EXERCISE 3-24 (20 MINUTES)

advertisement

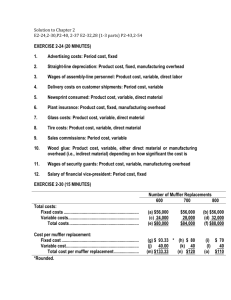

EXERCISE 3-24 (20 MINUTES) 1. Raw-material inventory, January 1 ....................................................................... Add: Raw-material purchases ............................................................................... Raw material available for use .............................................................................. Deduct: Raw-material inventory, January 31 ....................................................... Raw material used in January ............................................................................... Direct labor ............................................................................................................. Total prime costs incurred in January .................................................................. $174,200 248,300 $422,500 161,200 $261,300 390,000 $651,300 2. Total prime cost incurred in January .................................................................... $651,300 Applied manufacturing overhead (70% $390,000) ............................................ 273,000 Total manufacturing cost for January .................................................................. $924,300 EXERCISE 3-24 (CONTINUED) 3. Total manufacturing cost for January .................................................................. $ 924,300 Add: Work-in-process inventory, January 1 ........................................................ 305,500 Subtotal ................................................................................................................... $1,229,800 Deduct: Work-in-process inventory, January 31 ................................................. 326,300 Cost of goods manufactured ................................................................................. $ 903,500 4. Finished-goods inventory, January 1 ................................................................... $ 162,500 Add: Cost of goods manufactured ........................................................................ 903,500 Cost of goods available for sale ............................................................................ $1,066,000 Deduct: Finished-goods inventory, January 31 ................................................... 152,100 Cost of goods sold ................................................................................................. $ 913,900 Since the company accumulates overapplied or underapplied overhead until the end of the year, no adjustment is made to cost of goods sold until December 31. 5. Applied manufacturing overhead for January ..................................................... $273,000 Actual manufacturing overhead incurred in January .......................................... 227,500 Overapplied overhead as of January 31 ............................................................... $ 45,500 The balance in the Manufacturing Overhead account on January 31 is a $45,500 credit balance. NOTE: Actual selling and administrative expense, although given in the exercise, is irrelevant to the solution. EXERCISE 3-25 (25 MINUTES) JOB-COST RECORD Job Number TB78 Description Date Started 8/11 Date Completed teddy bears 8/20 Number of Units Completed Direct Material Requisition Number Quantity 201 500 208 600 Date 8/11 8/12 Unit Price $.90 .40 Cost $450 240 Rate $14 Cost $7,700 Direct Labor Hours 550 Date 8/15 Time Card Number 82 Date 8/15 Manufacturing Overhead Activity Base Quantity direct-labor hours 550 1,000 Application Rate $3 Cost $1,650 Cost Summary Cost Item Total Direct Material Total Direct Labor Total Manufacturing Overhead Total Cost Unit Cost Date 8/30 Amount $ 690 7,700 1,650 $10,040 $ 10.04 Shipping Summary Units Remaining Units Shipped In Inventory 800 200 *200 units remaining in inventory$10.04 = $2,008 EXERCISE 3-26 (15 MINUTES) 1. Applied manufacturing overhead = total manufacturing costs 30% = $1,250,000 30% Cost Balance $2,008* = $375,000 Applied manufacturing overhead = direct-labor cost 80% Direct-labor cost = applied manufacturing overhead 80% = $375,000 .8 = $468,750 2. Direct-material used = total manufacturing cost – direct labor cost – applied manufacturing overhead = $1,250,000 – $468,750 – $375,000 = $406,250 3. Let X denote work-in-process inventory on December 31. Total manufacturing cost $1,250,000 work-in-process + inventory, – Jan. 1 + .75X – work-in-process inventory, Dec. 31 X = cost of goods manufactured = $1,212,500 .25X = $1,250,000 – $1,212,500 X = $150,000 Work-in-process inventory on December 31 amounted to $150,000. EXERCISE 3-27 (5 MINUTES) Work-in-Process Inventory ....................................................... Raw-Material Inventory ................................................... Wages Payable ................................................................ Manufacturing Overhead ................................................ 