Venture to introduce Germany Wind Industry to the Baltimore Region

advertisement

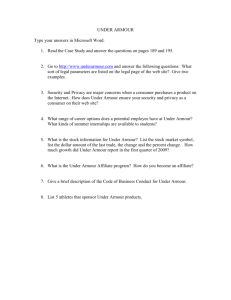

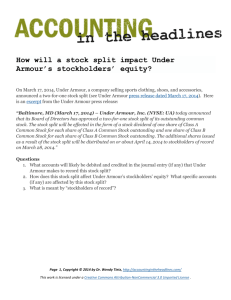

FINAL REPORT Professor Alan Randolph, MGMT 781 University of Baltimore May 5, 2008 Presented By: Canan Aldogan Douglas Scott Pierson Tat F. Tam Mustafa Zahit Umarusman Christine Zurenko Final Report: Germany and Baltimore Strategic Global Ventures 1 I. Executive Summary The U.S. economy is showing signs of recession and inflation worries in the face of the recent housing market and sub prime lending debacles (Makin 1). Despite this trend, Under Armour, part of the sports apparel and textile industry, has done well to position itself from its inception to look for sales beyond the U.S. economy by broadening into the European and other international markets (“Under Armor profit jumps, but misses estimate” 1). Forming partnerships with channels of distribution is important when going global, so as to ensure proper positioning of Under Armour products in local sporting goods stores throughout the country. By effectively marketing to German tastes, their sophisticated knowledge base and interests regarding specific sports, through typical European channels, Under Armour stands to make an instant splash in Germany and Europe. Lastly, in a similar fashion as to how Under Armour got its jumpstart in the U.S. by advertising in last year's Super Bowl, we believe Under Armour should target the next major sporting event that all eyes will be watching in Europe, the 2010 World Cup in South Africa. Germany’s GDP growth in 2007 was 2.5% and is forecasted to retain its strength in the following years (“Country Brief: Germany” 1). With a growth capacity of 28%, we can say that Germany is still the world largest wind energy producer. The trip to Berlin, Germany with the International Strategies class has helped our group gain an insight and a unique perspective into the economy and industrial strengths of Germany, broadening our understanding of the country beyond the borders of the U.S. We recommend that a strategic alliance form between Constellation Energy and Siemens as a 50-50 Joint Venture to concentrate on developing a market and eventually take a leadership role in the off-shore, and to a lesser extent, on-shore Wind Energy Industry in the United States. We would like to hypothetically name such a partnership a Constellation-Siemens JV. Though there are certainly risks involved in both the Sports Apparel and Wind Energy recommendations we have made, we strongly believe that the benefits by far outweigh the risks. Additionally, both cultures are quite open-minded which presents great potential for the sharing of knowledge. Under such circumstances, respective corporate core competencies could be traded to provide competitive advantages for the respective local markets. It is through these observations and strategies that our group has discerned that it is not through our separation of cultures and ideas that we grow as a society, but our exchange of these cultures and ideas that we can connect with the world around us. II. Baltimore Region Global Potential- Sports Apparel Industry The U.S. economy is showing signs of recession and inflation worries in the face of the recent housing market and sub prime lending debacles (Makin 1). This has resulted in less demand from the consumer market here in the U.S. Despite this trend, Under Armour has done well to position itself from its inception to look for sales beyond the U.S. economy by expanding into the European and other international markets (“Under Final Report: Germany and Baltimore Strategic Global Ventures 2 Armor profit jumps, but misses estimate” 1). This forward-thinking strategy will help Under Armour to continue to increase revenues. The Baltimore region welcomed a company by the name of Under Armour, Inc in 1996. It was nothing short of an overnight phenomenon. Under Armour had a marketing strategy and an innovation that put them on the map almost immediately. Surprisingly, only four years prior to this, Fila U.S.A., Inc. moved to this region, although not much was heard about this move from Brisbane, California. Under Armour was founded in 1995 by former University of Maryland football player, Kevin Plank. He worked hard and used his garage and personal credit to support his business in the beginning. His idea took off, eventually leading his company to become the official apparel suppliers for National Hockey League, the U.S. Ski Team, USA Rugby, the National Lacrosse League, and Major League Lacrosse. Additionally, Under Armour is a supplier to the National Football League and Major League Baseball. In the United States, Under Armour’s key to success was the innovative moisture wicking compression t-shirt. This is a product that lives up to the promise of comfort and performance enhancement. Unique marketing and branding strategy, innovation, and exemplary customer service are additional keys to success in Under Armour. The sports apparel industry is highly competitive. Under Armour's success in breaking into this market starts with Marketing and Branding. Using professional athletes for advertisements is something the sports industry does. However, going this route could get extremely expensive. Like the old saying goes, “It is all about who you know.” Since Kevin Plank played football for the University of Maryland, he had many teammates and friends from other teams he was able to call upon to help with his advertising. By doing so, this eliminated a lot of the costs. Under Armour’s first commercial debut was during the 2007 Super Bowl. With the connections Plank had, he was able to have big name athletes like Ray Lewis (Baltimore Ravens), Carl Edwards (Nascar driver), Vernon Davis (San Francisco 49ers) and Eric Ogbogu (former with Dallas Cowboys). Innovation is another key to success and is also one of the main driving forces in competition. Under Armour is best known for its moisture compression apparel; heat gear and cold gear. Currently, Under Armour is releasing a new prototype for cross trainers. The shoes are designed to enhance and maximize performance. Under Armour's motto is that they are “building the next generation of athlete, the athlete of tomorrow” (“Prototype” 1). Americans are superficial. We are concerned about what is on the outside (aesthetics) as opposed to the inside (high quality, high functioning merchandise). Take for example Under Armour's website. The site in the United States is attractive and catches your eye with all of the special effects, whereas the site in Germany is more product informative After the first quarter of 2008, details indicate that UA’s EPS was stronger than expected. The first quarter diluted EPS is $.06. Estimates were between $.03 and $.05 for the first half of the fiscal year. First quarter net revenues increased almost 27% to a little more Final Report: Germany and Baltimore Strategic Global Ventures 3 than $157M. Regarding solely apparel, UA’s net revenues increased by nearly 25% to almost $130M. During this time, women’s apparel revenue increased by 35.9%. UA still projects 2008 net revenue of somewhere between $765M to $775M. This is 26-28% more than in 2007. UA’s 2008 operating income has been revised after the first quarter to $104.5M from $103.5M, which is 20-21% more than in 2007 (“Under Armour Reports 27%” 1). Under Armour is one of the top ten industry leaders. They are ranked number eight in the industry, with Columbia Sports, Ralph Lauren Polo and VF Corp preceding them. The company is headquartered in Baltimore, Maryland and makes revenues of $606.56M. In comparison, Nike, Inc., the largest sports apparel company in the world, makes over $17.92B (“Yahoo: UA” 1). It is a highly competitive industry with numerous players from all over the world. Nike and Adidas dominate comprising approximately 90% of the market share. Only as far back as 1992, has the Baltimore region had a sports apparel firm located in the region. At that time, Fila U.S.A., Inc. officially relocated from Brisbane, California to Hunt Valley, Maryland. In 2006, Fila generated $1.3 Billion in revenues. The sports apparel industry has heavy competition, which leads to innovation. As mentioned earlier, Under Armour has taken a lead in developing a non-cleated crosstraining shoe. The shoe is designed with support and stability in mind, to enhance athletic training. According to Under Armour, this will complete their performancetraining package, which includes the performance apparel and shoes. The popularity of sports in the greater Baltimore region is also an industry strength. There are two professional football teams, the Redskins and Ravens, two major league baseball teams, a hockey team, soccer team and a basketball team. In addition to the major league baseball teams, the Orioles and the Nationals, many minor league baseball teams, and a variety of collegiate sports teams. The unhealthy American lifestyle could be considered a strength as well. A majority of American’s New Year’s Resolution is to go to the gym and get in shape. This also goes along with American