Format AMP1F16 Appraisal MICRO FINANCE

advertisement

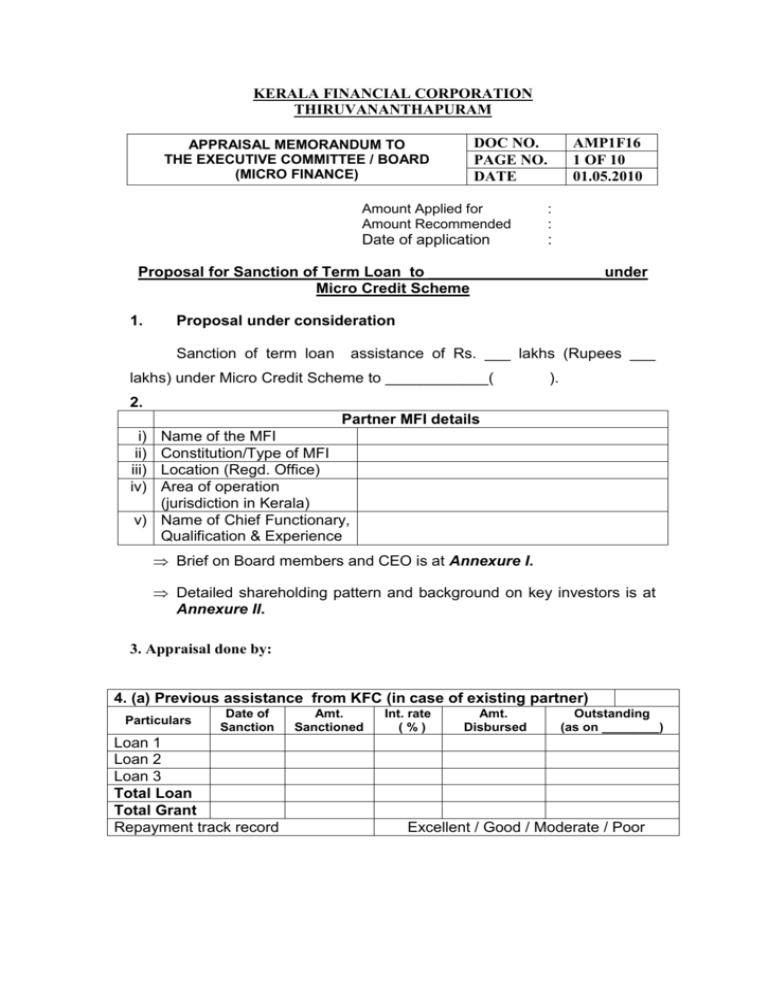

KERALA FINANCIAL CORPORATION THIRUVANANTHAPURAM APPRAISAL MEMORANDUM TO THE EXECUTIVE COMMITTEE / BOARD (MICRO FINANCE) DOC NO. PAGE NO. DATE AMP1F16 1 OF 10 01.05.2010 Amount Applied for Amount Recommended : : Date of application : Proposal for Sanction of Term Loan to ____________________ under Micro Credit Scheme 1. Proposal under consideration Sanction of term loan assistance of Rs. ___ lakhs (Rupees ___ lakhs) under Micro Credit Scheme to ____________( ). 2. Partner MFI details i) ii) iii) iv) Name of the MFI Constitution/Type of MFI Location (Regd. Office) Area of operation (jurisdiction in Kerala) v) Name of Chief Functionary, Qualification & Experience Brief on Board members and CEO is at Annexure I. Detailed shareholding pattern and background on key investors is at Annexure II. 3. Appraisal done by: 4. (a) Previous assistance from KFC (in case of existing partner) Particulars Date of Sanction Loan 1 Loan 2 Loan 3 Total Loan Total Grant Repayment track record Amt. Sanctioned Int. rate (%) Amt. Disbursed Outstanding (as on ________) Excellent / Good / Moderate / Poor 2 4 (b) Borrowings from other Bank/Institution (as (Rs. in on.....................) Lakhs) Name of Amount Rate of Amount o/s as on Comments Bank/FI sanctioned interest disbursed ,,,,,,,,,,,,,,,,, . 5. MFI Operational highlights Particulars FY ___ FY ____ FY ___ No. of Branches No. of Members No. of Borrowers Loan disbursed during the year (Rs. lakh) Outstanding portfolio (on balance sheet) (Rs. lakh) Outstanding portfolio (off balance sheet) (Rs. lakh) Portfolio growth rate % Portfolio at risk > 90 days (% of own portfolio) b) c) Effective interest rate to end user as certified by a CA: ___ % p.a. Loan and other products offered, Break up of District wise portfolio, Break up of portfolio by activity/ community are at Annexure IV. Comments: 6 Financial Highlights FY_____ Income from operations Grants and other non-operational income Total Income Financial Costs Operating costs Loan loss provision & write offs in P&L Total Expenditure PAT Loan Portfolio (Net O/s) Other assets Fixed Assets Total Assets Networth External Borrowings 2 FY____ FY____ (Rs. lakh) Recent period 3 6 Financial Highlights FY_____ FY____ FY____ (Rs. lakh) Recent period Loan Loss Reserve Other liabilities Total liabilities Off balance sheet assets 6.1. Comments on financials i. ii. iii. iv. v. Comments on Income & expenses, off balance sheet arrangements, networth, debts, OSS/ FSS, qualifying comments by the statutory auditor / any remarks in notes to accounts which have a significant bearing on the financials / write offs / purchase / sale of portfolio / other comments etc. (otherwise to indicate that there are no adverse comments) 6.2. Comments on Financials & Operations of Sister/ Associate concerns 6.3. Lending Model adopted by the MFI: SHG / Grameen / Others (Pl. specify) d) Detailed projections covering the period of the loan - Annexure V. e) Details of Rating /s is at Annexure VI. (BO to discuss the weaknesses observed by rating agency and obtain an undertaking from the MFI that the same shall be addressed to the satisfaction of SIDBI as per discussions held / strategy agreed). 7. i) Amount of loan Present Proposal details Rs. ___ crore 3 4 7.2. Eligibility norms/Parameters: Prescribed norm Status for compliance i) MFI in existence for 5 years/or demonstrated track record of running a successful micro credit programme for last 3 years. ii) New MFI promoted and managed by experience Micro Finance Professionals with experience of at least 3 years in Micro credit. iii) MFI has achieved minimum out reach of 3000 poor members or demonstrated the capability to reach this scale within next 12 months. iv) MFI should choose clients irrespective of class, creed and religion and its activity should be secular in nature. v) MFI maintenance satisfactory and transparent accounting MIS and Internal audit system or is willing to adopt such practices with the KFC assistance. vii) MFI has a relatively low risk portfolio or has definite plan to further improve its recovery performance. vii) Activities of SHGs