Robert N. Thornton

advertisement

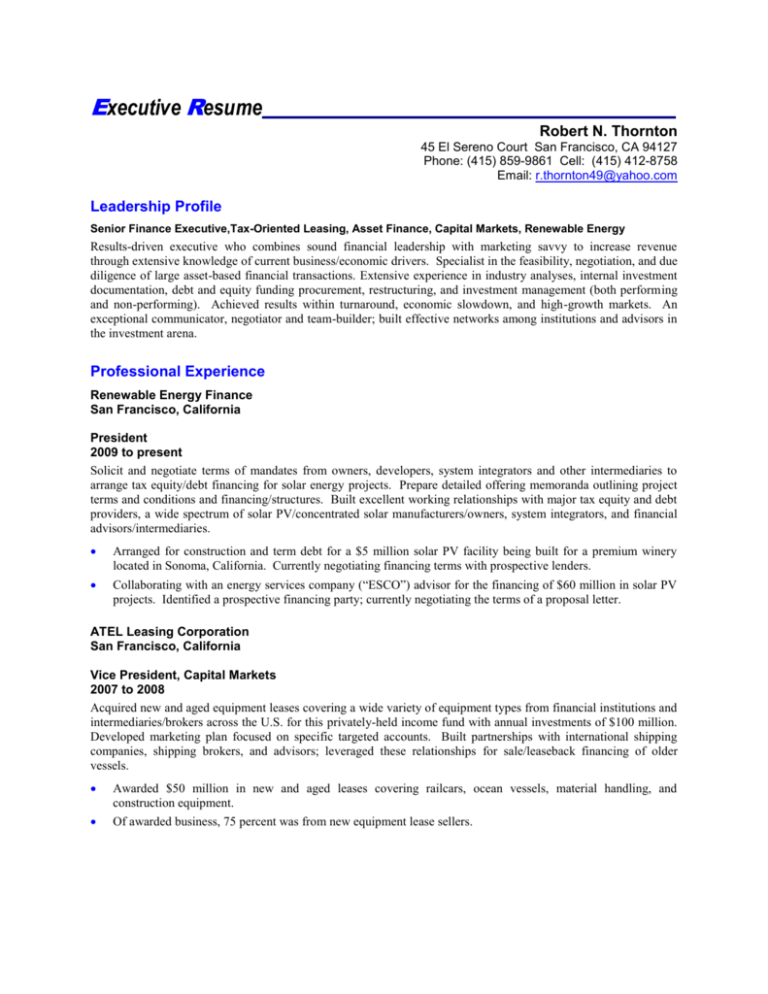

Executive Resume Robert N. Thornton 45 El Sereno Court San Francisco, CA 94127 Phone: (415) 859-9861 Cell: (415) 412-8758 Email: r.thornton49@yahoo.com Leadership Profile Senior Finance Executive,Tax-Oriented Leasing, Asset Finance, Capital Markets, Renewable Energy Results-driven executive who combines sound financial leadership with marketing savvy to increase revenue through extensive knowledge of current business/economic drivers. Specialist in the feasibility, negotiation, and due diligence of large asset-based financial transactions. Extensive experience in industry analyses, internal investment documentation, debt and equity funding procurement, restructuring, and investment management (both performing and non-performing). Achieved results within turnaround, economic slowdown, and high-growth markets. An exceptional communicator, negotiator and team-builder; built effective networks among institutions and advisors in the investment arena. Professional Experience Renewable Energy Finance San Francisco, California President 2009 to present Solicit and negotiate terms of mandates from owners, developers, system integrators and other intermediaries to arrange tax equity/debt financing for solar energy projects. Prepare detailed offering memoranda outlining project terms and conditions and financing/structures. Built excellent working relationships with major tax equity and debt providers, a wide spectrum of solar PV/concentrated solar manufacturers/owners, system integrators, and financial advisors/intermediaries. Arranged for construction and term debt for a $5 million solar PV facility being built for a premium winery located in Sonoma, California. Currently negotiating financing terms with prospective lenders. Collaborating with an energy services company (“ESCO”) advisor for the financing of $60 million in solar PV projects. Identified a prospective financing party; currently negotiating the terms of a proposal letter. ATEL Leasing Corporation San Francisco, California Vice President, Capital Markets 2007 to 2008 Acquired new and aged equipment leases covering a wide variety of equipment types from financial institutions and intermediaries/brokers across the U.S. for this privately-held income fund with annual investments of $100 million. Developed marketing plan focused on specific targeted accounts. Built partnerships with international shipping companies, shipping brokers, and advisors; leveraged these relationships for sale/leaseback financing of older vessels. Awarded $50 million in new and aged leases covering railcars, ocean vessels, material handling, and construction equipment. Of awarded business, 75 percent was from new equipment lease sellers. Robert N. Thornton Page 2 Republic Financial Corporation Aurora, Colorado/San Francisco, California Senior Director, Portfolio Acquisitions Aviation and Portfolio Group 2003 to 2007 Directed marketing to financial institutions and advisors to acquire both performing and non-performing commercial loans/leases (“investments”) for this private equity/investment company. Conducted credit due diligence, industry analyses, and internal investment committee write-ups. Participated in debt and equity funding procurement for 100 percent of the purchase price on a non-recourse basis. Actively managed non-performing investments, including terms restructuring with CFOs and sale of investments prior to maturity to other investors. Originated and closed the acquisition of two portfolios (both performing and non-performing) with a purchase price of $40 million. Key participant in sourcing both debt and equity to fund 100 percent of the purchase price on favorable terms and on a non-recourse basis. Within two years both portfolios were liquidated/restructured/resold at 200 percent of the acquisition cost. SC Capital Evergreen, Colorado VP, Acquisitions 2002 to 2003 Directly originated from financial institutions and brokers the acquisition of aged leases of facilities/complex assets that provide substantial potential for residual upside for this privately-held