Glossary of Terms

advertisement

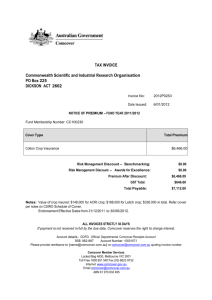

SG Accounting & Finance Glossary of Terms Accounting Terms Current Assets These assets change in value frequently. E.g. Bank, Cash, Debtor. Debtors A debtor is someone who owes a person or business money. Current Liabilities These are debts which are short-term. They are usually paid within one year. E.g. Creditors, Bank Overdraft. Creditors A creditor is someone to whom a business or person owes money. Long-Term Liabilities These are debts which are not usually paid off (settled) within one year. E.g. Bank Loan (taken out over 5 years). Cash Budget This is a financial statement which is prepared for a week, month or year to show the cash position for the period of time. The budget will show the OPENING BALANCE of cash, all cash received, all cash spent and the CLOSING BALANCE (the amount of cash left at the end of the period). The closing balance at the end of week 1 will be the opening balance at the beginning of week 2. Not-For-Profit Organisations These organisations are set up in order to provide a service for their members. They are not set up with the intention of making a profit. Many of these organisations run sporting activities such as tennis, squash, golf or bowling. Annual General Meeting (AGM) This is the meeting held once a year to which all members are invited. Committee members are appointed at this meeting and finance and any other important items are discussed. Honorarium This is a small fee paid to a committee member for the work he/she has undertaken for the club on a voluntary basis. Sole Trader A Sole Trader is the name given to a business which is set up and managed by one person. This person sets up the business and invests money in it – the money invested is known as CAPITAL. Sole Traders make their own decisions and take any profits or suffer any losses. Bank Overdraft This allows a bank customer to withdraw more money from his/her current account than has been deposited. The customer and bank arrange a maximum amount to be allowed, i.e. overdrawn, and the customers can continue to write cheques until this sum is reached. A bank overdraft is a short-term debt and would be recorded as a Current Liability. Interest will be charged on the amount overdrawn. Lease This is when property is purchased for a fixed period of time, e.g. 99 years. The person leasing the property usually borrows the money from a bank or other financial institution. Obviously, the amount borrowed PLUS the interest charge must be paid back at regular intervals. Ledger Accounts tell us a story of what is happening. Accounts are kept in the LEDGER. The Ledger is based on the DOUBLE-ENTRY SYSTEM. For each transaction there is a double effect with entries being made in 2 accounts – one being Debited and the other Credited. Cash This means that payment is made immediately by bank or cash. Credit This means that payment is made at a later date. Page 1 Invoice An Invoice is a bill sent by the Supplier to the Customer who is buying goods (stock) on credit. The invoice will show the date, description of the goods, quantity purchased unit price, total price, any trade discount, VAT and terms for cash discount. Invoices are used by the customer to prepare the purchases account. PURCHASES are goods/stock bought for resale. Copy Invoice A Copy Invoice is a copy of the original invoice which was sent out by the Supplier to the customer. Copy invoices are used by the Supplier to complete the Sales Account. SALES are goods/stock sold in the course of trading. Credit Note A credit note sometimes it is necessary to return goods bought on credit because they are faulty, damaged or not as ordered. A Credit Note is sent by the Supplier to the Customer who returns the goods and the value is deducted from the Customer’s monthly statement. It is used by the Customer to complete the Purchases Returns Account (also known as the Returns Outwards Account). Copy Credit Note This is a copy kept by the Supplier of a Credit Note sent to a Customer returning goods bought on credit. Cheque Counterfoil This is used to record information of a bank (cheque) payment made by the business. Cheque Counterfoils are used to record Bank payments in the Bank Account. Cheque These are entered in the business Bank Account to record money received. However, some businesses wait until they receive a BANK STATEMENT and use this document to record Bank transactions. Bank Statement This is a document sent by a bank to its customers detailing all money paid in and all money paid out during a set period of time (usually a month). Receipt This document is given by the Supplier to the Customer when payment is made in cash. Receipts are used by the Customer to complete the Cash Account. Trade Discount This is a discount offered by a Supplier to a Customer because: a) both deal in the same line of business (e.g. joiners) b) of BULK buying (this means buying in large quantities) c) the supplier is clearing out a discontinued line Trade Discount is deducted on the Invoice from the Cost of Goods in order to calculate the NET GOODS VALUE. Cash Discount This is a discount offered to