Axiom - WordPress.com

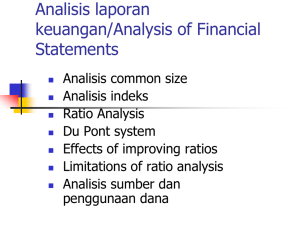

advertisement

V THE ROLE OF THE FINANCIAL MANAGER Firm’s operations (a bundle of real assets) (2) (1) Financial Manager (3) (4a) Financial markets (investors holding financial assets) (4b) N o t e : (1) Cash raised by selling financial assets to investors (2) Cash invested in the firm’s operations and used to purchase real assets (3) Cash generated by the firm’s operations (4a) Cash reinvested / laba ditahan (4b) Cash returned to investors / dividend Axiom 1 : The Risk-Return Trade-Off – We Won’t Take on Additional Risk Unless We Expect to Be Compensated with Additional Return Axiom 2 : The Time Value of Money – A Dollar Received Today Is Worth More Than a Dollar Received in the Future Axiom 3 : Cash – Not Profits – Is King Axiom 4 : Incremental Cash Flows – It’s Only What Changes That Counts Axiom 5 : The Curse of Competitive Markets – Why it’s Hard to Find Exceptionally Profitable Projects Axiom 6 : Efficient Capital Markets – The Markets Are Quick and the Prices Are Right Axiom 7 : The Agency Problem – Managers Won’t Work for Owners Unless It’s in Their Best Interest Axiom 8 : Taxes Bias Business Decisions Axiom 9 : All Risk Is Not Equal – Some Risk Can Be Diversified Away, and Some Cannot Axiom 10 : Ethical Behavior Is Doing the Right Thing, and Ethical Dilemmas Are Everywhere in Finance Rp. T1 H Nilai Rp.25.000 yang akan datang Garis tingkat bunga yang menunjukan arus kas dari pinjaman (borrowing) atau meminjamkan (lending) F O B D Rp. T0 Nilai Rp. 20.000 sekarang Keterangan gambar : Gambar di atas menunjukan bahwa meminjam (borrowing) dan meminjamkan (lending) memberikan pilihan kepada individu. Dengan meminjam (borrowing) sebesar OF seseorang mendapat tambahan konsumsi sebesar BD pada saat ini. Sebaliknya dengan memberikan pinjaman (lending) uang tunai sekarang sebesar OB, maka akan mendapat tambahan konsumsi yang akan datang sebesar FH. Contoh Perhitungan : Uang tunai dimiliki sekarang Rp 20.000,-. Uang tunai yang akan diterima 1 tahun yang akan datang (OF) Rp 25.000,-. Tingkat bunga p.a. 7%, ditunjukan dengan slove HD. Jika uang Rp 20.000,- (OB) diinvestasikan dengan bunga p.a. 7%, maka dalam 1 tahun akan didapat Rp 20.000 x (1+70%)=Rp 21.400 Dengan demikian uang yang dimiliki 1 tahun yang akan datang menjadi Rp 21.400 + Rp 25.000 = Rp 46.400,- (OH). Sebaliknya jika kita sekarang meminjam uang sebesar Rp 25.000 (OF) yang nilai present value-nya menjadi sebesar Rp 25.000/ (1+7%) = Rp 23.364. Sehingga jumlah uang yang kita miliki sekarang menjadi Rp 20.000 + Rp 23.364 = Rp 43.364.- Jika uang sebesar Rp 43.364 kita investasikan dengan tingkat bunga p.a. 7%, maka nilai uang yang akan datang menjadi sebesar Rp 43.364 x (1+7%) = Rp 46.400 (OD = OH). Three Ways to Transfer Capital in the Economy The business firm (a savingsdeficit unit) The business firm (a savingsdeficit unit) The business firm (a savingsdeficit unit) Savers (savings – surplus units) Savers (savings – surplus units) Funds Financial intermediary Intermediary’s Intermediary’s securities securities Funds Securities Investment banking firm Funds Indirect transfer using the financial intermediary Firm’s securities Indirect transfer using the investment banker Funds Direct transfer of funds Securities 3 Funds (dollars of savings) 2 Firm’s securities (stocks, bonds) 1 Savers (savings – surplus units) M A N A J E M E N K E U A N G A N 1 Bagaimana menginvestasikan dana? MASALAH UTAMA TUJUAN 2 Bagaimana mendapatkan sumber dana? memaksimumkan 3 Bagaimana membagikan laba perusahaan? nilai perusahaan Kas R U A N G Jangka Pendek PENGGUNAAN Surat