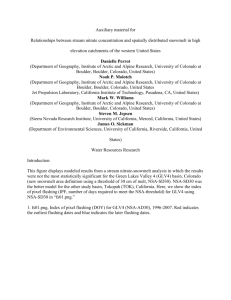

property rights appraised

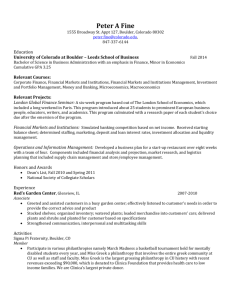

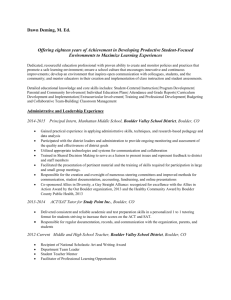

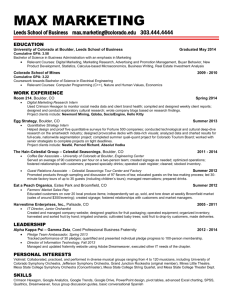

advertisement