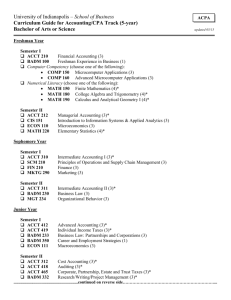

University of Indianapolis – School of Business

advertisement

University of Indianapolis – School of Business Curriculum Guide for Accounting/non-CPA Track (4-year) Bachelor of Arts or Science AACT updated 05/15 Freshman Year Semester I ACCT 210 Financial Accounting (3) BADM 100 Freshman Experience in Business (1) Computer Competency (choose one of the following): COMP 150 Microcomputer Applications (3) COMP 160 Advanced Microcomputer Applications (3) Numerical Literacy (choose one of the following): MATH 150 Finite Mathematics (4)* MATH 180 College Algebra and Trigonometry (4)* MATH 190 Calculus and analytical Geometry I (4)* Semester II ACCT 212 CIS 151 ECON 110 MATH 220 Managerial Accounting (3)* Introduction to Information Systems & Applied Analytics (3) Microeconomics (3) Elementary Statistics (4)* Sophomore Year Semester I ACCT 310 SCM 210 FIN 210 MKTG 290 Intermediate Accounting I (3)* Principles of Operations and Supply Chain Management (3) Finance (3) Marketing (3) Semester II ACCT 311 BADM 230 MGT 234 Intermediate Accounting II (3)* Business Law (3) Organizational Behavior (3) Junior Year Semester I ACCT 412 ACCT 419 BADM 233 BADM 350 ECON 111 Advanced Accounting (3)* Individual Income Taxes (3)* Business Law: Partnerships and Corporations (3) Career and Employment Strategies (1) Macroeconomics (3) Semester II ACCT 312 ACCT 418 ACCT 465 BADM 332 Cost Accounting (3)* Auditing (3)* Corporate, Partnership, Estate and Trust Taxes (3)* Research/Writing/Project Management (3)* ..............................................................continued on reverse side…………………………………………………………... Senior Year Semester I BADM 231 SCM 386 Business Communications (3) Quantitative Methods (3)* Semester II ACCT 314 BADM 439 SCM 388 Accounting Information Systems (3)* Business Policy and Strategy (3)* Production and Operations Management (3)* * See the Academic Catalog for course prerequisites NOTE: A grade of C- (1.7 on a 4.0 scale) or higher is required in all courses applying toward the Major. The Bachelor’s degree requires a minimum of 120 hours. This program may require attendance in both day and extended programs classes. See the General Education Core for additional course requirements. REMEMBER: If you have any questions about the Accounting/non-CPA Track Major (AACT) and its requirements, contact The Center for Advising and Student Achievement (788-2057, Schwitzer Student Center, Room 206). Courses and requirements sometimes change so keep in contact with your advisor.