customers to encourage them to pay their account promptly. This is usually shown on the Invoice under the section headed TERMS, e.g. 5% monthly. This means that if the Invoice is paid within one month, the customer can deduct 5% from the invoice total. Discount Allowed This discount is allowed to customers for paying their accounts promptly. It is treated as a business expense and appears as a deduction from profit in the Profit and Loss Account. a) DISCOUNT ALLOWED b) DISCOUNT RECEIVED Discount Received This discount is received from Suppliers because the business has paid their account promptly. It is treated as a business gain and appears as an addition to profit in the Profit Page 2 and Loss Account. VAT (value added tax) This is a Government Tax on the purchase of Goods and Services. A percentage rate is specified by Customers and Excise and this amount is added to the Net Goods Value to give the Total Invoice Price. Trial Balance After entering the transactions for an accounting period in the Ledger a TRIAL BALANCE is drawn up. This is a list of closing balances remaining in the books at the end of the trading period. The total of all Debit balances should equal the total of all Credit balances. This is a check on the arithmetical accuracy of the Ledger. Final accounts are prepared from this list of balances. Final Accounts The FINAL ACCOUNTS are prepared at the end of the trading period. They include the Trading Account and the Profit and Loss Accounts. Trading Account The purpose of this account is to calculate the Gross Profit/Loss made from buying and selling goods. The GROSS PROFIT is the difference between the TURNOVER and the COST OF GOODS SOLD. Turnover This is the Sales figure after any Sales Returns have been deducted. Turnover is sometimes referred to as Net Sales. Carriage In (Inwards) This is a cost to the business. Carriage. In is the name given to the expense of transporting goods into the business (Purchases). This expense increases the Cost of Goods Sold in the Trading Account. Carriage Out (Outwards) This is a cost to the business. Carriage Out is the name given to the expense of transporting goods going out of the business (Sales). This is entered in the Profit and Loss Account. It is not a trading expense. Sales Returns These are goods returned from a Customer to a business because they are faulty, damaged or not as ordered. These returns are deducted from Sales to calculate Turnover in the Trading Account. Purchases Returns These are goods returned by a Customer to a supplier because they are faulty, damaged or not as ordered. These returns are deducted from Purchases to reduce the value of Cost of Goods Sold in the Trading Account. Bad Debts A person who owes money to a business in a Debtor. If a debtor fails to pay his debts, e.g. because of the closure of his business, death or bankruptcy, the debtor’s account should be closed and the money due transferred to a Bad Debts Account. The Bad Debts account will be transferred to the Profit and Loss Account as an expense. Commission This is money given to sales staff to encourage higher sales. a) Commission Paid – This is an expense to the business and is shown as an expense in the Profit and Loss account. b) Commission Received – This is a gain to the business and is shown as an addition to Gross Profit in the Profit and Loss account. Drawings This is money or stock which the owner takes out of the business for his/her own use. The drawings account is transferred to the Capital account at the end of the accounting period. Break-Even This is used to show the level of activity needed to allow a business to cover its costs, i.e. Page 3 Analysis Fixed Costs how many products have to be made or how much revenue from sales has to be earned before a profit is made. These costs remain the same regardless of the level of output and must be paid even is no sales are made. Examples of fixed costs are: Rent of Premises, Wages of Assistant and Insurance. Variable Costs These costs vary according to the level of output, i.e. as Sales rise, Variable Costs rise. When selling, e.g. Ice Cream Cones, Variable Costs would be the Cones and the Ice-Cream. Total Costs This is the total of fixed and variable costs. Break-Even Point This is the point at which no profit or loss is made – the business simply covers its total costs. Contribution This is the name given to the Selling Price (per unit) less variable cost (per unit). This money contributes to covering Fixed Costs. When total Contribution – Fixed costs, no profit or loss is made and a Break-Even situation is reached. Royalties This is the name given to the cost charged by a business for the use of their name/product by another business. Income and Expenditure Account This account is prepared after a receipts and payments account of a club is drawn up. The receipts and payments account only records the money paid in and the money paid out during the accounting period, whereas the INCOME AND EXPENDITURE ACCOUNT shows the figures belonging to that particular period for Income and Expenditure – this includes items such as DEPRECIATION, ACCRUALS and PREPAYMENTS. Depreciation This is an