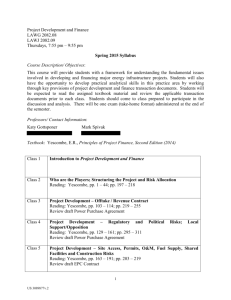

the conflict and change project – a case study

advertisement

SAMPLE FINANCING STRATEGY AnyTown Citizens Advice Financing Strategy 2010-2015 1. Introduction This document describes how the Board of AnyTown Citizens Advice (ACA) plans to finance the aims and principles as outlined in the strategic plan. The key purpose of the financing strategy is to ensure that our core work is maintained and sustained and that we make effective use of all financial support received. The financing strategy looks at where ACA is now; where we would like to be in three to five years time; and what strategies need to be implemented to achieve our financing targets. The Board will review the strategy annually. The following concepts and classifications provide a framework for this financing strategy. a) Classification of Anytown NGO’s activities Our work can be divided into two areas: key services and projects. ‘Key services’ are the core activities which must be continuously provided to fulfil our strategic objectives. These form the highest priority for financing and include: central advice service at AnyTown main office outreach advice desks (in three areas identified as high need) home visits to the elderly and disabled social policy work as informed by the advice work central support (including management, training, administration and equipment) associated with the above operations). ‘Projects’ are defined as short-term, self-contained activities that augment the key services. These will come and go over time as project funding, ACA’s priorities and the decisions of the Board dictate. It is a key principle that the short life of projects should not affect ACA’s sustainability and its key services. b) Classification of income † We have classified different types of income according to levels of restriction and the continuity and security of funds. This produces four distinct categories of income (illustrated in the funding mix matrix in Table 1 below): Core financing (unrestricted, longer term) Programme funding (restricted, longer term) Project funding (restricted, shorter term) General fundraising (unrestricted, shorter term) The most ‘valuable’ type of income is core financing since this offers long-term security and with fewer restrictions on its use. However project and programme funding is also valuable as it contributes to overhead costs. AnyTown Advice Service – Financing Strategy 2010-2015 Table 1: Funding Mix Matrix Unrestricted General fundraising Core financing Short- to medium-term (1 to 3 years) Medium- to long-term (3 to 5+ years) Relatively unrestricted Relatively unrestricted eg One-off grants and public donations eg Local authority grant, investment income Project funding Programme funding Short to medium term (1 to 3 years) Medium- to long-term (3 to 5 years) Relatively restricted Relatively restricted eg Lottery Fund eg Legal Services Commission (LSC) Shortterm Longterm Restricted c) Financial sustainability ACA seeks to achieve financial sustainability by: maintaining a diversified funding mix, with a solid block of core financing and programme funding to cover key services; and generating modest surpluses through general fundraising to build and maintain a reserve for unexpected expenses and general contingency planning. 2. Where we are now See Table 2 over-page for the funding mix for 2008/09 and Table 3 for the forecast for 2009/10. a) Current financing situation: In 2008/09 the County Council (CC) and AnyTown Borough Council (ABC) provided approx 50% of our total income. This percentage has declined to less than 47% in 2009/10. These grants fall into the category of core financing, a clear strength for the funding base of ACA. Around 20% of income is currently in the form of short term project funding – ie restricted and time limited (1 to 3 years). Project funds have reduced significantly in the last year as major grants from the Lottery Fund for our outreach work gradually tapers out and ends in 2010. Conversely longer term programme funding has increased in the last year from 20% to 29%, mainly due to the growth of the legal advice contract. The remaining 3-4% of income comes from one-off fundraising and miscellaneous income (including, for example, bank interest and public donations). This is mostly unrestricted income. The overall percentage of unrestricted income has reduced from 54% to 50% over the last two years. General reserves at the end of 2008/09 were sufficient for continuing basic operations for 35 days. 533576841 Page |2 AnyTown Advice Service – Financing Strategy 2010-2015 Table 2: Funding Mix 2008/09 Unrestricted funds Short term General fundraising Core financing Trusts One-off grants Misc. income Bank interest Gen. Donations 4% CC ABC Parish Councils Project funding Programme funding Lottery Fund Welfare Rights Unit Sure Start Court Desk LSC NHS Partnership AnyVillage Parish Council 27% 20% 50% Long term Restricted funds Table 3: Funding Mix 2009/10 (forecast figures) Unrestricted funds Short term General fundraising Core financing Trusts One-off grants Misc. income Bank interest Gen. Donations 3% CC ABC Parish Councils Project funding Programme funding Lottery Fund Welfare Rights Unit Other project fundraising LSC NHS Partnership AnyVillage Parish Council 21% 29% 47% Long term Restricted funds 533576841 Page |3 AnyTown Advice Service – Financing Strategy 2010-2015 b) Key weaknesses and risks: The service level agreements (SLAs) with