6,060 Finished-Goods Inventory......................................................... Work-in-Process Inventory ............................................. EXERCISE 3-28 (15 MINUTES) 6,060 1. Predetermined overheadrate (a) budgetedoverhead budgetedproductionvolume At 100,000 chicken volume: 5,100 720 240 6,060 Overheadrate (b) 100,000 $1.65 per chicken At 200,000 chicken volume: Overheadrate (c) $150,000 ($.15)(100,000) $150,000 ($.15)(200,000) 200,000 $.90 per chicken At 300,000 chicken volume: Overheadrate $150,000 ($.15)(300,000) 300,000 $.65 per chicken 2. The predetermined overhead rate does not change in proportion to the change in production volume. As production volume increases, the $150,000 of fixed overhead is allocated across a larger activity base. When volume rises by 100%, from 100,000 to 200,000 chickens, the decline in the overhead rate is 45.45% [($1.65 – $.90)/$1.65]. When volume rises by 50%, from 200,000 to 300,000 chickens, the decline in the overhead rate is 27.78% [($.90 – $.65)/$.90]. EXERCISE 3-29 (30 MINUTES) Job-order costing is the appropriate product-costing system for feature film production, because a film is a unique production. The production process for each film would use labor, material and support activities (i.e., overhead) in different ways. This would be true for any type of film (e.g., filming on location, filming in the studio, or using animation). EXERCISE 3-30 (20 MINUTES) 1. Raw-Material Inventory 295,100 226,200 68,900 Wages Payable 421,200 Manufacturing Overhead 234,000 2. Work-in-Process Inventory 23,400 226,200 421,200 234,000 156,000 748,800 Sales Revenue 253,500 Finished-Goods Inventory 39,000 156,000 171,600 23,400 Accounts Receivable 253,500 Cost of Goods Sold 171,600 JAY SPORTS EQUIPMENT COMPANY, INC. PARTIAL BALANCE SHEET AS OF DECEMBER 31, 20X2 Current assets Cash ....................................................................................................................... XXX Accounts receivable ............................................................................................. XXX Inventory Raw material .....................................................................................................$ 68,900 Work in process ............................................................................................... 748,800 Finished goods ................................................................................................ 23,400 JAY SPORTS EQUIPMENT COMPANY, INC. PARTIAL INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 20X2 Sales revenue .......................................................................................................... $253,500 Less: Cost of goods sold ....................................................................................... 171,600 Gross margin .......................................................................................................... $ 81,900 EXERCISE 3-31 (20 MINUTES) 1. 2. Raw material: Beginning inventory .................................................................................. Add: Purchases.......................................................................................... Deduct: Raw material used ....................................................................... Ending inventory........................................................................................ $142,000 ? 652,000 $162,000 Therefore, purchases for the year were ................................................... $672,000 Direct labor: Total manufacturing cost .......................................................................... Deduct: Direct material .............................................................................. Direct labor and manufacturing overhead ............................................... 3. $1,372,000 652,000 $ 720,000 Direct labor + manufacturing overhead Direct labor + (60%) (direct labor) (160%) (direct labor) = = = $720,000 $720,000 $720,000 Direct labor = $720,000 1.6 Direct labor = $450,000 Cost of goods manufactured: Work in process, beginning inventory ................................................. Add: Total manufacturing costs ........................................................... Deduct: Cost of goods manufactured .................................................. Work in process, ending inventory ...................................................... $ 160,000 1,372,000 ? $ 60,000 Therefore, cost of goods manufactured was ....................................... $1,472,000 EXERCISE 3-31 (CONTINUED) 4. Cost of goods sold: Finished goods, beginning inventory ...................................................... Add: Cost of goods manufactured ........................................................... Deduct: Cost of goods sold ...................................................................... Finished goods, ending inventory ............................................................ $ 180,000 1,472,000 ? $ 220,000 Therefore, cost of goods sold was ........................................................... $1,432,000 EXERCISE 3-32 (30 MINUTES) 1. CRUNCHEM CEREAL COMPANY SCHEDULE OF COST OF GOODS MANUFACTURED FOR THE YEAR ENDED DECEMBER 31, 20X4 Direct material: Raw-material inventory, January 1 ..........................................