University of Indianapolis – School of Business

advertisement

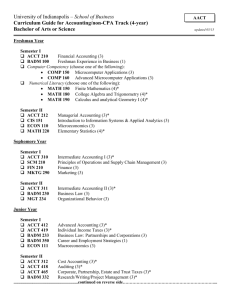

University of Indianapolis – School of Business Curriculum Guide for Accounting/CPA Track (5-year) Bachelor of Arts or Science ACPA updated 05/15 Freshman Year Semester I ACCT 210 Financial Accounting (3) BADM 100 Freshman Experience in Business (1) Computer Competency (choose one of the following): COMP 150 Microcomputer Applications (3) COMP 160 Advanced Microcomputer Applications (3) Numerical Literacy (choose one of the following): MATH 150 Finite Mathematics (4)* MATH 180 College Algebra and Trigonometry (4)* MATH 190 Calculus and Analytical Geometry I (4)* Semester II ACCT 212 CIS 151 ECON 110 MATH 220 Managerial Accounting (3)* Introduction to Information Systems & Applied Analytics (3) Microeconomics (3) Elementary Statistics (4)* Sophomore Year Semester I ACCT 310 SCM 210 FIN 210 MKTG 290 Intermediate Accounting I (3)* Principles of Operations and Supply Chain Management (3) Finance (3) Marketing (3) Semester II ACCT 311 BADM 230 MGT 234 Intermediate Accounting II (3)* Business Law (3) Organizational Behavior (3) Junior Year Semester I ACCT 412 ACCT 419 BADM 233 BADM 350 ECON 111 Advanced Accounting (3)* Individual Income Taxes (3)* Business Law: Partnerships and Corporations (3) Career and Employment Strategies (1) Macroeconomics (3) Semester II ACCT 312 ACCT 418 ACCT 465 BADM 332 Cost Accounting (3)* Auditing (3)* Corporate, Partnership, Estate and Trust Taxes (3)* Research/Writing/Project Management (3)* ..............................................................continued on reverse side…………………………………………………………... Senior Year Semester I SCM 386 BADM 231 Quantitative Methods (3)* Business Communications (3) Semester II ACCT 314 BADM 439 SCM 388 Accounting Information Systems (3)* Business Policy and Strategy (3)* Production and Operations Management (3)* Fifth Year** **In order to sit for the State of Indiana CPA licensure exam, a minimum of 150 credit hours are required. The University of Indianapolis offers an Accelerated BS/MBA Program. Application into this program must be completed prior to the beginning of the junior year. If accepted, students may substitute MBA courses as described in the Accelerated BS/MBA Course Outline listed in the Academic Catalog. MBA courses will then be applied toward the requirements of the undergraduate program; and upon completion of the BS degree, students will complete the remaining course requirements to be awarded an MBA degree. * See the Academic Catalog for course prerequisites NOTE: A grade of C- (1.7 on a 4.0 scale) or higher is required in all courses numbered 499 or lower applying toward the accounting major or minor. For student pursuing the Accelerated BS/MBA Program, a grade of B (3.0 on a 4.0 scale) is required in all courses numbered 500 or higher. This program may require attendance in both day and extended programs classes. See the General Education Core Guide for additional course requirements. REMEMBER: If you have any questions about the Accounting/CPA Track Major (ACPA) and its requirements, contact The Center for Advising and Student Achievement (788-2057, Schwitzer Student Center, Room 206). Courses and requirements sometimes change so keep in contact with your advisor.