investment company. Key player in arranging the funding to acquire investments on a non-recourse basis and restructuring the lease by extending the term of the lease and discounting the remaining rental payments. Acquired several leases at a cost of $28 million, funding them on a non-recourse basis. These acquisitions were done on a “negotiated” basis built upon prior relationships with the sellers. Within one year, the term of largest lease acquisition was extended several years that allowed rental payments to be discounted to a bank with the proceeds substantially exceeding the purchase price. GATX Capital Corporation San Francisco, California VP, Syndications Group 1998 to 2001 Sold existing leases from GATX and third-party managed portfolios and raised capital for GATX led joint ventures for this diversified leasing company with $2 billion in assets. Also raised capital for GATX and its sister company, General American Transportation Corp (GATC). Prepared offering memorandums, negotiated awards, and oversaw documentation/closing. Sold several leases covering a variety of assets and credits for $20 million above the targeted sales price, including older locomotive assets sold for $10 million above the expected stretch targeted price. Key player in arranging more than $100 million in recourse sale-leaseback financing and the first-ever securitization of $200 million in rail assets on a non-recourse basis. Arranged funding from institutional leasing companies for GATX-led partnerships to acquire commercial aircraft, rail, and telecommunication assets. Raised $200 million of $350 million from two institutions to lease internet infrastructure equipment to pre-IPO telecom companies. Both institutions elected to invest in the second partnership. Played a major role in arranging first 20 year securitized non-recourse leveraged lease of a pool of railcars on lease for terms of three to five years. Robert N. Thornton Page 3 Resold the equity in five of eight leveraged leases acquired from the NatWest Leasing portfolio as Natwest exited the leasing business. Secured trading gains of over $5 million that substantially exceeded the targeted amount through the use of a complex tax structure and aggressive marketing. Served as lessor advisor for $20 million in offshore drilling rigs leased to a private Mexican company. VP, Secondary Markets Originations Group 1993 to 1997 Developed and executed a marketing plan to acquire aged leases from institutions across the U.S. both for GATX’s own account and to syndicate to other investors. Oversaw the preparation and receipt of investment committee approvals and documentation/closing of acquisitions. Acquired more than $75 million in aged leases/residual interests covering several asset types from nine institutions—three of these institutions were new clients of GATX. Over the next five years, substantial gains were realized from reselling the leases, lease extensions, or outright sale of the assets. Bought interests in several boxcar leases at a deep discount that reflected historical credit problems with the lessee (since resolved) and write-downs by the lessor. Within six months, the leases were resold for a $10 million gain above the $20 million purchase price with the buyer re-bidding twice against itself. VP, Project Finance Group 1990 to 1992 Sourced new investment opportunities by contacting developers, financial institutions, and advisors across the U.S. Secured the tax equity investor for GATX’s first project finance investment. Sourced the tax equity for the $40 million transition ITC leveraged lease of the Agnews co-generation facility in California. Prepared the offering memorandum and completed the acquisition documentation. Sourced the acquisition of a $30 million co-generation facility and earned a $600,000 fee as the advisor to a large institutional investor. Employment Prior to 1990 Originated and syndicated large leveraged leases of utility and energy assets for First Chicago Leasing Corporation for six years, working with senior financial officers of utilities and energy companies in the Midwest/Eastern U.S. as well as advisors