proposed to be covered under the KFC Assistance. viii) Capacity Assessment Rating of the MFI. a) Rating Agencies: b) Rating Grade given 4 5 by the agency: c) Whether rating satisfactory. is 8 Status Compliance Key risk factors identified by the rating agency and our observations on the same. Risk Factor Our comments (1) (2) (3) 9. Details whether the names of MFI Partners a) b) RBI c) in the following. No. and / or date Caution list Wilful defaulters’ list of Yes / No Yes / No Wilful defaulters’ list of Yes / No CIBIL d) Blacklisted agencies of Rashtriya Mahila Kosh e) Satisfactory credit Opinion As on June 30, --of Bankers / Funding agencies f) KYC, AML and guidelines on non appearance of names on Terrorists lists circulated by RBI ii. Benchmark norms a) Portfolio At Risk > 90 days <10% b) Operational Self >90% Sufficiency 12 Yes / No Yes / No Yes / No Yes / No Yes / No Relaxations, if any (with justifications) 13. Conclusion and Recommendations The MFI has been associated with KFC/Banks/Fis such as with satisfactory conduct of the account and excellent repayment track record (to be modified suitably in the case of new partner). 5 6 The present term loan of Rs. ___ lakhs will facilitate the MFI to further scale up its operation. The proposal is based on the assessment made as per projections given in Annexure - V. Overall, the proposal is supportworthy. In view of the foregoing, EC/Board is requested to consider and sanction Term loan of Rs.___ lakh (Rupees _____________ ) to ___ (Name of MFI) on the standard terms and conditions (Only interest rate, security and repayment terms to be filled up for each case, as given below) as well as the special conditions given in Appendix: Terms Sheet: Repayment period Initial moratorium Rate of interest Upfront fees Security ____ years / months ____ months ___% p.a. _____ Hypothecation of 100% book debts / assets held in Trust or both FDR 10% of the loan amount together and the interest accrued thereon for a period of ..........years. Assets in any created out of the assistance to be held in Trust by the MFI on behalf in KFC. MANAGING DIRECTOR. Annexure I List of Board Members and CEO along with brief background Name & Designation Age Qualification Experience Annexure II Shareholding pattern Name of the Shareholder No. of shares Face value Premium Amount (Rs.__) 6 Percentage of share holding 7 Total Background of investors Annexure III Details of sources of funds as on Sl. No Institution Nature of Facility Amt Sanctioned (Rs. Lakh) Amt Int. O/s as on disbursed Rate (%) ______ On Balance Sheet 1 2 Sub total (a) Off Balance Sheet 1 2 Sub total (b) TOTAL (a + b) f) Clearly indicate if there are any overdues to any lender. Annexure IV Loan products, break up of portfolio, etc. of ________ Table A - Details of products Name of product Maximum loan Repayment period Rate of interest Flat / reducing balance (%) Table B - Statewise break up of portfolio 7 Fees / charges 8 Name of State Value of portfolio (Rs. __) Table C - Activity-wise Outstanding Activity Small business Animal Husbandry Service sector Agriculture and allied activities Others Total % Table D – Class / group classification of beneficiaries of the MFI Class / Caste Scheduled Castes Scheduled Tribes Other Backward Classes Minority communities Others Total % Annexure V Detailed projections Financial Details Projections for last FY Actuals for last FY No of borrowers Net portfolio Growth rate of portfolio Total Assets Networth External Borrowings Total liabilities 8 FY____ (Rs. Lakh) FY___ FY____ 9 Off balance sheet assets Income from operations Total Income Financial Costs Operating costs Loan loss provision Total Expenditure PBT/ Deficit PAT Annexure VI Rating Highlights Category wise rating is as under : Particulars Name of Rating agency Date of rating Rating Grade Rating Validity Equivalent grade Interpretation of grade 1st Rating 2nd Rating 3rd Rating Key risk factors identified by the rating agency and our observations on the same Sl. Risk Factor Our Comments (4) (5) (6) Annexure VII Break up of CB assistance proposed S. No. Description of component 9 Amount (Rs.___) 1 0 Reviewed by GM Approved by MD GMI/AMF 0.15 APPSL MICRO 10 Issued by MR