superficiality; we go to the gym and put on a fashion show. If you walk into a local Baltimore athletic club, you will see people in Nike and Adidas, the top two competitors in the industry. However, with Under Armour being located right in Baltimore, you will see a majority of the people in Under Armour apparel. It doesn’t matter how much it costs, as long as they look good sweating. The sports apparel industry also has its weaknesses. High competition is one of them, as an abundance of competitors makes it difficult to penetrate the market. When a company is able to do so and remain a player in the industry, it shows the strength of the product, and weakens the competition. Another weakness is that athletic endorsements tend to be expensive. For example, Under Armour ran two Super Bowl ads in 2007. The ads were $2.6 million USD each per 30second spots. Under Armour spent $5.2 million on two commercials that didn’t get the Final Report: Germany and Baltimore Strategic Global Ventures 4 best reviews, but due to the marketing strategy, were heavily publicized and talked about afterwards. In order to stay in the game, the companies in the sports apparel industry must continue to research and develop new products and new ideas in order to be successful in the market. Their ultimate goal is to take over market shares from their competitors. If the company is unable to spend money on this end, it will be hard to move forward. Porter Diamond Model for Sports Apparel Industry Factor conditions ◊ Climate Fluctuations ◊ Collegiate Sports Competition (in the U.S.) ◊ High-skilled labor force ◊ Geographic location close to sea ports and international airports Demand conditions ◊ Competitiveness of collegiate sports has led to innovation ◊ Unsophisticated consumers, concern for aesthetics (in the U.S.) ◊ Professional sports and professional athletes ◊ Sophisticated consumers, concern for high performance (in Germany) Related and Supporting Industries ◊ Textile Industry ◊ Collegiate Sports- U of MD, Hopkins, Loyola, Georgetown ◊ Professional sports and professional athletes ◊ Media (television and radio stations) Firm Strategy, Structure and Rivalry ◊ Highly competitive market ◊ Marketing Strategy: pick a winner to represent the product (ex. Nike & Tiger Woods, Adidas and Chaunce Billups, Under Armour and Ray Lewis, Puma and Pele). ◊ Transnational corporations are most successful in the industry As we can see, Under Armour has been successful in the United States. Next we will explore a strategy for Under Armour in Germany, which we believe will lead to a substantial presence and further growth. III. Germany Region Global Potential- Renewable Energy- Wind Energy Industry As we all witnessed during our trip, Germany boasts an extremely skilled labor force, and excellent infrastructure. Its economy is the third largest economy in the world and largest in Europe. Its economy has been growing for the last 20 years with the growth rate of 2.4% (“Country Brief: Germany” 1). Its economy is expo orientated and the exports are accounted as one third of national output. As a result of it, exports are key elements in German macroeconomic expansion. Export growth in 2007 is estimated to be 9%, Final Report: Germany and Baltimore Strategic Global Ventures 5 underscoring Germany's role as the world's biggest exporter. GDP growth in 2007 was 2.5% and is forecasted to retain its strength in the following years (“Country Brief: Germany” 1). Germany might as well have its slogan as the greenest country on earth. As global warming becomes more serious all around the world, people are becoming more environmentally conscious, trying to find ways to reduce energy consumption, and consume more renewable resources. In Germany around 6 percent of the energy consumption is from Renewable Energies. Approximately 214,000 people are currently employed in the renewable energy sector. The industry and its related technologies are considered as world leaders (“Home: Renewables Made in Germany” 1). Converting wind energy to electricity, wind turbines present an economical and environmentally friendly form of power that is becoming increasingly popular today. With a growth capacity of 28%, we can say that Germany is still the world largest wind energy producer. No country has done more to nurture wind technology and turn wind into a competitive source of energy. There are more than 18,000 wind turbines located in the German federal area and wind industry provides more than 70,000 jobs. But in spite of domination of Germany’s in the wind power industry, wind power still only contributes 7% of the power needs in Germany (“Wind Energy in Germany” 1). In 2007, the installed capacity was 25% less than 2006, showing a slowdown in the German market (“Global Wind 2007 Report.” 38). But even though this decreased, German turbine manufacturers are among the market leaders, representing a global market share of 22%. In addition to this, the German turbine and component manufacturers generated six billion euros in exports in 2007. Germany provides numerous services in the field of maintenance and servicing. As a result of this, even though the market growth is higher in Spain and the US, Germany remains the largest manufacturer of wind turbines and components in the world. These global growth segments offer substantial potential for the industry. 37 % of the world’s wind turbines and their components are made in Germany according to German Wind Energy Association. Germany’s dominance in this market can also be shown in VG7 as the fast growing German market has led to dominance in the market in 2006, exceeding even the Japanese and U.S. markets. This has formally propelled Germany into the market making their companies among not only the strongest within the boundaries of Germany, but also of the world. Because of favorable wind conditions, wind energy is mainly farmed in the northern part of the Germany. Wind turbines already generate at least one-third of the electricity generated in the states of Saxony-Anhalt, Mecklenburg-Western Pomerania and Schleswig-Holstein. Based on the observation that the wind is more constant and stronger over the ocean than on land, wind systems are being set up at sea to tap the higher potential there. When the wind farms are built farther offshore, the costs get higher. Final Report: Germany and Baltimore Strategic Global Ventures 6 In Germany the Renewable Energy Source Act (EEG) provides attractive feed-in tariffs with special bonuses for offshore installations and powering. The amount of the feed-in tariff depends on the location of the wind turbine. Producers of electricity from wind energy receive a guaranteed constant minimum price over a maximum term of 20 years. Since the guaranteed feed-in tariff for newly installed turbines is lowered every year, this encourages continuous technological development. (“Wind Energy in Germany” 1). Below are the overviews of the Wind Energy Porter Model. We have also developed Exhibit GRGP1 in the appendix to further explain some of the strengths and weaknesses for the wind industry. Wind Energy Porter Diamond Model Factor Conditions ◊ Skilled labor force in Germany – abundance of engineers and skilled laborers apply their skill sets to the production of wind turbines and solar panels ◊ World War II caused further research in the industry, including small wind generators used to recharge U-boat batteries ◊ Weather- Unique weather conditions, including higher winds in the Northern region bordering, the Baltic Seas and precipitation on average half of the number of days of the year results in research for advancements in efficiencies. Can you take a look at this?? The sentence doesn’t make sense to me and I can’t figure out what he is trying to say. ◊ Government involvement (Renewable Energy Source Act) has stimulated German companies’ interest to explore and discover highly efficient means to displace fossil-fuel-derived electricity Demand conditions ◊ High-energy consumption – with over 80 million German inhabitants, German energy consumption is the highest in Europe. Such consumption has caused the nation to conduct extensive R&D in alternative forms of energy ◊ Environmentally conscious culture – desire for a greener nation and a greener world has influenced research and promoted alternative energy production. ◊ Economic factors – higher price of gasoline is causing R&D in alternative forms of energy ◊ Government involvement helped in stimulating growth and corporate leadership in the industry Final Report: Germany and Baltimore Strategic Global Ventures 7 Related and Supporting Industries ◊ Electrical & mechanical engineering industries ◊ Metal manufacturers (steel) ◊ Energy suppliers ◊ Non-profit sector –specifically environmental protection agencies ◊ Government involvement (Renewable Energy Source Act) – helped to divert related companies and workers to look to the renewable energy sector for investment. Firm Strategy, Structure, & Rivalry ◊ Other alternative forms of energy such as water, nuclear, geothermal, bio-fuels. ◊ Fierce competition among o Wind energy producers including leaders Enercon, Vestas, GE