Case Write-ups (30%)

advertisement

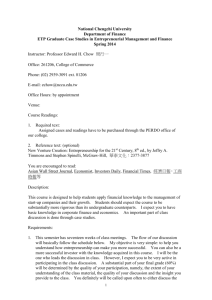

THE WEATHERHEAD SCHOOL OF MANAGEMENT DEPARTMENT OF MAREKTING AND POLICY STUDIES PLCY 440: ENTREPRENEURIAL FINANCE SPRING SEMESTER ‘00 Prof. David L. Deeds Office: 540 Sears Office Hrs: Thursday 6:30-8:00 Phone: (216)368-6008 E-Mail: DXD52@PO.CWRU.EDU Texts: Sahlman & Stevens –“The Entrepreneurial Venture” CWRU Note – Cases & Readings Course Objectives The central focus of this course will be to provide the students an understanding of the financing of entrepreneurial ventures. The course will address the types of financing available at different stages of the new venture (bootstrapping, Bank debt, trade debt, private placements, angels, venture capital, IPO’s, LBO’s, etc.), developing pro-forma financial statements, estimating capital requirements, and methods of firm and project valuation. This course will examine a number of specific issues and problems including: 1) 2) 3) 4) 5) 6) 7) How much money is needed to start, acquire or expand the business? How, when and what kind of financing should be used to seize the opportunity? What’s bootstrapping? How do I approach Angels? Venture Capitalists? How are deals structured, valued and evaluated? When should a venture consider a Private Placement, a LBO, a DPO, or an IPO? When should a venture be harvested? How do you get your capital out of the venture? Grading Case Write-ups 30% Group Project Class Participation & Individual Assignments 40% 30% 100% 1 Assignments Case Write-ups (30%) Each student will prepare a detailed case analysis of 2 cases during the semester. The write-ups will be in the form of a memo addressing the specific issues of the case and using the various financial models, readings, etc developed during the semester to present well developed, viable solutions to the challenges facing the individual firms. The write-ups must include executive summary, detailed financial analyses and clear action plans. Students will sign-up for the cases during the first night of class. Class Participation & Individual Assignments (30%): Class participation is the key to a successful course. Case analysis makes it imperative that you are familiar with the details of the readings and that you have invested a significant amount of thought into diagnosing and solving the problems presented in the case. By the time you get to class you should have a clear idea of the problems facing the company in the case and a potential solution to the problem. During class you will be expected to be able to clearly present and defend your ideas, as you would during any business meeting. You should be prepared to back your arguments up with facts from the case and from quantitative analysis of the case. In addition, at several points during the semester students will be asked to prepare assignments for class. These assignments will be collected and factored into the class participation grade. Project (40%) Student teams (4 max.) will develop a detailed financial plan for an opportunity of his or her choice. The opportunity can involve the creation of a new venture, financing plans for an existing new venture (< less than 2 years old) or the purchase of an existing business. The requirements for project are that (1) the opportunity be large enough to generate at least $20 million in revenues or $1,500,000 in net profit by the end of 5 years. (2) if purchasing a business there must be plans to grow the business by at least 50% over the next 5 years or increase the profitability of the business by at least 150%. The plan must include: 1. A well developed executive summary 2. Detailed pro-forma statements for the initial 5 years of operations as well as an in depth discussion of the assumptions and critical risks of the plan. The first years financials must be monthly. 3. A stage by stage discussion of the financing needs and sources for the venture for the next 5 years. This includes a detailed discussion of the sources and uses of all the capital to be raised by the company 4. A polished deal for each of the stages at which the firm will raise external capital and a discussion of the targets at each of the stages and the basis for the valuation of the company at each stage. 2 Schedule Week 1 – Introduction - 1/18 1. Sahlman & Stevenson – Ch. 1 & 4 Week 2 – Financial Management for New Ventures - 1/25 2. Sahlman & Stevenson – Ch. 6, & 9 3. Prepare Assignment #1 Week 3 – Valuation 1. Sahlman & Stevenson – Ch. 8 & 9. – 2/1 2. Langhor – Valuation as a source of insight – CWRU Note 3. A note on valuation in private equity settings – CWRU Note 4. A note of free cash flow valuation models – CWRU Note 5. Prepare Assignment #2 6. Initial Project Proposal Due Week 4 – Financing the Emerging Firm - 2/8 1. Sahlman & Stevenson – Chapter 12 &13 2. Bygrave “Calling on family and friends for start-up cash” CWRU Note 3. Timmmons & Sanders – “Everything you (Don’t) want to know about raising capital” – CWRU Note 4. Robert & Stevenson – “Alternative Sources of Financing” CWRU Note 5. Prepare a Seed funding proposal for your project for discussion in class Week 5 – Financing the Emerging Firm Continued – 2/15 1. Case: Interzine Productions Inc. - CWRU Note A. What methods of ‘Bootstrapping’ did Henley employ? B. What were the benefits of the AOL deal? Was it a good deal for Interzine? C. What have been the keys to Interzine’s early success? D. Where should Henley turn to for his next round of financing? Week 6 – Special Guest Speaker(s) on Seed Capital Financing/Bootstrapping – 2/22 Week 7 – Business Angels – 3/1 1. CWRU Note “Angel Investing” 2. Guest Speaker on Angel Investing Week 8 - The Venture Capital Market - 3/8 1. Sahlman & Stevens – Ch. 3, 15,16, 18 & 19 2. A Note of Private Equity Partnership Agreements – CWRU Note 3. A Note on Venture Leasing – CWRU Note 3 Week 9 – Venture Capital Continued – 3/22 1. A Note on Private Equity Securities – CWRU Note 2. Venture Capital Negotiations: VC versus Entrepreneur – CWRU Note 3. Case: edocs, Inc a. What’s edocs worth? b. Should Guerster shop the deal? c. Evaluate the term sheet - any problems? d. Should they take the deal? Week 10 – Venture Capital Continued – 3/29 1. Case: Preview Travel – CWRU Note A. How strong is Preview’s negotiating position as it stands? B. Is Quad Media’s valuation significantly different than the prior rounds? C. How much money does Preview need? D. Are there any other alternatives? Week 11 - Guest Speakers on the Venture Capital Industry – 4/5 Week 12 - Growth Financing – 4/12 1. Case: Internet Securities, Inc: Financing Growth a. What is the value of ISI in October 1998 b. From whom should Gary Mueller raise money? c. What advice would you give Gary on how to structure a deal with financial buyer? d. In your opinion is $12.5 million sufficient for ISI to reach positive cash flow? e. What should Gary Mueller do? 2. Rough Draft of Project Due in Class Week 13 – Corporate Partnering – 4/19 1. A note on Strategic Alliances – CWRU Note 2. Guest Speaker(s) on Corporate Partnering Week 14 - Going Public – IPO’s - 4/26 1. Sahlman & Stevenson – Ch. 23 2. So you want to go public? – CWRU Note 3. Preparing a Company for an Initial Public Offering –CWRU Note 4. A Note on the Initial Public Offering Process – CWRU Note 5. Case: Teleswitch – CWRU Note 6. Final Version of Project Due in Class 4