TUTORIAL 1

advertisement

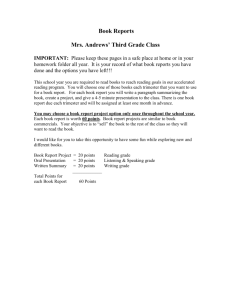

DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL QUESTION: CHAPTER 2 to CHAPTER 9 Warning: Tutorial class is only for those students who bring tutorial questions TUTORIAL 2 Question 1 Classify each of the following items as owner’s drawing (D), revenue (R), expense (E), asset (A), liability (L) or owner’s equity (OE). 1.Advertising expense 8.Account payable 2.Commission revenue 9.Cash 3.Cleaning equipment 10.Insurance expense 4.Account receivable 11.David, drawing 5.Salaries expense 12.Notes payable 6.Rent revenue 13.Salaries payable 7.Maria, capital 14.Utilities expense Question 2 Selected transactions for Cuci-Cuci service Company are listed below. 1. Made cash investment to start business. 2. Paid monthly rent. 3. Purchased equipment on account. 4. Billed customers for services performed. 5. Withdrew cash for owner’s personal use. 6. Received cash from customers billed in (4). 7. Incurred advertising expense on account. 8. Purchase additional equipment for cash. 9. Received cash from customers when service was performed. Instructions List the numbers of the above transaction and describe the effect of each transaction on assets, liabilities, and owner’s equity. For example, the first answer is : (1) Increase in assets and increase in owner’s equity. TM Multimedia University (Melaka Campus) 1 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3 On June 1, Linda established Anchorage Travel Agency. The following transactions were completed during the month. (1) (2) (3) (4) (5) (6) Linda invested RM30,000 cash in the business. Paid RM20,000 cash for land. Bought RM500 of office supplies on credit. Received RM5,500 cash from clients for the service revenue earned. Performed travel service for clients on credit, RM3,000. Paid cash expenses : computer lease RM600, office rent RM1,100, employee salary RM1,200, electricity RM400. (7) Paid RM300 on the account payable created in transaction 3. (8) Renovation of Linda’s house RM5,000. This is not a transaction of the business. (9) Collected RM1,000 on the account receivable created in transaction 5. (10) Sold land for cash at its cost at RM50,000. (11) Withdrew RM2,000 cash for personal expenses. Instructions : a) Prepare a tabular analysis of the transactions using the following column headings: Cash, Account receivable, Office Supplies, Land, Account payable, Linda capital and Retained earnings. b) From an analysis of the column Linda, capital, compute the net income or net loss for June. Question 4 Suraya opened a law office, Suraya, Attorney at Law, on April 1, 2007. On July 31, the balance sheet showed Cash RM 4,000; Account receivable RM 1,500; Supplies RM 500; Office Equipment RM 5,000; Account payable RM 4,200 and Suraya, capital RM 6,800. During August the following transactions occurred. 1. Collected RM 1,400 of account receivable. 2. Paid RM 2,700 cash on account payable. 3. Earned revenue of RM 7,500 of which RM 3,000 is collected in cash and the balance is due in September. 4. Purchased additional office equipment for RM 1,000, paying RM 400 in cash and the balance on account. 5. Paid salaries RM 3,000, rent for August RM 900 and advertising expenses RM 350. 6. Withdrew RM 550 in cash for personal use. 7. Received RM 2,000 from Standard Federal Bank-money borrowed on a note payable. 8. Incurred utility expenses for month on account RM 250. Instructions : a) Prepare a tabular analysis of the August transactions beginning with July 31 balances. The column headings should be as follows: Cash + Account receivable + Supplies + Office Equipment = Account payable + Notes payable + Suraya, capital+ Retained earnings. b) Prepare an income statement for August 31. TM Multimedia University (Melaka Campus) 2 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 On June 1, Jennifer Garner started Divine Cosmetics Co, a company that provides individual skin care treatment, by investing RM 26,200 cash in the business. Following are the assets and liabilities of the company at June 30 and the revenues and expenses for the month of June. Cash RM 10,000 Notes payable RM 13,000 Account receivable 4,000 Account payable 1,200 Service revenue 5,500 Supplies expense 1,600 Cosmetics supplies 2,000 Gas and oil expense 800 Advertising expense 500 Utilities expense 300 Equipment 25,000 Jennifer made no additional investment in June, but withdrew RM 1,700 in cash for personal use during the month. Instructions Prepare an income statement and a balance sheet at June 30, 2007. TM Multimedia University (Melaka Campus) 3 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 6 Laura Stiner started her own consulting firm, Stiner Consulting Sdn. Bhd., on May 1, 2009. The following transactions occurred during the month of May. May 1 2 3 5 9 12 15 17 20 23 26 29 30 Stiner invested RM 8,000 cash in the business. Paid RM 800 for office rent for the month. Purchased RM 500 of supplies on account. Paid RM 50 to advertise in the County News. Received RM 3,000 cash for services provided. Withdrew RM 700 cash for personal use. Performed RM 3,300 of services on account. Paid RM 3,000 for employee salaries. Paid for the supplies purchased on account on May 3. Received a cash payment of RM 2,000 for services provided on account on May 15. Borrowed RM 5,000 from the bank on a note payable. Purchased office equipment for RM 2,400 on account. Paid RM 150 for utilities. Instructions a) Show the effects of the previous transactions on the accounting equation using the following format. ASSETS LIABILITIES STOCKHOLDERS’ EQUITY = DATE Cash + Account Receivable + Supplies Office = Notes + Equipment Payable Account Payable Common Stock Retained Earnings b) Prepare an income statement for 31st May 2009. c) Prepare a balance sheet at May 31, 2009. TM Multimedia University (Melaka Campus) 4 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 7 Analyzing transaction with the (1) accounting equation and (2) preparing the Income Statement and Statement of Retained Earnings. The following amounts summarize the financial position of Ready Resources, Inc., on May 31, 20X8: Cash Account Receivable Supplies Land Account Payable Common Stock Retained Earnings : 1,200 : 1,500 :0 : 12,000 : 8,000 : 4,000 : 2,700 During June, 20X8, Ready Resources completed these transactions: a. The business received cash of $5,000 and issued common stcok. b. Performed services for a customer and received cash of $6,700. c. Paid $5,000 on accounts payable. d. Purchased supplies on account, $1,000. e. Collected cash from a customer on account, $500. Consulted on the design of a computer system and billed the customer for services rendered, f. $2,400. Recorded the following business expenses for the month: (1) paid office rent - $900; (2) paid g. advertising -$300. h. Declared and paid a cash dividend of $1,800. TM Multimedia University (Melaka Campus) 5 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 8 Financial balances for the business of Abu Enterprise on 30th June 2009 are provided as below: Assets = Liabilities + Equity