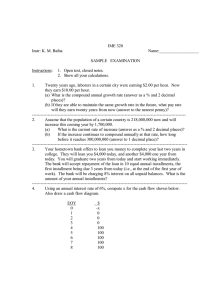

FE Practice Problems 5-63

advertisement

FE Practice Problems 5-631 Elin purchased a car for $10,000. she wrote a check for $2,000 as a down payment for the car and financed the $8,000 balance. The annual percentage rate (APR) is 9% compounded monthly, and the loan is to be repaid in equal monthly installments over the next four years. Elin’s monthly car payment is most nearly which of the following? [5.5] (a) $167 (b) $172 (c) 188 (d) $200 (e) $218 5-64 A specialized automatic machine costs $300,000 and is expected to save $111,837.50 per year while in operation. Using a 12% interest rate, what is the discounted payback period? [5.8] (a) 4 (b) 5 (c) 6 (d) 7 (e) 8 5-65 With interest at 8% compounded annually, how much money is required today to provide a perpetual income of $14, 316 per year? [5.3] (a) $ 178,950 (b) $ 96,061 (c) $ 175,134 (d) $ 171,887 5-66 What is the internal rate of return in the following cash flow? [5.6] Year End Cash Flow ($) (a) 12.95% 0 -3,345 (b) 11.95% 1 1,100 (c) 9.05% 2 1,100 (d) 10.05% 3 1,100 4 1,100 (e) 11.05% 5-67 A bond has a face value of $1,000, is redeamable in eight years, and pays interest of $100 at the end of the eight years. If the bond can be purchased for $981, what is the rate of return if the bond is held until maturity? [5.3] (a) 10.65% 1 (b) 12.65% (c) 10.35% (d) 11.65% Problems choosen from Engineering Economy, 13th Edition, Sullivan, W.G., et.al., Prentice-Hall, 2006 D:\98939486.doc Page 1 of 2 FE Practice Problems 5-70 A new machine was bought for $9,000 with a life of six years and no salvage value. Its annual operating costs were as follows: $7,000, $7,350, $7,717.499, … , $8,933.968 If the MARR = 12%, what was the annual equivalent cost of the machine? [5.5] (a) $7,809 (b) $41,106 (c) $9,998 (d) $2,190 (e) $9,895 5-71 A bank offers a loan at a nominal interest rate of 6% per year to be paid back in five equal annual installments. The bank also charges an application fee equal to 13.67% of the loan amount. What is the effective interest that the bank is charging? [5.6] (a) 11.65% (b) 11.35% (c) 12.65% (d) 12.35% 5-72 You want to deposit enough money in a bank account for your son’s education. You estimate that he will need $8,000 per year for four years, starting on his 18th birthday. Today is his first birthday. If you earn 12% interest, how much lump sum should you deposit in the bank today to provide for his education? [5.3] (a) $24,298 D:\98939486.doc (b) $3,538 (c) $32,000 d) $3,963 Page 2 of 2