Wind Energy, RE Power Systems, etc. ◊ Government involvement (Renewable Energy Source Act) – set the standard and challenges the industry to do better such as changing the renewable contribution to 27 percent of electricity by 2020. IV. Cultural Aspects According to Hofstede’s Dimensions of Difference, there are four primary dimensions by which managers and employees vary across the globe: power distance, uncertainty avoidance, individualism/collectivism, and masculinity. When comparing Germany and the United States according to these four dimensions, both are similar in many regards. Regarding power distance, or the "extent to which less powerful members of organizations accept the unequal distribution of power," Hofstede's findings indicate that Germany and the U.S. fall into the same grid, as small power distance countries. Low power distance countries provide a structure in which superiors and subordinates are able to bypass the boss more frequently in order to get their work done. High power distance countries place a great deal of importance on titles, status, and formality; however, these are less important in low power distance countries such as the U.S. and Germany. Uncertainty avoidance "measures of the extent to which people in a society feel threatened by ambiguous situations and the extent to which they try to avoid these situations by providing greater career stability, establishing more formal rules, rejecting deviant ideas and behavior, and accepting the possibility of absolute truths and the attainment of expertise." Hofstede's findings indicate that Germany has stronger uncertainty avoidance than the U.S. Our recent visit to Berlin corresponds with these findings. We noticed from several lectures and observations of human behavior that Germans tended to establish and follow formal rules, and seemed to seek lifelong employment with one corporation more so than citizens of the United States. Regarding individualism/collectivism, Hofstede's findings indicate that the United States is much more individualistic than Germany, implying that in the U.S., there are more "loosely knit social frameworks in which people are supposed to take care only of themselves and their immediate families." Germany, while considered more Final Report: Germany and Baltimore Strategic Global Ventures 8 individualistic than most other countries, is more collectivistic than the United States, meaning there are tighter "social frameworks in which people distinguish between their own groups and other groups." Based on our week-long trip to Berlin, we observed that women and men were, for the most part, treated as equals. The director of the Berlin School of Economics’ MBA program happened to be a woman, and one of our guest lectures was in charge of Human Resources for a large pharmaceutical corporation in Germany. Additionally, the Chancellor (Prime Minister) of Germany, Angela Merkel, is also female. In this respect, the glass ceiling affect that is sometimes seen in more machismo societies seems to be nonexistent in Germany. On Hofstede’s masculinity and femininity spectrum, the United States and Germany are considered masculine societies, meaning there is a stronger emphasis on individuals' materialistic desires, and less attention is directed toward relationships, concern for others, and quality of life. Since masculinity is approximately at the same exact level between the United States and Germany, the prospect of future business opportunities between both countries appears bright. When comparing the German (Berlin) region to the Baltimore region, we felt as though Germans were in some respects more cultural, or possessed a greater sense of cultural identity then Americans. An example of this may be seen with regard to foreign language skills, as a vast majority of the German public speaks more than one language. However, the United States certainly has a lot more diversity regarding ethnicities and race, whereas Germany is predominantly homogeneous. Both countries seemed to have a friendly people, willing and open to exchanging ideas and thoughts with one another. Regarding following rules, we found that Germans are more rule-bound and seem to be extremely timely, more so than U.S. citizens. Following rules at a basic level, such as crossing the street only when the green Ampelmännchen became visible, rather than crossing when red without traffic present, was commonplace. Foreign visitors seemed to disrespect this rule and engaged in jaywalking on multiple occasions, and when doing so, received surprised glares from the Germans. Another example of German rule-abiding behavior is that most Germans tend to pay the compulsory fees for public radio and television broadcasts. If this system was in place in the U.S., we feel that very few would actually pay the fee. Resulting from adherence to the rules, we believe that the German government is more trusting of its citizens than the U.S. government. It appears as though when asked to follow rules in the United States, there is more resistance or questioning, and often it is believed that people will do whatever is in their power to overcome, get around, or seek an alternate to any given rule. Several problems might arise from the aforementioned differences, primarily due to many of them being generalizations that may or may not be true. The media may influence such stereotypes, and it could cause people to have inaccurate preconceived notions. An example of this was evident when one of the German MBA students made a comment that Americans are inept in terms of geographic knowledge. Her effort to demean the Final Report: Germany and Baltimore Strategic Global Ventures 9 sophistication of MBA students from Baltimore was ironic, given that she herself has been living in Germany for the past year and has made little or no effort to learn the German language, which demonstrates a lack of sophistication. Regarding following rules and being punctual, our group tended to arrive ten minutes late to most functions; however, this was due primarily to our unfamiliarity with German public transportation. Resulting from this inability to follow rules regarding timeliness, it could have had a negative impact on the German perception of Americans. Additionally, watching Americans and their blatant disregard for adhering to Ampelmännchen street crossing signals could have led Germans to believe that Americans do not follow rules, and are therefore untrustworthy as business associates/partners. Several synergies might arise from the aforementioned differences. Due to both cultures being open-minded, there is great potential for the sharing of knowledge. Under such circumstances, respective corporate core competencies could be traded to provide competitive advantages for the respective local markets. V. Proposals for Global Business Ventures Expansion into the Germany Market- Under Armour Under Armour's expansion into the European market is currently underway, after launching its sports apparel line earlier this fiscal year. When traveling to Berlin, Germany in April 2008, it was apparent that Under Armour has successfully achieved a presence in Germany in terms of distribution, as local sporting-goods stores are stocking small but noticeable goods (see Exhibits UA1 and UA2); however, its presence remains minute in a marketplace full of fierce competition, primarily from German market leaders Adidas and Puma. This section will explore a strategy for an Under Armour global business venture in Germany, which is similar to the very one used when entering the U.S. market, with exception to several necessary modifications which account for cultural, economic, and political differences between the respective countries. When examining the strategy which led Under Armour to successfully break into the fiercely competitive U.S. marketplace, it is apparent that the key driver to such success was innovation – the creation of an innovative product that has proved to live up to its "promise of enhancing comfort and performance" (“Profile of Under Armour” 1). Operating with a unique marketing and branding strategy and exemplary customer service, as previously mentioned in this report, experts are optimistic about the company's long-term growth, with expected sales and earnings growth of up to 20-25% per year over the long term (“Profile of Under Armour” 1). Cultural, Economic and Political Considerations Germans are considered to be a sports-loving health-conscious populace, with an affinity for soccer (football), rugby, handball, mountain climbing, tennis, running and winter sports such as ice hockey and skiing (“Profile of Under Armour” 1). Based on the sheer number of sports, and the culture's desire to lead a healthy lifestyle, one might assume Final Report: Germany and Baltimore Strategic Global Ventures 10 that Under Armour should take a similar approach to the U.S., attacking all sports of interest with fervor and perseverance; however, soccer trumps all other sports in Germany, from the perspective of that of a fan or spectator and that of a player. Therefore, it would be in Under Armour's best interest