amount deducted from the value of an asset because of wear and tear, ageing asset becoming obsolete (out of date). The amount of depreciation deducted is decided by the Treasurer and/or the Club Committee and is given as a percentage of the total value of the asset e.g. 10% of cost. It is an expense in the Income and Expenditure Account and is deducted from the value of the Fixed Asset in the Balance Sheet. Accruals These are payments which are due to be made for the period but have not been made when the accounts were prepared. They appear in the Income and Expenditure Account as an addition to the original expense and also appear in the Balance Sheet as a Current Liability. Prepayments These are amounts of money paid in advance (i.e. before becoming due). They appear as a deduction to the original expense in the Income and Expenditure Account and as a Current Asset in the Balance Sheet. Revenue Expenditure These are day-to-day running costs/expenses of a Club/Business and are deducted before a Profit is calculated. Capital Expenditure This is not recorded in the Income and Expenditure Account. This type of Expenditure increases the value of the assets of a Club/Business e.g. the purchase of a fixed asset or improvements to Fixed Assets. Surplus Income more than expenditure. Deficit Income less than expenditure. Page 4 Income Statement Information regarding a particular fund-raising event e.g. a dance, is often recorded separately in an INCOME STATEMENT and the final net figure (i.e. Income or Expenditure) added into the main account. Accumulated Fund This is the term used for the Net Worth of the Club. Each year any surplus of income over expenditure is added to the Accumulated Fund. A deficit would, of course, be deducted from the Accumulated Fund. Chairman The chairman (chairperson) runs meetings and is the spokesperson for the Club. The chairman would be appointed by a committee formed at the Annual General Meeting of the Club. AGM This is the meeting held once a year to which all members are invited. Committee members are appointed at this meeting and finance and any other important items are discussed. Secretary The Secretary organises meetings, together with the Chairman. The Secretary would be responsible for any correspondence to be sent out on behalf of the Club and for any notes (Minutes) of meetings to be kept as a record of proceedings. Treasurer The TREASURER looks after the finances of the Club and prepares a set of Accounts for the members. Grant This is the term for a sum of money given to a club to be used for a specific expense e.g. Grant for Building Repairs. This Grant may be given by the Local Council, the government or sometimes a local business. This is not a loan and does not have to be repaid. Donation This is the term used for money gifted to a Club. Donations may be for specific projects or for the general use of the Club. These gifts do not have to be repaid. Honorarium This is money given to a person who has done voluntary work on behalf of the club. A Secretary or Treasurer may be given an Honorarium in recognition of the work they have done. Sponsorship Business will occasionally provide equipment or sports clothing for a club. Usually the company name is displayed on the equipment/clothing as a method of advertising, e.g. the use of company names on football strips. Bank Reconciliation Statement A treasurer must compare the monthly bank statement sent by the bank with his/her own record of bank transactions – the Bank Account. The Bank Reconciliation Statement will show where differences have occurred in the completion of both Accounts and will bring together the two balances. Unpresented Cheques These are cheques sent out and recorded in the Club/Business Bank Account that may not yet have been presented for payment. Standing Order Also written as SO. This is an instruction to the Bank to pay a set amount of money as regular intervals to the same person/business. The Bank will then deal with this payment until instructed otherwise. Bank Giro Credit Also written as BGC. This is a payment into someone else’s Bank account made at any bank using a Giro Credit Form. The Bank and Branch where the payee’s account is held must be entered on the Giro Credit Form. Electricity Bills have a Giro Credit Form attached when sent out. Page 5 Direct Debit Also written as DD. This is an instruction to the Bank to pay a sum of money when it is requested by a Creditor. This service allows the creditor to change the amount of money to be paid. Bank Charges This is money deducted from the Club/Business account by the Bank to cover the cost of looking after the account. Cash Card This is a card used to obtain money from a Cash Dispenser. A Cash Dispensing machine can usually be found on the outside wall of the Bank. It is a 24-hour service. Money is obtained by keying in a PIN Number. Each customer of the Bank is given their own special pin number which activates the Bank computer when the card is inserted into the machine and the number keyed in. Overdrawn When a Bank Statement shows a Debit Balance (DR) it means that the Bank Account Holder has spent more money than is available