Accounts Office Accounts Note Abu, Cash + Receivable + Supplies + Equipment = Payable + Payable + Capital Bal. 11,000 + 15,000 + 1,500 + 24,000 = 3,500 + 12,000 + 36,000 During July, the business of Abu entered into the following transactions: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Collected RM8,000 of the accounts receivable. Paid RM1,800 on accounts payable. Purchased equipment for RM8,100. Paid RM3,000 in cash and signed a Maybank business loan agreement for RM5,100 to pay for the remainder of the equipment. Billed customers for the services performed, RM6,300. Purchased supplies on credit, RM375. Paid expenses in cash, RM2,925 (salary, RM1,650; filling fee RM825; assessment, RM450) The owner withdrew RM2,000 for personal use. Used RM900 of supplies. Abu invested another RM14,000 cash in the business. Paid RM 50 to advertise in the County News. Performed RM 3,300 of services on account. Received a cash payment of RM 4,300 for services provided on account on transaction 4. Paid for the supplies purchased on account on transaction 5. Paid RM 150 for utilities. Instructions: (a) Analyze the effects of the above business transactions on the accounting equation. (b) Prepare an Income Statement for the month of July 2009. (c) Prepare a Balance Sheet as at July 31, 2009. TM Multimedia University (Melaka Campus) 6 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 3: RECORDING TRANSACTIONS Question 1 On 1 July 2007, Johnny opens Johnny’s Research Service. He will be the owner of the proprietorship. During the entity’s month of operations, the business completes these transactions : a. To begin operations, Johnny deposited RM45,000 of personal funds in a bank account entitled “Johnny’s Research Service”. The business receives the cash and gives Johnny capital (owner’s equity). b. He pays RM30,000 cash for a small building to be used as an office for the business. c. He purchases office supplies for RM500 on account. d. He pays cash of RM6,000 for office furniture. e. He pays RM200 on the account payable he created in transaction (c). f. He withdraws RM1,000 cash for personal use. Instructions: 1. Journalize these transactions and post to the accounts. Key the journal entries by letter. 2. Show all the accounts(column type) after posting. 3. Prepare the trial balance as at July 31,2007. Question 2 Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. TM Stockholders invest RM20,000 in cash in starting a real estate office operating as a corporation. Purchased RM400 of office supplies on credit. Purchased office equipment for RM7,500, paying RM2,500 in cash and signed a RM5,000 note payable with Maybank Berhad. Real estate commissions billed to clients amount to RM5,000. Paid RM700 in cash for the current month's rent. Paid RM200 cash on account for office supplies purchased in transaction 2. Received a bill for RM500 for advertising for the current month. Paid RM2,200 cash for office salaries. Paid RM1,200 cash dividends to stockholders. Received a check for RM4,000 from a client in payment on account for commissions billed in transaction 4. Multimedia University (Melaka Campus) 7 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3 Transactions for Pate Company for the month of October are presented below. Journalize each transaction and identify each transaction by number. You may omit journal explanations. 1. 2. 3. 4. 5. 6. 7. 8. 9. Stockholders invested additional RM45,000 cash in the business. Purchased land costing RM28,000 for cash. Purchased equipment costing RM8,000 for RM4,000 cash and the remainder on credit. Purchased supplies on account for RM800. Paid RM1,000 for a one-year insurance policy. Received RM2,000 cash for services performed. Received RM4,000 for services previously performed on account. Paid wages to employees for RM2,500. Paid dividends to stockholders of RM1,000. Question 4 Louise Lane incorporated as a licensed architect. During the first month of the operation of her business, the following events and transactions occurred. April 1 1 2 3 10 11 20 30 30 Invested RM 25,000 cash in exchange for common stock. Hired a secretary-receptionist at a salary of RM 500 per week payable monthly. Paid office rent for the month RM 1,200. Purchased architectural supplies on account from S.M.U Company RM 2,000. Completed blueprints on a carport and billed client RM 900 for services. Received RM 800 cash advance from Jesse Izzo for the design of a new home. Received RM 1,750 cash for services completed and delivered to Clark Kent. Paid secretary- receptionist for the month RM 2,000. Paid RM 900 to S.M.U. Company on account. Instructions : Journalize the transactions, post to the ledger accounts and prepare a trial balance on April 30,2006. TM Multimedia University (Melaka Campus) 8 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 1. October 1, C.R. Byrd invests RM10,000 cash in an advertising venture to be known as the Pioneer Advertising Agency. 2. October 1, office equipment costing RM5,000 is purchased by signing a RM5,000 note payable with Hong Leong Bank Berhad. 3. October 2, a RM1,200 cash advance is received from R. Knox, a client, for advertising services that are expected to be completed by December 31. 4. October 3, office rent for October is paid in cash, RM900. 5. October 4, RM600 is paid for a one-year insurance policy that will expire next year on September 30. 6. October 5, an estimated 3-month supply of advertising materials is purchased on account from Aero Supply for RM2,500. 7. October 9, hire four employees to begin work on October 15. Each employee is to receive a weekly salary of RM500 for a 5-day work week, payable every 2 weeks - first payment made on October 26 8. October 20, C. R. Byrd withdraws RM500 cash for personal use. 9. October 31, received RM10,000 in cash from Copa Company for advertising services rendered in October. Instructions : Journalize the transactions, post to the ledger accounts and prepare a trial balance on October 31,2007. Question 6 Selected transactions for Lily, an interior decorator, in her first month of business, are as follows. Jan 2 Invested RM 25,000 cash in business. 3 Purchased used car for RM 6,000 cash for use in business. 9 Purchased supplies on account for RM 1,000. 12 Billed customer RM 2,000 for service performed. 16 Paid RM 250 cash for advertising expenses. 18 Received RM 1,000 cash from customers billed on January 12. 24 Paid creditor RM 500 cash on balance owed. 28 Withdrew RM 1,500 cash for personal use of owner. 29 Paid salary RM 1,000 cash. 31 Paid RM 200 cash for utilities. Instructions: 1) Journalize the above transactions. 2) Post to ledger. 3) Prepare Income Statement and Balance Sheet for the month. TM Multimedia University (Melaka Campus) 9 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 7 The accounts of Custom Pool Service, Inc., follow with their normal balances at June 30, 20X6. The accounts are listed in no particular order. Instructions: 1. Prepare the company’s trial balance as at June 30, 20X6. 