Lesson x

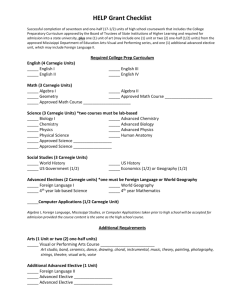

advertisement

QuantwayTM Student Handout Lesson 1.7: A Taxing Set of Problems Theme: Personal Finance Specific Objectives Students will understand that order of operations is needed to communicate mathematical expressions to others. Students will be able to perform multistep calculations using information from a real-world source. rewrite multistep calculations as a single expression. explain the meaning of a calculation within a context. Problem Situation: FICA Taxes The United States government requires that businesses pay into two national insurance programs— Social Security and Medicare—which help senior citizens pay for their personal expenses and health care. Businesses take money out of their employees’ paychecks in order to pay the government. If you work for a business, your employer deducts Social Security and Medicare taxes from your paycheck. Also, the business pays a portion of the taxes for you. These taxes are called Federal Insurance Contributions Act (FICA) taxes. People who own their own businesses are self-employed. They have to pay their own taxes. This is called the self-employment tax. In this lesson, you will use a tax worksheet called the Short Schedule SE. This is an Internal Revenue Service (IRS) tax form. The IRS is the part of the government that collects taxes. It has many different types of forms for individuals and businesses to figure out how much they owe in taxes. With the Short Schedule SE, you will calculate how much two self-employed individuals owe in self-employment tax. © 2012 THE CARNEGIE FOUNDATION FOR THE ADVANCEMENT OF TEACHING Version 1.5 1 QuantwayTM Student Handout Lesson 1.7: A Taxing Set of Problems Theme: Personal Finance (1) Sundos Allianthi sells crafts such as jewelry and baskets for extra money. She does not have a farm or get any of the benefits on Line 1b. In 2010, she sold $11,385 in crafts and her expenses totaled $3,862. Expenses are the things she needed to buy for her business. Fill out Section A—Short Schedule SE below for Sundos. How much self-employment tax does Sundos owe? Assume that Line 29 of her 1040 form has a 0 amount. This is asked for on Line 3 of the Short Schedule SE. © 2012 THE CARNEGIE FOUNDATION FOR THE ADVANCEMENT OF TEACHING Version 1.5 2 QuantwayTM Student Handout Lesson 1.7: A Taxing Set of Problems Theme: Personal Finance (2) Raven Craig started a tutoring business at the end of 2010. She has no income to report on Line 1a or Line 1b of Schedule SE. She earned $1,050 and her expenses totaled $630. How much selfemployment tax does Raven Craig owe? (3) In Question 1, you learned about Sundos Allianthi. You used the Short Schedule SE form to figure out how much self-employment tax she owes. Now, write your answer in a single expression that someone else could use and understand. (4) Look back at the expression you wrote for Question 3. Imagine you have to explain the expression and how you calculated the tax to Sundos. Answer these questions about the expression: (a) What does the operation $11,385 − $3,862 mean in the context? In other words, what does the result of this operation represent for Sundos? (b) What does the operation of multiplying by 0.9235 mean in this context? (c) What does the operation of multiplying by 0.153 mean in this context? In 2010, the U.S. Congress passed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The act reduced the self-employment tax rate from 15.3% to 13.3%. This changes the amount in the first bullet under Line 5 of the Short Schedule SE. (5) Predict how much Raven Craig and Sundos Allianthi will save in taxes in 2011 if their incomes and expenses are the same as they were in 2010. Do not use pencil and paper or a calculator. Write down your predictions of how much they will save. © 2012 THE CARNEGIE FOUNDATION FOR THE ADVANCEMENT OF TEACHING Version 1.5 3 QuantwayTM Student Handout Lesson 1.7: A Taxing Set of Problems Theme: Personal Finance Making Connections Record the important mathematical ideas from the discussion. Further Applications (1) In Question 7c of the Lesson 1.7 assignment, you were asked to calculate the income tax for a person earning $63,500. (a) Write a single expression for this calculation. (b) The $4,750 in the third line of the table is based on information from the previous two lines. Explain how the $4,750 is calculated. (Hint: Start by thinking about where the $850 in Line 2 came from.) +++++ This lesson is part of QUANTWAY™, A Pathway Through College-Level Quantitative Reasoning, which is a product of a Carnegie Networked Improvement Community that seeks to advance student success. The original version of this work, version 1.0, was created by The Charles A. Dana Center at The University of Texas at Austin under sponsorship of the Carnegie Foundation for the Advancement of Teaching. This version and all subsequent versions, result from the continuous improvement efforts of the Carnegie Networked Improvement Community. The network brings together community college faculty and staff, designers, researchers and developers. It is a research and development community that seeks to harvest the wisdom of its diverse participants through systematic and disciplined inquiry to improve developmental mathematics instruction. For more information on the Quantway Networked Improvement Community, please visit carnegiefoundation.org. TM +++++ Quantway™ is a trademark of the Carnegie Foundation for the Advancement of Teaching. It may be retained on any identical copies of this Work to indicate its origin. If you make any changes in the Work, as permitted under the license [CC BY NC], you must remove the service mark, while retaining the acknowledgment of origin and authorship. Any use of Carnegie’s trademarks or service marks other than on identical copies of this Work requires the prior written consent of the Carnegie Foundation. This work is licensed under a Creative Commons Attribution-NonCommercial 3.0 Unported License. (CC BY-NC) © 2012 THE CARNEGIE FOUNDATION FOR THE ADVANCEMENT OF TEACHING Version 1.5 4