to have its primary focus on this sport. Regarding education, Germany boasts a highly literate, highly educated, and highly skilled work force. Technologically savvy consumers place great emphasis on the quality of merchandise, and not superficial or aesthetical aspects, which are so important for American consumers. Economically speaking, Germans are thrifty spenders and are not risk-takers. Perhaps they are more skeptical and conservative, needing assurance that they will have a positive return on their investment. Breaking into the German market could pose difficult for these reasons; however, we believe that after Under Armour's potential is proven and the company's innovation has become known by the public, the German populace will be sure to spend more knowing that usage will enhance personal performance. Germans are an environmentally friendly people. Therefore, Under Armour must make sure to divulge information on its environmentally friendly practices. Demonstrating that the corporation places an emphasis on "staying green" throughout the entire supply chain, from manufacturer/producer to distribution to retailer to consumer, is an important aspect that should not be overlooked when considering entry into the German marketplace. Stiff governmental regulations are often in line with such a green-mentality, so regardless as to whether or not Under Armour decides to portray to the public that it is “green,” it will need to do so in order to stock shelves in Germany. Many of these considerations can be made with the assistance of an investment/consulting agency, such as Invest in Germany, an established outfit in which understands the lay of the land and the country's rule of law. Strategy Defined The following strategy involves several actions, including electing the appropriate manager for Under Armour's European operations, forming partnerships with German distribution channels, importing finished goods as opposed to manufacturing within the country, and carrying out similar strategic marketing initiatives to those that have worked well in the United States, such as negotiating contracts with professional sports teams and up-and-coming athletes, and advertising through the most cost-effective means. When expanding operations overseas, it is important to have a regional or local manager. In selecting this individual, many considerations should be made, including but not limited to a manager who shares the same corporate vision; has familiarity with the region and understands the local language, customs, culture, and behavior of its inhabitants; understands the regional competition; and understands the political environment. Interestingly, Under Armour followed this very same strategy in the selection of its President and Managing Direct for European operations, Peter Maher, in 2007. Final Report: Germany and Baltimore Strategic Global Ventures 11 Formerly Head of International Sales and General Manager of Puma in Central Europe, Mr. Maher is well suited to be a direct report to CEO Kevin Plank. During his tenure at Puma, Peter Maher oversaw sales growth from 600 million Euros in 2001 to 2.4 billion Euros in 2006 (“UA appoints Peter Maher” 1). Mr. Maher also brought with him a strong understanding of the dominant sport in Germany, soccer, having also held executive positions at Adidas, including head of the Global Football Unit, where he formed key relationships with football (soccer) organizations FIFA and UEFA. After joining the Under Armour team, Peter Maher established three growth drivers: "establishing authentic, on field presence" through key teams and athletes across variety of sports, including soccer, rugby, and cricket; “developing an authentic retail distribution network through relationships with key sporting goods retailers;" and "building the team and infrastructure to execute against the growth strategy” (“UA appoints Peter Maher” 1). Forming partnerships with channels of distribution is also important when going global, so as to ensure proper positioning of Under Armour products in local sporting goods stores throughout the country. This strategy has also been implemented in Germany through Peter Maher's leadership. Main Sport, as seen in Exhibit UA 1 of the Appendix, is one retail chain that Under Armour has contracted to position its products (“Under Armour Announces” 1). Considering the high cost of labor and stringent government regulations, as well as the weakened U.S. dollar, we believe that it is not economically reasonable for Germany to import raw materials and manufacture finished goods within its borders. Rather, it should import finished goods from Baltimore directly, or from other Under Armour plants throughout the globe. If the exchange rate fluctuates in the future and the Euro value deflates, perhaps Germany could consider creating production facilities within its own borders, or in neighboring Eastern European countries, so long as the German government permits such plans. Another key component to Under Armour's global venture strategy in Germany is continuing to negotiate contracts and partnerships with professional sports teams, as it has brilliantly done in the United States. As previously mentioned, soccer should be emphasized being that it is Germany’s most popular sport. Under Armour attacked Germany in exactly this manner two months ago, negotiating an agreement with Hannover 96 Soccer Club (Sharrow 1). The agreement ensures that Under Armour is the official performance apparel kit provider for Hannover 96 through 2011, beginning with the 2008/09 season. It includes advertising rights inside Hannover's AWD Arena, housing almost 50,000 spectators, and promotional rights as well (Sharrow, 1). The contract with Hannover 96 is critically important to the German global venture, in that it gives Under Armour great exposure, allows athletes to experience the benefits first-hand, and provides a competitive advantage for teams when they use UA products. In addition to negotiating contracts within the soccer world, we believe Under Armour should not forget other sports, and should simultaneously negotiate contracts with other Final Report: Germany and Baltimore Strategic Global Ventures 12 sports teams. Interestingly, this is also being done in Germany, as research indicates Under Armour has negotiated deals with handball and ice hockey, including 1860 Munich, a Germany hockey league team, "Alder Mannheim, TBV Lemgo and TV GroBwallstadt" (“Under Armour is New” 1). In continuing to operate under the strategies that proved successful for Under Armour in the U.S., we believe that Under Armour should continue to scout out young talent. Picking winners before they win to endorse and wear their products is a form of investment in which UA is incredibly adept. Similar to how Under Armour has attracted interest in the world of professional tennis through Russian superstar Igor Valerievich Andreev's endorsement, by tapping into a market of soon-to-be star professional athletes, especially soccer athletes, Under Armour has a lot to gain. During the 2006 World Cup in Germany, one of Germany's new young talents on the German National Team squad, Philip Lahm, went from a talented player to rock-star status literally overnight, after scoring the first goal on opening day. By the time the Cup had ended, he was nominated for the FIFA World Player of the Year 2006. Previously a defender for Bayern Munich, Mr. Lahm is considered to be one of the best young fullbacks in the world. Last week he signed a contract with Barcelona, one of Europe's premiere teams. Interestingly, prior to the 2006 World Cup, Mr. Lahm was unknown to the world of soccer. This all changed 6 minutes into the Cup's opening game, when Mr. Lahm scored the first goal, watched by approximately 1.5 billion viewers, or 20 percent of the world's population (Kellett 1). In a similar fashion as to how Under Armour got its jumpstart in the U.S. by advertising in last year's Super Bowl, we believe Under Armour should target the next major sporting event that all eyes will be watching in Europe, the 2010 World Cup in South Africa. In targeting this event, UA should pay for sponsorship, including television advertisements and on-field billboards. If possible, the company should find the next rising star on Germany's National Team. We believe that the team's goalie, whoever is chosen to play in this position, should be a primary consideration for the no-name-but-soon-to-beheavyweight-star. Oliver Khan, the previous goalie for the German national team, is due to retire. Since goalies can make or break a team, we feel that the next Oliver Khan could be the key ingredient to Germany winning another World Cup. (Last time Germany won the World Cup, in the 2002, it was due in large part to stellar performance by Oliver Khan). Picking the next goalie, a current no-namer, and locking him into a long-term contract would be an investment well worth taking. By effectively marketing to German tastes, their sophisticated knowledge base and interests regarding specific sports, through typical European channels, Under Armour stands to make an instant