Berharga Piutang Persediaan DANA (INVESTASI) Time Value Jangka Panjang L I N G K U P Anggaran Modal of Money Penerimaan Arus Kas Pengeluaran Jangka Pendek SUMBER M A T E R I Manajemen Modal Kerja Hutang Dagang Pinjaman Bank Struktur Keuangan DANA Leasing Ht Jk Panjang Jangka Panjang Pinjaman Bank Obligasi Struktur Modal Modal Sendiri Biaya Modal Saham Preferen Penilaian Saham Biasa Surat Laba Ditahan Berharga LAPORAN ARUS KAS (STATEMENT OF CASH FLOWS) = LAPORAN PENERIMAAN & PENGELUARAN LAPORAN RUGI-LABA (INCOME STATEMENT) = LAPORAN HASIL USAHA NERACA (BALANCE SHEET) = LAPORAN POSISI KEUANGAN yaitu laporan yang menyajikan informasi yang relevan tentang penerimaan dan pengeluaran kas suatu perusahaan selama satu periode tertentu. LAPORAN ARUS KAS 1 2 3 Arus kas dari aktivitas operasi Kas masuk Kas keluar Jumlah kas dari operasi Arus kas dari aktivitas pendanaan Kas masuk Kas keluar Jumlah kas dari pendanaan Arus kas dari aktivitas investasi Kas masuk Kas keluar Jumlah kas dari investasi Surplus (Defisit) kas Saldo kas awal periode Saldo kas akhir periode XX XX XX XX XX XX XX XX XX XX XX XX yaitu laporan keuangan yang menunjukan hasil usaha suatu perusahaan (pendapatan, biaya dan rugi/laba) selama periode tertentu. PT. XYZ LAPORAN RUGI – LABA (UNTUK PERIODE YANG BERAKHIR PADA TANGGAL TERTENTU) Penjualan Harga Pokok Penjualan Laba (Rugi) Kotor Biaya Operasi Laba (Rugi) Operasi Pendapatan / Biaya Lain-lain Laba (Rugi) Sebelum Bunga Bunga Laba (Rugi) Sebelum Pajak Pajak Penghasilan (PPH) Laba (Rugi) Bersih Pos-Pos Luar Biasa Laba (Rugi) Setelah Pos Luar Biasa XX XX (-) XX XX (-) XX XX (+/-) XX XX (-) XX XX (-) XX XX (+/-) XX yaitu laporan keuangan yang menunjukan posisi keuangan suatu perusahaan (aktiva, hutang dan modal) pada suatu saat tertentu. PT. XYZ NERACA 31 DESEMBER .... DEBET KREDIT AKTIVA PASIVA Aktiva Lancar Investasi Jk.Panjang Aktiva Tetap Aktiva Lain-Lain XX XX XX XX Hutang Lancar Hutang Jk.Panjang Modal XX XX XX Total Aktiva XX Total Hutang & Modal XX Tujuan Umum Memberi informasi tentang harta, hutang & modal Memberi informasi tentang perubahan harta netto sebagai akibat kegiatan operasi perusahaan Untuk mengestimasi kemampuan perusahaan dalam memperoleh laba Memberikan informasi lainnya tentang pembelanjaan, penanaman dan kebijakan akuntansi perusahaan Tujuan Kualitatif Agar laporan keuangan bermanfaat bagi pihak-pihak yang berkepentingan, maka harus memenuhi 7 tujuan kualitatif sbb : 1. Relevan 2. Dapat Dimengerti 3. Dapat Diuji 4. Netral 5. Tepat Waktu 6. Daya Banding 7. Lengkap Future Value = Nilai Terminal Bunga Berganda = Compound Interest Investasi deposito Rp 10.000; dengan Bunga 10% p.a. V1 = 10.000 x (1+10%) = 11.000 V2 = 10.000 x (1+10%)2 = 12.100, atau V2 = 11.000 x (1+10%) = 12.100, atau FV = Vn = V0 x (1+r)n FV = PV (1+r)n atau Bila bunga dibayar beberapa kali dalam setahun, misalnya setiap 6 bulan atau 2 kali dalam setahun, maka : V ½ = Rp 10.000 x (1 + 10%/2) = Rp 10.500 V Akhir Tahun = 10.000 Rumus 1+(10%/2)2 = Rp 11.025 Vn = Vo 1+(r/n)a.n Bila bunga dibayar bulanan : Tahun I = V1 = 10.000 Tahun II = V2 = 10.000 1+(10%/12)12.1 1+(10%/12)12.2 = 10.051 = 12.204 Bila kita akan menerima Rp 10.000 satu tahun yang akan datang. Dengan bunga 18% p.a., maka : PV = V0 = PV = V0 = V1 FV n = (1+i) (1+i)n 10.000 (1+18%) = 8.475 Bila Rp 10.000 tsb akan diterima 2 tahun yad., maka : PV = V0 = 10.000 = 7.181 (1+18%)2 RUMUS : PV = V0 = Vn (1+r)n = FV (1+r)n Discount factor : Cicilan TV = Rp 400.000/bulan selama 6 bulan, maka : PV = 400.000 400.000 400.000 + 2 + -----(1+0,02) (1+0,02) (1+0,02)n PV = Rp 400.000 (5,601) = Rp 2.240.400 Discount Factor Tabel