasonably estimated or whether the intangible has an obviously very long indeterminate (indefinite) life. Many cases will be clear-cut and can be justified to the auditors but others will be in gray areas such that the desired reporting result will call forth the case justifying the classification of the intangible one way or another. ©Cambridge Business Publishers, 2010 96 Advanced Accounting, 1st Edition In these gray areas, management may elect to minimize periodic amortization charges against earnings and take their chances on the somewhat random and very subjective impairment tests. To the extent possible, management would likely classify items and load cost in the indefinitelived category to minimize the effect on earnings. c. With goodwill no longer being subject to amortization, and impairment charges being part of income from continuing operations, companies may seek to lower the probability that they will have to recognize goodwill impairment charges. The subjectivity inherent in valuing the reporting units to which the goodwill is assigned—cash flow forecasts and discount rate selections—facilitates decisions to load goodwill onto reporting units that are less-likely impairment candidates, i.e., units with fair value significantly above carrying value. d. Revaluation of limited-life intangibles is $2,000 (= $3,000 – $1,000). Amortization of this revaluation for 2007 = $2,000/15 x 9/12 = $100. Equity method income = $1,000 – $100 = $900 Consolidation Working Paper Entries: (C) Equity income 900 Dividends—Caremark Investment in Caremark (E) Stockholders’ equity—Caremark (1) (1) 550 350 1,700 Investment in Caremark $26,900 – $20,800 – ($9,400 – $5,000) (R) Goodwill Identifiable intangibles, limited life Identifiable intangibles, indefinite life (2) 1,700 20,800 2,000 2,400 Investment in Caremark (2) 25,200 $6,400 – $4,000 (O) Amortization expense 100 Identifiable intangibles, limited life Solutions Manual, Chapter 4 100 ©Cambridge Business Publishers, 2010 97 ©Cambridge Business Publishers, 2010 98 Advanced Accounting, 1st Edition