$ 45,000 Add: Purchases of raw material ............................................... 417,000 Raw material available for use .................................................$462,000 Deduct: Raw-material inventory, December 31 ...................... 49,500 Raw material used ..................................................................... Direct labor ......................................................................................... Manufacturing overhead Total manufacturing costs ................................................................ Add: Work-in-process inventory, January 1 .................................... Subtotal .............................................................................................. Deduct: Work-in-process inventory, December 31 ......................... Cost of goods manufactured ............................................................ $ 412,500 180,000 378,000* $ 970,500 58,500 $1,029,000 64,350 $ 964,650 *Applied manufacturing overhead is $378,000 ($180,000210%). Actual manufacturing overhead is also $378,000, so there is no overapplied or underapplied overhead. 2. Finished-goods inventory, January 1 ....................................................................$ 63,000 Add: Cost of goods manufactured ........................................................................ 964,650 Cost of goods available for sale ............................................................................$1,027,650 Deduct: Finished-goods inventory, December 31 ................................................ 69,300 Cost of goods sold .................................................................................................$ 958,350 3. The electronic version of the Solutions Manual “BUILD A SPREADSHEET SOLUTIONS” is available on your Instructors CD and on the Hilton, 8e website: www.mhhe.com/hilton8e. EXERCISE 3-33 (20 MINUTES) NOTE: Budgeted sales revenue, although given in the exercise, is irrelevant to the solution. 1. Predetermined overhead rate = budgetedmanufacturing overhead budgetedlevel of cost driver (a) $650,000 = $32.50 per machine hour 20,000 machine hours (b) $650,000 = $26.00 per direct-labor hour 25,000 direct - labor hours $650,000 $325,000 * (c) = $2.00 per direct-labor dollar or 200% of direct-labor cost *Budgeted direct-labor cost = 25,000$13 2. Actual manufacturing overhead – applied manufacturing overhead = overapplied or underapplied overhead (a) $690,000 – (22,000)($32.50) = $25,000 overapplied overhead (b) $690,000 – (26,000)($26.00) = $14,000 underapplied overhead (c) $690,000 – ($364,000†)(200%) = $38,000 overapplied overhead †Actual direct-labor cost = 26,000$14 EXERCISE 3-34 (5 MINUTES) 1. 2. Work-in-Process Inventory ...................................................... Manufacturing Overhead ............................................... 690,000 Work-in-Process Inventory ...................................................... Manufacturing Overhead................................................ 715,000* *Applied manufacturing overhead = $715,000 = 22,000 hours x $32.50 per machine hour 690,000 715,000 EXERCISE 3-35 (15 MINUTES) 1. Predetermined overhead rate = $993,300 / 77,000 hours = $12.90 per hour 2. To compute actual manufacturing overhead: Depreciation ............................................................................................... Property taxes ............................................................................................ Indirect labor .............................................................................................. Supervisory salaries .................................................................................. Utilities ........................................................................................................ Insurance .................................................................................................... Rental of space .......................................................................................... Indirect material: Beginning inventory, January 1 ........................................................ $ 46,000 Add: Purchases .................................................................................. 95,000 Indirect material available for use ..................................................... $141,000 Deduct: Ending inventory, December 31 .......................................... 62,000 Indirect material used ......................................................................... Actual manufacturing overhead ............................................................... Overapplied overhead = actual manufacturing overhead = $997,000 – ($12.9079,000*) = $22,100 – $225,000 19,000 79,000 210,000 58,000 32,000 295,000 79,000 $997,000 applied manufacturing overhead *Actual direct-labor hours. 3. Manufacturing Overhead ........................................................... Cost of Goods Sold ......................................................... 