Contoh : Investasi Rp 500.000.000,Diharapkan kas masuk bersih per tahun Rp 250.000.000,selama 3 tahun. Untuk menghitung IRR dilakukan, sbb: -500 250 250 250 + =0 0 + 2 + (1+i) (1+i) (1+i) (1+i)3 500 = 250 250 250 + 2 + (1+i) (1+i) (1+i)3 1 1 1 + + 500=250 (1+i) (1+i)2 (1+i)3 Discount Factor Lihat Tabel PV Annuitas Dari Tabel Annuitas dapat dilihat angka-angka dengan n=3, Berada antara I=23% dan 24%. Ini berarti IRR 23% s/d 24%. Interpolasi untuk memperoleh hasil yang lebih tepat : Tk. Bunga 23% 24% Discount Factor 2,011 1,981 Arus Kas 250 juta 250 juta PV Arus Kas 502.850 juta 495.325 juta Perbedaan PV arus kas pada kolom paling kanan menunjukan perbedaan tingkat bunga = 1%, sehingga dengan kata lain : Tk. Bunga 23% 24% 1% PV Arus 502.850 495.325 7.525 Kas juta juta juta Kalau digunakan tingkat bunga 23%, maka PV kas masih lebih besar 2.850 dari Rp 500 juta. Nilai 2.850 ekuivalen dengan (2.850/7.525) x 1% = 0,38% Jadi IRR seharusnya = i = 23% + 0,38% = 23,38% Konsep NPV (Net Present Value) 1. Nilai tanah Rp 2.000.000.000 2. Nilai bangunan Rp 5.000.000.000 3. Nilai jual setelah 1 tahun Rp 9.000.000.000 4. Tingkat bunga relevan p.a 18% Pertanyaan: a. Berapa PV dari Rp 9.000.000.000 b. Apakah nilai tersebut lebih besar dari Rp 7.000.000.000 PV Penerimaan = 9.000.000.000 = Rp 7.627.000.000 1 + 18% NPV = FV (1+r)n NPV = 9.000.000.000 (1+18%) – C0 Biaya Pokok – 7.000.000.000 = 7.627.000.000 – 7.000.000.000 = + 627.000.000,- NPV Positif Berarti Investasi Feasible IRR (Internal Rate of Return) 7.000.000.000 = 9.000.000.000 1+i 7.000.000.000 – 7.000.000.000i = 9.000.000.000 7.000.000.000i = 2.000.000.000 i = 28,57% Untuk menilaikan investasi dapat digunakan 2 pedoman, yaitu : 1. Menghasilkan NPV positif 2. IRR yang lebih besar dari pada tingkat keuntungan yang disyaratkan Return on Equity 18.04% divided by Return on Assets 1- 9.04% Net Profit Margin Total Asset Turnover multiplied by 14.77% Net Income 0.612 Sales Sales $10,648 $10,648 divided by $1,573 Total Debt Total Assets 1 – 0.499 divided by Total Assets $17,386 Sales $1,573 less Total Costs & Expenses Current Assets Fixed Assets Other Assets $7,054 $1,103 $14,352 $283 Costs of Goods Sold $6,163 Cash & Marketable Securities $330 Cash Operating Expenses $1,435 Accounts Receivable $495 Depreciation $476 Inventory $70 Interest Expenses $343 Other Current Assets $208 Taxes $678 FINANCIAL RATIO Financial Ratios McDonald’s Corporation Industry Average 1. Firm Liquidity Current ratio = Acid test ratio = Average collection period account receivable turnover = = current assets current liabilities current assets - inventories current liabilities account receivable daily credit sales 495M 10,648M + 365M credit sales 10,648M account receivable cost of goods sold inventory 2. Operating Profitability Operating Operating income income returnon = Total assets investment Operating profit Operating income = margin Sales Total assets Sales = turnover Total assets Account receivable Sales = turnover Account receivable Inventory turnover = cost of goods sold inventory Fixed assets Sales = turnover Net fixed assets 3. Financing Decisions Total debt Debt ratio = Total assets Times interest Operating income = earned Interest expense 4. Return on equity Net income Return on equity = Common equity Inventory turnover = 1,103M 2,135M 1,103M – 70M 2,135M 495M 6,163M 70M 2,594M 17,386M 2,594M 10,648M 10,648M 17,368M 10,648M 495M 6,163M 70M 10,648M 14,352M 8,668M 17,386M 2,594M 343M 1,573M 8,718M = 0.52 0.90 = 0.48 0.62 = 17.0 6.0 = 21.5 60.8 = 88.0 56.3 = 14.9% 13.2 = 24.4% 8.0 = 0.61% 1.65 = 21.5 60.8 = 88.0 56.3 = 0.74 2.0 = 49.9% 66.0% = 7.56% 