in the Account. A Credit Balance (CR) on the Bank Statement shows that the Account Holder still has funds in their account. Current Account A separate account is kept in the ledger to show a partners profit, drawings, interest on capital and drawings, and salary. The balance left on the current account represents the amount of undrawn profits that the partner is willing to leave in the business. Interest on capital Interest is sometimes granted on a partner’s capital to allow for difference in the capital invested by each partner in the business. Interest on drawings It is the best interests of the partnership if as little cash is withdrawn from the partnership as possible. To deter partners from withdrawing cash they are often charged interest on drawings. Withdrawals of cash deprives the partnership of funds which could be used for meeting debts, funding expansion or achieving discounts through bulk purchases. Salary Some partners in a business spend considerable amounts of time working for the business. In order to compensate working partners for their work it is usual to pay them a SALARY. Bad debts Sometimes a debtor fails to pay his debt due to the closure of the business, death or bankruptcy. If this occurs the Debtor’s account is closed and the amount placed in a Bad Debts Accounts which is transferred at the end of the accounting period as an expense to the Profit and Loss Account. Provision for bad debts When a business realises they are going to have bad debts, they provide for them in advance. This is done by setting aside dome of the profits as a provision for Bad Debts. The provision will be charged against profit in the Profit and Loss account and will be shown as a deduction from the Debtors in the Balance Sheet. Depreciation Depreciation represents the fall in value of a fixed asset over a period of time. Most assets are likely to depreciate because of wear and tear and obsolescence. The estimated depreciation is set against profits each year and transferred to a Provision for Depreciation Account. Depreciation is shown as an expense in the Profit and Loss Account and is deducted from the cost of the asset in the Balance Sheet. Errors of Omission This is where a transaction has been completely left out of the books, e.g. sold goods on credit to I Henderson 360 – no entry has been made in the Sales Account (Cr) or in I Henderson’s Account (Dr). Page 6 Errors of Commission This is where the correct amount has been entered but in the wrong person’s account. E.g., Purchases on credit from D Philip of £55 – the correct amount is entered in the Purchases Account (Dr) but the 355 is entered in E Philip’s Account (Cr) not D Philip’s. Errors of Principle When an item is entered on the correct side of the account but in the wrong class of account. E.g., purchase of a motor van is entered in the Motor Vehicles Expenses Account (Dr) instead of the Motor Vehicles Account. Compensating Error This is where one error cancels out another. E.g., Sales £10 too much, Purchases 310 too much, therefore both sides of the Trial Balance will agree but will be overstated by £10. Errors of original entry This is where the error was made when entering information from the source document, e.g. invoices – the wrong figure is posted correctly to the ledger. The trial balance will agree but the totals are wrong. Complete reversal of entry This is where the correct accounts are used but the amount is posted to the wrong side. E.g., pay D Blythe 3260 by cheque is posted in error as: Dr Bank Account £260; Cr D Blythe. Suspense Account When a Trial Balance does not balance the difference between Dr and Cr side represents the effect of the error(s). Every effort should be made to find the error(s) but should this not be possible the amount is placed temporarily into an account called a SUSPENSE ACCOUNT. Ordinary Shares Shareholders with Ordinary Shares receive an annual Dividend. The Directors decide on the amount of the dividend. The Dividend can change each year, e.g. Year 1 = 10% Year 2 = 5%. Dividend will be determined on Profit figures – high profits usually mean high dividends and low profits usually mean low dividends. Preference Shares Shareholders with Preference Shares receive a fixed Dividend rate every year whether or not profits are high or low. Preference Shareholders will receive Dividends before Ordinary Shareholders. Debentures These are NOT shares. Debentures are Long Term Loans to the company which are to be paid back at a specific date. Debenture holders receive a fixed rate of interest on their Loan regardless of whether the Company makes a profit or loss – this interest is paid before Profit/Loss figure is calculated. Interim Dividend This is the money paid to the Shareholders during the year. It is part of their dividend payment. An Interim Dividend is often paid out half way through the financial year. Final Dividend This is the last Dividend payment due to Shareholders for a particular financial year. It is often paid after the Accounts have been prepared and is entered as a Current Liability in the Balance Sheet if it is still due to be paid at the end of the financial year. Page 7