and investment banks in New York City. Transitioned to managing director of the originations group at Matrix Leasing International (a lease advisory subsidiary of First Bank Systems). Hired as one of four senior officers to re-establish the company as a large ticket lease advisor; sourced the lease financing for utilitygenerating assets and project finance facilities. Significant accomplishments during this period included: Directly originated and syndicated the equity in $1.25 billion of utility-generating assets, energy facilities, and industrial assets. Highlights include the $650 million lease of the Rockport coal-fired generating unit for American Electric Power and the $250 million lease of a continuous caster for National Steel. Assisted in the origination and syndication of an additional $1.4 billion of utility assets including an interest in a nuclear power plant for the Pittsburgh utility DQE. Worked closely with the First Chicago Bank utility group relationship officers to enhance the bank’s relationship with important customers. The lease income and syndication fees in excess of $5 million were double-counted both by the leasing group as well as the utility group within the bank. Education/Professional Development Marketing/Economics of Commercial Solar Projects, Solar Living Institute, South San Francisco, CA—2009. MBA, Finance University of Colorado, Boulder Colorado. BA Political Science, George Washington University, Washington D.C. Key Accomplishment Summary Robert N. Thornton Gained Substantial Profits from Troubled Commercial Aircraft Leases Situation: As a result of the massive decline in aircraft values following the events of 9/11, a Midwest regional bank was under severe pressure by bank examiners to reduce non-performing loans/leases of commercial aircraft while positioning the bank to make a strategic acquisition of another regional bank. Action Plan: Using a prior relationship with the leasing sub of the Midwest bank, knowledge of their distressed commercial aircraft leases and acquisition plans, met with the decision makers when they responded positively to our offer to acquire the “problem” leases. Wanting to make the transaction larger, I convinced my contacts to add other performing leases to the portfolio to be sold indicating that they could allocate my purchase price among the various leases as they saw fit. Since our $5 million offer for the aircraft leases was above their severely written down values, they could allocate more of our purchase to the performing leases and achieve a breakeven value for the entire portfolio. Starting the search for a funding source/buyer prior to receiving a signed proposal letter allowed for sale of the performing portfolio on the closing date. Results: Sold the performing leases for an amount equal to the total purchase for the portfolio ($15 million) simultaneously that did not require outside funding. This sale allowed for the acquisition of the commercial aircraft leases at zero cost. Collected rental payments on the aircraft leases over the next two years, and re-sold the leases after the commercial aircraft market rebounded. Total profit was more than $5 million. Key Accomplishment Summary Robert N. Thornton Generated $10 Million in Profits through Knowledge of the Railcar Market Situation: Became aware of an opportunity to acquire several leases covering 1,000 boxcars to a subsidiary of a consortium of Class I railroads. At that time, the original 20-year lease would expire in five years. The subsidiary company had nearly filed for Chapter 11 five years after the lease commencement, at which time the leases were restructured in a complex restructuring. As a result, the investors/sellers substantially wrote down their investment. The subsidiary company had since recovered and, although my firm did not foresee strong residual values in this asset type, the acquisition provided an excellent opportunity to buy low and sell high. Action Plan: Researching the equipment market and prospects for a rebound in values, discovered that several investors were more optimistic regarding future residual values for older