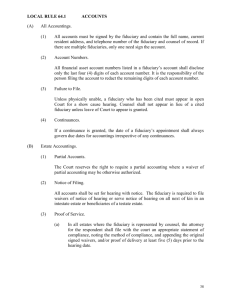

Fiduciary Precedents

advertisement