2. Prepare the Income Statement for the month ended June 30, 20X6. TM Multimedia University (Melaka Campus) 10 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 8 The accounting records hold the following errors: a. Recorded a $1,000 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $1,000 credit to Accounts Payable as $100. c. Did not record utilities expense or the related account payable in the amount of $200. d. Understated Common Stock by $1,100. e. Omitted Insurance Expense of $1,000 from the trial balance. Instructions: Prepare the correct trial balance at September 30, 20X3, complete with a heading. Journal entries are not required. TM Multimedia University (Melaka Campus) 11 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 9 The trial balance of Honeybee Hams, Inc., follows: Instructions: Prepare Honeybee Hams, Inc.'s income statement and statement of retained earnings for the year ended December 31, 20X6, and its balance sheet on that date. TM Multimedia University (Melaka Campus) 12 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 10: Ah Tong opened a boat hire business; Ah Tong Sdn. Bhd. in August 2009. The following transactions occurred during the first month of the business. August. 1 3 4 5 15 18 19 24 29 30 Ah Tong invested RM15,000 in cash in the business. Paid RM590 for August rent of premises. Purchased equipment costing RM7,000 with a cash for RM3,000 and a RM4,000 commercial loan from Hong Leong Bank. Purchased supplies costing RM250 on credit. Recorded revenue for the first half of the month of RM1,530 in cash and RM70 on credit. Paid for supplies purchased on 5th August 2009, RM250. Paid insurance expense for August of RM190. Received payment from customer on account of RM40. Recorded revenue for the second half of the month of RM1,330 in cash and RM60 on credit. Paid telephone expense of RM60 in cash. Instructions: (a) Prepare general journal entries to record the transactions. (b) Prepare a Trial Balance as at 31 August 2009. (d) Prepare an Income Statement for the month of August 2009. (e) Prepare a Balance Sheet as at August 31, 2009. TM Multimedia University (Melaka Campus) 13 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 11: Instructions: 1. 2. Prepare the income statement of Maxwell Banking Company, for the year ended December 31, 2008. What amount of dividends did Maxwell declare during the year ended December 31, 2008? Hint: Prepare a statement of retained earnings. Question 12: Instructions: Prepare the income statement and the statement of retained earnings of Ricoh Copy Center, Inc., ended July 31, 20X9. TM Multimedia University (Melaka Campus) 14 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 13: Instructions 1. 2. 3. 4. TM Prepare the income statement of Post Oak, Inc., for the year ended December 31, 2007. Prepare the company's statement of retained earnings for the year. Prepare the company's balance sheet at December 31, 2007. Analyze Post Oak by answering these questions: a. Was Post Oak profitable during 20X7? By how much? b. Did retained earnings increase or decrease? By how much? c. Which is greater, total liabilities or total equity? Who owns more of Post Oal's assets, creditors or Post Oak stockholders? Multimedia University (Melaka Campus) 15 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 14: Instructions: 1. Prepare the income statement of HD Radio Corporation for the year ended December 31, 20X8. 2. Prepare HD Radio’s statement of retained earnings for the year. 3. Prepare HD Radio’s balance sheet at December 31, 20X8. 4. Analyze HD Radio Corporation by answering these questions: (Challenge) a. Was HD Radio profitable during 20X8? By how much? b. Did retained earnings increase or decrease? By how much? c. Which is greater, total liabilities or total equity? Who owns more of HD Radio’s assets, creditors of the company or the HD Radio stockholders? TM Multimedia University (Melaka Campus) 16 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 15: The adjusted trial balance of Snead Corporation, at December 31, 20X6, follows below: Instructions: 1. Prepare Snead Corporation’s 20X6 income statement, statement of retained earnings, and balance sheet. TM Multimedia University (Melaka Campus) 17 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 4: ADJUSTING ENTRIES Question 1 Before month-end adjustments are made, the February 28 trial balance of Al’s Enterprise contains revenue of RM9,000 and expenses of RM4,800. Adjustments are necessary for the following items: 1. 2. 3. 4. 5. Depreciation for February is RM1,300. Service revenue earned but not yet billed is RM2,800. Accrued interest expense is RM900. Revenue collected in advance that is now earned is RM3,500. Portion of prepaid insurance expired during February is RM400. Instructions: 1) Prepare the adjusting entries for the month of February. 2) Compute the correct net income for Al’s Enterprise for February. Question 2 Ellis Company accumulates the following adjustment data at December 31. 1. Revenue of RM800 collected in advance has been earned. 2. Salaries of RM400 are unpaid. 3. Prepaid rent totaling RM450 has expired. 4. Supplies of RM350 have been used. 5. Revenue earned but unbilled totals RM750. 6. Utility expenses of RM300 are unpaid. 7. Interest of RM250 has accrued on a note payable. Instructions: (a) For each of the above items indicate: 1. 2. 3. 4. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense). The account relationship (asset/liability, liability/revenue, etc.). The status of account balances before adjustment (understatement or overstatement). The adjusting entry. Example Answer for number 1: Unearned revenue. Liability (overstated) and Revenue (understated). Dr Unearned revenue 800 Cr Revenue 800 (b) Assume net income before the adjustments listed above was RM15,500. What is the adjusted net income? TM Multimedia University (Melaka Campus) 18 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3 Terry Thomas opens the Green Thumb Lawn Care Company on April 1. At April 30, the trial balance shows the following balances for the selected accounts. Prepaid Insurance Equipment Notes Payable Unearned Revenue Service Revenue RM 3,600 28,000 20,000 4,200 1,800 Analysis reveals the following additional data. 1. Prepaid insurance is the cost of a 2-year insurance policy, effective April 1. 2. Depreciation on the equipment is RM 500 per month. 3. The notes payable is dated April 1, 12% per annum. 4. Six customers paid the company’s 7-months’ lawn service package of RM 4,200 beginning in April. These customers were serviced in April. 