splash in Germany and Europe. Such a strategy will include billboards in cities such as Berlin and at sporting events, as well as advertisements on TV, radio, and internet. Regarding the internet, Under Armour has already created a German web site for its products. When comparing the homepage for the German UA web site to the US UA web site, it is clear that Germans want to know more about the inner workings of the product and the materials inside that make it a quality product. Final Report: Germany and Baltimore Strategic Global Ventures 13 Quick links are available on the German UA page for Gear 101, a page explaining the ins and outs of heat gear and cold gear, UA Evolution, a page explaining the corporation's strong emphasis on innovation, and the various sports that are popular in Germany, of which football (soccer) tops the list. On the U.S. UA web site, it was extremely difficult to obtain information on hot and cold gear (See Appendix, Exhibit UA3, UA4, & UA5). Another key strategic consideration is to market heavily toward women. Women are becoming more health-conscious today, and females are engaging in sports a rapidly growing pace. As previously mentioned in this report, with women's sales skyrocketing in the U.S. this quarter, UA Germany should target German women and the variety of sports they enjoy, including soccer, basketball, volleyball, and skiing, which were popular amongst the German MBA students at the Berlin School of Economics.. Financial Opportunities: Under Armour's first quarter results show an amazingly optimistic outlook, as revenue growth exceeded expectations and is expected to continue in the long-run. This global venture in Germany could be even more significant in terms of growth, with the entire nation rallying behind the sport of soccer, whereas in the US, citizens are passionate for multiple sports and Under Armour can not possible take the market share of them all. As previously mentioned, 1.5 billion people watched the first game of the 2006 World Cup. Imagine if this number of people either subliminally or overtly saw an advertisement for Under Armour! The marketing potential is astronomical, considering that as the world further develops, and more and more people have televisions in their households, by 2010 the number of people watching the World Cup could be up to 2 billion or 1/3 of the world's population! In early February, Under Armour kicked off a rugby partnership (a sport much less popular than soccer) in the United Kingdom with the Welsh Rugby Union. The contract, while small, is expected to be worth an estimated $20 million dollars during a four-year deal. We can only imagine the potential that Under Armour has with negotiated contracts such as Hannover 96 in the professional world of soccer. Main Risks (economic, legal, political, cultural, etc.) In order to thrive and survive in the highly competitive European sports apparel market, UA must have many variables go in its favor. It is important to note that several factors may cause actual results to differ from forward-looking modular expectations. Risks are ever present in the corporation’s ability to manage growth effectively, and maintain effective internal controls. According to Peter Maher, Under Armour may experience "increased competition causing [them] to reduce the prices of [their] products or to increase significantly [their] marketing efforts in order to avoid losing market share," their "ability to accurately forecast consumer demand for [their] products, reduced demand for sporting goods and apparel generally; failure of [their] suppliers or manufacturers to produce or deliver [their] products in a timely or cost-effective manner; Final Report: Germany and Baltimore Strategic Global Ventures 14 [their] ability to accurately anticipate and respond to seasonal or quarterly fluctuations in [their] operating results; [their] ability to effectively market and maintain a positive brand image; the ability and effective operation of management information systems and other technology; [their] ability to attract and maintain the services of [their] senior management and key employees; and changes in general economic or market conditions, including as a result of political or military unrest or terrorist attacks." (“Under Armour Announces” 1). Additionally, the relationship between President Peter Maher and CEO Kevin Plank is vital to the global venture's success. If Peter is unable to communicate effectively with Kevin, or is lured away to a better offer with Puma or Adidas in a similar fashion to how Under Armour obtained him, the corporation could suffer tremendously. Venture Opportunity- Wind Industry from the Germany Region The trip to Berlin, Germany with the International Strategies class has helped our group gain an insight and a unique perspective into the economy and industry strengths of Germany, broadening our understanding of the country beyond the borders of the U.S. Their ability to strengthen their country since the 1990 reunification of the East and West Germany for the future impressed us tremendously. Most impressive was the German’s excessive excitement and commitment to conservation and making strives to bring ideas beyond what they were only once capable of. Thus, from the 3 industries we examined on the Country project, which included the Beverage, Wind and Solar Renewable energy Industries, we felt strongly that the companies in the German Renewable Energy sector, specifically, wind energy have a great deal of opportunities to achieve certain strategic alliances with companies in the Baltimore Region. U.S. Wind Energy Market As we began our examination, we first looked from a German company looking to enter the U.S. market perspective. From that perspective we found that the wind industry is also rapidly growing in the U.S. market, though not as extensive as the German market. When we looked further into the market, we found that there is still a multitude of opportunities left in the U.S. market. First, the U.S. wind power market has taken off only in selected markets. These markets are surprisingly isolated in the western and Midwest state areas, mostly within barren landscapes. Among these are the states with the largest existing wind power capacities including Texas with 4,356 MW of existing wind power, California with 2,439 MW, Minnesota with 1,300 MW and Iowa with 1273 MW (“Global Wind 2007 Report” 64). Interestingly, none of the top ten states with wind power capacity are located east of Illinois (see Exhibit VG2). Ironically, the state with the largest wind power capacity, Texas, also has the most wind devices under construction with 1,238 MW of power from the turbines under development (“Global Wind 2007 Report” 64). Presently, two of the U.S.’s largest states, California and Texas make up over 40% of the existing total wind power installations (“Global Wind 2007 Report” 64). Only a handful of the states have Final Report: Germany and Baltimore Strategic Global Ventures 15 made a dent into capitalizing on this form of renewable energy that is so plentiful. Exhibit VG1 shows the concentration of the wind energy capacities dominantly to the western half of the U.S. There have been to a certain degree some level of government involvement and subsidization with offers of federal production tax credits (PTC) and other incentives for wind power installations. Though there has been consistent growth in this industry for the past few years, these types of incentive programs have done little to motivate corporations to take advantage of such programs. This form of energy will only contribute to 1% of the total electricity supply needed for 2008 in the U.S. (“Global Wind 2007 Report” 64). This program is certainly nowhere near as effective as the German Renewable Energy Sources Act (EEG) initiated in April 2000. To compare, Germany’s EEG has propelled this nation, the size of the state of Montana to dominancy as the nation with the largest total capacity in the world with 20,622 MW (“Home: Renewables Made in Germany”, 1). German Wind industry- Opportunity in the U.S. Market Many factors make it favorable for the right German wind energy firm to establish a multinational presence and become a market leader in the United States, especially here in the Baltimore Region. First, as we looked at Exhibit VG1 once more, it is quite apparent that there is tremendous potential up and down the east coast region. Yet, as we examined a recent wind resource map (Exhibit VG3), we noticed that the areas where the wind is scaled “good” or better were essentially all the coastal areas throughout the eastern shore lines. A large segment of the southeastern part of the U.S. had ineffective conditions for wind energy resources. Though this area is limited it is within some of the German wind companies’ expertise. Knowledge and expertise in not only basic onshore wind turbines, but also in offshore wind turbines as well became essential elements as we devised recommendations on actions to take. Such knowledge and expertise is relevant as the expertise in the U.S. has been rather limited. The U.S. Department of