the local authorities specify that services provided by the ACA will include the central advice service, outreach desks and home visits. However, Table 3 demonstrates that whereas in 2008/09 73% of total costs are attributable to these ‘key services’ (excluding LSC work), less than 50% of the funding needed actually came from CC and ABC. Short-term project funds are, as a result, having to be used to fill the financing gap for some of ACA’s key services. This is not sustainable in the long-term and makes key services vulnerable to cut-back or closure. One recent example is the closure of one rural outreach desk. Table 3: 2008/09 Analysis of expenses by cost centre Cost Centre Core Advice Sure Start Legal Services (LSC) Rural Anti Poverty AnyVillage Outreach Mental Health outreach Court Desk Volunteers training TOTAL Total Expenses 88,241 23,322 51,477 29,793 3,132 4,192 9,376 28,465 237,998 Key Services 37% 10% 22% 13% Project 1% 2% 4% 12% 95% 5% In the past some projects have not paid their way with regards to central support costs. Although this situation has improved recently, it is important not to take on projects in the future unless all costs are fully funded. LSC funds are dependent on targets being achieved. Performance short-falls lead to financial penalties that have to be funded from unrestricted funds. This is a potentially high risk area, especially as ACA is vulnerable in the event of specialist advisers’ long leave of absence as there are no funds to pay for temporary cover. Reserves of 35 days fall short of the Board’s recommendation of a 60-day cushion. General fundraising events, whilst important and relatively successful, are time consuming for the management team and bring in small sums compared to the input. 3. Where we would like to be See Table 4 below for the suggested funding mix by 2015. In three to five years, all of ACA’s key services to be covered by a mix of core financing and/or programme funding. This will be in the region of 80% of total income. Additional short-term project activities to be funded by separate funding streams and to include a proportionate contribution to central support costs. Where full funding is not available for high value projects, the Board to approve, if considered appropriate, an internal subsidy from ad hoc fundraising. Project funds should be maintained in the region of 10-15% so that a positive contribution is made to central costs. Project funding will not be used to finance key services. 533576841 Page |4 AnyTown Advice Service – Financing Strategy 2010-2015 General unrestricted income from ine-off fundraising to be maintained in the region of 10-15% of total income and to be used to generate modest surpluses to build up ACA’s general reserves. General reserves to be built up and maintained at a minimum of 60 days and a maximum of 90 days. Table 4: Suggested Funding Mix 2015 Unrestricted funds General fundraising Core financing Trusts One-off grants Bank interest Gen. Donations 10-15% CC ABC Parish Councils Project funding Programme funding Self contained ‘add on’ projects LSC NHS/Partnerships AnyVillage Parish Council 10-15% 20% Short term 60% Long term Restricted funds 4. How we will get there a) Increase the level of core financing and programme funding to cover all key services Negotiate with ABC/CC to increase levels of support to cover 100% of the defined ‘key services’. (excluding the work covered by the LSC). This requires a fully-costed budget for each key activity. Explore corporate financing options for activities within key services. Explore project funding for new outreach desks. b) Strategic financing of central support costs. The indirect (central support) costs associated with key services to be financed through local authority and LSC grants. All project activities to contribute to indirect costs. Budgets to be prepared for each new project will clearly identify direct and indirect costs. Central support charges to be allocated on a full-time equivalent pro rata basis. c) Build up reserves Annual budgets to include a specified amount each year to be put aside for the reserves fund until the target level of 60 days has been reached. Maximise use of restricted funds to release unrestricted funds for general reserves. 533576841 Page |5 AnyTown Advice Service – Financing Strategy 2010-2015 d) Plan the replacement of fixed assets Budget to include a specified amount each year for an equipment replacement fund. Undertake ad hoc fundraising for specific items of equipment, eg computers, as opportunities arise. e) Apply funds to achieve maximum benefit f) Undertake a review of spending to identify areas where savings can be made to release unrestricted funds. Regularly review the allocation of unrestricted funds to projects that are not fully funded. This should be done by the Board with the business plan priorities in mind. Formulate a fundraising strategy Establish a 2-year rolling fundraising strategy to include priorities for funding and new project and programme funding options. Consider the need for and feasibility of recruiting a specialist fundraiser. 5. Key Policies The following policies support and inform this financing strategy: Reserves policy Cost recovery policy Ethical policy † The word ‘financing’ is used here to describe all sources of income – from grants and donations to income generating activities and investments. ‘Funding’ generally refers to narrower sources of income from grant-making bodies. 533576841 Page |6