22,100 22,100 4. The electronic version of the Solutions Manual “BUILD A SPREADSHEET SOLUTIONS” is available on your Instructors CD and on the Hilton, 8e website: www.mhhe.com/hilton8e. NOTE: Budgeted selling and administrative expense, although given in the exercise, is irrelevant to the solution. EXERCISE 3-36 (20 MINUTES) Calculation of proration amounts: Account Amount Work in Process ..................................... $ 29,000 Finished Goods ...................................... 50,750 Cost of Goods Sold ................................ 65,250 Total ........................................................ $145,000 Percentage 20% 35% 45% 100% Underapplied Account Overhead Work in Process ..................................... $22,000* Finished Goods ...................................... 22,000 Cost of Goods Sold ................................ 22,000 x x x x *Underapplied overhead = $22,000 = Percentage 20% 35% 45% Calculation of Percentage 29,000 $145,000 50,750 $145,000 65,250 $145,000 Amount Added to Account $4,400 7,700 9,900 actual overhead – applied overhead $167,000 – $145,000 Journal entry: Work-in-Process Inventory ........................................... Finished-Goods Inventory............................................. Cost of Goods Sold ....................................................... Manufacturing Overhead ............................................... 4,400 7,700 9,900 22,000 PROBLEM 3-56 (25 MINUTES) 1. Quarter 1st.................................................................. 2nd ................................................................. 3rd ................................................................. 4th ................................................................. Predetermined Overhead Rate $8 per hour 10 per hour 8 per hour 10 per hour Calculations $400,000/50,000 $320,000/32,000 $200,000/25,000 $280,000/28,000 February $600 340 May $600 340 2. Direct material ............................................. Direct labor .................................................. Manufacturing overhead: 20 hrs$8 per hr ................................ 20 hrs$10 per hr .............................. Total cost ..................................................... 160 $1,100 200 $1,140 3. Total cost ..................................................... Markup (10%) .............................................. Price ............................................................. 4. Predetermined rate February $1,100 110 $1,210 May $1,140 114 $1,254 annual budgetedmanufacturing overhead annual budgeteddirect-labor hours $1,200,000 $8.89 per hour (rounded) 135,000 5. Direct material .............................................. Direct labor ................................................... Manufacturing overhead (20 hrs $8.89) .. Total cost ...................................................... February $ 600.00 340.00 177.80 $1,117.80 May $ 600.00 340.00 177.80 $1,117.80 PROBLEM 3-56 (CONTINUED) 6. Total cost ...................................................... Markup (10%) ............................................... Price .............................................................. $1,117.80 111.78 $1,229.58 Notice that with quarterly overhead rates, the firm may underprice its product in February and overprice it in May. PROBLEM 3-57 (55 MINUTES) The answers to the questions are as follows: 1. 2. 3. 4. 5. $648,000 $57,000 $210,000 $114,000 $240,000 6. 7. 8. 9. 10. $180,000 $450,000 $120,000 $45,000 Zero The completed T accounts, along with supporting calculations, follow. Raw-Material Inventory Bal. 8/31 45,000 210,000 120,000 Bal. 9/30 135,000 Accounts Payable 36,000 243,000 210,000 3,000 Work-in-Process Inventory Bal. 8/31 24,000 Direct 450,000 material 120,000 Direct labor 240,000 Overhead 180,000 Bal. 9/30 114,000 Manufacturing Overhead 180,000 180,000 Wages Payable 3,000 238,500 240,000 4,500 Bal. 8/31 Bal. 9/30 Sales revenue Bal. 9/30 Finished-Goods Inventory Bal. 8/31 105,000 450,000 540,000 Bal. 9/30 15,000 Cost of Goods Sold 540,000 Sales Revenue 648,000 Accounts Receivable Bal. 8/31 24,000 648,000 615,000 Bal. 9/30 57,000 Supporting Calculations: 1. Bal. 8/31 = cost of goods sold120% = $540,000120% = $648,000 PROBLEM 3-57 (CONTINUED) 2. Ending balance in accounts receivable = beginning balance + sales revenue – collections = $24,000 + $648,000 – $615,000 = $57,000 3. 4. Purchases of raw material = addition to accounts payable Addition to accounts payable = ending balance + payments – beginning balance = $3,000 + $243,000 – $36,000 = $210,000 September 30 balance in work-in-process inventory = direct + direct + manufacturing material labor overhead = $61,500 + (1,500)($20) + (1,500)($15*) = $114,000 *Predetermined overhead rate = = budgetedoverhead † budgeteddirect-labor hours $2,160,000 144,000 = $15 per direct-labor hour †Budgeted 5. direct-labor hours = Addition to work in process for direct labor = September credit to wages payable budgeted direct-labor cost $2,880,000 144,000 direct-labor rate $20 September credit to wages payable = ending balance + payments – beginning balance = $4,500 + $238,500 $3,000 = $240,000 PROBLEM 3-57 (CONTINUED) 