5. Lawn services provided other customers but not billed at April 30 total RM 1,500. Instructions: Prepare the adjusting entries for the month of April. Show computation. Question 4 Prepare year-end adjusting entries for each of the following: a. Office supplies had a balance of RM84 on January 1. Purchased debited to office supplies during the year amount to RM415. A year-end inventory reveals supplies of RM285 on hand. b. Depreciation of office equipment is estimated to be RM2,130 for the year. c. Property taxes for six months, estimated to total RM875, have accrued but are unrecorded. d. Unrecorded interest receivable on government bond RM850 e. Unearned revenue has a balance of RM900. The services for RM300 received in advance have now been performed. f. Services totaling RM200 have been performed for which the customer has not yet been billed. TM Multimedia University (Melaka Campus) 19 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 The schedule below presents the trial balance for the Sigma Consultants Corporation on December 31,2002 Sigma Consultants Corporation Trial Balance December 31, 2002 Cash RM 12,786 Account receivable 24,840 Office supplies 991 Prepaid rent 1,400 Office equipment 6,700 Accumulated depreciation-office equipment Account payable Notes payable ` Unearned fees Common stock Retained earnings Dividends 15,000 Fees revenue Salaries expenses 33,000 Utility expenses 1,750 Rent expenses 7,700 RM104,167 RM 1,600 1,820 10,000 2,860 10,000 19,387 58,500 RM 104,167 The following information is also available: a. Ending inventory of office supplies, RM86 b. Prepaid rent expired, RM700 c. Depreciation of office equipment for period, RM600 d. Interest accrued on note payable, RM600 e. Salaries accrued at end of period, RM200 f. Fees still unearned at end of period, RM 1,410 g. Fees earned but not billed, RM600 h. Estimated federal income taxes for the year, RM3,000 Instructions: 1. Determine adjusting entries. 2. Prepare Column account for each of items listed in trial balance and consider the adjusting entries as made in Part 1. 3. Prepare adjusted trial balance. TM Multimedia University (Melaka Campus) 20 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 6 The schedule presents the trial balance for New Wave Dance Studio, Inc at the end of the current fiscal year. The following information is available to assist in the preparation of adjusting entries: New Wave Dance Studio, Inc Trial Balance October 31, 2002 Cash RM 1,028 Account receivable 517 Supplies 170 Prepaid rent 400 Prepaid Insurance 360 Equipment 9,100 Accumulated depreciation- equipment Account payable Unearned dance fees Common stock Retained earnings Dividends 12,000 Dance fees Wage expenses 3,200 Rent expenses 2,200 Utility expenses 1,200 RM 30,175 RM 400 380 900 1,500 1,000 25,995 RM 30,175 The following information is available to assist in the preparation of adjusting entries: a. An inventory of supplies reveals RM92 still on hand. b. The prepaid rent reflects the rent for October plus the rent for the last month of lease. c. Prepaid insurance consists of a two-year policy purchased on May1, 2002. d. Depreciation on equipment is estimated to be RM 800. e. Accrued wages are RM65 on October 31. f. Two-third of the unearned dance fees have been earned by October 31. g. Management estimates federal income taxes for the year to be RM 3,000. Instructions: 1. 2. 3. 4. TM Open the Column account in the trial balance. Determine adjusting entries and post them directly to the Column account. Prepare adjusted trial balance. Prepare Income Statements, statement of Retained Earnings, and Balance Sheet. Multimedia University (Melaka Campus) 21 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 7 Journalize transactions April 1 2 4 6 9 17 23 30 Received 25,000 and issued common stock. Purchased $800 of office supplies on account. Paid $20,000 cash for land to use as a building site. Performed service for customers and received cash of $2,000. Paid $100 on accounts payable. Performed service for FedEx on account totaling $1,200. Collected $900 from FedEx on account. Paid the following expenses: salary, $1,000; rent, $500. Instructions: Record the transactions in the journal of Double Tree. TM Multimedia University (Melaka Campus) 22 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 8: Journalize transactions Dec. 1 5 9 10 19 22 31 31 31 Barnett received $10,000 cash and issued common stock to stockholders. Paid monthly rent, $1,000. Paid $5,000 cash and signed a $25,000 note payable to purchase for an office site. Purchased supplies on account, $1,200. Paid $600 on account. Borrowed $15,000 from the bank for business use. Signed a note payable to the bank in the name of the business. Service rearnues earned during the month included $6,000 cash and $5,000 on account. Paid employees' salaries ($2,000), advertising expense ($1,500), and utilities expense ($1,100). Declared and paid a cash dividend of $4,000. Barnett's Auction Company uses the following accounts: Cash, Accounts Receivable, Supplies, Land, Accounts Payable, Notes Payable, Common Stock, Dividends, Service Revenue, Salary Expense, Rent Expense, Advertising Expense, and Utilities Expense. Instructions: 1 2 Journalize each transaction of Barnett Auction Company. Explanations are not required. After these transactions, how much cash does the business have? TM Multimedia University (Melaka Campus) 23 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 9 Journalize adjusting entries and analyze effects a b c d e f Prepaid insurance, beginning, $700. Payments for insurance during the period, $2,100. Prepaid insurance, ending $800. Interest revenue accrued, $900. Unearned service revenue, beginning, $800. Unearned service revenue, ending, $300. Depreciation, $6,200. Employees' salaires owed for 3 days of a 5-day work week, weekly payroll, $9,000. Income before income tax, $20,000. Income tax rate is 40%. Question 10 Notes receivable and accrued interest revenue Assume that Kraft Foods famous for cheese, Jell-O and Planters nuts completed the following selected transactions: Instructions Record the transactions in Kraft’s journal. Round interest amounts to the nearest dollar. Explanations are not required. TM Multimedia University (Melaka Campus) 24 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 11 The schedule presents the balance for Wei Seng Dance Studio Sdn. Bhd., at the end of the current fiscal year. Wei Seng Dance Studio Sdn. Bhd. For the Month ended April 30, 2009 Balance RM 11,610 200 400 1,800 9,600 390 Capital, Wei Seng Supplies Prepaid rent Prepaid insurance Equipment Unearned dance fees The following information is available to assist in the preparation of adjusting entries: a. b. c. d. e. f. g. An inventory of supplies reveals RM92 still on hand. The prepaid rent reflects the rent for April 2009. Prepaid insurance consists of a one-year policy purchased on April 1, 2009. Depreciation on equipment is estimated to be RM 800. Accrued wages are RM75 on April 30. Two-third of the unearned dance fees have been earned by April 30. Management estimates federal income taxes for the year to be RM 3,000. Instructions: a) Prepare the adjusting entries for the month of April 30, 2009. b) Prepare an Adjusted Trial Balance as at April 30, 2009. TM Multimedia University (Melaka Campus) 25 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 5 Question 1 Mr Farid open a company, named Besraya Enterprise. The Trial Balance of BESRAYA ENTERPRISE as at August 31, 2007, is as follows. BESRAYA Enterprise Trial Balance August 31, 2007 Debit RM Cash Account receivable Prepaid rent Supplies Office