Energy noted, “Design tools for wind and wave loading dynamics for off-shoring machines are not available – The design codes developed and validated by the program to support LWT (“Land-based Wind Turbines”) and previous land-based projects are not capable of simultaneously addressing wind and wave loading on turbine structures (“Wind Energy Multiyear” 60). Thus, Germany in becoming the world leader in wind power has an exceptional labor force and knowledge base that can benefit the needs along the eastern coastal region of the U.S. Firms from this region are endeavoring growth in their own limited coastal region to the north as they are in the process of setting up multi offshore farms in that part of the region. Most of the top firms in Germany are participating in these offshore efforts. In Exhibit VG4, we put these leading firms into perspective to gain a sense of which of them would be suitable to some level of strategic alliance. The top firms in the German wind industry market are Enercon GmBh (50.3% of the German Wind Industry market), Vestas (24.1%), Repower Systems (10.9%), Nordex (4.8%), and Siemens Wind Power Final Report: Germany and Baltimore Strategic Global Ventures 16 (3.5%) (See Exhibit VG5). It is interesting to note that Vestas is a company based in Denmark that has helped Germany tremendously to sustain growth of the wind energy industry. For our focus, we wanted to focus on wind energy companies based in Germany where the lead and growth is presently in the world market. Viable Germany Wind Energy Firms The leading firms in the German wind energy market were reviewed in detail to extrapolate firms that showed potential and strength to successfully traverse not only in a multinational sense but also to be able to conduct activities thousands of miles away. The wind industry presents unique challenges for some countries. First, the materials for the products for assembly weigh hundreds of tons, including the rotor blades weighing in most cases 100 tons in itself. The enormity of the technology is also evident in the size of the blades of the rotors. They can often span two soccer fields long. Not to mention the enormity of the heights for the tower that houses the generator and the rotor; they must also be tall. The offshore types must be much taller to reach the floor of the water. Second, such size and weight of these wind turbines require special equipment such as refitted cranes and massive sized trucks. For such size and dimensions, capitalization is quite an important factor as well. The firms must be able to handle the enormous capital requirements that go along with the enormous dimensions of the wind turbines. Thus, we began our search for potential and suitable firms by starting at the very top of the firms that had the most market shares in the German Wind Energy market. We isolated key figures from each of the top firms and put them side-by- side to compare the companies on several levels (see Exhibit VG4). By far, Enercon Gmbh certainly has the largest market share in this industry for Germany dominating over half the market. This is certainly indicative, as the company has installed over 12,500 turbines in several countries worldwide providing nearly 12 GW of power to households thus far. Yet, as we explored into the details of the company, we gained insight into an infringement case that disallowed Enercon from exporting their wind turbine technology to the U.S. until 2010 (“The Greening of Patent Litigation” 1). In another development, Enercon Gmbh lost another infringement case, this time involving against Vestas (Sandstrom 1). Additionally, there have been signs that Enercon wants to focus their business model on onshore wind turbines and limit their offshore efforts. These findings clearly indicate that Enercon Gmbh currently have many distractions to considerable them viable for global ventures at this time. Also, the company is simply too focused on their area of concentration, Germany’s onshore wind turbines. Another company we found to be perhaps distracted in this market is REpower AG. India’s Suzlon Energy Ltd. was able to acquire 87% control of the company with the help of France’s Avera and Portugal’s Martifer in the summer of 2007 (“India’s Suzlon Energy” 1). This acquisition allowed Suzlon to gain market strength becoming the 4th largest company in the world specializing in wind energy (“India’s Suzlon Energy” 1). More importantly, this acquisition gave Suzlon tremendous presence in the largest part of Final Report: Germany and Baltimore Strategic Global Ventures 17 the world wind energy market, the European Union. REpower only started in 2001 but was gaining experience fast. Still this may simply be another reason why REpower at the present moment might not be such a good candidate for a global venture. The last two companies we explored in the German wind industry, we found might actually be more viable candidates to initiate global ventures. The first of these two was Nordex. Nordex is the 4th largest currently in the German market, yet besides distractions, for many reasons, Nordex seemed more positioned for global ventures than REPower. First by revenue size, overall, Nordex achieved approximately 70 Million Euros more revenues (turnover) than REPower. Not only that, but the company had 16 years more experience than REPower and twice as much installation experience in number of turbines and total capacity installed. Yet, the only weakness we noticed was that the only other country besides those in the European Union that they have worked with was China. REPower had more experience in other markets such as India and Australia. Yet, this lack of multinational experience makes it more realistic and a bit more desirable for this company to want to move forward and broaden into other markets such as the U.S. The final firm we looked at in the German wind power market held the strongest potential in our eyes to establish a U.S. presence in this market. Overall, this company, Siemens, has more of a broad multinational presence than any of the other firms. Siemens is established in over 190 countries in unrelated industries. This is certainly an exceptional advantage that we could not ignore when we compared this organization with the other possible suitable firms. Yet, this firm’s advantages go even beyond that. The company as whole has a $112 Billion (USD) total revenue stream and total assets of over $113 Billion (USD). The company has quite a foundation, tracing the origins of its organization to 1847. Additionally, this firm has installed more number of turbines and more total capacity worldwide than REpower and Nordex combined (“Special Applications, Offshore” 1). As we will point out for later discussion, Siemens was the pioneer in installation of offshore wind turbines and has experiences in installing over 100 offshore wind turbines already (“Special Applications, Offshore” 1). Seizing Tremendous Offshore Wind Industry Opportunities As we previously mentioned in the “U.S. Wind Energy Market” section, we found that there is tremendous potential for the appropriate German wind energy firm to establish a global presence. As we’ve seen in the news and witnessed first hand at the gas pumps, energy and how we utilize it has become enormously important in our global landscape. We also noted how the west and the Midwest regions of the U.S. have shown tremendous growth and increases in the installations of wind turbines. As our group looked closer to Exhibits VG1 and VG3, we found that there is tremendous potential, due in part to the current economic and environmental sensitive nature of the U.S., for growth and an establishment of a wind turbine industry, especially of the offshore variety along the eastern seaboards of the U.S. The place to start and establish such an offshore wind industry is right here in the Baltimore Region. Final Report: Germany and Baltimore Strategic Global Ventures 18 As we examined places up and down the eastern coastline of the U.S., in coordination with the U.S. Department of Energy Wind Resources map as illustrated on Exhibit VG3, the Baltimore Region makes the most sense to start such an industry. First, as we mentioned in our previous report on the Baltimore Region, this area simply fuses together too many advantages to ignore. First, there are a multitude of airports in this region to handle such activities- BWI Airport - Thurgood Marshall Airport, Washington Dulles Airport, Reagan National Airport, and the Philadelphia International Airport to mention a few. Second, the Port of Baltimore ranks among the nations largest along the East Coast (“Port of Baltimore Rankings” 1). Additionally, the Baltimore Region is centrally and strategically located in an area where companies can deploy their resources up and down the East Coast, which is essential when dealing with cargo with the magnitude and size of the wind industry. This region can basically become a testing and strategic launching point for the wind industry all along the East Coast. Another factor that makes the Baltimore region an advantageous area to start this type of business is