6. September applied overhead = direct labor hourspredetermined overhead rate = 12,000*$15 = $180,000 *Direct labor hours 7. Cost of goods completed during September = addition to work in process for direct labor direct-labor rate = $240,000 12,000 hours $20 = beginning balance in work in process additions + during – November ending balance in work in process = $24,000 + ($120,000 + $240,000 + $180,000) – $114,000 = $450,000 8. Raw material used in September 9. August 31 balance in raw-material inventory = = September credit to raw= $120,000 (given) material inventory September 30 balance in rawmaterial inventory direct + material – purchases used = $135,000 + $120,000 – $210,000 = $45,000 10. Overapplied or underapplied overhead = actual overhead – applied overhead = $180,000 – $180,000 = 0 PROBLEM 3-58 (75 MINUTES) budgetedmanufacturing overhead budgeteddirect - labor hours $462,000 $22 per direct - labor hour 21,000 1. Predetermined overheadrate 2. Journal entries: (a) (b) (c) Raw-Material Inventory ...................................... Accounts Payable .................................... 6,000 Raw-Material Inventory ...................................... Accounts Payable .................................... 5,200 Work-in-Process Inventory ............................... Raw-Material Inventory ........................... 11,330* 6,000 5,200 11,330 *(260 sq. ft.$5.50 per sq. ft.) + (1,100 lbs.$9 per lb.) Manufacturing Overhead** ................................ Manufacturing-Supplies Inventory ......... 120 120 **Valve lubricant is an indirect material, so it is considered an overhead cost. (d) Work-in-Process Inventory ............................... Manufacturing Overhead ................................... Wages Payable......................................... 36,000 14,100 Work-in-Process Inventory ............................... Manufacturing Overhead......................... 39,600* 50,100 39,600 *Applied manufacturing overhead = 1,800 direct-labor hours$22 per hour. (e) Manufacturing Overhead ................................... Accumulated Depreciation: Building and Equipment ............................................. (f) Manufacturing Overhead ................................... Cash .......................................................... PROBLEM 3-58 (CONTINUED) (g) Manufacturing Overhead ................................... Accounts Payable .................................... 13,000 13,000 1,340 1,340 2,400 2,400 (h) (i) (j) (k) (l) (m) Manufacturing Overhead ................................... Cash .......................................................... 2,370 Manufacturing Overhead ................................... Prepaid Insurance .................................... 2,900 Selling and Administrative Expenses .............. Cash .......................................................... 7,500 Selling and Administrative Expenses .............. Accumulated Depreciation: Buildings and Equipment ............................................. 4,500 Selling and Administrative Expenses .............. Cash .......................................................... 1,150 Finished-Goods Inventory................................ Work-in-Process Inventory .................... 37,130* 2,370 2,900 7,500 4,500 1,150 37,130 *Cost of Job T79: Direct material (260$5.50) ................ Direct labor (850$20) ........................ Manufacturing overhead (850$22)... Total cost ............................................... (n) $ 1,430 17,000 18,700 $37,130 Accounts Receivable ........................................ Sales Revenue .......................................... 27,360* 27,360 . *(76 2)$720 per trombone Cost of Goods Sold .......................................... Finished-Goods Inventory ....................... 18,565** 18,565 **18,565 = $37,130 2. PROBLEM 3-58 (CONTINUED) 3. T-accounts and posting of journal entries: Cash Bal 11,000 1,340 2,370 7,500 (f) (h) (j) Accounts Payable 14,500 6,000 5,200 2,400 Bal (a) (b) (g) 1,150 Bal. (n) Bal. Accounts Receivable 20,000 27,360 Wages Payable 8,500 50,100 Prepaid Insurance 6,000 2,900 Accumulated Depreciation: Buildings and Equipment 99,000 Bal. 13,000 (e) 4,500 (k) Manufacturing-Supplies Inventory Bal. 600 120 Raw-Material Inventory 150,000 6,000 11,330 5,200 Bal. (a) (b) Work-in-Process Inventory Bal. 89,000 (c) 11,330 37,130 (d) 36,000 (d) 39,600 PROBLEM 3-58 (CONTINUED) Bal. (m) 4. Finished-Goods Inventory 223,000 37,130 18,565 (a) (l) (i) (c) (c) (d) (e) (f) (g) (h) (i) Manufacturing Overhead 120 39,600 14,100 13,000 1,340 2,400 2,370 2,900 (n) Cost of Goods Sold 18,565 (j) (k) (l) Selling and Administrative Expenses 7,500 4,500 1,150 Bal. (d) (d) (c) (m) Sales Revenue 27,360 (n) (n) Calculation of actual overhead: Indirect material (valve lubricant) .......................................... Indirect labor ........................................................................... Depreciation: factory building and equipment ..................... $ 120 14,100 13,000 Rent: warehouse ..................................................................... Utilities ..................................................................................... Property taxes ......................................................................... Insurance ................................................................................. Total actual overhead ............................................................. (b) Overapplied overhead 1,340 2,400 2,370 2,900 $36,230 actual manufacturing applied manufacturing = overhead overhead = $36,230 – $39,600* = $3,370 overapplied *$39,600 = 1,800 direct-labor hours$22 per hour. (c) Manufacturing Overhead ........................................................ 