illinois limited liability company intake form

advertisement

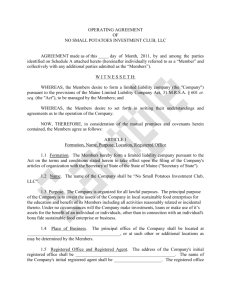

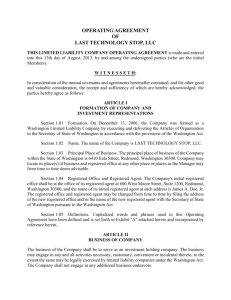

ILLINOIS LIMITED LIABILITY COMPANY INTAKE FORM 1. What is the full name of the Company (must include LLC or L.L.C.)? 2. Who are the members of the Company? Names and addresses Social Security Numbers 3. Will the Company be member-managed or manager-managed? (a) If member-managed, please answer the following: (i) Will each of the members be able to act on behalf of the Company, or is the vote of the members required? (ii) Are there events that require a supermajority vote of the members? If so, describe. (b) (c) 4. (i) Will each of the managers be able to act on behalf of the Company, or is the vote of the managers required? (ii) Are there events that require a vote of the managers and/or the members? If so, describe. Will any of the members/managers receive compensation for their services to the Company? Purpose (a) 5. If manager-managed, please answer the following: What is the purpose of the Company? May it engage in other businesses? Under what circumstances? Offices (a) Where will the principal place of business of the Company be located? (b) Who is the registered agent and where is the registered office? (c) May the Company do business outside of Illinois? 6. 7. 8. Finance (a) What capital contributions will each of the Members be making? (b) What membership interests will each of the Members be receiving? (c) Can members be required to make additional capital contributions? (d) Should a member be penalized for failing to make an additional capital contribution? (e) Will the members have pre-emptive rights with respect to the issuance of new membership interests? Distributions of Cash Flow (a) When and how will cash flow be distributed among the members? (b) Will distributions of profits be allocated among the members differently from distributions of capital? (c) Should each of the members be entitled to receive distributions at least equal to their tax liability from the Company? Allocations of Profit and Loss (a) 9. Withdrawal of a Member (a) 10. Are there any special allocations of profit and loss for tax purposes you wish to have made? May a member withdraw from the Company at any time? If so, is such member entitled to receive the fair market value of his or her interest in the Company at that time, or must they wait for liquidation of the Company? Transfer of Interests (a) Under what circumstances may a member transfer his membership interest to a person who is not a member? (b) Will the Company and/or the other members have a right of first refusal with respect to the interest to be transferred? (c) Is the consent of the members required to make a transferee a member? 2 11. Tax Matters Partner (a) Which of the members/managers will be responsible for communicating with the IRS in the event of an audit? 3