that there are numerous prime locations in this region for manufacturing facilities for this type of industry such as Sparrows Point, formerly the home of Bethlehem Steel, the largest steel mill of its type, and perhaps even the General Motors plant, the Broening Highway factory that closed down in 2005 (Hirsch 1). Viable companies in the Baltimore Region for Strategic Alliance We reviewed two possible companies in this region that may be pivotal to work with a German Wind Energy company in forming some sort of strategic alliance, Pepco Holdings, Inc. (“Pepco”) and Constellation Energy. These companies were chosen because they are the largest utility providers of the Baltimore Region and their customer base is the largest, serving the Baltimore, Washington and Annapolis metropolitan areas. After our reviewed, we found that this is where the differences ended. First, we found that the two companies focused their resources in different ways. Pepco focused their assets and devoted their resources to a more limited area including Maryland, District of Columbia and New Jersey. The company is also smartly partnering with extensive renewal energy partners such as Community Energy in Pennsylvania to bring more renewable energy to the region (“Pepco Energy Services Signs” 1). This certainly has done well for their reputation and helped to lower fossil fuel emissions. Their capital resources are certainly comparable to Constellation Energy and respectable with over $15 Billion in Assets. However, Constellation Energy’s resources are even more significant and have the extensive networks and experience to work with the German company in a strategic alliance. Constellation has Assets totaling almost $22 Billion and a revenue stream that is more than twice that of Pepco (See Exhibit VG7). Also, we believe Pepco’s focused efforts to limit their efforts of only certain states does not work as well as Constellation’s extensive network across the country to demonstrate to the potential alliance that they can go beyond those borders of New Jersey, Maryland, and the District of Columbia areas. Constellation’s presence is all along the eastern seaboard and more importantly actively along the busiest areas in this region. Furthermore, Constellation’s dealings in Canada Final Report: Germany and Baltimore Strategic Global Ventures 19 also provide the company a better understanding and experience of how to work with foreign companies. In current news Constellation’s owned utility supplier, Baltimore Gas and Electric (“BGE”) along with Constellation itself have been criticized for increasing their electricity rates in lieu of the deregulation efforts (Lee 1). Many criticisms have been placed on the state legislature and Constellation that they have not and do not do enough to keep electricity prices down, and that they have contributed to the aging energy supply system in the region. This type of criticism actually goes well to a Joint Venture of Constellation Energy and Siemens as state legislature as well as the general public would perceive such a formulation in a good light. The legislature would likely be very supportive of such efforts to bring so much benefit to the region, in which we will discuss further later on. Constellation Energy-Siemens Joint Venture With our research and review, we strongly recommend that a strategic alliance can and should be formed between Constellation Energy in the Baltimore Region and Siemens from Munich, Germany. The possibilities in this formation are quite substantial for both parties and the Baltimore Region. We also recommend that this strategic alliance originate as a 50-50 Joint Venture to concentrate on developing a market and eventually take a leadership role in the Offshore and to a lesser extent Onshore Wind Energy Industry in the United States. The formation, we would hypothetically name it, “Constellation-Siemens JV.” The start of such a joint venture would form a substantial venture that will transform the Baltimore Region into the heart of the Offshore Wind Industry fusing a powerful regional energy supplier with the #1 Offshore Wind Energy Company in the world (Portfolio 1). The benefits and advantages of the JV are listed for Constellation Energy on Exhibits VG8, for Siemens on Exhibit VG9 and for the Baltimore Region on VG10 for your review. There are of course some underlying risks involved in such joint ventures. Yet, after coming back from our class trip from Berlin, Germany, we are more confident that such risks can be mitigated. These risks include cultural differences as we talked about in Section IV. We learned as a group and as class that these cultural differences do not matter much in this world as long as there are common goals and common respect for one another. In our many visits and lectures in Berlin, we shared a good deal of understanding that our needs and desires for a better world where jobs are plentiful and people can share our respective thoughts on life in general are one and the same. In this case, we also share in our desires and goals for a more environmentally friendly place to live as shown in their unique approach to solving problems of keeping their streets clean and reducing reliance on fossil fuel consumption and usage. As for other areas of risk, they also work hard to ensure that the those solutions don’t cause other problems for the environment such as impacting the ecosystem, coming up with innovative solutions such as noise reducing mechanisms in the turbines. This is especially beneficial as they explore the sensitive Chesapeake Bay region for possible Final Report: Germany and Baltimore Strategic Global Ventures 20 wind turbine placement sites. The formation of the joint venture would help to ensure these risks are evaluated and mitigated. In fact, all indications are that the benefits of this joint venture, by far outweigh the risks involved. VI. Conclusion Prior to conducting our research, we did not consider the Baltimore Region such a center for such a diverse set of industries. There were always signs of such diversification whenever we took a trip down to the Inner Harbor. All the tall buildings, crab restaurants, different beers, people speaking different languages, all the different ships that would come in- they were certainly clues to global industries all over this region. It really wasn’t until the Berlin, Germany trip and when we researched into the respective industries that we gained an appreciation of this. The Baltimore Region is rich with resources and lush with industries that really put this region on a global scale, alongside cities nearby such as New York, Washington, D.C. and Philadelphia. For citizens of other countries, what this region offers is a unique perspective that our resources are abundant and our innovation is unique, bringing to the world such products as Under Armour’s Heat and Cold Gear and Satellite Radio. Our seas are wide open to exchange goods from clothes to seafood nurtured and grown in this region and to whatever else imaginable such as resources to bring their businesses here. This place offers many people from all over the world a place where they can start and grow their businesses beyond the east coast, in which would work quite well for companies from Europe and Africa. In return, the other countries such as Germany can offer their unique perspectives and their diversity that goes beyond our normal way of thinking. For instance, they have a cultural fondness for saving money for things they want to buy. In this near recessive economy, we can certainly take a lesson from such commitments. As an example, we have already spent our tax rebate checks already instead of taking that money and putting it into a savings account to save money. Another example of what we can learn from working with other countries is their unique ways that they tend to commit to the betterment of the environment. The citizens of Germany for instance do not sell resources such as water and sodas in disposable forms, but rather in recyclable forms and they do well to readily have disposal receptacles to handle them. It seems we are always disillusioned here in the U.S. that we do enough for the protection and betterment of the environment. Our trip to Berlin really gave us a sense that we are, in reality, many steps behind Germany and to a greater extent the entire European Union in many ways. This is not to say we don’t try hard enough here. What we’ve noticed here, in many ways German and the European Union have developed into a common system and a method. Still, we do offer a great deal of resources and diversification that are unique to this region. It is through these observations and strategies that our group has discerned that it is not through our separation of cultures and ideas that we grow as a society but our exchange of these cultures and ideas that we can connect with the world around us. Final Report: Germany and Baltimore Strategic Global Ventures Appendix Exhibit UA 1 (Sports World Retail Outlet). Exhibit UA 2 (Under Armour –small player in big market). 