equipment Rent expense Salaries expense Depreciation expense Farid, drawing Accumulated depreciation-Equipment Account payable Farid, capital Rent revenue Credit RM 280 120 80 100 500 40 200 60 20 RM1,400 100 200 300 800 RM1,400 Other data: (a) Prepaid rent expired during August, RM 40. (b) Depreciation expense on office equipment for the month of August, RM 60. (c) Supplies on hand on August 31 amounted to RM 70. (d) Salaries expense incurred at August 31 but not yet paid amounted to RM 140. Instructions: Enter the trial balance on a work sheet and complete the work sheet. TM Multimedia University (Melaka Campus) 26 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 2 The trial balance of Tumira Service is shown below : Tumira Service Trial Balance as at 30 September 2006 Cash RM3,500 Account receivable 3,400 Prepaid rent 1,200 Supplies 3,300 Equipment 32,600 Accumulated depreciation-equipment 1,800 Account payable 3,600 Mira, capital 36,000 Mira, drawing 2,000 Service revenue 7,100 Salary expense 1,800 Utility expense 700 Total RM48,500 RM48,500 Additional information at 30 September 2006 : a. Accrued service revenue, RM600. b. Depreciation, RM150. c. Accrued salary expense, RM500. d. Prepaid rent expired, RM800. e. Supplies used, RM1,600. Instructions: Enter the trial balance on a work sheet and complete the work sheet. TM Multimedia University (Melaka Campus) 27 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3 The trial balance columns of the work sheet for Undercover Roofing at March 31, 2005. UNDERCOVER ROOFING Work sheet For the month ended March 31, 2005 Trial balance Debit Credit RM RM Cash 2,500 Account receivable 1,800 Roofing supplies 1,100 Equipment 6,000 Accumulated depreciation- Equipment 1,200 Account payable 1,400 Unearned revenue 300 I.Spy, capital 7,000 I.Spy, drawing 600 Service revenue 3,000 Salaries expense 700 Miscellaneous expense 200 12,900 12,900 Other data : 1. A physical count reveals only RM 140 of roofing supplies on hand. 2. Depreciation for March is RM 200. 3. Unearned revenue amounted to RM 130 after adjustment on March 31. 4. Accrued salaries are RM 350. Instructions a) Enter the trial balance on a work sheet and complete the work sheet. b) Journalize the adjusting entries from the adjustments columns of the work sheet. c) Journalize the closing entries from the financial statement columns of the work sheet. d) Prepare an income statement and owner’s equity statement for the month of March. TM Multimedia University (Melaka Campus) 28 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 4 The adjusted trial balance of Lanza Company at the end of its fiscal year is : LANZA COMPANY Adjusted Trial Balance July 31, 2005 Debit Credit RM RM Cash 14,840 Account receivable 8,780 Equipment 15,900 Accumulated depreciation 5,400 Account payable 4,220 Unearned rent revenue 1,800 C.J.Lanza, capital 45,200 C.J.Lanza, drawing 16,000 Commission revenue 67,000 Rent revenue 6,500 Depreciation expense 4,000 Salaries expense 55,700 Utilities expense 14,900 __________ RM 130,120 RM 130,120 Instructions a) Prepare the closing entries. b) Prepare a post closing trial balance as at July 31 2005. TM Multimedia University (Melaka Campus) 29 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 At March 31, account balances after adjustments for Marley Cinema are as follows: Account Balances Accounts (After Adjustment) Cash (Asset) RM 6,000 Concession Supplies (Asset) 4,000 Theatre Equipment (Asset) 50,000 Accumulated Depreciation— Theatre Equipment(Asset) 12,000 Accounts Payable (Liability) 5,000 Marley, Capital (O.Equity) 20,000 Marley, Drawing(O.Equity) 12,000 Admission Ticket Revenues (I/S) 60,000 Popcorn Revenues (I/S) 37,000 Candy Revenues (I/S) 19,000 Advertising Expense (I/S) 12,000 Concession Supplies Expense (I/S) 19,000 Depreciation Expense(I/S) 4,000 Film Rental Expense(I/S) 16,000 Rent Expense(I/S) 12,000 Salaries Expense(I/S) 13,000 Utilities Expense(I/S) 5,000 Instructions Prepare the closing journal entries for Marley Cinema. TM Multimedia University (Melaka Campus) 30 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 6 Mike Young opened Young’s Carpet Cleaners on March 1. During March, the following transactions were completed. Mar 1 Invested RM 10,000 cash in the business. 1 Purchased used truck for RM 6,000 paying RM 3,000 cash and the balance on account. 3 Purchased cleaning supplies for RM 1,200 on account. 5 Paid RM 1,800 cash on one year insurance policy effective March 1. 14 Billed customers RM 2,800 for cleaning services. 18 Paid RM 1,500 cash on amount owed on truck and RM 500 on amount owed on cleaning supplies. 20 Paid RM 1,800 cash for employee salaries. 21 Collected RM 1,400 cash from customers billed on March 14. 28 Billed customers RM 2,500 for cleaning services. 31 Paid gas and oil for month on truck RM 200. 31 Withdrew RM 700 cash for personal use. Instructions a) Journalize and post March transactions to column account. b) Enter the following adjustments on the work sheet and complete the work sheet. 1. Earned but unbilled revenue at March 31 was RM 700. 2. Depreciation on equipment for the month was RM 250. 3. One twelfth of the insurance expired. 4. An inventory count shows RM 600 of cleaning supplies on hand at March 31. 5. Accrued but unpaid employee salaries were RM 500. c) Journalize above adjusting entries. d) Prepare closing entries and consider the closing in column account. e) Prepare post closing trial balance at March 31. Question 7 TM Multimedia University (Melaka Campus) 31 DFA 5058 Financial Accounting Trimester 3 2009/2010 The unadjusted trial balance of Princess, Inc. at January 31, 20X2, and the related month-end adjustment data follow: Adjustment data: a. Accrued service revenue at January 31, $2,000. b. Prepaid rent expired during the month. The unadjusted prepaid balance of $3,000 relates to the period, January through March. c. Supplies used during January, $2,000. d. Depreciation on furniture for the month. The estimated useful life of the furniture is 3 years. e. Accrued salary expense at January 31, Monday, Tuesday, and Wednesday. The 5-day weekly payroll of $5,000 will be paid on Friday February 2. Required. 1. Enter the trial balance on a work sheet and complete the work sheet. 2. Prepare the monthly income statement, the statement of retained earnings, and the classified balance sheet. TM Multimedia University (Melaka Campus) 32 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 8: The balance of ABC Sdn. Bhd. as at March 31, 2009, is as follow: ABC Sdn. Bhd. For the Month ended March 31, 2009 Cash Account receivable Supplies Equipment Accumulated depreciation- Equipment Account payable Unearned revenue Tan, capital Tan, drawing Prepaid rent Service revenue Salaries expense Miscellaneous expense Balance RM 5,900 2,500 1,300 8,000 1,800 2,900 390 9,000 500 3,200 8,210 800 100 Other data: 1. A physical count reveals only RM 180 of supplies on hand. 2. Depreciation for March is RM 300. 3. Unearned revenue amounted to RM 250 after adjustment on March 31. 4. Accrued salaries are RM 450. 5. Prepaid rent expired, RM 800. 