4.0% = 18.0% 20.0% Ratio I. Liquidity Ratios Current Ratio Quick Ratio How Calculate What It Measures Current assets Current liabilities Current assets minus inventory Current liabilities The extent to which a firm can meet its shortterm obligations. The extent to which a firm can meet its shortterm obligations without relying upon the sale of its inventories. Total debt Total assets Total debt Total stockholders’ equity Long - term debt Total stockholders’ equity Profit before interest and taxes Total interest charges The percentage of total funds that are provided by creditors. The percentage of total funds provided by creditors versus by owners. The balances between debt and equity in a firm’s long-term capital structure. The extent to which earnings can decline without the firm becoming unable to meet its annual interest costs. Whether a firm holds excessive stocks of inventories & whether a firm is selling its inventories slowly compared to the industry average. Sales productivity and plant and equipment utilization. Whether a firm is generating a sufficient volume of business for the size of its assets investment. II. Leverage Ratios Debt-to-total-assets ratio Debt-to-equity ratio Long-term debt-toequity ratio Times-interestearned ratio III. Activity Ratios Inventory turnover Sales Inventory of finished goods Fixed-assets turnover Total-assets turnover Sales Fixed assets Sales Total assets Ratio Account-receivable turnover Average collection period How Calculate What It Measures Annual credit sales Accounts receivable (In percentage terms) the average length of time it takes a firm to collect credit sales. (In days) the average days of time it takes a firm to collection credit sales. Accounts receivable Total sales/365 days IV. Profitability Ratios Gross profit margin Operating profit margin Net profit margin Return on total assets (ROA) Return on stockholders’ equity (ROE) Earning per share (EPS) Sales minus cost of goods sold Sales Earnings before interest & taxes (EBIT) Sales Net income Sales Net income Total assets Net income Total stockholders’ equity Net income Number of shares of common stock outstanding The total margin available to cover operating expenses and yield a profit. Profitability without concern for taxes and interest. After-tax profits per dollar of sales. After-tax profit per dollar of assets; this ratio also called return on investment (ROI) After-tax profit per dollar of stockholders’ investment in the firm Earning available to the owners of common stock V. Growth Ratios Sales Income Earnings per share Dividends per share Annual percentage growth in total sales Annual percentage growth in profits Annual percentage growth in EPS Annual percentage growth in dividends per share Price-earning ratio Market price per share Earnings per share Firm’s growth rate in sales Firm’s growth rate in profits Firm’s growth rate in EPS Firm’s growth rate in dividends per share Faster-growing and less risky firms tend to have higher price-earnings ratios THE BALANCE SHEET : AN OVERVIEW LIABILITIES (DEBT) AND EQUITY ASSETS Current Assets : Cash Marketable securities Account receivable Inventories Prepaid expenses Total current assets Fixed Assets : Machinery & equipment Buildings Land Inventories Total fixed assets Assets : Investment Patents Goodwill Total other assets Current Debt : Account payable Accrued expenses Short-term notes Total current debt $ Long-Term Debt : Long-term notes Mortgages Total long-term debt Equity : Prefered stock Common stock Par value Paid in capital Retained earning Total stockholder’s equity TOTAL ASSETS TOTAL DEBT & EQUITY