3,370 Cost of Goods Sold ...................................................... 3,370 PROBLEM 3-58 (CONTINUED) 5. BANDWAY COMPANY SCHEDULE OF COST OF GOODS MANUFACTURED FOR THE MONTH OF OCTOBER Direct material: Raw-material inventory, October 1 .......................... Add: October purchases of raw material ................ Raw material available for use ................................. Deduct: Raw-material inventory, October 31.......... Raw material used .................................................... Direct labor ....................................................................... Manufacturing overhead: Indirect material ........................................................ Indirect labor ............................................................. Depreciation on factory building and equipment ... Rent: warehouse ....................................................... Utilities....................................................................... Property taxes ........................................................... Insurance................................................................... Total actual manufacturing overhead ............... Add: overapplied overhead ................................ Overhead applied to work in process ..................... Total manufacturing costs .............................................. Add: Work-in-process inventory, October 1 .................. Subtotal ............................................................................ Deduct: Work-in-process inventory, October 31 ........... Cost of goods manufactured .......................................... $150,000 11,200 $161,200 149,870 $ 11,330 36,000 $ 120 14,100 13,000 1,340 2,400 2,370 2,900 $36,230 3,370* 39,600 $ 86,930 89,000 $175,930 138,800 $ 37,130† *The Schedule of Cost of Goods Manufactured lists the manufacturing costs applied to work in process. Therefore, the overapplied overhead, $3,370, must be added to actual overhead to arrive at the amount of overhead applied to work in process during October. †Cost of Job T79, which was completed during October. PROBLEM 3-58 (CONTINUED) 6. BANDWAY COMPANY SCHEDULE OF COST OF GOODS SOLD FOR THE MONTH OF OCTOBER Finished-goods inventory, October 1 ...................................................... Add: Cost of goods manufactured .......................................................... Cost of goods available for sale .............................................................. Deduct: Finished-goods inventory, October 31 ..................................... Cost of goods sold ................................................................................... Deduct: Overapplied overhead* ............................................................... Cost of goods sold (adjusted for overapplied overhead) ...................... $223,000 37,130 $260,130 241,565 $ 18,565 3,370 $ 15,195 *The company closes underapplied or overapplied overhead into cost of goods sold. Hence the balance in overapplied overhead is deducted from cost of goods sold for the month. 7. BANDWAY COMPANY INCOME STATEMENT FOR THE MONTH OF OCTOBER Sales revenue ........................................................................................... Less: Cost of goods sold ......................................................................... Gross margin ............................................................................................ Selling and administrative expenses ...................................................... Income (loss) ............................................................................................ $27,360 15,195 $12,165 13,150 $ (985) PROBLEM 3-59 (20 MINUTES) JOB-COST RECORD Job Number T79 Date Started October 5 Description Trombones Date Completed October 20 Number of Units Completed Direct Material Requisition Number Quantity 112 260 Date 10/5 Date 10/8 to 10/12 Date 10/8 to 10/12 Time Card Number 10-08 through 10-12 Unit Price $5.50 Cost $1,430 Rate $20 Cost $17,000 Direct Labor Hours 850 Manufacturing Overhead Cost Driver (Activity Base) Quantity Direct-labor hours 850 76 Application Rate $22 Cost $18,700 Cost Summary Cost Item Total direct material Total direct labor Total manufacturing overhead Total cost Unit cost Date October *Rounded †$18,565 = $37,130 ÷ 2 Amount $ 1,430 17,000 18,700 $37,130 $488.55* Shipping Summary Units Remaining Units Shipped In Inventory 38 38 Cost Balance $18,565† PROBLEM 3-60 (50 MINUTES) 1. Schedule of budgeted overhead costs: Department A Variable overhead A 21,000$17 ....................................................... B 21,000$5 ........................................................ Fixed overhead ............................................................. Total overhead .............................................................. Department B $357,000 210,000 $567,000 Grand total of budgeted overhead (A + B): $105,000 210,000 $315,000 $882,000 total budgeted overheadrate total budgeted direct - labor hours $882,000 $21per hour 42,000 Predetermined overheadrate 2. Product prices: Total cost..................................................................... Markup, 10% of cost ................................................... Price ............................................................................. 3. Basic System $1,190 119 $1,309 Advanced System $1,640 164 $1,804 Department A Department B $567,000 21,000 $315,000 21,000 $567,000 21,000 $315,000 21,000 $27 per direct-labor hour $15 per direct-labor hour Departmental overhead rates: Budgeted overhead (from requirement 1) ............................................... Budgeted direct-labor hours...................................... Predetermined overhead rates .................................. PROBLEM 3-60 (CONTINUED) 4. Revised product costs: Direct material ............................................................. Direct labor.................................................................. Manufacturing overhead: Department A: Basic system 5$27 ....................................... Advanced system 15$27 .............................. Department B: Basic system 15$15 ..................................... Advanced system 5$15 ................................ Total 5. Basic System $ 450 320 Advanced System $ 900 320 135 405 225 _ ____ $1,130 75 $1,700 Basic System $1,130 113 $1,243 Advanced System $1,700 170 $1,870 Revised product prices: Total cost..................................................................... Markup, 10% of cost ................................................... Price ........................................................................... PROBLEM 3-60 (CONTINUED) 6. COLORTECH CORPORATION Memorandum Date: Today To: President, ColorTech Corporation From: I. M. Student Subject: Departmental overhead rates Until now the company has used a single, plantwide overhead rate in computing product costs. This approach resulted in a product cost of $1,190 for the basic system and a cost of $1,640 for the advanced system. Under the company's pricing policy of adding a 10 percent markup, this yielded prices of $1,309 for the basic system and $1,804 for the advanced system. When departmental overhead rates are computed, it is apparent that the two production departments have very different cost structures. Department A is a relatively expensive department to operate, while Department B is less costly. It is important to recognize the different rates of cost incurrence in the two departments, because our two products require different amounts of time in the two departments. The basic system spends most of its time in Department B, the inexpensive department. The advanced system spends most of its time in Department A, the more expensive department. Thus, using departmental overhead rates shows that the basic system costs less than we had previously realized; the advanced system costs more. The revised product costs are $1,130 and $1,700 for the basic and advanced systems, respectively. With a 10 percent markup, these revised product costs yield prices of $1,243 for the basic system and $1,870 for the advanced system. We have been overpricing the basic system and underpricing the advanced system. I recommend that the company switch to a product costing system that incorporates departmental overhead rates. solutions to cases CASE 3-61 (45 MINUTES) 1. A job order costing system is appropriate in any environment where costs can be readily identified with specific products, batches, contracts, or projects. 2. The only job remaining in KidCo's Work-in-Process Inventory on December 31 is DRS114. The dollar value of DRS114 is calculated as follows: DRS114 balance, 11/30 ....................................................... December additions: Direct material used .................................................. Purchased parts......................................................... Direct labor ................................................................. Manufacturing overhead (19,500 hours$7.50*) ... Work-in-process inventory, 12/31 ..................................... $250,000 $124,000 87,000 200,500 146,250 557,750 $807,750 $4,500,000 600,000 hours $7.50 per hour * Manufacturing overheadrate 3. The dollar value of the playpens remaining in KidCo's finished-goods inventory on December 31 is $455,600, calculated as follows: Finished-goods inventory, 11/30 ............................................................ Units completed in December ................................................................ Units available for sale ............................................................................ Units shipped in December .................................................................... Finished-goods inventory, 12/31 ............................................................ Playpen Units 19,400 15,000 34,400 21,000 13,400 CASE 3-61 (CONTINUED) Since KidCo uses the FIFO inventory method, all units remaining in finished- goods inventory were completed in December. Unit cost of playpens completed in December: Work in process inventory, 11/30 .................................... December additions: Direct material used .................................................... Purchased parts .......................................................... Direct labor .................................................................. Manufacturing overhead (4,400 hours$7.50) ........ Total cost........................................................................... Unit cost = total cost units completed = $510,000 15,000 = $34 per unit Value of finished-goods inventory on 12/31 = Unit costquantity = $3413,400 = $455,600 $420,000 $ 3,000 10,800 43,200 33,000 90,000 $510,000 CASE 3-62 (50 MINUTES) 1. Manufacturers use predetermined overhead rates to allocate to production jobs the production costs that are not directly traceable to specific jobs. As a result, management will have timely and reasonably accurate job-cost information. Predetermined overhead rates are easy to apply and avoid fluctuations in job costs caused by changes in production volume or overhead costs throughout the year. 2. The manufacturing overhead applied through November 30 is calculated as follows: Machine hourspredetermined overhead rate = overhead applied 73,000$30 = $2,190,000 3. The manufacturing overhead applied in December is calculated as follows: Machine hourspredetermined overhead rate = overhead applied 6,000$30 = $180,000 4. Underapplied manufacturing overhead through December 31 is calculated as follows: Actual overhead ($2,200,000 + $192,000) ................................................... Applied overhead ($2,190,000 + $180,000) ................................................. Underapplied overhead ............................................................................... $2,392,000 (2,370,000) $ 22,000 CASE 3-62 (CONTINUED) 5. The balance in the Finished-Goods Inventory account on December 31 is comprised only of Job No. N11-013 and is calculated as follows: November 30 balance for Job No. N11-013 ............................................... December direct material ........................................................................... December direct labor ................................................................................ December overhead (1,000$30) ............................................................. Total finished-goods inventory .......................................................... 6. $110,000 8,000 24,000 30,000 $172,000 Opticom’s Schedule of Cost of Goods Manufactured for the year just completed is constructed as follows: OPTICOM, INC. SCHEDULE OF COST OF GOODS MANUFACTURED FOR THE YEAR ENDED DECEMBER 31 Direct material: Raw-material inventory, 1/1 ........................................... Raw-material purchases ($1,930,000 + $196,000) ......... Raw material available for use ....................................... Deduct: Indirect material used ($250,000 + $18,000) .. Raw-material inventory 12/31 ......................... Raw material used .......................................................... Direct labor ($1,690,000 + $160,000) .................................. Manufacturing overhead: Indirect material ($250,000 + $18,000) ........................... Indirect labor ($690,000 + $60,000) ................................ Utilities ($490,000 + $44,000).......................................... Depreciation ($770,000 + $70,000) ................................. Total actual manufacturing overhead ........................... Deduct: Underapplied overhead .................................... Overhead applied to work in process ............................... Total manufacturing costs ................................................. Add: Work-in-process inventory, 1/1 ................................ Subtotal ............................................................................... Deduct: Work-in-process inventory, 12/31* ...................... Cost of goods manufactured ............................................. *Supporting calculations follow. $ 210,000 2,126,000 $2,336,000 $268,000 170,000 438,000 $1,898,000 1,850,000 $268,000 750,000 534,000 840,000 2,392,000 22,000 $2,370,000 $6,118,000 120,000 $6,238,000 300,400 $5,937,600 CASE 3-62 (CONTINUED) *Supporting calculations for work in process 12/31: Direct material ..................... Direct labor.......................... Applied overhead: 2,500 hrs.$30............... 800 hrs.$30.................. Total ......................... D12-002 $ 75,800 40,000 75,000 ______ $190,800 D12-003 $ 52,000 33,600 Total $127,800 73,600 24,000 $109,600 75,000 24,000 $300,400