6. Instructions: a) Enter the trial balance on a work sheet and complete the work sheet. b) Journalize the adjusting entries from the adjustments columns of the work sheet. c) Journalize the closing entries from the financial statement columns of the work sheet. d) Prepare an Income Statement for the month ended 31 March 2009. e) Prepare a Balance Sheet as at March 31, 2009. TM Multimedia University (Melaka Campus) 33 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 6: MERCHANDISING OPERATIONS Question 1 On May 1, Bintang Supply had an inventory of 20 travel bags at a cost of RM25 each. The company uses a perpetual inventory system. During May, the following transactions and events occurred. May 4 Purchased 40 travel bags at RM25 each from Cloud Company, terms 2/10, n/30. May 6 Received credit of RM125 for the return of five travel bags purchased on May 4 that were defective. May 9 Sold 20 travel bags for RM35 each to Twinkle Store, terms 2/10, n/30. May 11 Sold 15 travel bags for RM35 each to Bulan Travel Agency, terms n/30. May 12 Bulan Travel Agency returned two defective travel bags that were purchased on May 11. May 13 Paid Cloud Company in full, less discount. Instructions Journalize the May transactions for Bintang Supply. Question 2 Suppose NEC Sales Co. engaged in the following transactions during June of the current year : June 3 Purchased inventory RM1,600 on credit terms of 2/10, net 30. 6 Returned 40% of the inventory purchased on June 3. It was defective. 9 Sold goods for cash, RM1,000 (cost RM550) 11 Paid the amount owed on account from the purchase of June 3, less the June 6 return. 15 Purchased goods for RM5,000. Credit terms were 3/15, net 30. 16 Paid a RM200 freight bill on goods purchased. 18 Sold inventory for RM2,000 on credit terms of 2/10, n/30 (cost, RM950) 20 Received returned goods from the customer of June 18 sale RM800 (cost RM480) 25 Received cash in full settlement of the account from the customer who purchased inventory on June 18, less the return and discount. 28 Sold goods for cash, RM3,200 (cost RM1,800) Instructions Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system. TM Multimedia University (Melaka Campus) 34 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3 MRH Book Store entered into the transactions listed below. In the journal provided, prepare MRH’s necessary entries, assuming use of the perpetual inventory system. July 6 Purchased RM2,900 of merchandise on credit, terms n/30. 8 Returned RM200 of the items purchased on July 6. 9 Paid freight charges of RM90 on the items purchased July 6. 19 Sold merchandise on credit for RM3,000, terms 1/10, n/30. The merchandise sold had a cost of RM1,700. 22 Of the merchandise sold on July 19, RM200 of it was returned. The items had cost the store RM100. 28 Received payment in full from the customer of July 19. 31 Paid for the merchandise purchased on July 6. Question 4 The adjusted trial balance of Pratt Company contained the following information: Income Statement Debit Sales Sales Returns and Allowances Sales Discounts Cost of Goods Sold Freight-out RM550,000 RM 20,000 7,000 366,000 2,000 Advertising Expense 15,000 Interest Expense 18,000 Store Salaries Expense 50,000 Utilities Expense 18,000 Depreciation Expense Credit 7,000 Interest Revenue 25,000 Instructions: Use the above information to prepare a multiple-step income statement for the year ended December 31, 2007. TM Multimedia University (Melaka Campus) 35 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 Gordon Company gathered the following condensed data for the year ended December 31, 2006: Cost of goods sold Net sales Administrative expenses Interest expense Dividend revenue Loss from employee strike Selling expenses RM 742,000 1,350,000 239,000 58,000 38,000 223,000 45,000 Instructions: Prepare a multiple-step income statement for the year ended December 31, 2006. Question 6 The Sunrise Distributing Company completed the following merchandising transaction in the month of July: July 2 4 Purchased merchandise on account from Brighton Supply Co. for RM5,100 CIF, terms n/30. Sold merchandise on account for RM6,000 CIF, terms n/30. This merchandise had cost Sunrise Distributing RM4,500. 5 Paid RM220 freight on July 4 sale. 6 Received credit from Brighton Supply Co. for merchandise returned, RM350. 14 Purchased merchandise for cash, RM4,300. 15 Received refund from supplier on cash purchase of July 14, RM300. 18 Purchased merchandise from Cameo Distributors for RM4,300, FOB Cameo's warehouse, terms n/30. 19 Paid freight on July 18 purchase, RM120. 23 Sold merchandise for cash, RM5,900. The cost of this merchandise was RM4,425. 26 Purchased merchandise for cash, RM2,400. 27 Paid Brighton Supply Co. the amount due. 28 Received collections in full from customers billed on July 4. 29 Made refunds to cash customers for defective merchandise, RM100, the cost is RM80. 30 Sold merchandise on account for RM3,900 FOB Sunrise's warehouse, terms n/30. Sunrise's cost for this merchandise was RM2,925. Instructions: Journalize the transactions, using the perpetual inventory system. TM Multimedia University (Melaka Campus) 36 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 7: (a) Darby sells RM50,000 of merchandise, terms 1/10, n/30. The merchandise cost RM30,000. (b) The customer in (a) returned RM5,000 of merchandise to Darby. The merchandise returned cost RM3,000. (c) Darby received the balance due within the discount period. Instruction: Based on the above transactions, prepare the necessary journal entries to record the following transactions, assuming Darby Company uses a perpetual inventory system. Question 8: The adjusted trial balance of Red Ribbons Company contained the following information: Debit Credit Sales RM 560,000 Sales Returns and Allowances RM 20,000 Sales Discounts 7,000 Cost of Goods Sold 386,000 Freight-out 2,000 Advertising Expense 15,000 Interest Expense 18,000 Store Salaries Expense 55,000 Utilities Expense 28,000 Depreciation Expense 7,000 Interest Revenue 30,000 Instruction: Use the above information to prepare a multiple-step income statement for the year ended December 31, 2010. TM Multimedia University (Melaka Campus) 37 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 7: CONCEPTUAL FRAMEWORK OF ACCOUNTING Short Answer Questions. 1. What are the three primary objectives of financial reporting? 2. Define each of the following qualitative characteristics: Relevance Predictive value Feedback value Timeliness Reliability Verifiability Representational faithfulness Neutrality 3. Define “comparability” and “consistency” and explain the difference between these two concepts. 4. Define “Revenues” & “Gains” and Why do accountants distinguish between “revenues” and “gains”? 5. Define “Expenses” & “Losses” and Why do accounts distinguish between “expenses” and “losses”? Multiple Choice Questions. 1. Determining periodic earnings and financial position depends on measuring economic resources and obligations and changes in them as these changes occur. This explanation pertains to A. Disclosure. B. Accrual accounting. C. Materiality. D. The matching concept. 