boxcars. Used market intelligence regarding the potential investor’s appetite for boxcars and direct feedback from the seller’s financial advisor indicating that his client was very motivated to sell. Engaged counsel to thoroughly review the complex documents associated with the restructuring. Identified a large investor who was desperate for volume and was bullish on the future values for boxcars. Met with lawyers who were involved in the lease restructuring, reviewed legal documents, and spoke with several of the co-investors. Identified several other leases (total of 1,250 boxcars) held by four different investors (who had written off their investments) and were receptive to sell their investments. Contacted these investors and negotiated very attractive purchase prices to acquire all of their interests. Prepared a detailed investment memorandum to seek approval to acquire both the large lease of 1,000 boxcars as well as the leases for the other 1,250 boxcars. After receiving approval for the acquisition and starting the acquisition documentation, began a dialogue with the targeted buyer of all 2,250 boxcars and shared the findings of the documentation review. Results: Within a week of closing the acquisition of the 2,250 boxcars, formally offered the leases to the buyer. Over a period of three weeks we got the buyer to bid against himself by raising the purchase price twice. Closed the sale of the 2,250 boxcars for a price of $30 million two months after acquisition, achieving a $10 million gain above the initial purchase price. Key Accomplishment Summary Robert N. Thornton Secured the Largest Leveraged Lease Financing in the Company’s History Situation: While a senior member of the utility/energy financing group at a major bank-owned leasing company, discovered that a large Midwest utility was seriously considering the sale leaseback financing of a recently constructed coalfired generating facility with an estimated cost of approx $1.3 billion. Action Plan: Leveraged a close relationship with the utility’s senior financial officers developed over five years (completed five separate lease financings totaling $80 million) and was allowed to bid on acting as its financial advisor. When Goldman Sachs was selected as the financial advisor for the utility, took advantage of a long-standing relationship with the utility and a history of working with other equity investors syndicating a portion of large utility assets to form a syndicate of investors to bid for the entire $1.3 billion lease financing. Numerous conference calls, detailed term sheets and personal visits to the other three investors were necessary to finalize the syndicate. Coordinated the economic analysis, asset/residual valuation, and credit review for both the leasing company and its syndicate members to allow a timely/competitive bid to Goldman Sachs. When our syndicate was awarded 50 percent of the financing ($650 million on the condition we improve the pricing and provide firm commitments not subject to further syndication), reduced the syndicate to those who could improve their pricing. Upon the award of the $650 million, oversaw the investment committee approval process and negotiation/completion of the document closing. Results: The leasing company was recognized within the equipment leasing industry by both utilities and investors as the leader in structuring and financing utility-generating assets. This lease financing led to several follow-on lease financings for the leasing company, both as an investor and advisor to other equity sources, including the lease financing of $2 billion for several nuclear power plants. The leasing company earned more than $2 million in syndication fees and earned excellent returns over the 30-year term of the lease. Years later, while working for another leasing company, successfully syndicated a $150 million interest in that same coal-fired generating facility that my company had acquired from an investor who was exiting the leasing business. Syndicated the $150 million interest to the original leasing company where the transaction originated, earning a $1 million trading gain.