21 Final Report: Germany and Baltimore Strategic Global Ventures Exhibit UA 3 (Under Armour U.S. Web Site). Exhibit UA 4 (Under Armour German Web Site). 22 Final Report: Germany and Baltimore Strategic Global Ventures Exhibit UA 5 (Under Armour German Web Site: Gear 101). Exhibit GRGP1. http://www.gwec.net/uploads/media/07-02_PR_Global_Statistics_2006.pdf 23 Final Report: Germany and Baltimore Strategic Global Ventures 24 Exhibit GRGP2. Wind Energy– Strength and Weaknesses Strengths ◊ German companies lead the world in market shares for Wind Energy ◊ Wind Energy is virtually limitless sources of energy ◊ Consumers are growing environmentally conscious ◊ Clean and non-polluting, renewable energy ◊ Reduces greenhouse gas emissions by displacing fossil-fuel-derived electricity ◊ Advancements in technology are improving efficiencies ◊ Germany’s highly skilled workers and engineers are good fit to produce the panels ◊ Government subsidized - Renewable Energy Source Act (also known as EEG or Ereuerbare-Ergien-Gezetz) including recent amendments Weaknesses ◊ Cost of Installation is often high ◊ Relatively low electrical output efficiency- 20-40% (Increasing) ◊ Aesthetics- often takes away from the natural beauty of the surroundings ◊ Selection and placement of wind turbines ◊ Not all locations are viable – areas of low wind for wind turbines and minimal sunlight for solar panels are inefficient ◊ Unmet Safety concerns- due to Lightning and Turbine failures Impact on Wildlife- Birds and other animals accidentally flying into the wind Turbines and noise from the Turbines cause confusion for the animals Final Report: Germany and Baltimore Strategic Global Ventures 25 Exhibit VG 1. http://www.eere.energy.gov/windandhydro/windpoweringamerica/wind_installed_capacit y.asp Exhibit VG2. http://www.gwec.net/fileadmin/documents/testfolder/Global_Wind_2007_Report_final.p df Final Report: Germany and Baltimore Strategic Global Ventures 26 Exhibit VG3. http://www.eere.energy.gov/windandhydro/windpoweringamerica/pdfs/wind_maps/us_w indmap.pdf Exhibit VG4. 2007 Snapshot- Major German Wind Turbine manufacturers Started Enercon GmbH REPower Nordex Siemens 1984 2001 1985 1847 (25 yrs 3,040 € 50.3% 14.0% 1 680.20 € 10.9% 10.5% 3 747 € 4.8% 3.4% 4 172,300 € 3.5% 7.1% 5 4 5 8 6 0 10+ Multiple infringement lawsuits/ does not want to get into the offshore business in Germany REPower taken over by Suzlon in 2007 3,500 530 wind) Revenue (In 000,000's) % Germany Marketshare % World Marketshare German Wind Energy Ranking World Wind Energy Ranking Offshore Experience Notable Recent Events Employees Pioneered 1st Offshore farm Received huge 100+ Germany's first offshore Order from UK wind turbine by Nordex in 2006 3 1,700 413,000 Final Report: Germany and Baltimore Strategic Global Ventures # of Turbines installed Total Capacity Installed Other Countries: Source: 27 12,500 11.7 GW 1,400 2.0 GW 3,328 4.0 GW (overall) 6,579 6.1 GW Sweden, Brazil, India, Turkey, Portugal http://www.enerconindia. net/profile.jsp?menuNam e=1&subMenu=&linkMen u=4 Japan, China, India and Australia http://www.repower.de/in dex.php?id=151&backPI D=25&tt_news=1700&L= 1 China Over 190 Countries http://www.nordexonline.com/en/companycareer-career/keyfigures-and-facts.html http://www.powergenerati on.siemens.com/products -solutionsservices/productspackages/windturbines/offshore/ Exhibit VG5. http://www.enercon.de/en/_home.htm Exhibit VG6. http://www.enercon.de/en/_home.htm Final Report: Germany and Baltimore Strategic Global Ventures Exhibit VG7. 2007 Snapshot- Major Baltimore Region Energy Companies PEPCO Holdings, Inc. Constellation Energy 1896- Based in Washington D.C. € 6,072 $9,366 € 9,796 $15,111 POM 22 24 5,131 1906- Based in Baltimore, MD € 13,739 $21,193 € 14,227 $21,945 CEG 11 0 10,200 Other Countries: Only in U.S.- Limited to Md, NJ and DE In Various regions throughout U.S. and Canada Source: http://finance.yahoo.com/q?s =pom http://finance.yahoo.com/q?s =CEG Started Revenue (EURO 000,000) Revenue ($US 000,000) Total Assets (EURO 000,000) Total Assets ($US 000,000) NYSE U.S. Utilities Co Ranking (Mkt Cap) Wind Turbines* Employees * Bear Wind Farm in Pennsylvania Exhibit VG8 – Benefits and Advantages to Constellation Energy. Establish New Renewal Energy Source Increase Global recognition Increase Satisfaction of customers Clean Energy Source Cheaper Energy Increase Market Share Shared Responsibilities and Risks 28 Final Report: Germany and Baltimore Strategic Global Ventures Exhibit VG9 - Benefits and Advantages to Siemens. First mover advantage in this region Increase Market Share Increase Wind Energy Presence Chance to find Innovations in Offshore Wind Energy Technology Shared Responsibilities and Risks Exhibit VG10 - Benefits and Advantages to the Baltimore Region. Baltimore Region Lower Carbon Pollution Levels Eventual Cheaper Source of Energy Growth in State Economy More Jobs! Utilization and Capitalization of Old Plant Facilities Bethlehem Steel Sparrows Point GM Plant recently Shutdown Global Exposure Development of more Business Opportunities Increase Tourism 29 Final Report: Germany and Baltimore Strategic Global Ventures Exhibit VG11. http://energy.maryland.gov/documents/MEASTRATEGICELECTRICITYPLAN.pdf Exhibit VG12. http://www.constellation.com/vcmfiles/Constellation/Files/Assets12.06.pdf 30 Final Report: Germany and Baltimore Strategic Global Ventures Exhibit VG13. Exhbit VG14. 31 Final Report: Germany and Baltimore Strategic Global Ventures 32 Works Cited “Country Brief: Germany.” Economist.com 28 Apr 2008. <http://www.economist.com/countries/Germany/profile.cfm?folder=ProfileEconomic%20Data> “Global Wind 2007 Report.” Gwec.net 20 Apr 2008. <http://www.gwec.net/fileadmin/documents/testfolder/Global_Wind_2007_Repor t_final.pdf> “The Greening of Patent Litigation” renewableenergyworld.com 30 Apr 2008 <http://www.renewableenergyworld.com/rea/partner/story?id=52167> Hirsch, Stacey. “Plant makes its final run.” The Baltimore Sun 14 May 2005 <http://www.baltimoresun.com/business/careers/balmd.bz.gm14may14,0,2702088.story> “Home: Renewables Made in Germany.” renewables-made-in-germany.com 30 Apr 2008. <http://www.renewables-made-in-germany.com/en/wind-energy> “India's Suzlon Energy completes REpower acquisition.” uk.reuter.com 28 Apr 2008. <http://uk.reuters.com/article/idUKBOM474320070602> Kellett, Bob. “3 Billion Eyes to View World Cup Opener.” worldcupblog.org. 8 Jun 2006 <http://www.worldcupblog.org/world-cup-2006/3-billion-eyes-to-viewworld-cup-opener.html> Lee, Peggy. “Protesters Still Fighting BGE Rate Hikes.” wjz.com 28 Apr 2008. <http://wjz.com/topstories/BGE.PSC.rate.2.428689.html> Makin, John. “Recession 2008?” The Wall Street Journal 8 Sep 2007: 1. “Pepco Energy Services Signs Largest Retail Wind-Power Contract In Mid-Atlantic Region.” pepcoenergy.com 28 Apr 2008. <http://www.pepcoenergy.com/NewsAndEvents/PressReleaseDetail.aspx?PressR eleaseId=36> “Profile of Under Armour: a Leader in Compression Performance Apparel.” Researchandmarkets.com 7 Apr 2008 <http://www.researchandmarkets.com/reports/c87891> “Prototype.” Underarmour.com 1 May 2008 < https://www.underarmour.com/prototype/ > “Port of Baltimore Rankings.” Greaterbaltimore.com 28 Apr 2008. Final Report: Germany and Baltimore Strategic Global Ventures 33 <http://www.greaterbaltimore.org/Portals/0/Transportation/Port/Port%20of%20B altimore%20Rankings%20of%20Annual%20Cargo%20Handled.pdf “Portfolio.” Siemens.com 28 Apr 2008. <http://www.powergeneration.siemens.com/aboutus/portfolio/> Sharrow, Ryan. “Hannover 96 soccer club to don Under Armour gear” Baltimore Business Journal 15 Feb 2008: 1. Sandstrom, Gustav. “Vestas wins Enercon patent infringement case” Forbes.com 30 Apr 2008 <http://www.forbes.com/markets/feeds/afx/2007/05/25/afx3758873.html> “Special Applications, Offshore.” Siemens.com 28 Apr 2008. <http://www.powergeneration.siemens.com/products-solutions-services/productspackages/wind-turbines/offshore/> “UA appoints Peter Maher as President & Managing Director, Europe.” Uabiz.com 28 Apr 2008. <http://www.uabiz.com/news/releasedetail.cfm?ReleaseID=252583> “Under Armour Announces a Series of Distribution Agreements to Bolster International Expansion.” Prnewswire.com 28 Apr 2008. < http://www.prnewswire.com/cgibin/stories.pl?ACCT=104&STORY=/www/story/07-252006/0004402742&EDATE> “Under Armour Germany.” Underarmour.com 28 Apr 2008 . <http://www.underarmour.de/Gear101.cfm?home=Herren&coll_id=&pf_id= > “Under Armour(R) is New Official Kit Supplier for Hannover 96.” Prnewswire.com 28 Apr 2008. <http://www.prnewswire.com/cgibin/stories.pl?ACCT=109&STORY=/www/story/02-152008/0004757077&EDATE=> “Under Armor profit jumps, but misses estimate.” Reuters.com 1 May 2008 <http://www.reuters.com/article/idUSN0126941420070201> “Under Armour Reports 27%.” Investor.underarmour.com 1 May 2008 <http://Investor.underarmour.com/releasedetail.cfm?ReleaseID=306991> “Wind Energy in Germany.” Wind-energie.com 28 Apr 2008. <http://www.windenergie.de/en/wind-energy-in-germany/overview/> “Wind Energy Multiyear Program Plan For 2007-2012” eere.energy.gov 30 Apr 2008 <http://www1.eere.energy.gov/windandhydro/pdfs/40593.pdf> “Yahoo: UA.” Yahoo.com 1 May 2008 <http://finance.yahoo.com/q?s=ua>