2. Revenue is generally recognized when the earning process is virtually complete and an exchange has taken place. What principle is described herein? A. Consistency. B. Matching. C. Realization. D. Conservatism. TM Multimedia University (Melaka Campus) 38 DFA 5058 Financial Accounting Trimester 3 2009/2010 3. According to the FASB conceptual framework, which of the following is an essential characteristic of an asset? A. The claims to an asset’s benefits are legally enforceable. B. An asset is tangible. C. An asset is obtained at a cost. D. An asset provides future benefits. 4. In analyzing a company's financial statements, which financial statement would a potential investor primarily use to assess the company's liquidity and financial flexibility? A. Balance sheet. B. Income statement. C. Statement of retained earnings. D. Statement of cash flows. 5. What is the purpose of information presented in notes to the financial statements? A. To provide disclosures required by generally accepted accounting principles. B. To correct improper presentation in the financial statements. C. To provide recognition of amounts not included in the totals of the financial statements. D. To present management's responses to auditor comments. 6. According to the FASB conceptual framework, the objectives of financial reporting for business enterprises are based on A. Generally accepted accounting principles. B. Reporting on management's stewardship. C. The need for conservatism. D. The needs of the users of the information. 7. According to the FASB conceptual framework, the usefulness of providing information in financial statements is subject to the constraint of A. Consistency. B. Cost-benefit. C. Reliability. D. Representational faithfulness. TM Multimedia University (Melaka Campus) 39 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 8: INTERNAL CONTROL AND CASH Question 1 Helen Company has the following internal control procedures over cash disbursements. 1. Company cheques are prenumbered. 2. The bank statement is reconciled monthly by an internal auditor. 3. Blank cheques are stored in a safe in the treasurer’s office. 4. Only the treasurer or assistant treasurer may sign the cheques. 5. Cheque signers are not allowed to record cash disbursement transactions. Instruction: Identify the internal control principle that is applicable to each procedure. Question 2 Listed below are five procedures followed by the Hilton Company. 1. Several individuals operate the cash register using the same register drawer. 2. Monthly bank reconciliation is prepared by someone who has no other cash responsibilities. 3. Benny writes checks and also records cash payment journal entries. 4. One individual orders inventory, while a different individual authorized payments. 5. Unnumbered sales invoices from credit sales department are forwarded to the accounting department every four weeks for recording. Instructions : Indicate whether each procedure is an example of good internal control or of weak internal control. For every example, indicate which internal control principle is violated. Use the table below. Procedure IC Good or weak? Related internal control principle 1. 2. 3. 4. 5. TM Multimedia University (Melaka Campus) 40 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question3 Match the internal control principle below with the appropriate cash disbursements procedure described. A. Establishment of responsibility B. Segregation of duties C. Documentation procedures D. Physical, mechanical, and electronic controls E. Independent internal verification F. Other controls _____ 1. Compare checks to invoices. _____ 2. Different individuals approve and make payments. _____ 3. Print check amounts by machine with indelible ink. _____ 4. Only designated personnel are authorized to sign checks. _____ 5. Each check must have approved invoice. _____ 6. Stamp invoices PAID. Question 4 The following is a summary of the petty cash transactions for a week: Income RM Expenditure Opening balance 500 Traveling expenses Sale of stamps 10 Subsistence expenses Sale of paper 50 RM 150 250 Instructions : What sum should be reclaimed by the cashier at the end of the week? TM Multimedia University (Melaka Campus) 41 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5 Suppose on June 1, Sun Medicare, a manufacturing company, creates a petty cash fund with an imprest balance of RM300. During June, Lisa, fund custodian, signs the following petty cash tickets : Petty cash Ticket Item Number 1 Postage for package received 2 Decorations and refreshments for office party 3 Two boxes of stationery 4 Printer cartridges 5 Dinner money for sales manager entertaining a customer Amount RM 18 13 20 27 50 On June 30, prior to replenishment, the fund contains these tickets plus cash RM170. The accounts affected by petty cash payments are office supplies expense, entertainment expense and postage expense. Instructions : 1. Make journal entries to (a) create the fund and (b) replenish it. 2. Make the entry on July 1 to increase the fund balance to RM400. Include the explanation. Question 6 The petty cash fund of RM200 for Walsh Company appeared as follows on December 31, 2005: Cash Petty cash vouchers Freight in Postage Balloons for a special occasion Meals RM95.60 RM19.40 40.00 18.00 25.00 Instructions: 1. Briefly describe when the petty cash fund should be replenished. Because there is cash on hand, is there a need to replenish the fund at year end on December 31? Explain. 2. Prepare in general journal form the entry to replenish the fund. 3. On December 31, the office manager gives instructions to increase the petty cash fund by RM100. Make the appropriate journal entry. TM Multimedia University (Melaka Campus) 42 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 7 The following information pertains to I-10 Shoes Store. 1. Cash balance per bank, April 30, RM7,263. 2. April bank service charge not recorded by the depositor RM28. 3. Cash balance per books, April 30, RM7,284. 4. Deposits in transit, April 30, RM1,500. 5. Bank collected RM900 note for I-10 Shoes Store , plus interest RM36, less fee RM20. The collection has not been recorded by I-10 Shoes Store, and no interest has been accrued. 6. Outstanding checks, April 30, RM591. Instructions : (a) Prepare a bank reconciliation at April 30. (b) Journalize the adjusting entries at April 30 on the books of I-10 Shoes Store. TM Multimedia University (Melaka Campus) 43 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 8 Instruction: Prepare Bryant's bank reconciliation at November 30, 20X6. TM Multimedia University (Melaka Campus) 44 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 9 The cash data of Alta Vista Toyota for June 20X4 follow: (Continue…….) TM Multimedia University (Melaka Campus) 45 DFA 5058 Financial Accounting Trimester 3 2009/2010 Alta Vista received the following bank statement on June 30, 20X4: Additional data for the bank reconciliation include the following: a. The EFT deposit was a receipt of monthly rent. The EFT debit was a monthly insurance payment. b. The unauthorized signature check was received from a customer c. The correct amount of check number 3115, a payment on account, is $1,390. (Alta Vista’s accountant mistakenly recorded the check for $1,930.) Instructions: 1. Prepare the Alta Vista Toyota bank reconciliation at June 30, 20X4. 2. Describe how a bank account and the bank reconciliation help the general manager control Alta Vista’s cash. TM Multimedia University (Melaka Campus) 46 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 10 Instructions: 1 2 TM Prepare the bank reconciliation for Varian Engineering Associates. Journalize the May 31 transactions needed to update Varian’s Cash account. explanation for each entry. Multimedia University (Melaka Campus) Include an 47 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 11 The cash data of Navajo Products for September 20X5 follow: (Continue………….) TM Multimedia University (Melaka Campus) 48 DFA 5058 Financial Accounting Trimester 3 2009/2010 On September 30, 20X5, Navajo received this bank statement: Additional data for the bank reconciliation: The EFT deposit was for monthly rent revenue. The EFT deduction was for monthly a. insurance expense. The NSF check was received from a customer. b. The correct amount of check number 1419, a payment on account, is $4,216. (The Navajo accountant mistakenly recorded the check for $4,126.) 1. 2. TM Instruction: Prepare the bank reconciliation of Navajo Products at September 30, 20X5. Describe how a bank account and the bank reconciliation help managers control a firm’s cash. Multimedia University (Melaka Campus) 49 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 12 Instructions 1. 2. TM Prepare the bank reconciliation for Bed & Bath Accessories at January 31. Journalize the transactions needed to update the Cash account. Include an explanation for each entry. Multimedia University (Melaka Campus) 50 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 13 On October 1, 2010, Kyle XYZ Company establishes an imprest petty cash fund by issuing a check for RM200 to Winnie, the custodian of the petty cash fund. On October 31, 2010, Winnie submitted the following paid petty cash receipts for replenishment of the petty cash fund when there is RM55 cash in the fund: Freight-in RM27 Office Supplies Expense 35 Entertainment of Clients 60 Postage Expense 20 Instructions Prepare the journal entries required to establish the petty cash fund on October 1 and the replenishment of the fund on October 31, 2010. TM Multimedia University (Melaka Campus) 51 DFA 5058 Financial Accounting Trimester 3 2009/2010 TUTORIAL 9: FINANCIAL STATEMENT ANALYSIS Question 1: Necco Company Balance Sheet As at December 31 Assets Current assets Equipment Total assets Liabilities Current liabilities Long-term liabilities Total liabilities Stockholders’ equity Common stock $ 1 par Retained earnings Total liabilities and stockholders’ equity 2007 2006 $ 130,000 300,000 $ 430,000 $ 105,000 250,000 $ 355,000 80,000 150,000 230,000 59,000 105,000 164,000 100,000 100,000 200,000 80,000 111,000 191,000 $ 430,000 $ 355,000 Instructions. (a) Prepare a schedule showing a horizontal analysis for 2007 using 2006 as the base year. (b) Prepare a schedule showing a vertical analysis for both years. TM Multimedia University (Melaka Campus) 52 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 2: Data for Simba Corporation for the year ended December 31, is presented below. Simba Corporation Condensed Income Statement For the year ended December 31 2006 2005 Amount Amount $ 750,000 $ 600,000 Cost of goods sold 450,000 390,000 Gross profit 300,000 210,000 Selling expenses 125,000 75,000 Administration expenses 76,000 54,000 Total operating expenses 201,000 129,000 Income before income taxes 99,000 81,000 Income tax expenses 30,000 20,000 Net income 69,000 61,000 Sales Instructions: (a) Prepare a schedule showing a horizontal analysis for 2006 using 2005 as the base year. (b) Prepare a schedule showing a vertical analysis for both years. TM Multimedia University (Melaka Campus) 53 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 3: The comparative income statements for Gardenia Corporation are shown below. Gardenia Corporation Comparative Income Statement For the year Ended December 31 2007 Net sales $ 500,000 Cost of goods sold 350,000 Gross profit 150,000 Operating expenses 68,300 Net income 81,700 2006 $ 400,000 320,000 80,000 35,000 45,000 Instructions: a) Prepare a horizontal analysis of the income statement data for Gardenia Corporation using 2006 as a base. Show the amounts of increase or decrease. b) Prepare a vertical analysis of the income statement data for Gardenia Corporation in columnar form for both years. TM Multimedia University (Melaka Campus) 54 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 4: The comparative balance sheet of TravelMate Company appears below: TRAVELMATE COMPANY Comparative Balance Sheet December 31, ———————————————————————————————————— Assets 2011 Current assets .......................................................................................... RM 360 Plant assets .............................................................................................. 2010 RM300 640 500 Total assets .............................................................................................. RM1,000 RM800 Liabilities and stockholders' equity Current liabilities .................................................................................... RM 150 RM120 Long-term debt ........................................................................................ 240 160 Common stock ........................................................................................ 350 280 Retained earnings .................................................................................... 260 240 Total liabilities and stockholders' equity .......................................... RM1,000 RM800 Instructions: (a) Using horizontal analysis, show the percentage change for each balance sheet item using 2010 as base year. (b) TM Using vertical analysis, prepare a common size comparative balance sheet. Multimedia University (Melaka Campus) 55 DFA 5058 Financial Accounting Trimester 3 2009/2010 Question 5: The comparative condensed balance sheets of CACTUS Corporation are presented below. Cactus Corporation Comparative Condensed Balance Sheets December 31 2011 2010 Assets Current assets RM 72,000 RM 80,000 Property, plant and equipment (net) 94,500 90,000 Intangibles 33,500 40,000 RM200,000 RM210,000 RM 40,800 RM 48,000 Long-term liabilities 141,000 150,000 Stockholders' equity 18,200 12,000 RM200,000 RM210,000 Total assets Liabilities and stockholders' equity Current liabilities Total liabilities and stockholders' equity Instructions (a) Prepare a horizontal analysis of the balance sheet data for CACTUS Corporation using 2010 as a base. (b) Prepare a vertical analysis of the balance sheet data for CACTUS Corporation in columnar form for 2011. TM Multimedia University (Melaka Campus) 56